S. 3405: PRC Financial Intermediary Review Act

This bill, known as the PRC Financial Intermediary Review Act, aims to enhance oversight and transparency regarding certain financial entities. Here are the key components of what the bill proposes:

Objective of the Bill

The primary goal of the bill is to require the Securities and Exchange Commission (SEC) to conduct an in-depth study of specific brokers and dealers, along with investment advisers, that are:

- Members of a national securities association

- Registered with the SEC

- Controlled by or organized under the laws of the People’s Republic of China

Study Parameters

The SEC is tasked with examining:

- The transparency of these financial entities

- The level of cooperation these entities provide in terms of regulatory practices

Report Submission

Following the study, the SEC must submit a report to Congress. This report will include the findings and results from their examination of the specified brokers, dealers, and investment advisers.

Timeline

The SEC is given a period of one year from the enactment of the bill to conduct the study and produce the report.

Intended Impact

The intent behind this legislation appears to focus on enhancing regulatory scrutiny over financial intermediaries that have connections to China, which may be driven by broader concerns regarding financial security and transparency in international financial markets.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

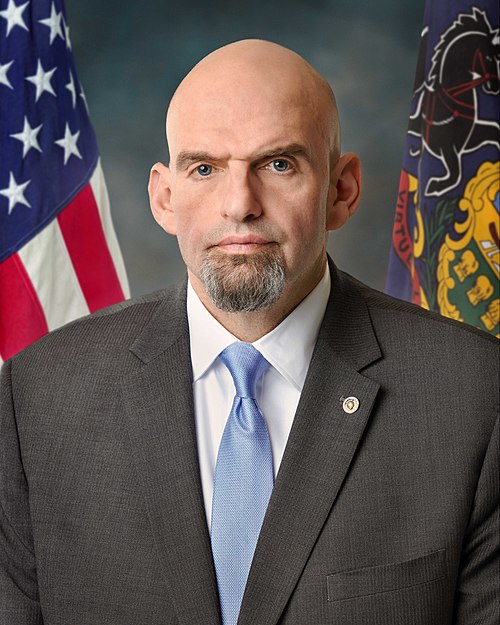

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 09, 2025 | Introduced in Senate |

| Dec. 09, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.