I'm thrilled to announce the launch of the Editorial Quant newsletter - where data meets dollars and cents.

My name is David Love, and I’ve been working with Quiver Quantitative since 2021 to help bridge the information gap between retail investors and Wall Street. What can you expect from this newsletter?

Fun deep dives into our alternative datasets

Market insights you won't find in mainstream financial media

Practical applications of Quiver data for your trading strategies

This isn't your typical financial newsletter filled with recycled Bloomberg headlines. We're exploring the quirky corners of market data that actually move the needle. Anyone who enjoys the fascinating intersection of alternative data and financial markets will find something valuable here.

Have questions? Spotted an interesting data trend? Just want to chat about what we're building? → Drop me a line at

[email protected]If you find value in what we're doing, please share with your network (yes, even your mom who keeps asking what stocks to buy).

Michael Burry is long GameStop. This is intrinsically funny because he famously sold (GME) just before it went to the moon in 2021. Now he's calling it a value play (trading near tangible book value) rather than a meme redux.

The thesis is straightforward: he's effectively "paying $1 for every $1 of real assets," positioning GameStop as an asset-backed cigar butt rather than a growth stock. He explicitly praised CEO Ryan Cohen, saying he likes the governance and sees long-term potential despite acknowledging the decline in the legacy videogame retail business.

The joke here is genre-mixing: the serious value investor returns to the meme stock, but this time for boring Buffett-esque reasons. The stock jumped 8% on the news because markets love a sequel.

And the insiders agree with him. Cohen himself recently bought 1 million GME shares in two trades at around $21 per share—worth about $21.4 million—lifting his stake to roughly 9.3%. He told the SEC that CEOs who don't buy their own stock with personal funds "should be fired."

GameStop remains a shrinking retailer with an investment thesis that's three mutually incompatible ideas stapled together: Buffett value + activist governance + internet meme optionality.

The incentives are retail wants fireworks, management wants respectability, and Burry wants vindication. It's also a reminder that "fundamental value" in meme stocks often means "assets you can write a Substack about," not actually discounted cash flows. Read analysis →

Elsewhere, Burry has puts on Oracle, betting against its AI-driven data center expansion. He argues Oracle's massive AI and cloud pivot requires a large, debt-funded data-center buildout that he considers unnecessary and possibly ego-driven.

Oracle has become one of the largest non-financial corporate debt issuers, with tens of billions outstanding as it finances the capex binge. Oracle is debt-funding its massive AI buildout while insiders’ cash out. The company's senior team collectively sold millions at the recent highs:

Their AI strategy is basically: build expensive data centers now, determine if customers actually need them later. It's perfectly aligned incentives - everyone's aligned with themselves.

Bond investors fund the AI dream, equity investors buy the narrative, insiders harvest it, and Burry buys the right to say "told you so" via puts.

What makes the insider selling notable isn't the amount—executives sell stock all the time. It's the timing. These sales came right after Oracle's stock hit all-time highs on AI hype, and right before Burry publicly announced his short. The people closest to Oracle's actual AI demand pipeline decided December was a good time to lighten up.

The symmetry with the first story is fun: Burry is long the dying retailer and short the AI infrastructure darling. In both cases, his thesis is basically "the narrative has outrun the fundamentals." Whether he's right is TBD, but at least he's consistent. Read analysis →

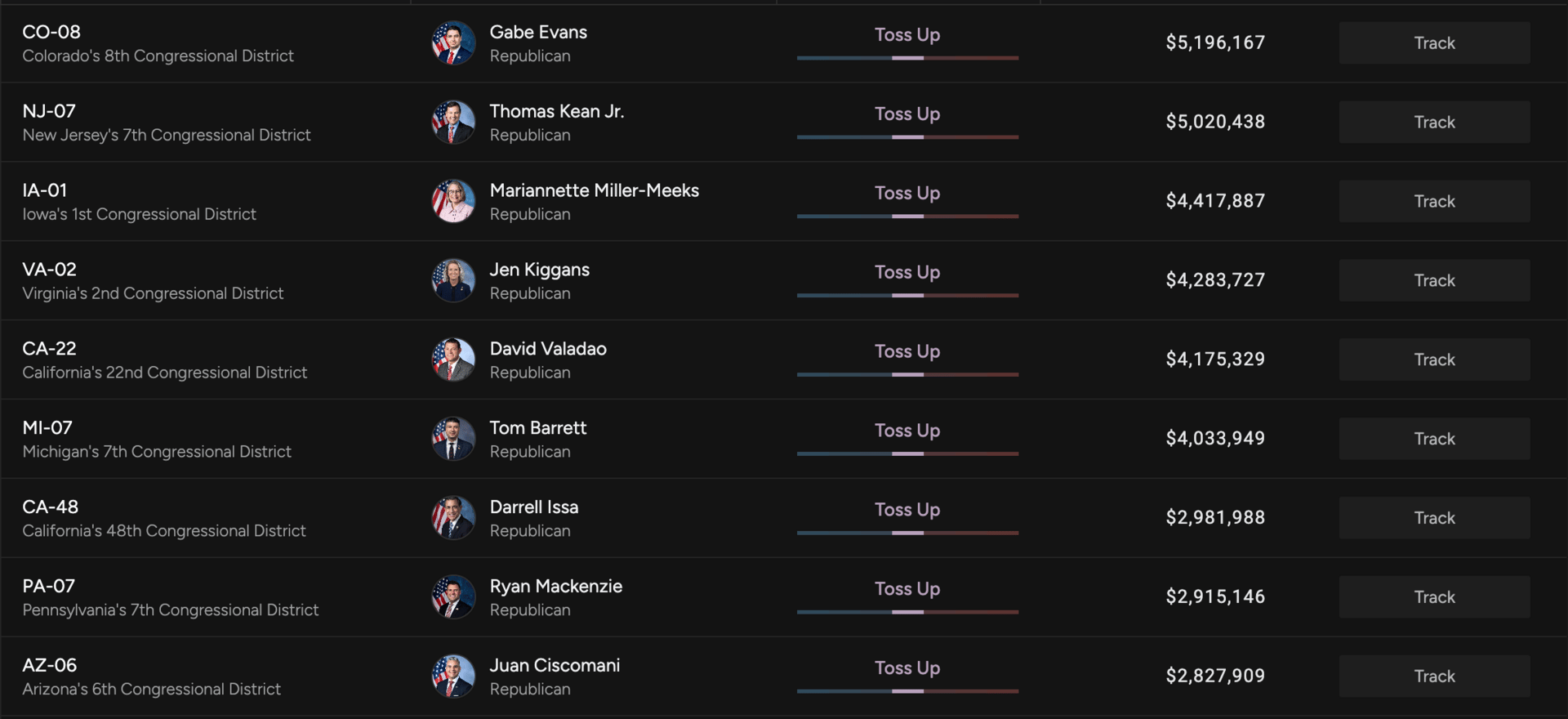

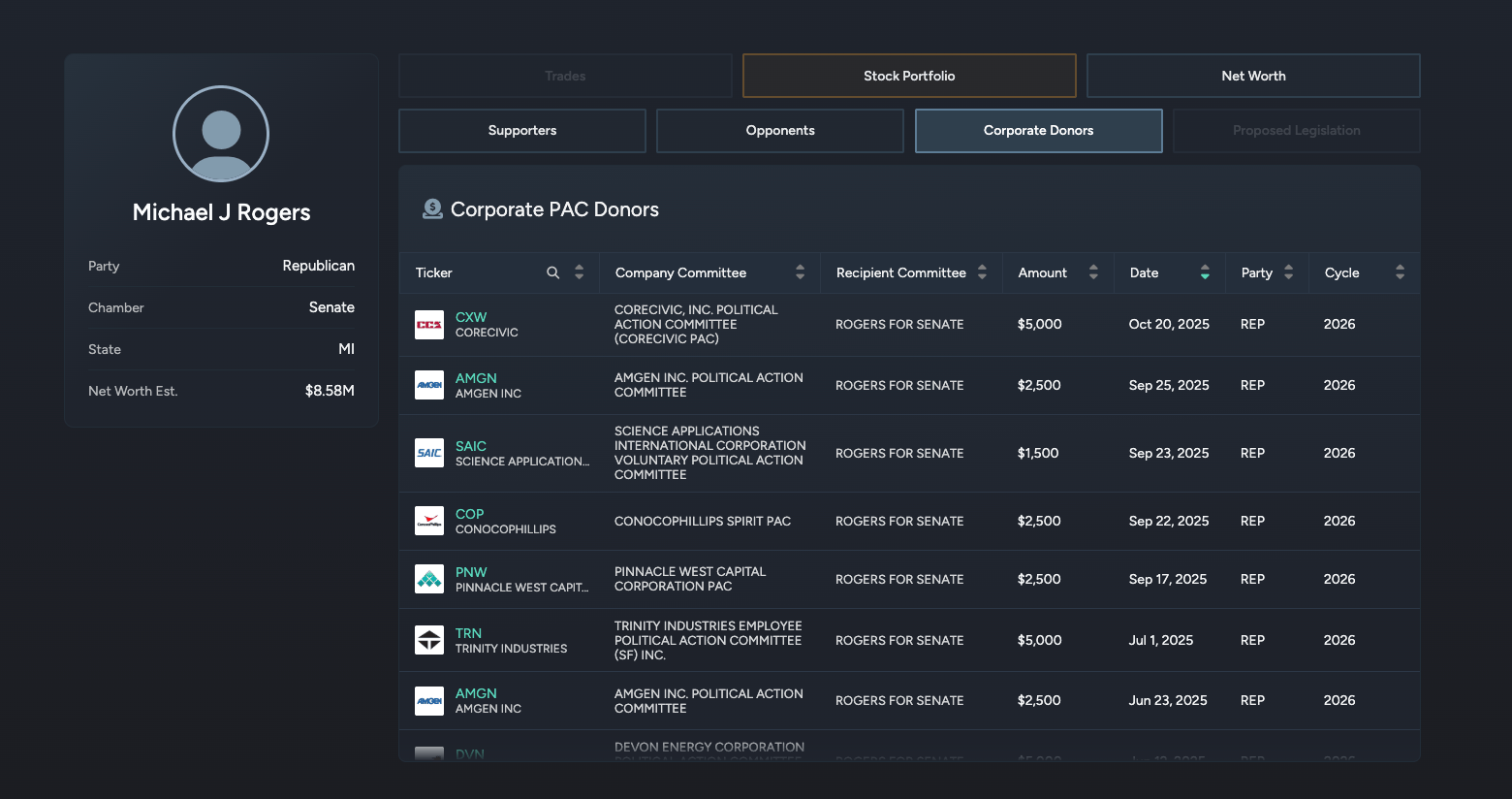

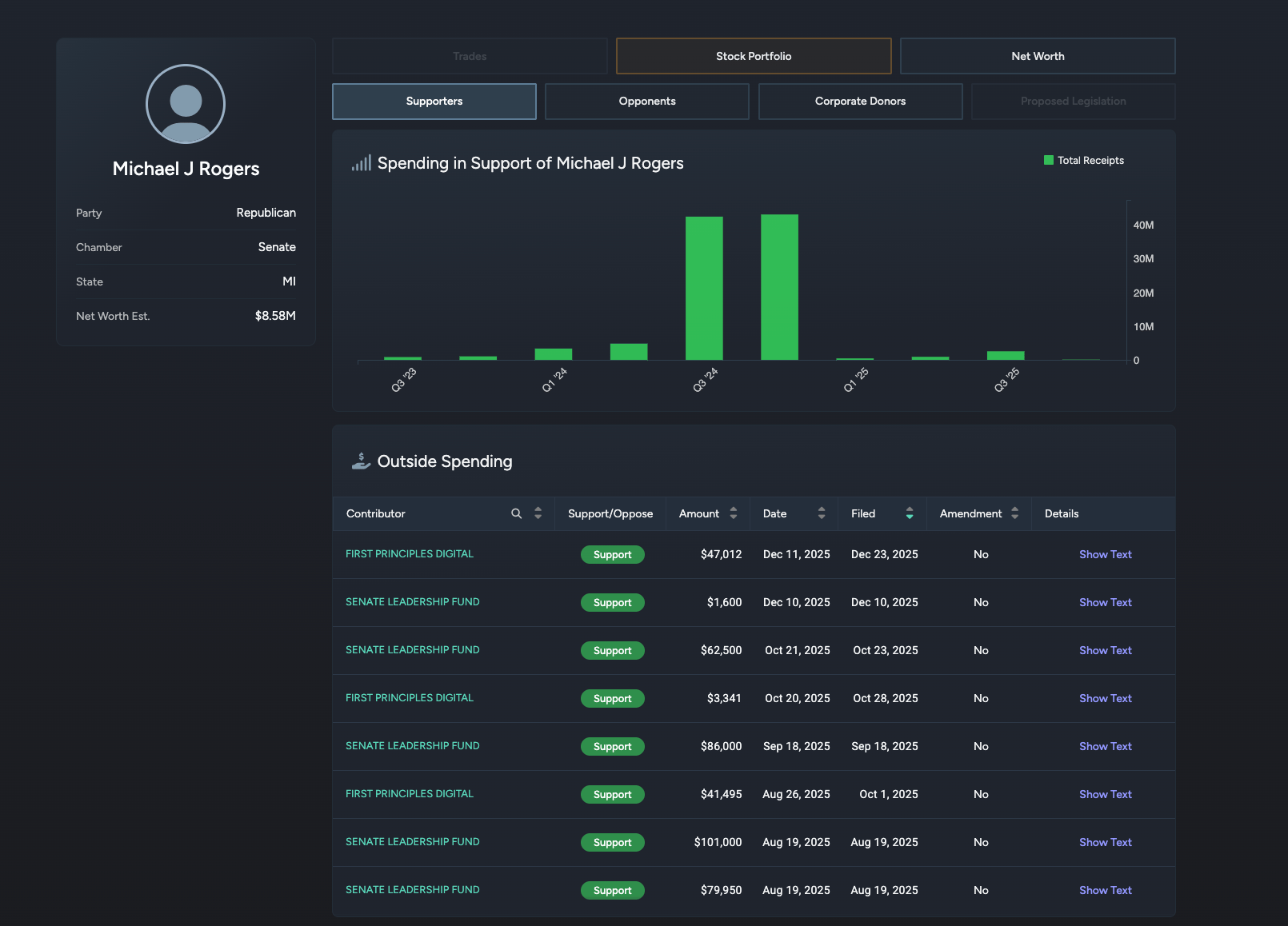

House Republicans advanced a bill to curtail lawmaker stock trading, with a markup on legislation designed to respond to years of scandal over member trades.

The proposal would tighten rules on individual stock trading by members and spouses, though it stops short of an outright ban on holding individual stocks while in office. Reporting highlights that some of the most active traders in Congress made hundreds of trades per year, including transactions that coincided suspiciously with committee work or policy moves.

Read Full Article

The people who wrote insider-trading laws are shocked to discover that trading around your own votes looks bad once someone makes a dashboard out of it.

While it is encouraging to see more attention being brought to this issue, Congress has a long track record of preferring to talk about a stock trading ban rather than actually enact it. Read analysis →