S. 3156: Federal Worker Mortgage Forbearance Act

This bill, known as the Federal Worker Mortgage Forbearance Act, aims to assist federal employees facing financial difficulties due to government shutdowns. Here are the key points of what the bill proposes:

Eligibility for Forbearance

- The bill allows certain federal employees and contractors to request a forbearance on their federally backed mortgage loans during periods when the government is not funded.

- A 'covered individual' includes federal employees not receiving pay due to a lapse in appropriations, such as those on furlough or performing emergency work.

- Contractors who support these employees during regular periods but are unable to do so during a shutdown are also included.

- The forbearance period extends 180 days after the government resumes funding.

Requesting Forbearance

- Affected individuals can request forbearance regardless of their loan's delinquency status.

- The request must be submitted to the mortgage loan servicer, along with an affirmation of experiencing financial hardship because of the government shutdown.

Forbearance Terms

- If approved, the forbearance lasts for 90 days.

- No fees, penalties, or additional interest will accrue during the forbearance period, except what is already stipulated in the original mortgage agreement.

- At the end of the forbearance, no lump-sum payment will be required to cover missed payments during the forbearance period.

- Individuals can request to discontinue the forbearance at any time.

Credit Reporting Considerations

- The bill mandates changes to credit reporting regulations, ensuring that forbearance periods do not negatively affect borrowers' credit scores.

- Mortgage servicers must report accounts in good standing or maintain delinquent statuses during the forbearance period as necessary, without penalizing the borrower for missed payments.

Notification Requirements

- Agencies must inform affected employees of their forbearance rights within 10 days of a government shutdown.

Criminal Penalties

- The bill includes a provision that imposes penalties for knowingly making false statements in connection with forbearance requests.

Effective Date

- The bill is retroactively effective from September 30, 2025, meaning it will apply to any government shutdowns occurring from that date onward.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Show More

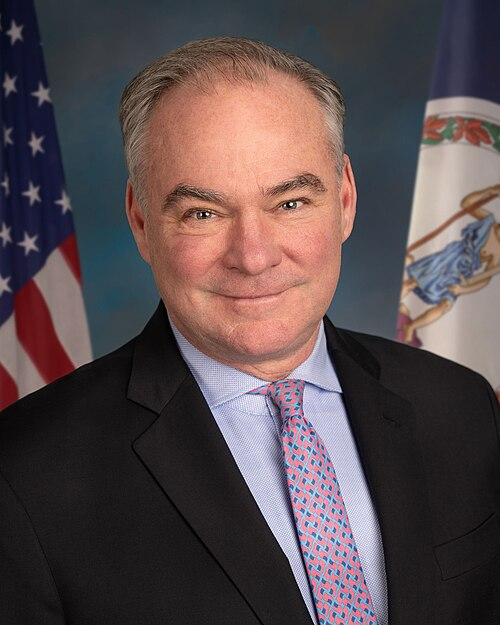

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 07, 2025 | Introduced in Senate |

| Nov. 07, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.