S. 2019: Taskforce for Recognizing and Averting Payment Scams Act

The Taskforce for Recognizing and Averting Payment Scams Act (also known as the TRAPS Act) is a proposed piece of legislation aimed at combating payment scams through the establishment of a Task Force. This Task Force will be created no later than 90 days after the enactment of the bill and will be chaired by the Secretary of the Treasury. The primary objectives and responsibilities of the Task Force are outlined below:

Membership

The Task Force will include representatives from various federal agencies and sectors, including:- The Bureau of Consumer Financial Protection

- The Federal Communications Commission

- The Federal Trade Commission

- The Department of Justice

- The Office of the Comptroller of the Currency

- The Board of Governors of the Federal Reserve System

- The National Credit Union Administration

- The Federal Deposit Insurance Corporation

- The Financial Crimes Enforcement Network

- Experts from financial institutions, credit unions, digital payment networks, community banks, consumer groups, and industry associations

- Victim representatives and experts from scam support networks

Purpose and Responsibilities

The Task Force will focus on the following key areas:- Examine current trends in payment scams and identify effective prevention methods.

- Adopt a cross-sector approach to ensure comprehensive recommendations, addressing the broad impact of scams across industries.

- Include representation from stakeholders with experience in supporting scam victims and those with industry insights into scam tactics.

- Evaluating best practices against methods used by scammers, such as spoofed calls and scam messages.

- Assessing efforts made by other countries to prevent scams.

- Identifying current scam tactics targeting consumers via payment platforms.

- Developing education strategies to help consumers detect and report scams.

- Coordinating with law enforcement to pursue scammers.

- Consulting with relevant stakeholders, including various governmental and financial entities.

- Exploring potential new federal legislation to assist in combating payment scams.

- Identifying solutions for scams involving compromise of business email.

Reporting Requirements

The Task Force is required to produce a report within one year of its establishment, detailing:- Findings from its evaluations and reviews regarding payment scams.

- The educational strategies outlined for consumers.

- Any recommendations for legislative or regulatory changes to enhance scam prevention.

- Suggestions for improving inter-agency cooperation in investigating scams.

Duration and Termination

The Task Force will operate for a total of three years from the date of submission of its first report, unless terminated earlier.Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

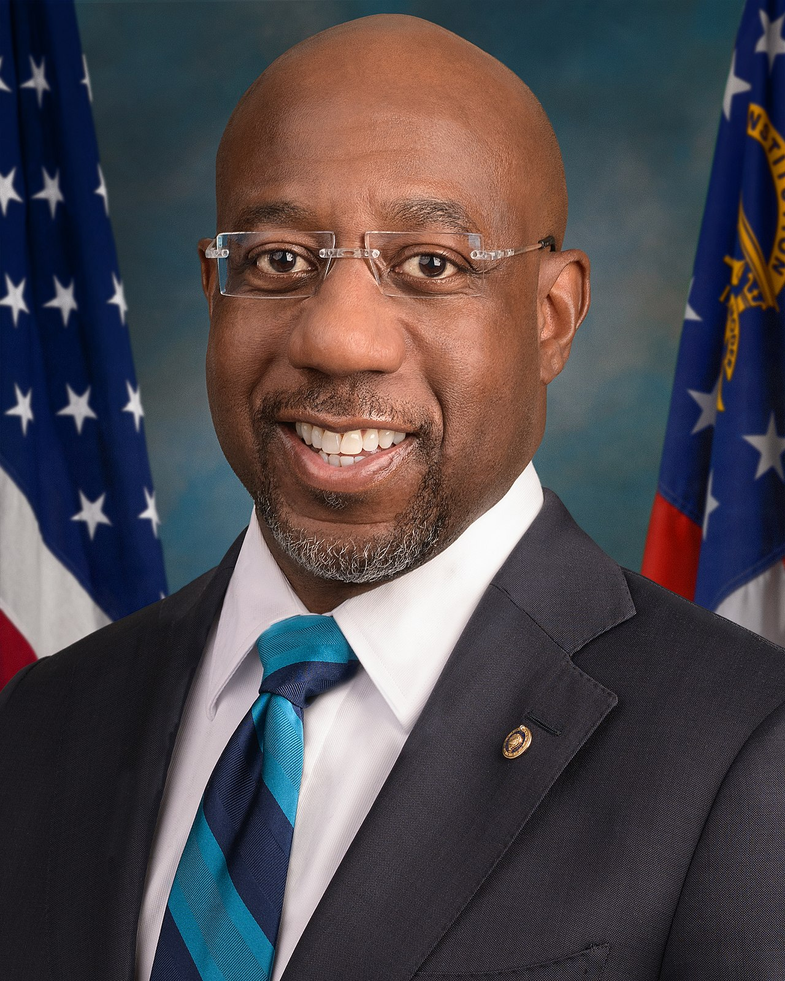

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 10, 2025 | Introduced in Senate |

| Jun. 10, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.