S. 3265: Improve and Enhance the Work Opportunity Tax Credit Act

This bill aims to amend the work opportunity tax credit (WOTC) by enhancing its benefits and extending its validity, thereby encouraging more effective hiring of targeted workers. The key provisions of the bill are as follows:

Extension of the Tax Credit

The expiration date of the work opportunity tax credit is extended from December 31, 2025, to December 31, 2030. This allows businesses to continue benefiting from the tax credit for a longer period.

Enhancements to Credit Amount

The calculation of the tax credit is modified to provide greater benefits:

- Employers can receive a credit equal to 50% of the first $6,000 of qualified first-year wages for each eligible employee.

- If a hired individual works at least 400 hours for the employer, the employer can also receive a credit of 50% on qualified wages exceeding $6,000 and up to double that amount.

Inflation Adjustments

The bill adds provisions to adjust specific dollar amounts for inflation from 2026 onward. This includes increasing the $6,000 threshold based on cost-of-living adjustments, ensuring that the benefits keep pace with inflation.

Changes for Specific Groups

The bill modifies existing rules to enhance benefits for certain groups:

- For qualified veterans, the wage limit for credit eligibility is increased significantly, ranging from 200% to 400% of the standard amount depending on the veteran's classification.

- Family assistance recipients will receive credits at different rates for both first and second-year wages, with a maximum of $10,000 for both years.

- Summer youth employees are also covered under enhanced credit provisions.

Removal of Age Limits

The bill removes age-related limits for recipients of supplemental nutrition assistance program benefits, making it easier for these individuals to qualify for tax credits.

Inclusion of Military Spouses

A new provision allows spouses of military personnel to qualify for the work opportunity tax credit. Employers can receive benefits when hiring qualified military spouses.

Promotion of Targeted Hiring

The bill directs various government agencies, including the Departments of Treasury, Commerce, and Labor, to promote the hiring of members of targeted groups (as defined in existing legislation) across critical industries such as manufacturing, infrastructure, energy, healthcare, and construction.

Effective Date

The changes made by this bill will apply to individuals who begin work for employers after December 31, 2025, ensuring the new provisions take effect in 2026.

Relevant Companies

- GE (General Electric) - May benefit from enhanced hiring incentives, particularly for veterans and military spouses in sectors like manufacturing and energy.

- MRK (Merck & Co., Inc.) - Could leverage the tax credits to employ members of targeted groups in healthcare.

- FDX (FedEx) - May utilize credits for hiring summer youth employees and veterans in logistics and infrastructure roles.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

TrackBill Cassidy

Sponsor

-

TrackJohn Boozman

Co-Sponsor

-

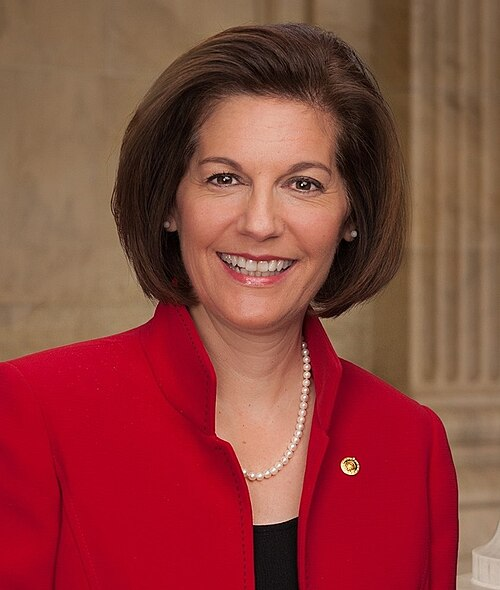

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackMargaret Wood Hassan

Co-Sponsor

-

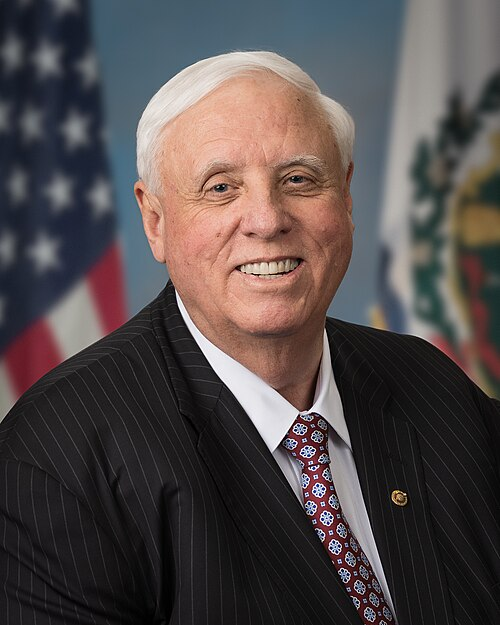

TrackJames C. Justice

Co-Sponsor

-

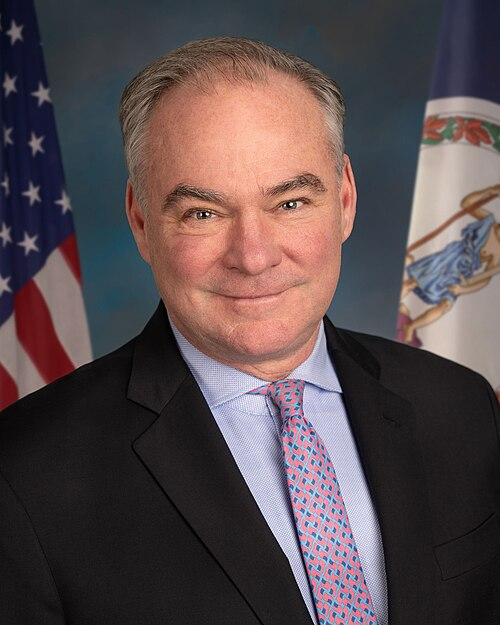

TrackTim Kaine

Co-Sponsor

-

TrackRoger Marshall

Co-Sponsor

-

TrackJerry Moran

Co-Sponsor

-

TrackGary C. Peters

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

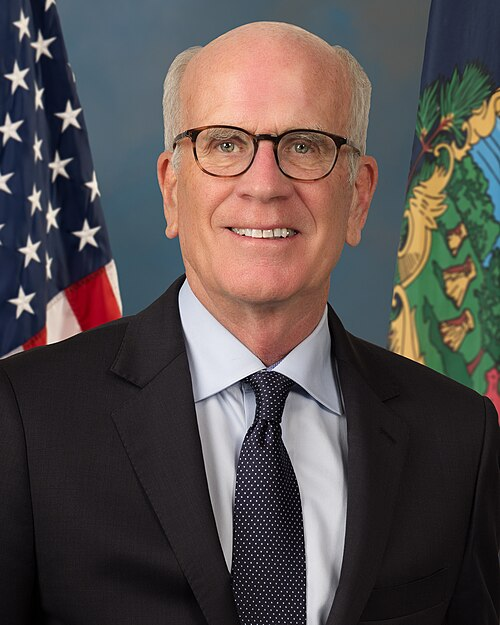

TrackPeter Welch

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 20, 2025 | Introduced in Senate |

| Nov. 20, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.