S. 3189: Strengthening Resources for Our Schools Act

This bill, known as the Strengthening Resources for Our Schools Act, proposes changes to the Internal Revenue Code related to retirement income for certain individuals. Specifically, the bill aims to exempt retirement income from taxation for those who have retired from serving as law enforcement officers or members of the Armed Forces when they subsequently become employed as school resource officers. Here’s a breakdown of the main points:

Key Provisions

- Retirement Income Exclusion: The bill would allow retired individuals who are employed as school resource officers to exclude their retirement income from their gross income during the time they work as school resource officers.

- Eligibility Requirements: To qualify for this exclusion, individuals must:

- Have retired from service as a law enforcement officer or a member of the Armed Forces.

- Be currently employed as a school resource officer and have passed any required background checks.

- Meet applicable peace officer training and certification standards as required by the state.

- Definition of Retirement Income: The bill defines retirement income to include any payments from pensions or retirement plans related to their previous employment as law enforcement or military personnel.

- Lifetime Exemption Clause: If a school resource officer has worked in that position for ten or more years, they may continue to exclude their retirement income from taxation even after their service ends.

- Reporting Requirements: The bill requires law enforcement agencies to report to the Secretary of the Treasury the employment start and end dates of individuals serving as school resource officers.

- Penalties for Non-Compliance: The bill includes provisions for penalties if law enforcement agencies fail to file the required notices of employment under the new provisions.

- Regulatory Guidance: The Secretary of the Treasury is tasked with issuing necessary regulations to implement these measures within 180 days after enactment.

Effective Date

The provisions of this bill would apply to taxable years starting after the date of enactment.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

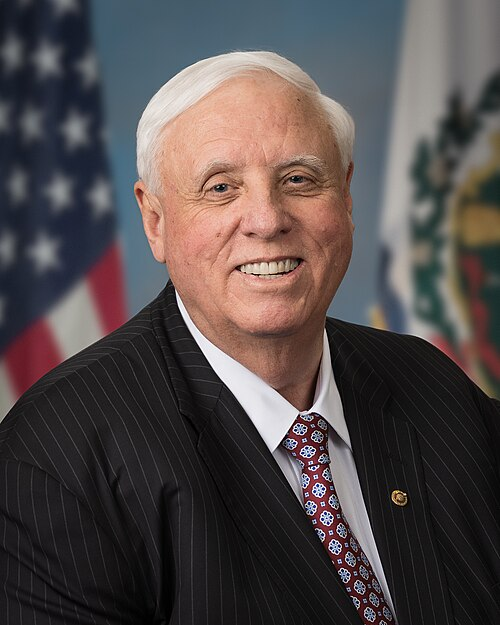

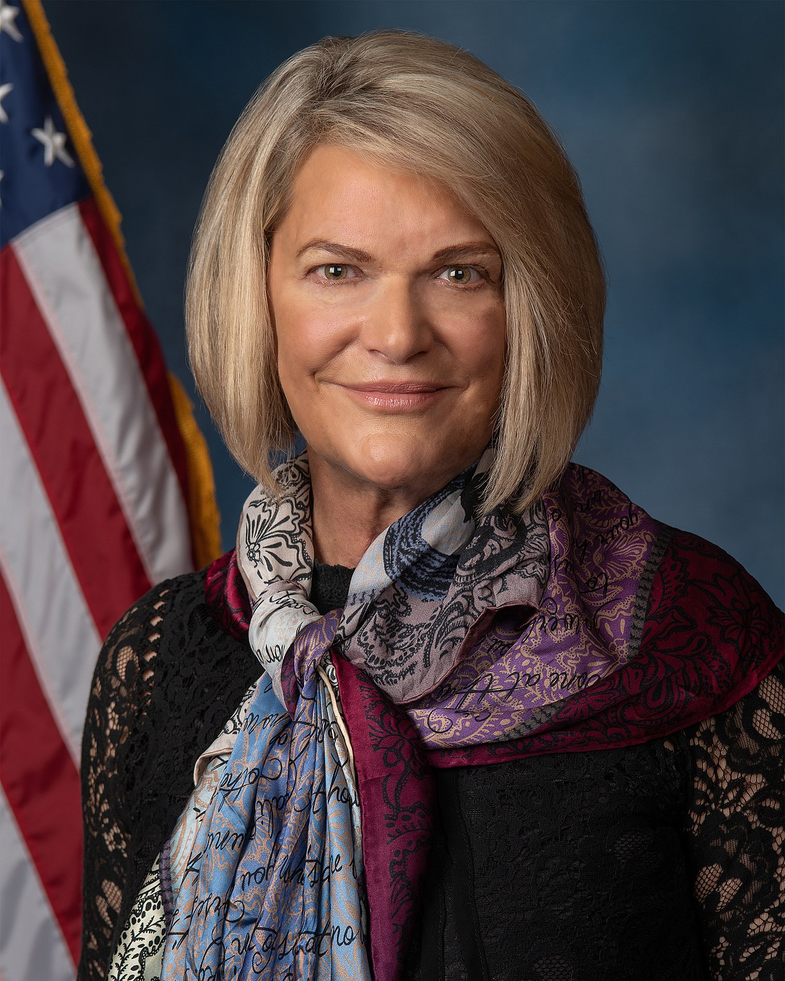

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Nov. 18, 2025 | Introduced in Senate |

| Nov. 18, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.