Quiver News

The latest insights and financial news from Quiver Quantitative

We have seen 101 open market insider transactions reported today, December 20, 2025. You can track them all on the Quiver Quantitative Insider Trading dashboard. Here are some of the largest open market insider stock purchases we have seen.

NAVAN, INC. ($NAVN)

Andreessen Horowitz Fund V, L.P. bought 347,600 shares on 12/17 for an estimated $4,397,140.

Past $NAVN Insider Trades

NAVAN, INC. insiders have traded $NAVN stock on the open market 19 times in the past 6 months. Of those trades, 13 have been purchases and 6 have been sales.

Here’s a breakdown of recent trading of $NAVN stock by insiders over the last 6 months:

- ILAN EZRA TWIG (Chief Technology Officer) sold 1,000,000 shares for an estimated $25,000,000

- ARIEL M. COHEN (Chairperson and CEO) has made 0 purchases and 4 sales selling 924,332 shares for an estimated $23,108,300.

- BENJAMIN A HOROWITZ has made 3 purchases buying 692,395 shares for an estimated $9,352,310 and 0 sales.

- HOROWITZ FUND V, L.P. ANDREESSEN has made 3 purchases buying 692,395 shares for an estimated $9,352,310 and 0 sales.

- HOROWITZ LSV FUND I, L.P. ANDREESSEN has made 3 purchases buying 692,395 shares for an estimated $9,352,310 and 0 sales.

- HOROWITZ LSV FUND III, L.P. ANDREESSEN has made 3 purchases buying 692,395 shares for an estimated $9,352,310 and 0 sales.

- MICHAEL ERIC SINDICICH (President) sold 231,842 shares for an estimated $5,796,050

- ANRE D WILLIAMS purchased 100,000 shares for an estimated $1,272,480

GRAN TIERRA ENERGY INC. ($GTE)

Lau Daniel bought 360,000 shares on 12/18 for an estimated $1,423,728.

Past $GTE Insider Trades

GRAN TIERRA ENERGY INC. insiders have traded $GTE stock on the open market 51 times in the past 6 months. Of those trades, 48 have been purchases and 3 have been sales.

Here’s a breakdown of recent trading of $GTE stock by insiders over the last 6 months:

- PARTNERS INVESTMENT MANAGEMENT LLC EQUINOX has made 47 purchases buying 1,283,783 shares for an estimated $5,268,541 and 0 sales.

- DANIEL LAU purchased 360,000 shares for an estimated $1,423,728

- DAVID P SMITH sold 7,750 shares for an estimated $35,495

- JIM EVANS (EVP, Corporate Services) has made 0 purchases and 2 sales selling 6,140 shares for an estimated $24,314.

HALLADOR ENERGY CO ($HNRG)

Wesley Charles Ray IV bought 20,000 shares on 12/17 for an estimated $356,576.

Past $HNRG Insider Trades

HALLADOR ENERGY CO insiders have traded $HNRG stock on the open market 17 times in the past 6 months. Of those trades, 3 have been purchases and 14 have been sales.

Here’s a breakdown of recent trading of $HNRG stock by insiders over the last 6 months:

- DAVID C HARDIE has made 0 purchases and 14 sales selling 472,062 shares for an estimated $9,208,793.

- CHARLES RAY IV WESLEY has made 3 purchases buying 53,000 shares for an estimated $912,644 and 0 sales.

HYPERION DEFI, INC. ($HYPD)

Walters Happy David bought 61,930 shares on 12/17 for an estimated $187,152.

Past $HYPD Insider Trades

HYPERION DEFI, INC. insiders have traded $HYPD stock on the open market 2 times in the past 6 months. Of those trades, 2 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $HYPD stock by insiders over the last 6 months:

- HAPPY DAVID WALTERS purchased 61,930 shares for an estimated $187,152

- MICHAEL S GELTZEILER purchased 30,000 shares for an estimated $90,210

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

Congress members introduced H.Res. 955 to enhance U.S. efforts against pediatric HIV/AIDS globally through prevention and treatment.

Quiver AI Summary

Congress members introduce resolution on pediatric HIV/AIDS: Congresswoman Jennifer McClellan, Congresswoman Robin Kelly, and Congressman Mark Pocan have introduced H.Res. 955 aimed at enhancing U.S. leadership in combating pediatric HIV/AIDS. The resolution seeks to advance prevention efforts, expand treatment for women and children, and support affected families globally.

Global statistics and support highlighted: According to the World Health Organization, while HIV infections and related deaths have declined since 2010, 40.8 million people live with HIV, including 1.4 million children. The resolution is endorsed by several health organizations, emphasizing the need for improved pediatric treatment and a dedicated strategy under the PEPFAR program.

Members of Congress emphasize urgency: The sponsors of the resolution stressed the critical importance of U.S. involvement in the global fight against HIV/AIDS, particularly among children. They aim to reaffirm America's commitment to ending the epidemic by 2030 and ensuring access to effective treatments for all affected individuals.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Jennifer L. McClellan Fundraising

Jennifer L. McClellan recently disclosed $211.8K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 439th most from all Q3 reports we have seen this year. 42.0% came from individual donors.

McClellan disclosed $197.5K of spending. This was the 297th most from all Q3 reports we have seen from politicians so far this year.

McClellan disclosed $121.7K of cash on hand at the end of the filing period. This was the 878th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Jennifer L. McClellan's fundraising on Quiver Quantitative.

Jennifer L. McClellan Net Worth

Quiver Quantitative estimates that Jennifer L. McClellan is worth $2.5M, as of December 20th, 2025. This is the 235th highest net worth in Congress, per our live estimates.

McClellan has approximately $372.1K invested in publicly traded assets which Quiver is able to track live.

You can track Jennifer L. McClellan's net worth on Quiver Quantitative's politician page for McClellan.

Jennifer L. McClellan Bill Proposals

Here are some bills which have recently been proposed by Jennifer L. McClellan:

- H.R.5965: Student Veteran Work Study Modernization Act

- H.R.5327: Nottoway Indian Tribe of Virginia Federal Recognition Act

- H.R.5243: To amend title XVIII of the Social Security Act to increase data transparency for supplemental benefits under Medicare Advantage.

- H.R.4894: Deceptive Practices and Voter Intimidation Prevention Act of 2025

- H.R.4703: To establish a system to track, record, and report all instances in which a United States citizen or individual lawfully admitted for permanent resident was, for the purpose of immigration enforcement, detained or removed by the Department of Homeland Security, and for other purposes.

- H.R.3574: To amend the Internal Revenue Code of 1986 to permit qualified distributions from section 529 plans for certain transportation and parking expenses.

You can track bills proposed by Jennifer L. McClellan on Quiver Quantitative's politician page for McClellan.

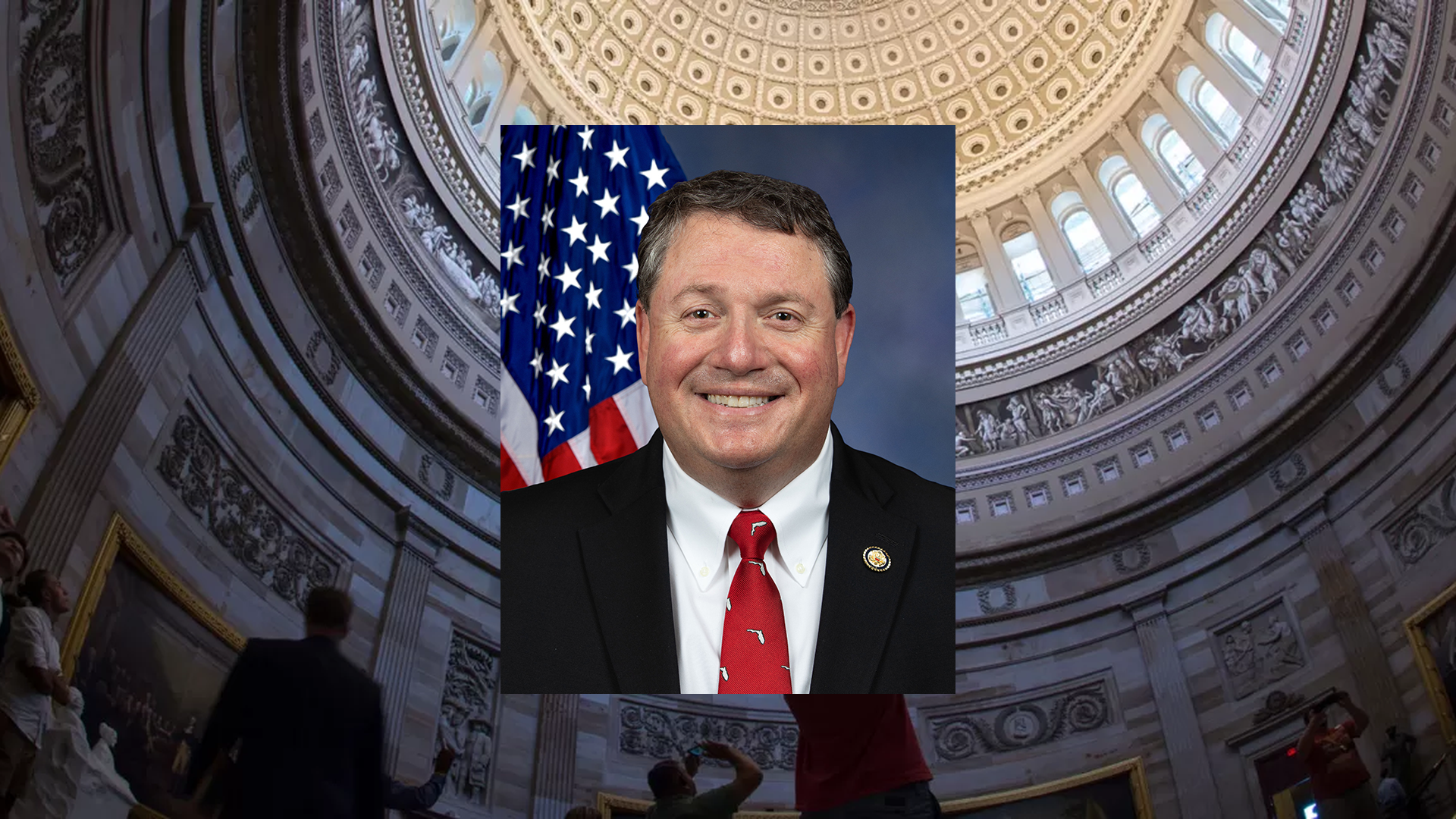

Bipartisan bill introduced to enhance healthcare access for military families through improved reporting and resolution mechanisms.

Quiver AI Summary

Bipartisan Bill Introduced for Military Health Care Access: Representatives Don Bacon, Steven Horsford, Jen Kiggans, and Chrissy Houlahan have introduced the Military Care Access, Reporting, and Evaluation (Military CARE) Act to enhance health care access for military families. The proposed legislation aims to streamline the reporting of issues faced by TRICARE beneficiaries.

Key Features of the Military CARE Act: The bill intends to create a standardized digital platform for reporting care issues, ensure real-time notifications to patient advocates, and require quarterly analysis of complaints by the Defense Health Agency. Supporters believe this will improve transparency and accountability in military health care.

Support from Military Advocates: Numerous military organizations have endorsed the legislation, highlighting the need for reliable data and oversight to address access-to-care problems. Advocates argue that improving these systems is vital for ensuring that military families receive the health care they deserve.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

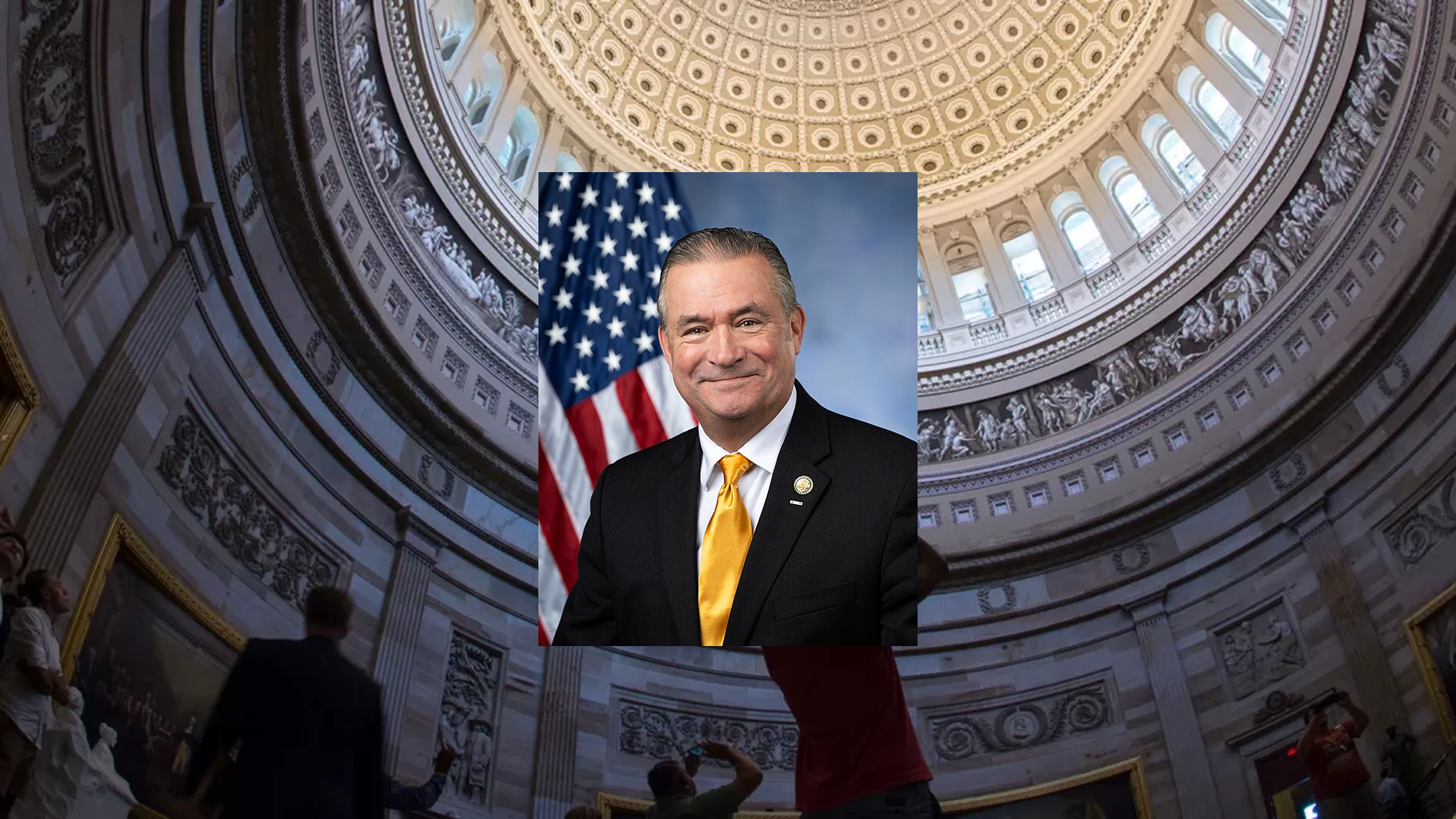

Don Bacon Fundraising

Don Bacon recently disclosed $-31 of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 2457th most from all Q3 reports we have seen this year. 100.0% came from individual donors.

Bacon disclosed $604.3K of spending. This was the 74th most from all Q3 reports we have seen from politicians so far this year.

Bacon disclosed $576.8K of cash on hand at the end of the filing period. This was the 488th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Don Bacon's fundraising on Quiver Quantitative.

Don Bacon Net Worth

Quiver Quantitative estimates that Don Bacon is worth $1.7M, as of December 20th, 2025. This is the 271st highest net worth in Congress, per our live estimates.

Bacon has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Don Bacon's net worth on Quiver Quantitative's politician page for Bacon.

Don Bacon Bill Proposals

Here are some bills which have recently been proposed by Don Bacon:

- H.R.6612: Defense Civilian Faculty Copyright Act of 2025

- H.R.6611: The F–47 Program Total Force Act of 2025

- H.R.6558: Defense Secure Mobile Phones Act of 2025

- H.R.6557: The Center for Strategic Deterrence and Weapons of Mass Destruction Studies Act of 2025

- H.R.6510: National Military Civilian Medical Surge Program Act of 2025

- H.R.4583: Living Donor Protection Act of 2025

You can track bills proposed by Don Bacon on Quiver Quantitative's politician page for Bacon.

JEFFREY A BEDELL, the See Remarks of $ALRM, sold 22,727 shares of the company on 12-16-2025 for an estimated $1,177,713. We received data on the trade from a recent SEC filing. This was a sale of approximately 4.3% of their shares of this class of stock. Following this trade, they now own 505,805 shares of this class of $ALRM stock.

$ALRM Insider Trading Activity

$ALRM insiders have traded $ALRM stock on the open market 10 times in the past 6 months. Of those trades, 4 have been purchases and 6 have been sales.

Here’s a breakdown of recent trading of $ALRM stock by insiders over the last 6 months:

- DANIEL KERZNER (See Remarks) has made 0 purchases and 2 sales selling 30,004 shares for an estimated $1,509,301.

- JEFFREY A BEDELL (See Remarks) has made 0 purchases and 2 sales selling 25,000 shares for an estimated $1,297,068.

- STEPHEN TRUNDLE (Chief Executive Officer) has made 4 purchases buying 26,000 shares for an estimated $1,257,281 and 0 sales.

- STEPHEN C. EVANS sold 1,154 shares for an estimated $60,319

- KEVIN CHRISTOPHER BRADLEY (Chief Financial Officer) sold 754 shares for an estimated $42,789

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$ALRM Hedge Fund Activity

We have seen 153 institutional investors add shares of $ALRM stock to their portfolio, and 185 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- PRICE T ROWE ASSOCIATES INC /MD/ added 758,573 shares (+911.0%) to their portfolio in Q3 2025, for an estimated $40,265,054

- BROWN CAPITAL MANAGEMENT LLC removed 576,431 shares (-33.8%) from their portfolio in Q3 2025, for an estimated $30,596,957

- NEW YORK STATE COMMON RETIREMENT FUND removed 511,226 shares (-97.1%) from their portfolio in Q3 2025, for an estimated $27,135,876

- FISHER ASSET MANAGEMENT, LLC removed 245,470 shares (-97.2%) from their portfolio in Q3 2025, for an estimated $13,029,547

- ROYAL BANK OF CANADA removed 191,433 shares (-71.8%) from their portfolio in Q3 2025, for an estimated $10,161,263

- CALIFORNIA PUBLIC EMPLOYEES RETIREMENT SYSTEM removed 175,569 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $9,319,202

- D. E. SHAW & CO., INC. added 167,391 shares (+268.7%) to their portfolio in Q3 2025, for an estimated $8,885,114

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$ALRM Revenue

$ALRM had revenues of $256.4M in Q3 2025. This is an increase of 6.61% from the same period in the prior year.

You can track ALRM financials on Quiver Quantitative's ALRM stock page.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Revenue Growth Buzz: Recent chatter on social media has been lively around Reddit's impressive revenue growth, with some highlighting a reported 68% increase and first-time profitability. This has sparked excitement among users, especially as the stock saw significant after-hours jumps. Many are pointing to the company’s data as a key asset for advertising and AI training.

AI Data Concerns: On the flip side, there’s growing concern over Reddit’s role in the AI economy, with posts noting a sharp drop in reliance on its data by certain AI models. Some users mentioned a decline in stock price linked to fears about traffic impacts from AI trends. The debate continues on whether these challenges dent the company’s long-term potential.

Future Outlook: Discussions also touch on Reddit’s future, with optimistic takes on user growth, ad revenue, and potential S&P 500 eligibility if profitability holds. Others are weighing in on analyst price targets and technical setups, showing a mix of confidence and caution. The conversation remains dynamic as traders assess the stock’s current levels.

Note: This discussion summary was generated from an AI condensation of post data.

Reddit Insider Trading Activity

Reddit insiders have traded $RDDT stock on the open market 366 times in the past 6 months. Of those trades, 0 have been purchases and 366 have been sales.

Here’s a breakdown of recent trading of $RDDT stock by insiders over the last 6 months:

- JENNIFER L. WONG (Chief Operating Officer) has made 0 purchases and 91 sales selling 320,214 shares for an estimated $66,436,316.

- STEVE LADD HUFFMAN (CEO & President) has made 0 purchases and 109 sales selling 200,000 shares for an estimated $41,653,865.

- CHRISTOPHER BRIAN SLOWE (Chief Technology Officer) has made 0 purchases and 103 sales selling 178,000 shares for an estimated $36,092,563.

- BENJAMIN SEONG LEE (Chief Legal Officer) has made 0 purchases and 29 sales selling 86,608 shares for an estimated $19,321,435.

- ANDREW VOLLERO (Chief Financial Officer) has made 0 purchases and 8 sales selling 30,000 shares for an estimated $6,542,556.

- MICHELLE MARIE REYNOLDS (Chief Accounting Officer) has made 0 purchases and 26 sales selling 24,678 shares for an estimated $5,155,837.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

Reddit Revenue

Reddit had revenues of $584.9M in Q3 2025. This is an increase of 67.91% from the same period in the prior year.

You can track RDDT financials on Quiver Quantitative's RDDT stock page.

Reddit Hedge Fund Activity

We have seen 524 institutional investors add shares of Reddit stock to their portfolio, and 362 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- JPMORGAN CHASE & CO added 2,807,862 shares (+136.9%) to their portfolio in Q3 2025, for an estimated $645,780,181

- CRESSET ASSET MANAGEMENT, LLC added 2,450,793 shares (+196.4%) to their portfolio in Q3 2025, for an estimated $563,657,882

- FMR LLC added 2,308,733 shares (+20.6%) to their portfolio in Q3 2025, for an estimated $530,985,502

- QUANTINNO CAPITAL MANAGEMENT LP added 2,011,418 shares (+110214.7%) to their portfolio in Q3 2025, for an estimated $462,606,025

- SCGE MANAGEMENT, L.P. removed 1,612,000 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $242,718,840

- NORGES BANK added 1,513,635 shares (+343.5%) to their portfolio in Q2 2025, for an estimated $227,908,021

- TIGER GLOBAL MANAGEMENT LLC removed 1,476,469 shares (-24.0%) from their portfolio in Q3 2025, for an estimated $339,573,105

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

Reddit Analyst Ratings

Wall Street analysts have issued reports on $RDDT in the last several months. We have seen 10 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Citigroup issued a "Buy" rating on 11/03/2025

- B. Riley Securities issued a "Buy" rating on 10/31/2025

- Needham issued a "Buy" rating on 10/31/2025

- Piper Sandler issued a "Overweight" rating on 09/18/2025

- JMP Securities issued a "Market Outperform" rating on 09/18/2025

- Oppenheimer issued a "Outperform" rating on 09/16/2025

- Jefferies issued a "Buy" rating on 09/10/2025

To track analyst ratings and price targets for Reddit, check out Quiver Quantitative's $RDDT forecast page.

Reddit Price Targets

Multiple analysts have issued price targets for $RDDT recently. We have seen 18 analysts offer price targets for $RDDT in the last 6 months, with a median target of $242.5.

Here are some recent targets:

- John Colantuoni from Jefferies set a target price of $325.0 on 12/11/2025

- Ronald Josey from Citigroup set a target price of $265.0 on 11/03/2025

- Mark Shmulik from Bernstein set a target price of $210.0 on 10/31/2025

- Doug Anmuth from JP Morgan set a target price of $227.0 on 10/31/2025

- Justin Post from B of A Securities set a target price of $210.0 on 10/31/2025

- Laura Martin from Needham set a target price of $300.0 on 10/31/2025

- Naved Khan from B. Riley Securities set a target price of $245.0 on 10/31/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$HIMS stock fell 5% this week, according to our price data from Polygon.

It has been the 31st most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $HIMS (you can track the company live on Quiver's $HIMS stock page):

$HIMS Insider Trading Activity

$HIMS insiders have traded $HIMS stock on the open market 64 times in the past 6 months. Of those trades, 0 have been purchases and 64 have been sales.

Here’s a breakdown of recent trading of $HIMS stock by insiders over the last 6 months:

- ANDREW DUDUM (Chief Executive Officer) has made 0 purchases and 24 sales selling 1,252,093 shares for an estimated $62,715,056.

- OLUYEMI OKUPE (Chief Financial Officer) has made 0 purchases and 12 sales selling 369,389 shares for an estimated $19,936,780.

- MICHAEL CHI (Chief Operating Officer) has made 0 purchases and 10 sales selling 77,349 shares for an estimated $4,288,956.

- PATRICK HARRISON CARROLL (Chief Medical Officer) has made 0 purchases and 3 sales selling 80,042 shares for an estimated $4,088,809.

- SOLEIL BOUGHTON (Chief Legal Officer) has made 0 purchases and 11 sales selling 28,675 shares for an estimated $1,419,687.

- IRENE BECKLUND (PAO) has made 0 purchases and 2 sales selling 16,821 shares for an estimated $733,472.

- DEBORAH M. AUTOR (Chief Policy Officer) sold 7,054 shares for an estimated $258,952

- GARCIA ANDREA G PEREZ sold 2,500 shares for an estimated $97,925

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$HIMS Hedge Fund Activity

We have seen 302 institutional investors add shares of $HIMS stock to their portfolio, and 288 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- JPMORGAN CHASE & CO added 15,045,710 shares (+549.0%) to their portfolio in Q3 2025, for an estimated $853,392,671

- SRS INVESTMENT MANAGEMENT, LLC removed 4,000,000 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $226,880,000

- TIDAL INVESTMENTS LLC added 2,707,111 shares (+1779.6%) to their portfolio in Q3 2025, for an estimated $153,547,335

- FARALLON CAPITAL MANAGEMENT LLC added 2,533,271 shares (+30.8%) to their portfolio in Q3 2025, for an estimated $143,687,131

- PRICE T ROWE ASSOCIATES INC /MD/ added 2,504,252 shares (+444.1%) to their portfolio in Q3 2025, for an estimated $142,041,173

- RENAISSANCE TECHNOLOGIES LLC added 2,227,400 shares (+32.4%) to their portfolio in Q3 2025, for an estimated $126,338,128

- D. E. SHAW & CO., INC. removed 1,886,971 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $107,028,995

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$HIMS Congressional Stock Trading

Members of Congress have traded $HIMS stock 1 times in the past 6 months. Of those trades, 1 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $HIMS stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 08/04.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$HIMS Analyst Ratings

Wall Street analysts have issued reports on $HIMS in the last several months. We have seen 2 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- BTIG issued a "Buy" rating on 11/04/2025

- B of A Securities issued a "Underperform" rating on 11/04/2025

- Canaccord Genuity issued a "Buy" rating on 09/12/2025

To track analyst ratings and price targets for $HIMS, check out Quiver Quantitative's $HIMS forecast page.

$HIMS Price Targets

Multiple analysts have issued price targets for $HIMS recently. We have seen 5 analysts offer price targets for $HIMS in the last 6 months, with a median target of $48.0.

Here are some recent targets:

- Glen Santangelo from Barclays set a target price of $48.0 on 12/09/2025

- David Larsen from BTIG set a target price of $85.0 on 11/04/2025

- Allen Lutz from B of A Securities set a target price of $32.0 on 11/04/2025

- Maria Ripps from Canaccord Genuity set a target price of $68.0 on 09/12/2025

- Jailendra Singh from Truist Securities set a target price of $37.0 on 08/18/2025

You can track data on $HIMS on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$SMCI stock fell 4% this week, according to our price data from Polygon.

It has been the 47th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $SMCI (you can track the company live on Quiver's $SMCI stock page):

$SMCI Insider Trading Activity

$SMCI insiders have traded $SMCI stock on the open market 8 times in the past 6 months. Of those trades, 0 have been purchases and 8 have been sales.

Here’s a breakdown of recent trading of $SMCI stock by insiders over the last 6 months:

- LIANG CHIU-CHU SARA LIU sold 200,000 shares for an estimated $12,000,000

- CHARLES LIANG (President and CEO) sold 200,000 shares for an estimated $12,000,000

- GEORGE KAO (SVP, OPERATIONS) has made 0 purchases and 2 sales selling 96,904 shares for an estimated $3,623,420.

- DAVID E WEIGAND (SVP, Chief Financial Officer) has made 0 purchases and 3 sales selling 50,000 shares for an estimated $2,135,780.

- SHERMAN TUAN sold 48,630 shares for an estimated $1,604,790

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$SMCI Hedge Fund Activity

We have seen 376 institutional investors add shares of $SMCI stock to their portfolio, and 402 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- COATUE MANAGEMENT LLC removed 8,866,735 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $434,558,682

- GOLDMAN SACHS GROUP INC added 4,511,082 shares (+173.6%) to their portfolio in Q3 2025, for an estimated $216,261,271

- CITADEL ADVISORS LLC added 3,743,281 shares (+756.7%) to their portfolio in Q3 2025, for an estimated $179,452,891

- JPMORGAN CHASE & CO added 3,546,184 shares (+150.3%) to their portfolio in Q3 2025, for an estimated $170,004,060

- D. E. SHAW & CO., INC. added 3,529,404 shares (+345.0%) to their portfolio in Q3 2025, for an estimated $169,199,627

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC added 3,038,136 shares (+83.5%) to their portfolio in Q3 2025, for an estimated $145,648,239

- NORGES BANK added 2,723,732 shares (+789.6%) to their portfolio in Q2 2025, for an estimated $133,490,105

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$SMCI Congressional Stock Trading

Members of Congress have traded $SMCI stock 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $SMCI stock by members of Congress over the last 6 months:

- REPRESENTATIVE GILBERT RAY CISNEROS, JR. has traded it 2 times. They made 1 purchase worth up to $15,000 on 09/05 and 1 sale worth up to $15,000 on 11/12.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$SMCI Analyst Ratings

Wall Street analysts have issued reports on $SMCI in the last several months. We have seen 2 firms issue buy ratings on the stock, and 2 firms issue sell ratings.

Here are some recent analyst ratings:

- Argus Research issued a "Buy" rating on 11/06/2025

- Rosenblatt issued a "Buy" rating on 11/05/2025

- Goldman Sachs issued a "Sell" rating on 10/24/2025

- B of A Securities issued a "Underperform" rating on 07/09/2025

To track analyst ratings and price targets for $SMCI, check out Quiver Quantitative's $SMCI forecast page.

$SMCI Price Targets

Multiple analysts have issued price targets for $SMCI recently. We have seen 13 analysts offer price targets for $SMCI in the last 6 months, with a median target of $45.0.

Here are some recent targets:

- Jim Kelleher from Argus Research set a target price of $64.0 on 11/06/2025

- Tim Long from Barclays set a target price of $43.0 on 11/06/2025

- Vijay Rakesh from Mizuho set a target price of $45.0 on 11/05/2025

- N. Quinn Bolton from Needham set a target price of $51.0 on 11/05/2025

- Kevin Cassidy from Rosenblatt set a target price of $55.0 on 11/05/2025

- An analyst from KGI Securities set a target price of $60.0 on 11/05/2025

- Matt Bryson from Wedbush set a target price of $42.0 on 11/05/2025

You can track data on $SMCI on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$OKLO stock fell 5% this week, according to our price data from Polygon.

It has been the 32nd most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $OKLO (you can track the company live on Quiver's $OKLO stock page):

$OKLO Insider Trading Activity

$OKLO insiders have traded $OKLO stock on the open market 45 times in the past 6 months. Of those trades, 0 have been purchases and 45 have been sales.

Here’s a breakdown of recent trading of $OKLO stock by insiders over the last 6 months:

- JACOB DEWITTE (Co-Founder, CEO) has made 0 purchases and 16 sales selling 600,000 shares for an estimated $67,358,095.

- CAROLINE COCHRAN (Co-Founder, COO) has made 0 purchases and 16 sales selling 600,000 shares for an estimated $67,358,095.

- RICHARD CRAIG BEALMEAR (Chief Financial Officer) has made 0 purchases and 5 sales selling 175,000 shares for an estimated $15,304,009.

- MICHAEL STUART KLEIN has made 0 purchases and 5 sales selling 100,000 shares for an estimated $9,430,564.

- WILLIAM CARROLL MURPHY GOODWIN (Chief Legal & Strategy Officer) has made 0 purchases and 3 sales selling 59,187 shares for an estimated $4,634,957.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$OKLO Hedge Fund Activity

We have seen 443 institutional investors add shares of $OKLO stock to their portfolio, and 235 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- MIRAE ASSET GLOBAL ETFS HOLDINGS LTD. added 2,968,981 shares (+71.8%) to their portfolio in Q3 2025, for an estimated $331,427,349

- VANGUARD GROUP INC added 2,901,909 shares (+33.4%) to their portfolio in Q3 2025, for an estimated $323,940,101

- EXODUSPOINT CAPITAL MANAGEMENT, LP removed 1,492,879 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $166,650,082

- VAN ECK ASSOCIATES CORP added 1,316,867 shares (+61.0%) to their portfolio in Q3 2025, for an estimated $147,001,863

- BLACKROCK, INC. added 1,298,177 shares (+17.7%) to their portfolio in Q3 2025, for an estimated $144,915,498

- UBS GROUP AG added 1,098,263 shares (+77.1%) to their portfolio in Q3 2025, for an estimated $122,599,098

- MORGAN STANLEY added 1,002,946 shares (+77.6%) to their portfolio in Q3 2025, for an estimated $111,958,861

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$OKLO Analyst Ratings

Wall Street analysts have issued reports on $OKLO in the last several months. We have seen 6 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- B. Riley Securities issued a "Buy" rating on 11/12/2025

- Canaccord Genuity issued a "Buy" rating on 10/09/2025

- Barclays issued a "Overweight" rating on 09/29/2025

- Wedbush issued a "Outperform" rating on 09/22/2025

- HC Wainwright & Co. issued a "Buy" rating on 08/12/2025

- Cantor Fitzgerald issued a "Overweight" rating on 07/15/2025

To track analyst ratings and price targets for $OKLO, check out Quiver Quantitative's $OKLO forecast page.

$OKLO Price Targets

Multiple analysts have issued price targets for $OKLO recently. We have seen 13 analysts offer price targets for $OKLO in the last 6 months, with a median target of $117.0.

Here are some recent targets:

- Jeff Campbell from Seaport Global set a target price of $150.0 on 12/08/2025

- Sean Milligan from Needham set a target price of $135.0 on 12/05/2025

- Jon Windham from UBS set a target price of $95.0 on 12/03/2025

- Daniel Ives from Wedbush set a target price of $150.0 on 11/12/2025

- Ryan Pfingst from B. Riley Securities set a target price of $129.0 on 11/12/2025

- Dimple Gosai from B of A Securities set a target price of $111.0 on 11/12/2025

- George Gianarikas from Canaccord Genuity set a target price of $175.0 on 10/09/2025

You can track data on $OKLO on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$UNH stock fell 5% this week, according to our price data from Polygon.

It has been the 5th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $UNH (you can track the company live on Quiver's $UNH stock page):

$UNH Insider Trading Activity

$UNH insiders have traded $UNH stock on the open market 1 times in the past 6 months. Of those trades, 0 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $UNH stock by insiders over the last 6 months:

- CHARLES D. BAKER sold 27 shares for an estimated $9,613

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$UNH Hedge Fund Activity

We have seen 1,592 institutional investors add shares of $UNH stock to their portfolio, and 2,138 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- WELLINGTON MANAGEMENT GROUP LLP removed 7,697,387 shares (-31.8%) from their portfolio in Q3 2025, for an estimated $2,657,907,731

- CAPITAL RESEARCH GLOBAL INVESTORS added 7,293,009 shares (+126.9%) to their portfolio in Q3 2025, for an estimated $2,518,276,007

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC added 5,146,915 shares (+59.8%) to their portfolio in Q3 2025, for an estimated $1,777,229,749

- PRICE T ROWE ASSOCIATES INC /MD/ removed 3,768,686 shares (-17.2%) from their portfolio in Q3 2025, for an estimated $1,301,327,275

- CAPITAL WORLD INVESTORS added 3,439,182 shares (+18.8%) to their portfolio in Q3 2025, for an estimated $1,187,549,544

- FMR LLC removed 3,112,368 shares (-18.5%) from their portfolio in Q3 2025, for an estimated $1,074,700,670

- APPALOOSA LP removed 2,246,500 shares (-91.7%) from their portfolio in Q3 2025, for an estimated $775,716,450

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$UNH Government Contracts

We have seen $14,311,022,652 of award payments to $UNH over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- EXPRESS REPORT: R3 FY25 3RD QTR APRIL: $830,362,703

- EXPRESS REPORT: R3 FY25 3RD QTR MAY: $819,320,444

- EXPRESS REPORT: R3 FY25 2ND QTR MARCH: $791,841,212

- EXPRESS REPORT: R3 FY25 2ND QTR JANUARY: $732,700,373

- EXPRESS REPORT: R3 FY25 2ND QTR FEBRUARY: $730,504,137

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$UNH Congressional Stock Trading

Members of Congress have traded $UNH stock 28 times in the past 6 months. Of those trades, 12 have been purchases and 16 have been sales.

Here’s a breakdown of recent trading of $UNH stock by members of Congress over the last 6 months:

- REPRESENTATIVE JULIE JOHNSON has traded it 3 times. They made 0 purchases and 3 sales worth up to $45,000 on 11/13, 08/14, 07/24.

- REPRESENTATIVE GILBERT RAY CISNEROS, JR. has traded it 4 times. They made 2 purchases worth up to $30,000 on 10/09, 09/05 and 2 sales worth up to $65,000 on 11/12, 08/05.

- REPRESENTATIVE RICHARD MCCORMICK has traded it 2 times. They made 1 purchase worth up to $15,000 on 11/05 and 1 sale worth up to $15,000 on 09/18.

- REPRESENTATIVE LISA C. MCCLAIN has traded it 5 times. They made 2 purchases worth up to $30,000 on 10/30, 08/13 and 3 sales worth up to $45,000 on 10/31, 10/30, 06/24.

- SENATOR MARKWAYNE MULLIN has traded it 2 times. They made 1 purchase worth up to $50,000 on 09/24 and 1 sale worth up to $50,000 on 08/01.

- REPRESENTATIVE VAL T. HOYLE sold up to $15,000 on 09/23.

- SENATOR SHELDON WHITEHOUSE has traded it 2 times. They made 0 purchases and 2 sales worth up to $100,000 on 09/04, 08/28.

- REPRESENTATIVE MARJORIE TAYLOR GREENE has traded it 2 times. They made 2 purchases worth up to $30,000 on 08/28, 08/04 and 0 sales.

- REPRESENTATIVE TIM MOORE has traded it 5 times. They made 4 purchases worth up to $130,000 on 08/08, 08/01, 07/21, 07/16 and 1 sale worth up to $100,000 on 08/15.

- SENATOR ANGUS S. KING JR. sold up to $15,000 on 07/15.

- SENATOR SHELLEY MOORE CAPITO sold up to $15,000 on 06/23.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$UNH Analyst Ratings

Wall Street analysts have issued reports on $UNH in the last several months. We have seen 14 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- Bernstein issued a "Outperform" rating on 10/30/2025

- Piper Sandler issued a "Overweight" rating on 10/29/2025

- UBS issued a "Buy" rating on 10/29/2025

- RBC Capital issued a "Outperform" rating on 10/29/2025

- Jefferies issued a "Buy" rating on 10/17/2025

- Goldman Sachs issued a "Buy" rating on 10/14/2025

- Keybanc issued a "Overweight" rating on 10/08/2025

To track analyst ratings and price targets for $UNH, check out Quiver Quantitative's $UNH forecast page.

$UNH Price Targets

Multiple analysts have issued price targets for $UNH recently. We have seen 18 analysts offer price targets for $UNH in the last 6 months, with a median target of $403.0.

Here are some recent targets:

- Lance Wilkes from Bernstein set a target price of $440.0 on 10/30/2025

- Ryan Langston from TD Cowen set a target price of $338.0 on 10/30/2025

- Jessica Tassan from Piper Sandler set a target price of $417.0 on 10/29/2025

- Kevin Caliendo from UBS set a target price of $430.0 on 10/29/2025

- Ben Hendrix from RBC Capital set a target price of $408.0 on 10/29/2025

- David Windley from Jefferies set a target price of $409.0 on 10/17/2025

- Scott Fidel from Goldman Sachs set a target price of $406.0 on 10/14/2025

You can track data on $UNH on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$RGTI stock fell 9% this week, according to our price data from Polygon.

It has been the 42nd most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $RGTI (you can track the company live on Quiver's $RGTI stock page):

$RGTI Insider Trading Activity

$RGTI insiders have traded $RGTI stock on the open market 21 times in the past 6 months. Of those trades, 0 have been purchases and 21 have been sales.

Here’s a breakdown of recent trading of $RGTI stock by insiders over the last 6 months:

- MICHAEL S. CLIFTON has made 0 purchases and 6 sales selling 375,000 shares for an estimated $7,865,295.

- HELENE GAIL SANDFORD has made 0 purchases and 7 sales selling 104,635 shares for an estimated $3,682,913.

- THOMAS J IANNOTTI has made 0 purchases and 2 sales selling 200,000 shares for an estimated $3,619,890.

- RAY O JOHNSON has made 0 purchases and 2 sales selling 166,715 shares for an estimated $3,132,200.

- DAVID RIVAS (CHIEF TECHNOLOGY OFFICER) has made 0 purchases and 2 sales selling 86,290 shares for an estimated $1,763,027.

- JEFFREY A. BERTELSEN (CHIEF FINANCIAL OFFICER) has made 0 purchases and 2 sales selling 7,621 shares for an estimated $155,700.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$RGTI Hedge Fund Activity

We have seen 310 institutional investors add shares of $RGTI stock to their portfolio, and 146 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- D. E. SHAW & CO., INC. added 12,764,516 shares (+inf%) to their portfolio in Q3 2025, for an estimated $380,254,931

- VANGUARD GROUP INC added 9,228,888 shares (+40.4%) to their portfolio in Q3 2025, for an estimated $274,928,573

- MAREX GROUP PLC removed 5,087,751 shares (-69.0%) from their portfolio in Q3 2025, for an estimated $151,564,102

- BLACKROCK, INC. added 4,489,029 shares (+21.3%) to their portfolio in Q3 2025, for an estimated $133,728,173

- PRICE T ROWE ASSOCIATES INC /MD/ added 4,201,228 shares (+663.8%) to their portfolio in Q3 2025, for an estimated $125,154,582

- TIDAL INVESTMENTS LLC added 2,377,981 shares (+99.9%) to their portfolio in Q3 2025, for an estimated $70,840,053

- SUSQUEHANNA INTERNATIONAL GROUP, LLP removed 2,213,503 shares (-98.4%) from their portfolio in Q3 2025, for an estimated $65,940,254

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$RGTI Analyst Ratings

Wall Street analysts have issued reports on $RGTI in the last several months. We have seen 5 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Wedbush issued a "Outperform" rating on 12/17/2025

- Mizuho issued a "Outperform" rating on 12/11/2025

- Benchmark issued a "Buy" rating on 11/12/2025

- Needham issued a "Buy" rating on 08/04/2025

- Cantor Fitzgerald issued a "Overweight" rating on 07/02/2025

To track analyst ratings and price targets for $RGTI, check out Quiver Quantitative's $RGTI forecast page.

$RGTI Price Targets

Multiple analysts have issued price targets for $RGTI recently. We have seen 7 analysts offer price targets for $RGTI in the last 6 months, with a median target of $35.0.

Here are some recent targets:

- Antoine Legault from Wedbush set a target price of $35.0 on 12/17/2025

- Kevin Garrigan from Jefferies set a target price of $30.0 on 12/16/2025

- Vijay Rakesh from Mizuho set a target price of $50.0 on 12/11/2025

- David Williams from Benchmark set a target price of $40.0 on 11/12/2025

- Craig Ellis from B. Riley Securities set a target price of $35.0 on 11/12/2025

- Quinn Bolton from Needham set a target price of $18.0 on 08/04/2025

- Troy Jensen from Cantor Fitzgerald set a target price of $15.0 on 07/02/2025

You can track data on $RGTI on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$OPEN stock fell 4% this week, according to our price data from Polygon.

It has been the 49th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $OPEN (you can track the company live on Quiver's $OPEN stock page):

$OPEN Insider Trading Activity

$OPEN insiders have traded $OPEN stock on the open market 9 times in the past 6 months. Of those trades, 5 have been purchases and 4 have been sales.

Here’s a breakdown of recent trading of $OPEN stock by insiders over the last 6 months:

- ERIC CHUNG-WEI WU has made 2 purchases buying 751,879 shares for an estimated $4,999,995 and 0 sales.

- KASRA NEJATIAN (Chief Executive Officer) purchased 125,000 shares for an estimated $1,004,562

- CHRISTINA SCHWARTZ (See Remarks) sold 73,951 shares for an estimated $583,961

- SHRISHA RADHAKRISHNA (President) has made 2 purchases buying 30,000 shares for an estimated $128,339 and 0 sales.

- SYDNEY SCHAUB (Chief Legal Officer) has made 0 purchases and 3 sales selling 47,361 shares for an estimated $122,477.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$OPEN Hedge Fund Activity

We have seen 212 institutional investors add shares of $OPEN stock to their portfolio, and 195 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- JANE STREET GROUP, LLC added 23,861,727 shares (+1184.0%) to their portfolio in Q3 2025, for an estimated $190,177,964

- RENAISSANCE TECHNOLOGIES LLC added 17,272,580 shares (+195.6%) to their portfolio in Q3 2025, for an estimated $137,662,462

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. removed 15,838,339 shares (-96.8%) from their portfolio in Q3 2025, for an estimated $126,231,561

- TWO SIGMA ADVISERS, LP removed 13,030,800 shares (-99.6%) from their portfolio in Q3 2025, for an estimated $103,855,476

- QUBE RESEARCH & TECHNOLOGIES LTD removed 12,540,603 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $99,948,605

- AMERICAN CENTURY COMPANIES INC added 11,007,457 shares (+inf%) to their portfolio in Q3 2025, for an estimated $87,729,432

- WEISS ASSET MANAGEMENT LP removed 9,606,779 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $76,566,028

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$OPEN Congressional Stock Trading

Members of Congress have traded $OPEN stock 2 times in the past 6 months. Of those trades, 2 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $OPEN stock by members of Congress over the last 6 months:

- REPRESENTATIVE CLEO FIELDS has traded it 2 times. They made 2 purchases worth up to $30,000 on 09/19, 07/21 and 0 sales.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$OPEN Analyst Ratings

Wall Street analysts have issued reports on $OPEN in the last several months. We have seen 0 firms issue buy ratings on the stock, and 3 firms issue sell ratings.

Here are some recent analyst ratings:

- Citigroup issued a "Sell" rating on 11/12/2025

- Keefe, Bruyette & Woods issued a "Underperform" rating on 11/10/2025

- Zelman & Assoc issued a "Underperform" rating on 08/07/2025

To track analyst ratings and price targets for $OPEN, check out Quiver Quantitative's $OPEN forecast page.

$OPEN Price Targets

Multiple analysts have issued price targets for $OPEN recently. We have seen 4 analysts offer price targets for $OPEN in the last 6 months, with a median target of $1.5.

Here are some recent targets:

- Ygal Arounian from Citigroup set a target price of $1.4 on 11/12/2025

- Ryan Tomasello from Keefe, Bruyette & Woods set a target price of $2.0 on 11/10/2025

- An analyst from Zelman & Assoc set a target price of $1.0 on 08/07/2025

- Lloyd Walmsley from UBS set a target price of $1.6 on 08/06/2025

You can track data on $OPEN on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$AVGO stock fell 6% this week, according to our price data from Polygon.

It has been the 4th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $AVGO (you can track the company live on Quiver's $AVGO stock page):

$AVGO Insider Trading Activity

$AVGO insiders have traded $AVGO stock on the open market 186 times in the past 6 months. Of those trades, 3 have been purchases and 183 have been sales.

Here’s a breakdown of recent trading of $AVGO stock by insiders over the last 6 months:

- HENRY SAMUELI has made 0 purchases and 23 sales selling 1,163,011 shares for an estimated $378,655,313.

- HOCK E TAN (President and CEO) has made 0 purchases and 5 sales selling 328,154 shares for an estimated $105,056,040.

- MARK DAVID BRAZEAL (Chief Legal & Corp Affairs Ofc) has made 0 purchases and 60 sales selling 190,012 shares for an estimated $56,265,801.

- KIRSTEN M. SPEARS (CFO & Chief Accounting Officer) has made 0 purchases and 45 sales selling 54,762 shares for an estimated $15,869,748.

- CHARLIE B KAWWAS (President, Semi Solutions Grp) has made 0 purchases and 43 sales selling 9,560 shares for an estimated $3,309,571.

- JUSTINE PAGE has made 0 purchases and 6 sales selling 4,800 shares for an estimated $1,587,952.

- HARRY L. YOU has made 3 purchases buying 3,550 shares for an estimated $1,227,870 and 0 sales.

- GAYLA J DELLY sold 3,000 shares for an estimated $795,390

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$AVGO Hedge Fund Activity

We have seen 2,094 institutional investors add shares of $AVGO stock to their portfolio, and 1,950 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC added 31,423,170 shares (+78.8%) to their portfolio in Q3 2025, for an estimated $10,366,818,014

- CAPITAL WORLD INVESTORS removed 12,713,939 shares (-8.6%) from their portfolio in Q3 2025, for an estimated $4,194,455,615

- WELLINGTON MANAGEMENT GROUP LLP removed 10,906,362 shares (-19.0%) from their portfolio in Q3 2025, for an estimated $3,598,117,887

- NORGES BANK removed 5,462,267 shares (-7.5%) from their portfolio in Q2 2025, for an estimated $1,505,673,898

- BNP PARIBAS FINANCIAL MARKETS removed 5,416,301 shares (-47.9%) from their portfolio in Q3 2025, for an estimated $1,786,891,862

- BANK OF AMERICA CORP /DE/ removed 5,123,905 shares (-7.6%) from their portfolio in Q3 2025, for an estimated $1,690,427,498

- PRICE T ROWE ASSOCIATES INC /MD/ added 4,904,436 shares (+6.3%) to their portfolio in Q3 2025, for an estimated $1,618,022,480

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$AVGO Government Contracts

We have seen $67,073,179 of award payments to $AVGO over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- NEW 66 MONTH OPEN-MARKET CONTRACT FOR RENEWAL OF CA SOFTWARE, SUPPORT SERVICES, AND MAINTENANCE. CA PROPRIE...: $41,249,999

- CA SOFTWARE MAINTENANCE: $21,091,011

- BROADCOM TECHNICAL SUPPORT SERVICES INDEFINITE DELIVERY/INDEFINITE QUANTITY (IDIQ) CONTRACT - TASK ORDER F...: $3,629,376

- BROADCOM IDIQ TASK ORDER FOR CLARITY INVESTMENT MANAGEMENT TOOL (IMT) SUPPORT SERVICES.: $885,600

- BROADCOM TECHNICAL SUPPORT SERVICES INDEFINITE DELIVERY/INDEFINITE QUANTITY (IDIQ) CONTRACT - TASK ORDER F...: $170,880

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$AVGO Congressional Stock Trading

Members of Congress have traded $AVGO stock 19 times in the past 6 months. Of those trades, 13 have been purchases and 6 have been sales.

Here’s a breakdown of recent trading of $AVGO stock by members of Congress over the last 6 months:

- REPRESENTATIVE GILBERT RAY CISNEROS, JR. has traded it 2 times. They made 2 purchases worth up to $30,000 on 11/18, 10/17 and 0 sales.

- REPRESENTATIVE LISA C. MCCLAIN has traded it 3 times. They made 1 purchase worth up to $15,000 on 10/30 and 2 sales worth up to $30,000 on 10/31, 10/30.

- REPRESENTATIVE JARED MOSKOWITZ has traded it 3 times. They made 3 purchases worth up to $80,000 on 10/10 and 0 sales.

- REPRESENTATIVE VAL T. HOYLE sold up to $50,000 on 09/23.

- REPRESENTATIVE CLEO FIELDS has traded it 6 times. They made 6 purchases worth up to $315,000 on 09/17, 08/15, 08/13, 07/29, 07/18 and 0 sales.

- SENATOR SHELLEY MOORE CAPITO sold up to $15,000 on 07/18.

- REPRESENTATIVE RITCHIE TORRES sold up to $15,000 on 07/11.

- REPRESENTATIVE JAMES COMER sold up to $15,000 on 07/03.

- REPRESENTATIVE JOSH GOTTHEIMER purchased up to $15,000 on 06/25.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$AVGO Analyst Ratings

Wall Street analysts have issued reports on $AVGO in the last several months. We have seen 16 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Piper Sandler issued a "Overweight" rating on 12/12/2025

- Rosenblatt issued a "Buy" rating on 12/12/2025

- Mizuho issued a "Outperform" rating on 12/12/2025

- Oppenheimer issued a "Outperform" rating on 12/12/2025

- Benchmark issued a "Buy" rating on 12/12/2025

- Bernstein issued a "Outperform" rating on 12/12/2025

- UBS issued a "Buy" rating on 12/01/2025

To track analyst ratings and price targets for $AVGO, check out Quiver Quantitative's $AVGO forecast page.

$AVGO Price Targets

Multiple analysts have issued price targets for $AVGO recently. We have seen 22 analysts offer price targets for $AVGO in the last 6 months, with a median target of $450.0.

Here are some recent targets:

- William Stein from Truist Securities set a target price of $510.0 on 12/19/2025

- Timothy Arcuri from UBS set a target price of $475.0 on 12/15/2025

- Vivek Arya from B of A Securities set a target price of $500.0 on 12/12/2025

- Tom O'Malley from Barclays set a target price of $500.0 on 12/12/2025

- Christopher Danely from Citigroup set a target price of $480.0 on 12/12/2025

- Harsh Kumar from Piper Sandler set a target price of $430.0 on 12/12/2025

- Stacy Rasgon from Bernstein set a target price of $475.0 on 12/12/2025

You can track data on $AVGO on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$TEM stock fell 9% this week, according to our price data from Polygon.

It has been the 6th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $TEM (you can track the company live on Quiver's $TEM stock page):

$TEM Insider Trading Activity

$TEM insiders have traded $TEM stock on the open market 111 times in the past 6 months. Of those trades, 0 have been purchases and 111 have been sales.

Here’s a breakdown of recent trading of $TEM stock by insiders over the last 6 months:

- ERIC P LEFKOFSKY (CEO and Chairman) has made 0 purchases and 56 sales selling 1,530,537 shares for an estimated $116,367,102.

- THEODORE LEONSIS has made 0 purchases and 2 sales selling 64,000 shares for an estimated $4,592,200.

- RYAN FUKUSHIMA (Chief Operating Officer) has made 0 purchases and 20 sales selling 57,559 shares for an estimated $4,308,740.

- JAMES WILLIAM ROGERS (Chief Financial Officer) has made 0 purchases and 7 sales selling 34,751 shares for an estimated $2,499,084.

- ANDREW POLOVIN (EVP and General Counsel) has made 0 purchases and 9 sales selling 29,864 shares for an estimated $2,144,365.

- ERIK PHELPS (EVP & Chief Admin & Legal Off) has made 0 purchases and 5 sales selling 8,499 shares for an estimated $592,859.

- WAYNE A.I. FREDERICK sold 3,675 shares for an estimated $283,820

- RYAN M BARTOLUCCI (Chief Accounting Officer) has made 0 purchases and 4 sales selling 3,738 shares for an estimated $262,337.

- JENNIFER A DOUDNA has made 0 purchases and 3 sales selling 3,227 shares for an estimated $227,759.

- DAVID R EPSTEIN has made 0 purchases and 4 sales selling 1,240 shares for an estimated $91,006.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$TEM Hedge Fund Activity

We have seen 253 institutional investors add shares of $TEM stock to their portfolio, and 169 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- GOLDMAN SACHS GROUP INC removed 4,030,697 shares (-94.7%) from their portfolio in Q3 2025, for an estimated $325,317,554

- NEA MANAGEMENT COMPANY, LLC removed 2,615,979 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $166,219,305

- BLACKROCK, INC. added 2,597,838 shares (+62.8%) to their portfolio in Q3 2025, for an estimated $209,671,504

- BAILLIE GIFFORD & CO removed 2,401,588 shares (-19.9%) from their portfolio in Q3 2025, for an estimated $193,832,167

- VANGUARD GROUP INC added 1,706,837 shares (+22.1%) to their portfolio in Q3 2025, for an estimated $137,758,814

- D. E. SHAW & CO., INC. added 1,605,757 shares (+380.8%) to their portfolio in Q3 2025, for an estimated $129,600,647

- BANK OF AMERICA CORP /DE/ added 1,277,244 shares (+112.9%) to their portfolio in Q3 2025, for an estimated $103,086,363

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$TEM Government Contracts

We have seen $18,460,020 of award payments to $TEM over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- ADAPT CRO SUPPORT SERVICES SOLICITATION: $12,741,975

- TUMOR NORMAL MATCHED GENOMIC TESTING SERVICES: $5,718,045

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$TEM Analyst Ratings

Wall Street analysts have issued reports on $TEM in the last several months. We have seen 5 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- BTIG issued a "Buy" rating on 11/25/2025

- Morgan Stanley issued a "Overweight" rating on 11/11/2025

- HC Wainwright & Co. issued a "Buy" rating on 11/07/2025

- Canaccord Genuity issued a "Buy" rating on 11/05/2025

- Guggenheim issued a "Buy" rating on 09/26/2025

To track analyst ratings and price targets for $TEM, check out Quiver Quantitative's $TEM forecast page.

$TEM Price Targets

Multiple analysts have issued price targets for $TEM recently. We have seen 9 analysts offer price targets for $TEM in the last 6 months, with a median target of $89.0.

Here are some recent targets:

- Casey Woodring from JP Morgan set a target price of $80.0 on 12/15/2025

- Tejas Savant from Morgan Stanley set a target price of $85.0 on 12/02/2025

- Mark Massaro from BTIG set a target price of $105.0 on 11/25/2025

- David Westenberg from Piper Sandler set a target price of $80.0 on 11/11/2025

- Yi Chen from HC Wainwright & Co. set a target price of $89.0 on 11/07/2025

- Kyle Mikson from Canaccord Genuity set a target price of $95.0 on 11/05/2025

- Ryan MacDonald from Needham set a target price of $100.0 on 11/05/2025

You can track data on $TEM on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$CRWD stock fell 5% this week, according to our price data from Polygon.

It has been the 34th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $CRWD (you can track the company live on Quiver's $CRWD stock page):

$CRWD Insider Trading Activity

$CRWD insiders have traded $CRWD stock on the open market 201 times in the past 6 months. Of those trades, 0 have been purchases and 201 have been sales.

Here’s a breakdown of recent trading of $CRWD stock by insiders over the last 6 months:

- GEORGE KURTZ (PRESIDENT AND CEO) has made 0 purchases and 60 sales selling 84,597 shares for an estimated $40,062,997.

- MICHAEL SENTONAS (PRESIDENT) has made 0 purchases and 9 sales selling 68,088 shares for an estimated $33,887,158.

- BURT W. PODBERE (CHIEF FINANCIAL OFFICER) has made 0 purchases and 23 sales selling 35,260 shares for an estimated $16,826,188.

- SAMEER K GANDHI has made 0 purchases and 71 sales selling 31,223 shares for an estimated $15,259,703.

- ROXANNE S AUSTIN has made 0 purchases and 6 sales selling 25,000 shares for an estimated $12,590,000.

- DENIS OLEARY has made 0 purchases and 4 sales selling 7,750 shares for an estimated $3,994,628.

- ANURAG SAHA (CHIEF ACCOUNTING OFFICER) has made 0 purchases and 9 sales selling 7,991 shares for an estimated $3,876,185.

- JOHANNA FLOWER has made 0 purchases and 19 sales selling 4,420 shares for an estimated $2,135,374.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$CRWD Hedge Fund Activity

We have seen 1,090 institutional investors add shares of $CRWD stock to their portfolio, and 863 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC added 1,626,924 shares (+70.5%) to their portfolio in Q3 2025, for an estimated $797,810,991

- MORGAN STANLEY removed 1,617,058 shares (-20.0%) from their portfolio in Q3 2025, for an estimated $792,972,902

- VESTOR CAPITAL, LLC removed 977,184 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $479,191,489

- PRICE T ROWE ASSOCIATES INC /MD/ added 958,014 shares (+29.4%) to their portfolio in Q3 2025, for an estimated $469,790,905

- PATHSTONE HOLDINGS, LLC removed 843,963 shares (-25.6%) from their portfolio in Q3 2025, for an estimated $413,862,575

- GOLDMAN SACHS GROUP INC removed 710,473 shares (-30.8%) from their portfolio in Q3 2025, for an estimated $348,401,749

- ARROWSTREET CAPITAL, LIMITED PARTNERSHIP removed 630,875 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $309,368,482

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$CRWD Congressional Stock Trading

Members of Congress have traded $CRWD stock 3 times in the past 6 months. Of those trades, 2 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $CRWD stock by members of Congress over the last 6 months:

- REPRESENTATIVE MARJORIE TAYLOR GREENE purchased up to $15,000 on 09/11.

- REPRESENTATIVE LISA C. MCCLAIN has traded it 2 times. They made 1 purchase worth up to $15,000 on 07/16 and 1 sale worth up to $15,000 on 08/04.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$CRWD Analyst Ratings

Wall Street analysts have issued reports on $CRWD in the last several months. We have seen 23 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Freedom Capital Markets issued a "Buy" rating on 12/11/2025

- Goldman Sachs issued a "Buy" rating on 12/04/2025

- BMO Capital issued a "Outperform" rating on 12/03/2025

- JP Morgan issued a "Overweight" rating on 12/03/2025

- Rosenblatt issued a "Buy" rating on 12/03/2025

- Keybanc issued a "Overweight" rating on 12/01/2025

- Wedbush issued a "Outperform" rating on 12/01/2025

To track analyst ratings and price targets for $CRWD, check out Quiver Quantitative's $CRWD forecast page.

$CRWD Price Targets

Multiple analysts have issued price targets for $CRWD recently. We have seen 38 analysts offer price targets for $CRWD in the last 6 months, with a median target of $567.0.

Here are some recent targets:

- Todd Weller from Stephens & Co. set a target price of $590.0 on 12/18/2025

- Keith Weiss from Morgan Stanley set a target price of $537.0 on 12/18/2025

- Almas Almaganbetov from Freedom Capital Markets set a target price of $550.0 on 12/11/2025

- Fatima Boolani from Citigroup set a target price of $595.0 on 12/04/2025

- Gabriela Borges from Goldman Sachs set a target price of $564.0 on 12/04/2025

- Gray Powell from BTIG set a target price of $640.0 on 12/03/2025

- Mike Cikos from Needham set a target price of $575.0 on 12/03/2025

You can track data on $CRWD on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$MSTR stock fell 7% this week, according to our price data from Polygon.

It has been the 24th most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $MSTR (you can track the company live on Quiver's $MSTR stock page):

$MSTR Insider Trading Activity

$MSTR insiders have traded $MSTR stock on the open market 89 times in the past 6 months. Of those trades, 15 have been purchases and 74 have been sales.

Here’s a breakdown of recent trading of $MSTR stock by insiders over the last 6 months:

- WEI-MING SHAO (EVP & General Counsel) has made 2 purchases buying 15,000 shares for an estimated $1,436,450 and 68 sales selling 142,402 shares for an estimated $51,370,057.

- PETER L JR BRIGER purchased 220,000 shares for an estimated $19,800,000

- JEANINE MONTGOMERY (VP & CAO) has made 1 purchase buying 5,000 shares for an estimated $450,000 and 2 sales selling 43,793 shares for an estimated $18,845,092.

- ANDREW KANG (EVP & CFO) has made 1 purchase buying 2,800 shares for an estimated $252,000 and 4 sales selling 25,000 shares for an estimated $9,820,750.

- JARROD M PATTEN has made 3 purchases buying 29,335 shares for an estimated $2,816,253 and 0 sales.

- GREGG WINIARSKI purchased 10,000 shares for an estimated $976,520

- PHONG LE (President & CEO) has made 4 purchases buying 5,619 shares for an estimated $506,308 and 0 sales.

- JANE A DIETZE has made 2 purchases buying 2,600 shares for an estimated $239,808 and 0 sales.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$MSTR Hedge Fund Activity

We have seen 630 institutional investors add shares of $MSTR stock to their portfolio, and 557 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- CLEAR STREET LLC added 5,971,971 shares (+inf%) to their portfolio in Q2 2025, for an estimated $2,414,049,837

- CLEAR STREET DERIVATIVES LLC removed 5,283,815 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $2,135,876,537

- CAPULA MANAGEMENT LTD added 1,755,481 shares (+309608.6%) to their portfolio in Q3 2025, for an estimated $565,633,533

- NATIONAL BANK OF CANADA /FI/ added 1,476,858 shares (+260.0%) to their portfolio in Q3 2025, for an estimated $475,858,416

- ROYAL BANK OF CANADA added 1,376,824 shares (+729.8%) to their portfolio in Q3 2025, for an estimated $443,626,461

- VANGUARD GROUP INC added 1,344,519 shares (+7.3%) to their portfolio in Q3 2025, for an estimated $433,217,466

- GOLDMAN SACHS GROUP INC added 1,300,403 shares (+164.2%) to their portfolio in Q3 2025, for an estimated $419,002,850

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$MSTR Government Contracts

We have seen $29,200 of award payments to $MSTR over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- MICROSTRATEGY TECHNICAL SUPPORT STANDARD RENEWAL - FY25 HHS PROGRAM PERFORMANCE TRACKING SYSTEM: $29,200

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$MSTR Analyst Ratings

Wall Street analysts have issued reports on $MSTR in the last several months. We have seen 8 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- HC Wainwright & Co. issued a "Buy" rating on 11/03/2025

- Canaccord Genuity issued a "Buy" rating on 11/03/2025

- BTIG issued a "Buy" rating on 10/31/2025

- TD Cowen issued a "Buy" rating on 10/31/2025

- Citigroup issued a "Buy" rating on 10/21/2025

- Mizuho issued a "Outperform" rating on 08/11/2025

- Benchmark issued a "Buy" rating on 08/01/2025

To track analyst ratings and price targets for $MSTR, check out Quiver Quantitative's $MSTR forecast page.

$MSTR Price Targets

Multiple analysts have issued price targets for $MSTR recently. We have seen 11 analysts offer price targets for $MSTR in the last 6 months, with a median target of $485.0.

Here are some recent targets:

- Gautam Chhugani from Bernstein set a target price of $450.0 on 12/08/2025

- Mike Colonnese from HC Wainwright & Co. set a target price of $475.0 on 11/03/2025

- Joseph Vafi from Canaccord Genuity set a target price of $474.0 on 11/03/2025

- Lance Vitanza from TD Cowen set a target price of $535.0 on 10/31/2025

- Andrew Harte from BTIG set a target price of $630.0 on 10/31/2025

- Brett Knoblauch from Cantor Fitzgerald set a target price of $560.0 on 10/31/2025

- Peter Christiansen from Citigroup set a target price of $485.0 on 10/21/2025

You can track data on $MSTR on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$VST stock fell 5% this week, according to our price data from Polygon.

It has been the 43rd most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $VST (you can track the company live on Quiver's $VST stock page):

$VST Insider Trading Activity

$VST insiders have traded $VST stock on the open market 54 times in the past 6 months. Of those trades, 0 have been purchases and 54 have been sales.

Here’s a breakdown of recent trading of $VST stock by insiders over the last 6 months:

- JAMES A BURKE (President and CEO) has made 0 purchases and 51 sales selling 789,467 shares for an estimated $160,145,125.

- CARRIE LEE KIRBY (EVP and Chief Admin. Officer) sold 58,275 shares for an estimated $10,183,556

- SCOTT A HUDSON (EVP & President Vistra Retail) sold 56,000 shares for an estimated $9,456,160

- STEPHANIE ZAPATA MOORE (EVP and General Counsel) sold 8,219 shares for an estimated $1,424,763

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$VST Hedge Fund Activity

We have seen 730 institutional investors add shares of $VST stock to their portfolio, and 655 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- JPMORGAN CHASE & CO added 2,074,364 shares (+23.4%) to their portfolio in Q3 2025, for an estimated $406,409,394

- NORGES BANK added 1,831,733 shares (+61.7%) to their portfolio in Q2 2025, for an estimated $355,008,172

- LONE PINE CAPITAL LLC removed 1,770,478 shares (-27.4%) from their portfolio in Q3 2025, for an estimated $346,872,049

- DZ BANK AG DEUTSCHE ZENTRAL GENOSSENSCHAFTS BANK, FRANKFURT AM MAIN added 1,746,319 shares (+827.3%) to their portfolio in Q3 2025, for an estimated $342,138,818

- RUBRIC CAPITAL MANAGEMENT LP removed 1,424,803 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $279,147,403

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC added 1,290,548 shares (+77.1%) to their portfolio in Q3 2025, for an estimated $252,844,164

- MEREWETHER INVESTMENT MANAGEMENT, LP removed 1,221,514 shares (-92.9%) from their portfolio in Q3 2025, for an estimated $239,319,022

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$VST Congressional Stock Trading

Members of Congress have traded $VST stock 3 times in the past 6 months. Of those trades, 1 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $VST stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN has traded it 3 times. They made 1 purchase worth up to $15,000 on 10/30 and 2 sales worth up to $30,000 on 10/31, 10/30.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$VST Analyst Ratings

Wall Street analysts have issued reports on $VST in the last several months. We have seen 7 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- JP Morgan issued a "Overweight" rating on 12/16/2025

- Keybanc issued a "Overweight" rating on 11/25/2025

- Evercore ISI Group issued a "Outperform" rating on 11/07/2025

- BMO Capital issued a "Outperform" rating on 11/07/2025

- Wells Fargo issued a "Overweight" rating on 10/28/2025

- Morgan Stanley issued a "Overweight" rating on 09/25/2025

- UBS issued a "Buy" rating on 07/25/2025

To track analyst ratings and price targets for $VST, check out Quiver Quantitative's $VST forecast page.

$VST Price Targets

Multiple analysts have issued price targets for $VST recently. We have seen 11 analysts offer price targets for $VST in the last 6 months, with a median target of $233.0.

Here are some recent targets:

- Jeremy Tonet from JP Morgan set a target price of $233.0 on 12/16/2025

- Sophie Karp from Keybanc set a target price of $217.0 on 11/25/2025

- James Thalacker from BMO Capital set a target price of $245.0 on 11/07/2025

- Durgesh Chopra from Evercore ISI Group set a target price of $243.0 on 11/07/2025

- Shahriar Pourreza from Wells Fargo set a target price of $238.0 on 10/28/2025

- Angie Storozynski from Seaport Global set a target price of $242.0 on 10/08/2025

- Stephen Byrd from Morgan Stanley set a target price of $223.0 on 09/25/2025

You can track data on $VST on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$PANW stock fell 3% this week, according to our price data from Polygon.

It has been the 21st most-searched ticker on Quiver Quantitative over the last week, out of 50 total tickers searched.

Here is what we see in our data on $PANW (you can track the company live on Quiver's $PANW stock page):

$PANW Insider Trading Activity

$PANW insiders have traded $PANW stock on the open market 75 times in the past 6 months. Of those trades, 0 have been purchases and 75 have been sales.

Here’s a breakdown of recent trading of $PANW stock by insiders over the last 6 months:

- NIKESH ARORA (Chief Executive Officer) has made 0 purchases and 7 sales selling 846,408 shares for an estimated $172,721,695.

- LEE KLARICH (EVP Chief Product & Tech Ofcr) has made 0 purchases and 31 sales selling 724,644 shares for an estimated $143,155,898.

- NIR ZUK (EVP, Chief Technology Officer) has made 0 purchases and 17 sales selling 200,000 shares for an estimated $37,146,511.

- JAMES J GOETZ has made 0 purchases and 5 sales selling 25,000 shares for an estimated $4,880,042.

- DIPAK GOLECHHA (EVP, Chief Financial Officer) has made 0 purchases and 11 sales selling 10,000 shares for an estimated $2,030,185.

- JOSH D. PAUL (Chief Accounting Officer) has made 0 purchases and 4 sales selling 2,700 shares for an estimated $537,892.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$PANW Hedge Fund Activity

We have seen 1,475 institutional investors add shares of $PANW stock to their portfolio, and 869 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- UBS AM, A DISTINCT BUSINESS UNIT OF UBS ASSET MANAGEMENT AMERICAS LLC added 4,423,091 shares (+59.6%) to their portfolio in Q3 2025, for an estimated $900,629,789

- KINGSTONE CAPITAL PARTNERS TEXAS, LLC removed 3,092,454 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $629,685,483

- DZ BANK AG DEUTSCHE ZENTRAL GENOSSENSCHAFTS BANK, FRANKFURT AM MAIN added 2,882,007 shares (+568.5%) to their portfolio in Q3 2025, for an estimated $586,834,265

- FMR LLC removed 2,772,474 shares (-26.7%) from their portfolio in Q3 2025, for an estimated $564,531,155

- JANE STREET GROUP, LLC added 2,608,526 shares (+169384.8%) to their portfolio in Q3 2025, for an estimated $531,148,064

- ROYAL BANK OF CANADA added 2,454,869 shares (+32.9%) to their portfolio in Q3 2025, for an estimated $499,860,425

- CITADEL ADVISORS LLC added 2,271,937 shares (+882.5%) to their portfolio in Q3 2025, for an estimated $462,611,811

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$PANW Congressional Stock Trading

Members of Congress have traded $PANW stock 5 times in the past 6 months. Of those trades, 3 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $PANW stock by members of Congress over the last 6 months:

- REPRESENTATIVE MARJORIE TAYLOR GREENE purchased up to $15,000 on 10/24.

- SENATOR JOHN W. HICKENLOOPER purchased up to $250,000 on 09/02.

- REPRESENTATIVE VAL T. HOYLE sold up to $15,000 on 08/19.

- REPRESENTATIVE LISA C. MCCLAIN has traded it 2 times. They made 1 purchase worth up to $15,000 on 07/10 and 1 sale worth up to $15,000 on 07/16.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$PANW Analyst Ratings

Wall Street analysts have issued reports on $PANW in the last several months. We have seen 25 firms issue buy ratings on the stock, and 2 firms issue sell ratings.

Here are some recent analyst ratings:

- Morgan Stanley issued a "Overweight" rating on 12/18/2025

- JP Morgan issued a "Overweight" rating on 12/17/2025

- Goldman Sachs issued a "Buy" rating on 11/21/2025

- HSBC issued a "Reduce" rating on 11/21/2025

- Cantor Fitzgerald issued a "Overweight" rating on 11/20/2025

- Needham issued a "Buy" rating on 11/20/2025

- BTIG issued a "Buy" rating on 11/20/2025

To track analyst ratings and price targets for $PANW, check out Quiver Quantitative's $PANW forecast page.

$PANW Price Targets