Quiver News

The latest insights and financial news from Quiver Quantitative

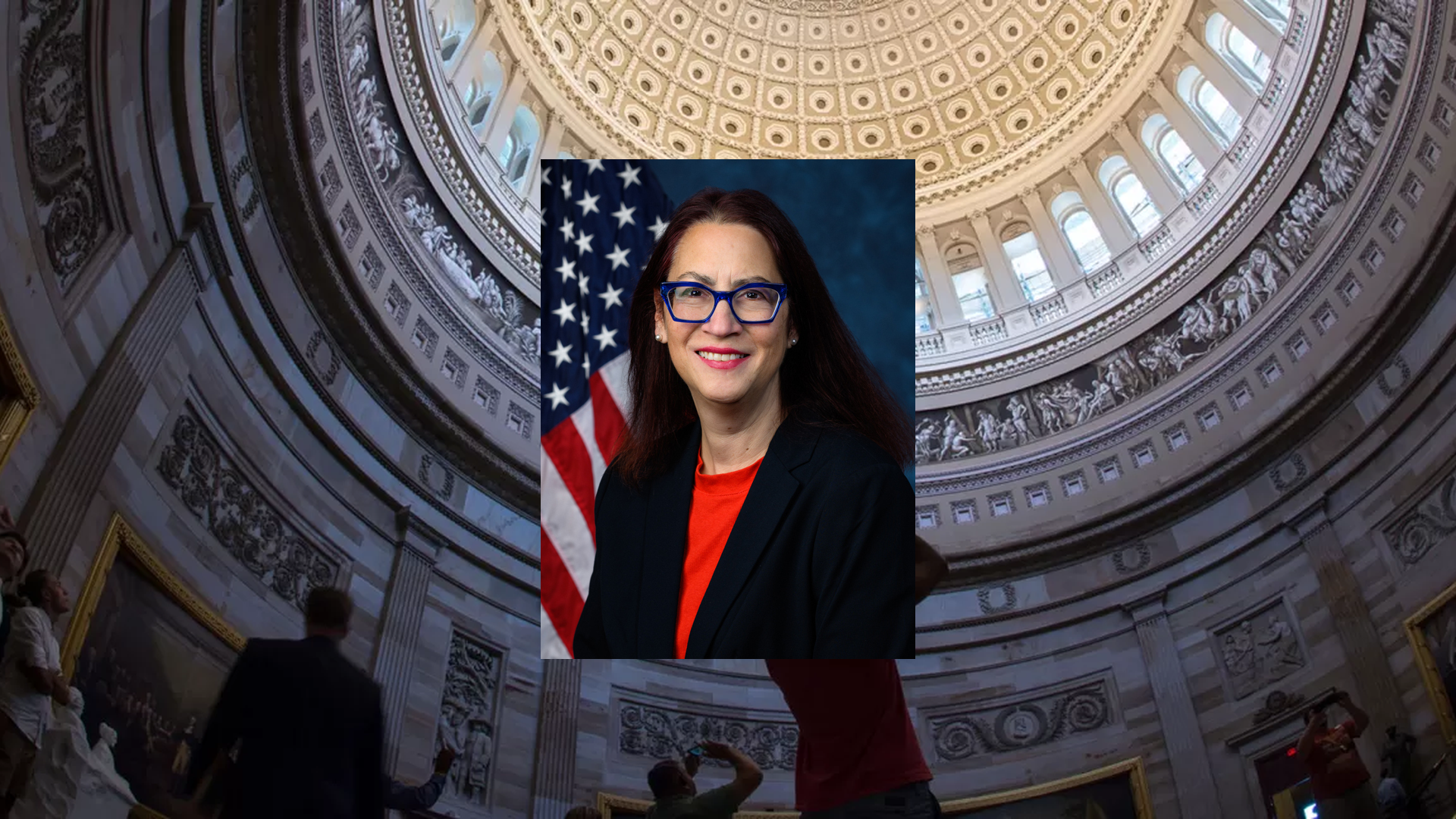

Congresswoman Julie Fedorchak supports House Resolution 668 to release documents related to Jeffrey Epstein's case.

Quiver AI Summary

On September 5, 2025, Congresswoman Julie Fedorchak (R-ND) endorsed H. Res. 668, a resolution calling for the House Oversight Committee to obtain and release documents related to Jeffrey Epstein’s crimes. This move aims to enhance transparency for victims and the public concerning Epstein's detention and death.

Fedorchak emphasized the need for accountability, stating, “The American people—and especially Epstein’s victims—deserve transparency and justice.” The resolution directs the committee to investigate government handling of Epstein's cases and seeks to eliminate barriers to information access while allowing limited redactions for sensitive data.

Under the resolution, the Committee is mandated to obtain unclassified records, flight logs, and related communications. Unlike previous proposals, H. Res. 668 includes provisions that take effect immediately, minimizing delays in the investigative process.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Julie Fedorchak Net Worth

Quiver Quantitative estimates that Julie Fedorchak is worth $7.4M, as of September 6th, 2025. This is the 132nd highest net worth in Congress, per our live estimates.

Fedorchak has approximately $2.1M invested in publicly traded assets which Quiver is able to track live.

You can track Julie Fedorchak's net worth on Quiver Quantitative's politician page for Fedorchak.

Julie Fedorchak Bill Proposals

Here are some bills which have recently been proposed by Julie Fedorchak:

- H.R.3843: Baseload Reliability Protection Act

- H.R.3062: Promoting Cross-border Energy Infrastructure Act

- H.R.2838: Ending Intermittent Energy Subsidies Act of 2025

- H.R.2252: North Dakota Trust Lands Completion Act of 2025

- H.R.1830: To designate the facility of the United States Postal Service located at 840 Front Street in Casselton, North Dakota, as the "Commander Delbert Austin Olson Post Office".

You can track bills proposed by Julie Fedorchak on Quiver Quantitative's politician page for Fedorchak.

Julie Fedorchak Fundraising

Julie Fedorchak recently disclosed $184.4K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 465th most from all Q2 reports we have seen this year. 29.7% came from individual donors.

Fedorchak disclosed $66.8K of spending. This was the 627th most from all Q2 reports we have seen from politicians so far this year.

Fedorchak disclosed $466.9K of cash on hand at the end of the filing period. This was the 485th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Julie Fedorchak's fundraising on Quiver Quantitative.

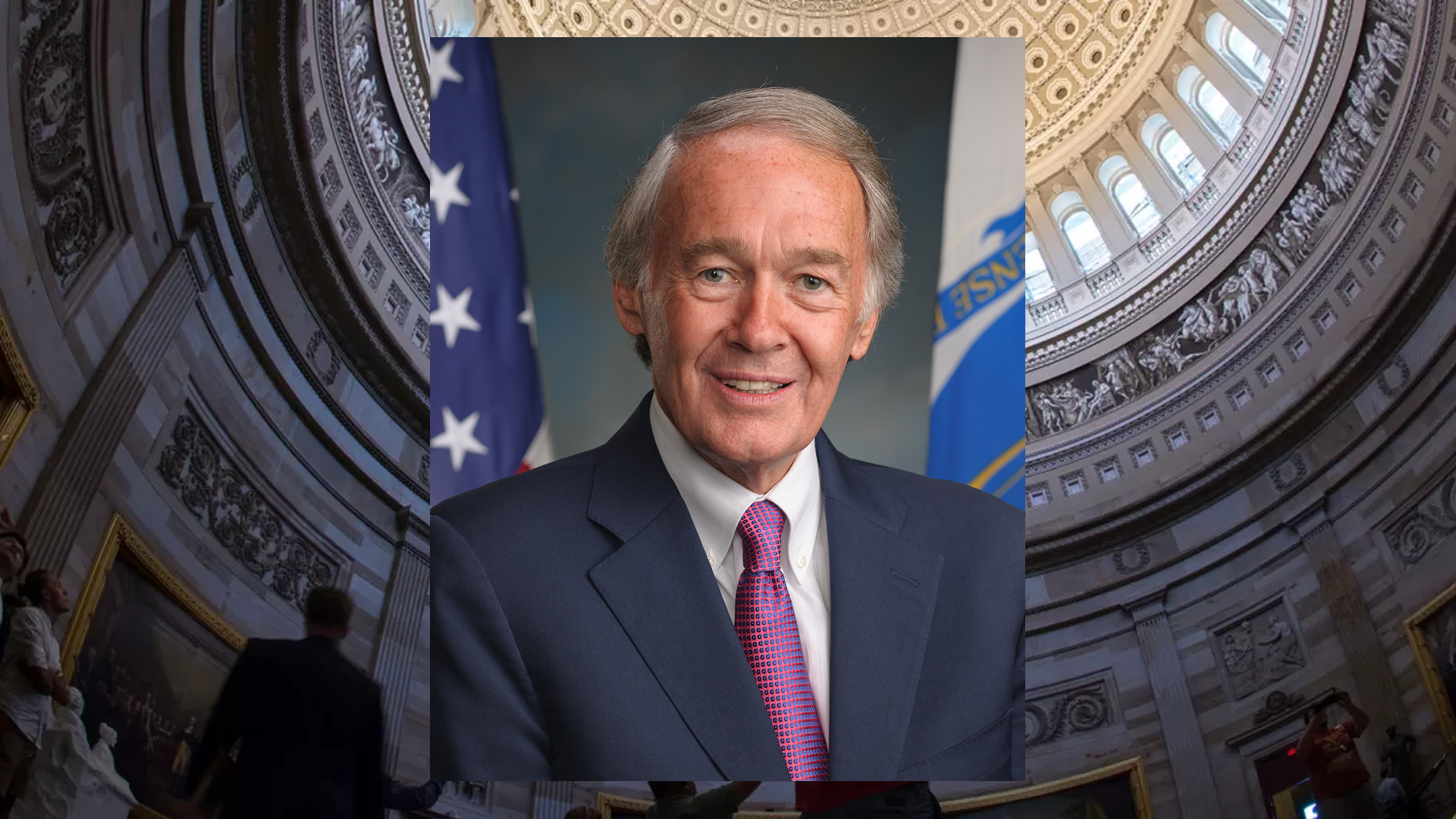

Senate Democrats express concerns over Trump's nominee, asserting dual roles jeopardize Federal Reserve independence.

Quiver AI Summary

Senator Jack Reed and fellow Senate Democrats have expressed concerns regarding President Trump's nomination of Stephen Miran to the Federal Reserve's Board of Governors. They argue that Miran's plan to maintain his White House role while serving on the Fed undermines the bank's independence, with Reed stating, "This arrangement would not serve the best interest of the American people."

During a Senate Banking Committee hearing, Miran indicated he would take a leave of absence rather than resign. The committee members criticized this dual role, emphasizing potential conflicts of interest and demanding a commitment from Miran to resign upon confirmation. They await further legal justification for this arrangement.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Jack Reed Net Worth

Quiver Quantitative estimates that Jack Reed is worth $333.3K, as of September 6th, 2025. This is the 424th highest net worth in Congress, per our live estimates.

Reed has approximately $276.8K invested in publicly traded assets which Quiver is able to track live.

You can track Jack Reed's net worth on Quiver Quantitative's politician page for Reed.

Jack Reed Bill Proposals

Here are some bills which have recently been proposed by Jack Reed:

- S.2338: Strengthening Local Food Security Act of 2025

- S.1904: Ending Taxpayer Support for Big Egg Producers Act

- S.1903: A bill to prohibit changes to Medicare and Medicaid in reconciliation.

- S.1576: Stop Subsidizing Multimillion Dollar Corporate Bonuses Act

- S.1467: Homebuyers Privacy Protection Act

- S.1400: Adult Education WORKS Act

You can track bills proposed by Jack Reed on Quiver Quantitative's politician page for Reed.

Jack Reed Fundraising

Jack Reed recently disclosed $652.6K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 105th most from all Q2 reports we have seen this year. 59.9% came from individual donors.

Reed disclosed $206.1K of spending. This was the 258th most from all Q2 reports we have seen from politicians so far this year.

Reed disclosed $2.5M of cash on hand at the end of the filing period. This was the 114th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Jack Reed's fundraising on Quiver Quantitative.

Senators Duckworth and Durbin, along with Rep. Schneider, criticize DHS after being locked out during a visit to Naval Station Great Lakes.

Quiver AI Summary

On September 5, 2025, U.S. Senator Tammy Duckworth, Senator Dick Durbin, and Representative Brad Schneider visited Naval Station Great Lakes, expressing concern over being denied access by the Department of Homeland Security (DHS). Duckworth described the officials as having "locked their doors and fled the base," raising issues of transparency regarding the deployment of federal agents.

Durbin characterized the situation as a "political theater" by President Trump that disrupts military operations and threatens community safety, while Schneider criticized Trump's potential interference with the base's mission, calling it "shameful." The lawmakers noted that DHS had contacted the base about its intended use but refused to meet with them.

The visit was prompted by the Trump Administration's plans for the base, which, according to the lawmakers, lack clear details about DHS's involvement and the necessity of this operation, given existing facilities in the area. A press conference followed the visit, highlighting their concerns about federal actions during a sensitive period.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Tammy Duckworth Net Worth

Quiver Quantitative estimates that Tammy Duckworth is worth $1.3M, as of September 6th, 2025. This is the 300th highest net worth in Congress, per our live estimates.

Duckworth has approximately $793.8K invested in publicly traded assets which Quiver is able to track live.

You can track Tammy Duckworth's net worth on Quiver Quantitative's politician page for Duckworth.

Tammy Duckworth Bill Proposals

Here are some bills which have recently been proposed by Tammy Duckworth:

- S.2377: EACH Act of 2025

- S.2239: Improving Access to Prenatal Care for Military Families Act

- S.2199: A bill to require the Secretary of Defense to issue regulations requiring that optional combat boots worn by members of the Armed Forces wear be made in the United States, and for other purposes.

- S.2198: Military in Law Enforcement Accountability Act

- S.2162: Kangaroo Protection Act of 2025

- S.1966: Don't Miss Your Flight Act

You can track bills proposed by Tammy Duckworth on Quiver Quantitative's politician page for Duckworth.

Tammy Duckworth Fundraising

Tammy Duckworth recently disclosed $961.0K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 42nd most from all Q2 reports we have seen this year. 98.2% came from individual donors.

Duckworth disclosed $711.5K of spending. This was the 52nd most from all Q2 reports we have seen from politicians so far this year.

Duckworth disclosed $3.4M of cash on hand at the end of the filing period. This was the 78th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Tammy Duckworth's fundraising on Quiver Quantitative.

Senator Van Hollen and Congresswoman Norton reintroduced legislation for D.C. to gain control over its National Guard and police.

Quiver AI Summary

This week, U.S. Senator Chris Van Hollen and Congresswoman Eleanor Holmes Norton reintroduced legislation aimed at granting the District of Columbia full control over its National Guard and police forces. This move follows concerns regarding the federal government's assertion of control over D.C. police and the prolonged deployment of the National Guard amid ongoing tensions.

Senator Van Hollen criticized the current administration's approach, stating, "In a raw power grab, Donald Trump has overtaken D.C.’s police..." He emphasized the urgency of empowering local leaders to manage D.C.'s law enforcement effectively. Meanwhile, Congresswoman Norton reiterated the importance of D.C. statehood for self-governance and public safety.

The proposed bills include the District of Columbia Police Home Rule Act, which seeks to limit presidential control over local police, and the District of Columbia National Guard Home Rule Act, transferring command of the National Guard to the D.C. Mayor, akin to state governors. These measures are supported by several Democratic senators.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Chris Van Hollen Bill Proposals

Here are some bills which have recently been proposed by Chris Van Hollen:

- S.2689: District of Columbia Police Home Rule Act

- S.2688: District of Columbia National Guard Home Rule Act

- S.2590: Fresh Start Act of 2025

- S.2438: Transformation to Competitive Integrated Employment Act

- S.2369: Francis G. Newlands Memorial Removal Act

- S.2266: Consumer Online Payment Transparency and Integrity Act

You can track bills proposed by Chris Van Hollen on Quiver Quantitative's politician page for Van Hollen.

Chris Van Hollen Fundraising

Chris Van Hollen recently disclosed $244.1K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 355th most from all Q2 reports we have seen this year. 95.7% came from individual donors.

Van Hollen disclosed $111.6K of spending. This was the 464th most from all Q2 reports we have seen from politicians so far this year.

Van Hollen disclosed $2.2M of cash on hand at the end of the filing period. This was the 142nd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Chris Van Hollen's fundraising on Quiver Quantitative.

Senators introduced the "CDFI Fund Transparency Act" to enhance transparency and bolster economic prosperity through CDFI operations.

Quiver AI Summary

U.S. Senators Steve Daines, Mark Warner, Mike Crapo, and Raphael Warnock have introduced the "CDFI Fund Transparency Act," aimed at enhancing operational transparency for the Community Development Financial Institutions (CDFI) fund. The bill mandates annual testimony from the Secretary of the Treasury concerning the fund’s activities.

Daines emphasized the importance of CDFIs in providing opportunities for families in underserved communities, while Warner highlighted the need for increased accountability. Supporters believe the legislation will maintain public trust and bolster economic growth in low-income areas.

Jim Nussle, President/CEO of America’s Credit Unions, stated, “Transparency builds trust among decision makers and the public,” expressing support for the bill as critical for ensuring the CDFI Fund's impact on vulnerable communities.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Steve Daines Net Worth

Quiver Quantitative estimates that Steve Daines is worth $21.4M, as of September 6th, 2025. This is the 59th highest net worth in Congress, per our live estimates.

Daines has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Steve Daines's net worth on Quiver Quantitative's politician page for Daines.

Steve Daines Bill Proposals

Here are some bills which have recently been proposed by Steve Daines:

- S.2715: A bill to amend title XVIII of the Social Security Act to require hospitals with approved medical residency training programs to submit to the Secretary of Health and Human Services certain information regarding osteopathic and allopathic candidates for such programs.

- S.2704: A bill to amend the Community Development Banking and Financial Institutions Act of 1994 to increase transparency and accountability regarding the operations of the Community Development Financial Institutions Fund.

- S.2577: McCarran-Walter Technical Corrections Act

- S.2461: Promotion and Expansion of Private Employee Ownership Act of 2025

- S.1967: PROTECT Act of 2025

- S.1912: Protecting Veteran Community Care Act

You can track bills proposed by Steve Daines on Quiver Quantitative's politician page for Daines.

Steve Daines Fundraising

Steve Daines recently disclosed $678.9K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 92nd most from all Q2 reports we have seen this year. 55.4% came from individual donors.

Daines disclosed $280.5K of spending. This was the 178th most from all Q2 reports we have seen from politicians so far this year.

Daines disclosed $3.3M of cash on hand at the end of the filing period. This was the 81st most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Steve Daines's fundraising on Quiver Quantitative.

Congressman Steve Cohen criticizes the Trump administration's funding cuts, leading to the closure of a key minority business center.

Quiver AI Summary

Congressman Steve Cohen (TN-9) expressed disappointment following the announcement that the Minority Business Development Center in Memphis has closed due to funding cuts from the Trump Commerce Department. He stated that the decision will adversely affect local businesses that the center has supported for 13 years.

Cohen, who played a key role in the center's establishment in 2012, described the funding cut as a "short-sighted decision" that silences the voice of Black and minority entrepreneurs. He highlighted the center's role in fostering minority-owned business growth and creating job opportunities.

The Minority Business Development Center was established under the U.S. Department of Commerce to aid minority businesses, emphasizing job retention and access to procurement contracts. Cohen's statement marks a significant response to the center's closure and reflects concerns about its impact on the local economy.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Steve Cohen Net Worth

Quiver Quantitative estimates that Steve Cohen is worth $9.0M, as of September 6th, 2025. This is the 115th highest net worth in Congress, per our live estimates.

Cohen has approximately $3.8M invested in publicly traded assets which Quiver is able to track live.

You can track Steve Cohen's net worth on Quiver Quantitative's politician page for Cohen.

Steve Cohen Bill Proposals

Here are some bills which have recently been proposed by Steve Cohen:

- H.R.4587: Independent Acting IGs Act of 2025

- H.R.4026: POST Act of 2025

- H.R.3908: National Emergencies Reform Act of 2025

- H.R.3754: Don’t Miss Your Flight Act

- H.R.3712: Complete Streets Act of 2025

- H.R.3623: Horse Transportation Safety Act of 2025

You can track bills proposed by Steve Cohen on Quiver Quantitative's politician page for Cohen.

Steve Cohen Fundraising

Steve Cohen recently disclosed $89.9K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 633rd most from all Q2 reports we have seen this year. 10.7% came from individual donors.

Cohen disclosed $101.0K of spending. This was the 509th most from all Q2 reports we have seen from politicians so far this year.

Cohen disclosed $1.7M of cash on hand at the end of the filing period. This was the 185th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Steve Cohen's fundraising on Quiver Quantitative.

Hakeem Jeffries announces Brendan Boyle as Democratic head of NATO Parliamentary Assembly for 119th Congress, succeeding Gerry Connolly.

Quiver AI Summary

Democratic Leader Hakeem Jeffries announced the appointment of Congressman Brendan Boyle as the Democratic head of the NATO Parliamentary Assembly for the 119th Congress, succeeding the late Representative Gerry Connolly. Jeffries expressed confidence in Boyle's capability to fulfill this important role.

Jeffries highlighted Boyle's experience as Co-Chair of the Congressional EU Caucus and Vice Chair of the NATO PA Political Committee, noting his commitment to supporting transatlantic alliances and countering challenges posed by Russian aggression in Ukraine.

Jeffries emphasized the importance of standing with allies during challenging times, stating, "We will not abandon our friends in their hour of great need."

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Hakeem S. Jeffries Net Worth

Quiver Quantitative estimates that Hakeem S. Jeffries is worth $586.7K, as of September 6th, 2025. This is the 385th highest net worth in Congress, per our live estimates.

Jeffries has approximately $160.2K invested in publicly traded assets which Quiver is able to track live.

You can track Hakeem S. Jeffries's net worth on Quiver Quantitative's politician page for Jeffries.

Hakeem S. Jeffries Bill Proposals

Here are some bills which have recently been proposed by Hakeem S. Jeffries:

- H.R.19: Reserved for the Minority Leader.

- H.R.18: Reserved for the Minority Leader.

- H.R.13: Reserved for the Minority Leader.

You can track bills proposed by Hakeem S. Jeffries on Quiver Quantitative's politician page for Jeffries.

Hakeem S. Jeffries Fundraising

Hakeem S. Jeffries recently disclosed $2.1M of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 14th most from all Q2 reports we have seen this year. 81.6% came from individual donors.

Jeffries disclosed $2.2M of spending. This was the 9th most from all Q2 reports we have seen from politicians so far this year.

Jeffries disclosed $6.3M of cash on hand at the end of the filing period. This was the 34th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Hakeem S. Jeffries's fundraising on Quiver Quantitative.

The House Natural Resources Subcommittee held a hearing on Congressman Moulton's bipartisan Young Fishermen’s Development Act reauthorization bill.

Quiver AI Summary

On September 3, the House Natural Resources Subcommittee on Water, Wildlife, and Fisheries held a hearing regarding Congressman Seth Moulton's (D-MA) bill to reauthorize the Young Fishermen’s Development Act, which is co-led by Congressman Nick Begich (R-AK). Moulton emphasized the need for support to extend the program for five more years.

The Young Fishermen’s Development Act, established in 2021, supports training and education for new commercial fishermen through a competitive grant program administered by NOAA’s Sea Grant Program. The bill aims to continue funding initiatives that benefit young fishermen across the nation.

Moulton highlighted the cultural significance of fishing in coastal communities, particularly in Massachusetts, stating, "Investing in young fishermen means protecting the future of our food supply and our coastal economies." He called for the committee's support to ensure the program's continuation through 2031.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Seth Moulton Net Worth

Quiver Quantitative estimates that Seth Moulton is worth $7.8M, as of September 6th, 2025. This is the 127th highest net worth in Congress, per our live estimates.

Moulton has approximately $8.4K invested in publicly traded assets which Quiver is able to track live.

You can track Seth Moulton's net worth on Quiver Quantitative's politician page for Moulton.

Seth Moulton Bill Proposals

Here are some bills which have recently been proposed by Seth Moulton:

- H.R.4257: End Domestic Terrorism Act

- H.R.3692: To reauthorize the Young Fishermen's Development Act.

- H.R.3409: HEADs UP Act of 2025

- H.R.2215: Salem Maritime National Historical Park Redesignation and Boundary Study Act

- H.R.1725: Sgt. Isaac Woodard, Jr. and Sgt. Joseph H. Maddox GI Bill Restoration Act of 2025

You can track bills proposed by Seth Moulton on Quiver Quantitative's politician page for Moulton.

Seth Moulton Fundraising

Seth Moulton recently disclosed $348.9K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 247th most from all Q2 reports we have seen this year. 84.8% came from individual donors.

Moulton disclosed $203.0K of spending. This was the 263rd most from all Q2 reports we have seen from politicians so far this year.

Moulton disclosed $2.2M of cash on hand at the end of the filing period. This was the 141st most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Seth Moulton's fundraising on Quiver Quantitative.

The House Committee advanced a FEMA reform bill aimed at enhancing efficiency, awaiting a full House vote.

Quiver AI Summary

The U.S. House Committee on Transportation and Infrastructure has approved H.R. 4669, the FEMA Reauthorization Act, with a bipartisan vote of 57-3. This bill includes provisions from the bipartisan FEMA Independence Act, co-led by Representatives Byron Donalds and Jared Moskowitz, aimed at restructuring FEMA to operate independently from the Department of Homeland Security.

The initiative seeks to enhance the efficiency of federal emergency management by directly reporting to the President, to address concerns that FEMA has become "overly-bureaucratic, overly-politicized, [and] overly-inefficient," according to Congressman Donalds. The bill will proceed to a vote in the U.S. House of Representatives.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Byron Donalds Net Worth

Quiver Quantitative estimates that Byron Donalds is worth $4.4M, as of September 6th, 2025. This is the 180th highest net worth in Congress, per our live estimates.

Donalds has approximately $545.1K invested in publicly traded assets which Quiver is able to track live.

You can track Byron Donalds's net worth on Quiver Quantitative's politician page for Donalds.

Byron Donalds Bill Proposals

Here are some bills which have recently been proposed by Byron Donalds:

- H.R.4922: DC CRIMES Act

- H.R.4494: Flood Insurance Relief Act

- H.R.3667: Strengthening American Nuclear Energy Act

- H.R.3626: International Nuclear Energy Act of 2025

- H.R.3433: WILD Act of 2025

- H.R.2835: Small Bank Holding Company Relief Act

You can track bills proposed by Byron Donalds on Quiver Quantitative's politician page for Donalds.

Byron Donalds Fundraising

Byron Donalds recently disclosed $74.7K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 670th most from all Q2 reports we have seen this year. 70.8% came from individual donors.

Donalds disclosed $147.6K of spending. This was the 377th most from all Q2 reports we have seen from politicians so far this year.

Donalds disclosed $456.1K of cash on hand at the end of the filing period. This was the 488th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Byron Donalds's fundraising on Quiver Quantitative.

Senator Cornyn's bill establishing the VA's Veteran Customer Service Office is now law, enhancing veteran services nationwide.

Quiver AI Summary

U.S. Senator John Cornyn (R-TX) announced that the Improving Veteran Experience Act has been signed into law by President Trump, establishing the Veterans Experience Office (VEO) within the Department of Veterans Affairs (VA) on a permanent basis. Cornyn stated, "The brave men and women who have selflessly served our country deserve the highest-quality health care, services, and benefits."

The VEO was established in 2015 to gather feedback from veterans and improve the VA's services and resources. This bipartisan legislation was also supported by Senator Angus King (I-ME). The goal is to ensure that veterans receive consistent and quality care across the nation.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

John Cornyn Net Worth

Quiver Quantitative estimates that John Cornyn is worth $1.5M, as of September 6th, 2025. This is the 287th highest net worth in Congress, per our live estimates.

Cornyn has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track John Cornyn's net worth on Quiver Quantitative's politician page for Cornyn.

John Cornyn Bill Proposals

Here are some bills which have recently been proposed by John Cornyn:

- S.2683: VSAFE Act of 2025

- S.2680: LETITIA Act

- S.2584: Enduring Justice for Victims of Trafficking Act

- S.2543: Stop the SWARM Act of 2025

- S.2501: VSAFE Act of 2025

- S.2413: Justice for Victims of Illegal Alien Murders Act

You can track bills proposed by John Cornyn on Quiver Quantitative's politician page for Cornyn.

John Cornyn Fundraising

John Cornyn recently disclosed $674.8K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 95th most from all Q2 reports we have seen this year. 75.1% came from individual donors.

Cornyn disclosed $484.1K of spending. This was the 89th most from all Q2 reports we have seen from politicians so far this year.

Cornyn disclosed $5.9M of cash on hand at the end of the filing period. This was the 39th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track John Cornyn's fundraising on Quiver Quantitative.

Senator Tammy Baldwin and colleagues urge the VA to withdraw proposed abortion restrictions affecting veterans' healthcare.

Quiver AI Summary

U.S. Senator Tammy Baldwin, alongside several colleagues, urged the Trump Administration's Department of Veterans Affairs (VA) to rescind a proposed rule reinstating a near-total abortion ban. They argue it endangers vital health care for veterans and could have dire consequences, especially for those facing health crises due to pregnancy.

The lawmakers emphasized that the proposed rule undermines the VA's obligations to provide comprehensive care, criticizing claims that abortions are unnecessary. They highlight the unique health risks faced by veterans and assert that such restrictions could jeopardize the lives of those affected.

In their public comment, Baldwin and her colleagues stressed the shared concerns of veterans nationwide about the impacts of this rule, particularly following the Dobbs decision, which has led to increased abortion restrictions in many states. They called for the VA to reconsider the proposal for the sake of veterans' health and well-being.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Tammy Baldwin Net Worth

Quiver Quantitative estimates that Tammy Baldwin is worth $933.0K, as of September 6th, 2025. This is the 336th highest net worth in Congress, per our live estimates.

Baldwin has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Tammy Baldwin's net worth on Quiver Quantitative's politician page for Baldwin.

Tammy Baldwin Bill Proposals

Here are some bills which have recently been proposed by Tammy Baldwin:

- S.2711: A bill to amend the Communications Act of 1934 and title 17, United States Code, to provide greater access to in-State television broadcast programming for cable and satellite subscribers in certain counties.

- S.2575: Healthcare for Our Troops Act

- S.2532: Safe Response Act

- S.2507: DAIRY PRIDE Act

- S.2436: Healthy H2O Act

- S.2370: A bill to provide for eligibility for veterans of Operation End Sweep for the Vietnam Service Medal.

You can track bills proposed by Tammy Baldwin on Quiver Quantitative's politician page for Baldwin.

Tammy Baldwin Fundraising

Tammy Baldwin recently disclosed $428.6K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 195th most from all Q2 reports we have seen this year. 98.6% came from individual donors.

Baldwin disclosed $360.5K of spending. This was the 130th most from all Q2 reports we have seen from politicians so far this year.

Baldwin disclosed $178.7K of cash on hand at the end of the filing period. This was the 687th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Tammy Baldwin's fundraising on Quiver Quantitative.

Congress members propose the Protect and Respect ICE Act to increase penalties for assaults on ICE officers.

Quiver AI Summary

Congresswoman Diana Harshbarger (R-TN-01) announced the introduction of the Protect and Respect ICE Act alongside Congresswomen Ashley Hinson and Congressman Brad Knott. This legislation seeks to double the penalties for assaults against ICE officers, responding to what Harshbarger described as a troubling increase in these incidents.

Harshbarger emphasized the importance of protecting law enforcement, citing a reported 700% rise in assaults on ICE agents, which she attributes to "radical Left’s rhetoric." The bill aims to deter violence against these officers by implementing stricter consequences.

As part of the discussion surrounding the legislation, Harshbarger noted specific violent incidents involving ICE personnel, highlighting the necessity of the proposed measures. The bill is positioned as part of a broader commitment to uphold public safety and reinforce support for law enforcement agencies.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Diana Harshbarger Bill Proposals

Here are some bills which have recently been proposed by Diana Harshbarger:

- H.R.4132: Prescription Information Modernization Act of 2025

- H.R.3589: RESTORE Act

- H.R.3287: Pregnancy.Gov Act

- H.R.3186: Universal Savings Account Act of 2025

- H.R.2844: Michael Enzi Voluntary Protection Program Act

- H.R.2713: MAIN Event Ticketing Act

You can track bills proposed by Diana Harshbarger on Quiver Quantitative's politician page for Harshbarger.

Diana Harshbarger Fundraising

Diana Harshbarger recently disclosed $217.0K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 397th most from all Q2 reports we have seen this year. 42.5% came from individual donors.

Harshbarger disclosed $97.4K of spending. This was the 515th most from all Q2 reports we have seen from politicians so far this year.

Harshbarger disclosed $1.6M of cash on hand at the end of the filing period. This was the 193rd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Diana Harshbarger's fundraising on Quiver Quantitative.

Senator Gillibrand emphasizes the need for $5 million funding for a new facility at the New York School for the Deaf.

Quiver AI Summary

U.S. Senator Kirsten Gillibrand visited the New York School for the Deaf on the first day of classes to emphasize the need for $5 million in funding for a new Career and Technical Education (CTE) Facility. This facility aims to support deaf and hard-of-hearing students, enhancing their educational and employment opportunities.

Gillibrand stated, “Making sure every New Yorker has access to career development opportunities is critical.” Superintendent Dr. Joseph Santini praised the funding as transformative, while other officials highlighted its importance for creating equitable career pathways for students with disabilities.

The initiative, which partners with the Westchester Putnam Central Labor Body, is seen as a significant step toward preparing deaf students for future careers. New York State Senate Majority Leader Andrea Stewart-Cousins commended Gillibrand for her efforts in securing critical federal support for the school.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Kirsten E. Gillibrand Net Worth

Quiver Quantitative estimates that Kirsten E. Gillibrand is worth $1.1M, as of September 6th, 2025. This is the 318th highest net worth in Congress, per our live estimates.

Gillibrand has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Kirsten E. Gillibrand's net worth on Quiver Quantitative's politician page for Gillibrand.

Kirsten E. Gillibrand Bill Proposals

Here are some bills which have recently been proposed by Kirsten E. Gillibrand:

- S.2703: A bill to amend title 9 of the United States Code with respect to arbitration of disputes involving age discrimination.

- S.2512: EATS Act of 2025

- S.2472: Department of Defense PFAS Discharge Prevention Act

- S.2337: Providing Child Care for Police Officers Act of 2025

- S.2299: Resilient Transit Act of 2025

- S.2255: Trafficking Survivors Relief Act of 2025

You can track bills proposed by Kirsten E. Gillibrand on Quiver Quantitative's politician page for Gillibrand.

Kirsten E. Gillibrand Fundraising

Kirsten E. Gillibrand recently disclosed $203.6K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 424th most from all Q2 reports we have seen this year. 81.8% came from individual donors.

Gillibrand disclosed $259.0K of spending. This was the 194th most from all Q2 reports we have seen from politicians so far this year.

Gillibrand disclosed $1.4M of cash on hand at the end of the filing period. This was the 213th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Kirsten E. Gillibrand's fundraising on Quiver Quantitative.

Rep. Don Bacon criticizes funding cuts for Baltic Security, asserting it jeopardizes Eastern European military assistance and strengthens Russian aggression.

Quiver AI Summary

U.S. Representative Don Bacon criticized a reported decision by the Administration to cancel funding for the Baltic Security initiative. He described the move as "flat out wrong," arguing that it undermines military assistance to Eastern European allies amid threats from Russia.

Bacon emphasized the importance of bolstering defenses against Russian aggression, particularly citing concerns about Russia's actions in Ukraine. He called on the Administration to reconsider its funding cuts, suggesting that they signal weakness to adversaries.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Don Bacon Net Worth

Quiver Quantitative estimates that Don Bacon is worth $1.7M, as of September 6th, 2025. This is the 268th highest net worth in Congress, per our live estimates.

Bacon has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Don Bacon's net worth on Quiver Quantitative's politician page for Bacon.

Don Bacon Bill Proposals

Here are some bills which have recently been proposed by Don Bacon:

- H.R.4583: Living Donor Protection Act of 2025

- H.R.4582: To amend the Family and Medical Leave Act of 1993 and title 5, United States Code, to clarify that organ donation surgery qualifies as a serious health condition.

- H.R.4362: AFIDA Improvements Act of 2025

- H.R.4310: Back the Blue Act of 2025

- H.R.4309: National Concussion and Traumatic Brain Injury Clearinghouse Act of 2025

- H.R.4156: Support for Ownership and Investment in Land Act

You can track bills proposed by Don Bacon on Quiver Quantitative's politician page for Bacon.

Don Bacon Fundraising

Don Bacon recently disclosed $313.2K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 282nd most from all Q2 reports we have seen this year. 42.8% came from individual donors.

Bacon disclosed $256.3K of spending. This was the 198th most from all Q2 reports we have seen from politicians so far this year.

Bacon disclosed $1.2M of cash on hand at the end of the filing period. This was the 259th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Don Bacon's fundraising on Quiver Quantitative.

Congresswoman Laura Friedman convened her Immigration Advisory Committee to address concerns over immigration raids in Los Angeles.

Quiver AI Summary

U.S. Congresswoman Laura Friedman (CA-30) held the inaugural meeting of her Immigration Advisory Committee to address concerns raised by local legal aid clinics and immigrant rights groups regarding immigration enforcement actions during the Trump administration in Los Angeles.

Friedman emphasized, "This administration has been more concerned about meeting an arbitrary quota than it has been about actually addressing crime," advocating for "commonsense and dignified immigration policies."

The committee includes representatives from various organizations, such as the International Rescue Committee and the Coalition for Humane Immigrant Rights LA, reflecting a broad coalition addressing these issues.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Laura Friedman Net Worth

Quiver Quantitative estimates that Laura Friedman is worth $1.1M, as of September 6th, 2025. This is the 325th highest net worth in Congress, per our live estimates.

Friedman has approximately $437.5K invested in publicly traded assets which Quiver is able to track live.

You can track Laura Friedman's net worth on Quiver Quantitative's politician page for Friedman.

Laura Friedman Bill Proposals

Here are some bills which have recently been proposed by Laura Friedman:

- H.R.5085: To exempt Federal actions related to the construction of infill housing from the requirements of the National Environmental Policy Act of 1969, and for other purposes.

- H.R.4796: Restoring Essential Healthcare Act

- H.R.4662: To designate the facility of the United States Postal Service located at 6444 San Fernando Road in Glendale, California, as the "Paul Ignatius Post Office".

- H.R.3874: Rim of the Valley Corridor Preservation Act

- H.R.2428: Wildfire Homeowner Relief Act

- H.R.2427: Stop Disaster Price Gouging Act

You can track bills proposed by Laura Friedman on Quiver Quantitative's politician page for Friedman.

Laura Friedman Fundraising

Laura Friedman recently disclosed $176.6K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 482nd most from all Q2 reports we have seen this year. 74.8% came from individual donors.

Friedman disclosed $141.2K of spending. This was the 395th most from all Q2 reports we have seen from politicians so far this year.

Friedman disclosed $324.2K of cash on hand at the end of the filing period. This was the 564th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Laura Friedman's fundraising on Quiver Quantitative.

Senator Adam Schiff criticizes attempts to restart oil pipelines linked to the 2015 Refugio spill in a Los Angeles Times op-ed.

Quiver AI Summary

U.S. Senator Adam Schiff (D-Calif.) recently published an op-ed in the Los Angeles Times that raises concerns about Sable Offshore Corporation's plans to restart oil drilling operations using the same pipelines involved in the 2015 Refugio State Beach oil spill. Schiff argues that resuming these operations poses significant environmental risks and contradicts the state's regulatory frameworks.

In his op-ed, Schiff criticized the Trump administration for supporting Sable's actions despite the lack of necessary permits and stated that this move could pave the way for broader offshore drilling off California's coast. He called on Californians to unite in safeguarding the environment against such threats.

Schiff's piece emphasizes the historical context of oil spills and suggests the public must actively advocate for stronger environmental protection measures, echoing the collective efforts that led to the establishment of Earth Day. The op-ed can be found in full via a link provided in the announcement.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Adam B. Schiff Net Worth

Quiver Quantitative estimates that Adam B. Schiff is worth $2.0M, as of September 6th, 2025. This is the 251st highest net worth in Congress, per our live estimates.

Schiff has approximately $1.1M invested in publicly traded assets which Quiver is able to track live.

You can track Adam B. Schiff's net worth on Quiver Quantitative's politician page for Schiff.

Adam B. Schiff Bill Proposals

Here are some bills which have recently been proposed by Adam B. Schiff:

- S.2569: Mortgage Relief for Disaster Survivors Act

- S.2432: A bill to designate the facility of the United States Postal Service located at 6444 San Fernando Road in Glendale, California, as the "Paul Ignatius Post Office".

- S.2349: INSURE Act

- S.2219: BEACON Act

- S.2189: Equal Access to Reproductive Care Act

- S.2188: ATF DATA Act

You can track bills proposed by Adam B. Schiff on Quiver Quantitative's politician page for Schiff.

Adam B. Schiff Fundraising

Adam B. Schiff recently disclosed $1.2M of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 31st most from all Q2 reports we have seen this year. 98.8% came from individual donors.

Schiff disclosed $1.3M of spending. This was the 22nd most from all Q2 reports we have seen from politicians so far this year.

Schiff disclosed $7.3M of cash on hand at the end of the filing period. This was the 27th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Adam B. Schiff's fundraising on Quiver Quantitative.

TODD KRASNOW, a director at $SYM, sold 846 shares of the company on 09-03-2025 for an estimated $39,025. We received data on the trade from a recent SEC filing. This was a sale of approximately 100.0% of their shares of this class of stock. Following this trade, they now own 0 shares of this class of $SYM stock.

$SYM Insider Trading Activity

$SYM insiders have traded $SYM stock on the open market 55 times in the past 6 months. Of those trades, 0 have been purchases and 55 have been sales.

Here’s a breakdown of recent trading of $SYM stock by insiders over the last 6 months:

- MILLENNIUM GST NON-EXEMPT TRUST RBC has made 0 purchases and 2 sales selling 220,000 shares for an estimated $10,218,503.

- ROLLIN L. FORD sold 90,000 shares for an estimated $4,641,273

- WILLIAM M III BOYD (Chief Strategy Officer) has made 0 purchases and 14 sales selling 83,700 shares for an estimated $3,865,204.

- TODD KRASNOW has made 0 purchases and 18 sales selling 62,000 shares for an estimated $2,675,350.

- CHARLES KANE has made 0 purchases and 4 sales selling 25,000 shares for an estimated $1,190,461.

- DANIELA L RUS has made 0 purchases and 5 sales selling 17,411 shares for an estimated $931,519.

- DAVID A LADENSOHN has made 0 purchases and 2 sales selling 15,000 shares for an estimated $815,317.

- CAROL J. HIBBARD (Chief Financial Officer) has made 0 purchases and 2 sales selling 10,921 shares for an estimated $453,438.

- MARIA G FREVE (See Remarks) has made 0 purchases and 3 sales selling 4,407 shares for an estimated $171,867.

- MICHAEL DAVID DUNN (Chief Customer Officer) has made 0 purchases and 2 sales selling 4,206 shares for an estimated $92,148.

- MERLINE SAINTIL has made 0 purchases and 2 sales selling 1,209 shares for an estimated $40,281.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$SYM Hedge Fund Activity

We have seen 161 institutional investors add shares of $SYM stock to their portfolio, and 122 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- FMR LLC removed 595,564 shares (-88.7%) from their portfolio in Q2 2025, for an estimated $23,137,661

- BNP PARIBAS FINANCIAL MARKETS removed 491,804 shares (-61.9%) from their portfolio in Q2 2025, for an estimated $19,106,585

- ZEVENBERGEN CAPITAL INVESTMENTS LLC removed 421,122 shares (-74.8%) from their portfolio in Q2 2025, for an estimated $16,360,589

- D. E. SHAW & CO., INC. added 418,342 shares (+inf%) to their portfolio in Q2 2025, for an estimated $16,252,586

- RENAISSANCE TECHNOLOGIES LLC added 409,500 shares (+inf%) to their portfolio in Q2 2025, for an estimated $15,909,075

- ROYAL BANK OF CANADA added 340,689 shares (+401.5%) to their portfolio in Q2 2025, for an estimated $13,235,767

- MILLENNIUM MANAGEMENT LLC removed 311,141 shares (-71.4%) from their portfolio in Q2 2025, for an estimated $12,087,827

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$SYM Analyst Ratings

Wall Street analysts have issued reports on $SYM in the last several months. We have seen 4 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- Needham issued a "Buy" rating on 08/07/2025

- Oppenheimer issued a "Outperform" rating on 08/07/2025

- Arete Research issued a "Buy" rating on 06/25/2025

- Citigroup issued a "Buy" rating on 04/14/2025

- BWS Financial issued a "Sell" rating on 04/02/2025

To track analyst ratings and price targets for $SYM, check out Quiver Quantitative's $SYM forecast page.

$SYM Price Targets

Multiple analysts have issued price targets for $SYM recently. We have seen 8 analysts offer price targets for $SYM in the last 6 months, with a median target of $48.5.

Here are some recent targets:

- Matt Summerville from DA Davidson set a target price of $47.0 on 08/25/2025

- Colin Rusch from Oppenheimer set a target price of $59.0 on 08/07/2025

- James Ricchiuti from Needham set a target price of $57.0 on 08/07/2025

- Michael Latimore from Northland Capital Markets set a target price of $56.0 on 07/08/2025

- An analyst from Arete Research set a target price of $50.0 on 06/25/2025

- Andrew Kaplowitz from Citigroup set a target price of $29.0 on 04/14/2025

- Mark Delaney from Goldman Sachs set a target price of $18.0 on 04/10/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Alexander Azoy, the Chief Accounting Officer of $RCUS, sold 1,579 shares of the company on 09-05-2025 for an estimated $18,758. We received data on the trade from a recent SEC filing. This was a sale of approximately 5.0% of their shares of this class of stock. Following this trade, they now own 30,194 shares of this class of $RCUS stock.

$RCUS Insider Trading Activity

$RCUS insiders have traded $RCUS stock on the open market 1 times in the past 6 months. Of those trades, 0 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $RCUS stock by insiders over the last 6 months:

- ALEXANDER AZOY (Chief Accounting Officer) sold 1,579 shares for an estimated $18,758

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$RCUS Hedge Fund Activity

We have seen 109 institutional investors add shares of $RCUS stock to their portfolio, and 99 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- POINT72 ASSET MANAGEMENT, L.P. added 3,099,567 shares (+108.1%) to their portfolio in Q2 2025, for an estimated $25,230,475

- FMR LLC removed 1,883,552 shares (-42.3%) from their portfolio in Q2 2025, for an estimated $15,332,113

- BOXER CAPITAL MANAGEMENT, LLC removed 1,602,200 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $12,577,270

- SUVRETTA CAPITAL MANAGEMENT, LLC added 1,127,954 shares (+44.0%) to their portfolio in Q2 2025, for an estimated $9,181,545

- WOODLINE PARTNERS LP removed 1,127,275 shares (-22.0%) from their portfolio in Q2 2025, for an estimated $9,176,018

- BRAIDWELL LP removed 802,100 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $6,296,485

- CUTTER CAPITAL MANAGEMENT, LP added 731,818 shares (+inf%) to their portfolio in Q1 2025, for an estimated $5,744,771

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$RCUS Analyst Ratings

Wall Street analysts have issued reports on $RCUS in the last several months. We have seen 3 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Wells Fargo issued a "Overweight" rating on 08/07/2025

- Morgan Stanley issued a "Overweight" rating on 05/09/2025

- Barclays issued a "Overweight" rating on 04/23/2025

To track analyst ratings and price targets for $RCUS, check out Quiver Quantitative's $RCUS forecast page.

$RCUS Price Targets

Multiple analysts have issued price targets for $RCUS recently. We have seen 4 analysts offer price targets for $RCUS in the last 6 months, with a median target of $18.0.

Here are some recent targets:

- Eva Fortea Verdejo from Wells Fargo set a target price of $25.0 on 08/07/2025

- Terence Flynn from Morgan Stanley set a target price of $22.0 on 05/09/2025

- Salveen Richter from Goldman Sachs set a target price of $13.0 on 05/08/2025

- Peter Lawson from Barclays set a target price of $14.0 on 04/23/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Jason Wilk, the Chief Executive Officer of $DAVE, sold 26 shares of the company on 09-04-2025 for an estimated $5,213. We received data on the trade from a recent SEC filing. This was a sale of approximately 0.0% of their shares of this class of stock. Following this trade, they now own 217,854 shares of this class of $DAVE stock.

$DAVE Insider Trading Activity

$DAVE insiders have traded $DAVE stock on the open market 125 times in the past 6 months. Of those trades, 0 have been purchases and 125 have been sales.

Here’s a breakdown of recent trading of $DAVE stock by insiders over the last 6 months:

- JASON WILK (Chief Executive Officer) has made 0 purchases and 26 sales selling 187,738 shares for an estimated $39,641,722.

- IMRAN KHAN has made 0 purchases and 46 sales selling 100,000 shares for an estimated $21,227,226.

- KYLE BEILMAN (CFO and COO and Secretary) has made 0 purchases and 20 sales selling 38,943 shares for an estimated $8,167,255.

- YADIN ROZOV has made 0 purchases and 11 sales selling 20,160 shares for an estimated $4,063,468.

- MICHAEL W POPE has made 0 purchases and 16 sales selling 16,793 shares for an estimated $3,613,457.

- ANDREA MITCHELL has made 0 purchases and 5 sales selling 2,361 shares for an estimated $543,263.

- DAN PRESTON sold 2,361 shares for an estimated $491,017

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$DAVE Hedge Fund Activity

We have seen 170 institutional investors add shares of $DAVE stock to their portfolio, and 97 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- DIVISADERO STREET CAPITAL MANAGEMENT, LP removed 460,551 shares (-46.3%) from their portfolio in Q2 2025, for an estimated $123,616,493

- D. E. SHAW & CO., INC. added 420,653 shares (+491.1%) to their portfolio in Q2 2025, for an estimated $112,907,471

- NVP ASSOCIATES, LLC removed 350,000 shares (-60.1%) from their portfolio in Q2 2025, for an estimated $93,943,500

- TWO SIGMA ADVISERS, LP added 236,073 shares (+2089.1%) to their portfolio in Q2 2025, for an estimated $63,364,353

- TWO SIGMA INVESTMENTS, LP added 191,842 shares (+1372.4%) to their portfolio in Q2 2025, for an estimated $51,492,311

- COOPER CREEK PARTNERS MANAGEMENT LLC removed 190,077 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $51,018,567

- G2 INVESTMENT PARTNERS MANAGEMENT LLC removed 149,816 shares (-56.2%) from their portfolio in Q2 2025, for an estimated $40,212,112

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$DAVE Analyst Ratings

Wall Street analysts have issued reports on $DAVE in the last several months. We have seen 6 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- JMP Securities issued a "Market Outperform" rating on 08/07/2025

- Barrington Research issued a "Outperform" rating on 08/04/2025

- B. Riley Securities issued a "Buy" rating on 07/29/2025

- Benchmark issued a "Buy" rating on 06/30/2025

- Lake Street issued a "Buy" rating on 05/09/2025

- Canaccord Genuity issued a "Buy" rating on 05/09/2025

To track analyst ratings and price targets for $DAVE, check out Quiver Quantitative's $DAVE forecast page.

$DAVE Price Targets

Multiple analysts have issued price targets for $DAVE recently. We have seen 6 analysts offer price targets for $DAVE in the last 6 months, with a median target of $278.5.

Here are some recent targets:

- Gary Prestopino from Barrington Research set a target price of $290.0 on 08/18/2025

- Joseph Vafi from Canaccord Genuity set a target price of $229.0 on 08/08/2025

- Devin Ryan from JMP Securities set a target price of $280.0 on 08/07/2025

- Hal Goetsch from B. Riley Securities set a target price of $277.0 on 07/29/2025

- Mark Palmer from Benchmark set a target price of $320.0 on 07/14/2025

- Jacob Stephan from Lake Street set a target price of $177.0 on 05/09/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Yadin Rozov, a director at $DAVE, sold 228 shares of the company on 09-04-2025 for an estimated $46,509. We received data on the trade from a recent SEC filing. This was a sale of approximately 0.3% of their shares of this class of stock. Following this trade, they now own 79,923 shares of this class of $DAVE stock.

$DAVE Insider Trading Activity

$DAVE insiders have traded $DAVE stock on the open market 123 times in the past 6 months. Of those trades, 0 have been purchases and 123 have been sales.

Here’s a breakdown of recent trading of $DAVE stock by insiders over the last 6 months:

- JASON WILK (Chief Executive Officer) has made 0 purchases and 24 sales selling 180,181 shares for an estimated $38,134,827.

- IMRAN KHAN has made 0 purchases and 46 sales selling 100,000 shares for an estimated $21,227,226.

- KYLE BEILMAN (CFO and COO and Secretary) has made 0 purchases and 20 sales selling 38,943 shares for an estimated $8,167,255.

- YADIN ROZOV has made 0 purchases and 11 sales selling 20,160 shares for an estimated $4,063,468.

- MICHAEL W POPE has made 0 purchases and 16 sales selling 16,793 shares for an estimated $3,613,457.

- ANDREA MITCHELL has made 0 purchases and 5 sales selling 2,361 shares for an estimated $543,263.

- DAN PRESTON sold 2,361 shares for an estimated $491,017

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$DAVE Hedge Fund Activity

We have seen 170 institutional investors add shares of $DAVE stock to their portfolio, and 97 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- DIVISADERO STREET CAPITAL MANAGEMENT, LP removed 460,551 shares (-46.3%) from their portfolio in Q2 2025, for an estimated $123,616,493

- D. E. SHAW & CO., INC. added 420,653 shares (+491.1%) to their portfolio in Q2 2025, for an estimated $112,907,471

- NVP ASSOCIATES, LLC removed 350,000 shares (-60.1%) from their portfolio in Q2 2025, for an estimated $93,943,500

- TWO SIGMA ADVISERS, LP added 236,073 shares (+2089.1%) to their portfolio in Q2 2025, for an estimated $63,364,353

- TWO SIGMA INVESTMENTS, LP added 191,842 shares (+1372.4%) to their portfolio in Q2 2025, for an estimated $51,492,311

- COOPER CREEK PARTNERS MANAGEMENT LLC removed 190,077 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $51,018,567

- G2 INVESTMENT PARTNERS MANAGEMENT LLC removed 149,816 shares (-56.2%) from their portfolio in Q2 2025, for an estimated $40,212,112

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$DAVE Analyst Ratings

Wall Street analysts have issued reports on $DAVE in the last several months. We have seen 6 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- JMP Securities issued a "Market Outperform" rating on 08/07/2025

- Barrington Research issued a "Outperform" rating on 08/04/2025

- B. Riley Securities issued a "Buy" rating on 07/29/2025

- Benchmark issued a "Buy" rating on 06/30/2025

- Lake Street issued a "Buy" rating on 05/09/2025

- Canaccord Genuity issued a "Buy" rating on 05/09/2025

To track analyst ratings and price targets for $DAVE, check out Quiver Quantitative's $DAVE forecast page.

$DAVE Price Targets

Multiple analysts have issued price targets for $DAVE recently. We have seen 6 analysts offer price targets for $DAVE in the last 6 months, with a median target of $278.5.

Here are some recent targets:

- Gary Prestopino from Barrington Research set a target price of $290.0 on 08/18/2025

- Joseph Vafi from Canaccord Genuity set a target price of $229.0 on 08/08/2025

- Devin Ryan from JMP Securities set a target price of $280.0 on 08/07/2025

- Hal Goetsch from B. Riley Securities set a target price of $277.0 on 07/29/2025

- Mark Palmer from Benchmark set a target price of $320.0 on 07/14/2025

- Jacob Stephan from Lake Street set a target price of $177.0 on 05/09/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

DARRYL RAWLINGS, a director at $TRUP, sold 30,369 shares of the company on 09-04-2025 for an estimated $1,357,500. We received data on the trade from a recent SEC filing. This was a sale of approximately 2.1% of their shares of this class of stock. Following this trade, they now own 1,413,281 shares of this class of $TRUP stock.

$TRUP Insider Trading Activity

$TRUP insiders have traded $TRUP stock on the open market 18 times in the past 6 months. Of those trades, 0 have been purchases and 18 have been sales.

Here’s a breakdown of recent trading of $TRUP stock by insiders over the last 6 months:

- DARRYL RAWLINGS has made 0 purchases and 2 sales selling 50,000 shares for an estimated $2,236,725.

- FAWWAD QURESHI (Chief Financial Officer) has made 0 purchases and 5 sales selling 15,029 shares for an estimated $660,836.

- MARGARET TOOTH (CEO) has made 0 purchases and 4 sales selling 12,200 shares for an estimated $475,221.

- EMILY DREYER (SVP, Channel Growth) has made 0 purchases and 2 sales selling 14,025 shares for an estimated $454,590.

- BRENNA MCGIBNEY (Chief Administration Officer) has made 0 purchases and 3 sales selling 9,811 shares for an estimated $383,788.

- JOHN R GALLAGHER (Chief Operating Officer) has made 0 purchases and 2 sales selling 7,100 shares for an estimated $293,879.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$TRUP Hedge Fund Activity

We have seen 123 institutional investors add shares of $TRUP stock to their portfolio, and 127 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- WELLINGTON MANAGEMENT GROUP LLP removed 452,862 shares (-18.2%) from their portfolio in Q2 2025, for an estimated $25,065,911

- J. GOLDMAN & CO LP removed 400,220 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $14,916,199

- FMR LLC added 343,071 shares (+36.8%) to their portfolio in Q2 2025, for an estimated $18,988,979

- BANK OF AMERICA CORP /DE/ removed 322,289 shares (-19.8%) from their portfolio in Q2 2025, for an estimated $17,838,696

- D. E. SHAW & CO., INC. added 242,404 shares (+161.5%) to their portfolio in Q2 2025, for an estimated $13,417,061

- SCULPTOR CAPITAL LP removed 194,700 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $7,256,469

- FREESTONE GROVE PARTNERS LP removed 161,327 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $6,012,657

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$TRUP Analyst Ratings

Wall Street analysts have issued reports on $TRUP in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Piper Sandler issued a "Overweight" rating on 07/03/2025

- Lake Street issued a "Buy" rating on 05/02/2025

To track analyst ratings and price targets for $TRUP, check out Quiver Quantitative's $TRUP forecast page.

$TRUP Price Targets

Multiple analysts have issued price targets for $TRUP recently. We have seen 3 analysts offer price targets for $TRUP in the last 6 months, with a median target of $60.0.

Here are some recent targets:

- John Barnidge from Piper Sandler set a target price of $67.0 on 08/08/2025

- Jonathan Block from Stifel set a target price of $45.0 on 08/08/2025

- Mark Argento from Lake Street set a target price of $60.0 on 05/02/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Mark E Saad, a director at $AXSM, sold 9,127 shares of the company on 09-05-2025 for an estimated $1,141,513. We received data on the trade from a recent SEC filing. This was a sale of approximately 47.7% of their shares of this class of stock. Following this trade, they now own 10,002 shares of this class of $AXSM stock.

$AXSM Insider Trading Activity

$AXSM insiders have traded $AXSM stock on the open market 18 times in the past 6 months. Of those trades, 0 have been purchases and 18 have been sales.

Here’s a breakdown of recent trading of $AXSM stock by insiders over the last 6 months:

- ROGER JEFFS has made 0 purchases and 6 sales selling 110,158 shares for an estimated $13,373,843.

- MARK L. JACOBSON (Chief Operating Officer) has made 0 purchases and 3 sales selling 65,673 shares for an estimated $6,993,636.

- HUNTER R. MURDOCK (General Counsel) has made 0 purchases and 5 sales selling 36,014 shares for an estimated $3,647,496.

- MARK E SAAD sold 9,127 shares for an estimated $1,141,513

- MARK COLEMAN has made 0 purchases and 3 sales selling 10,500 shares for an estimated $1,105,848.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$AXSM Hedge Fund Activity

We have seen 203 institutional investors add shares of $AXSM stock to their portfolio, and 166 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- RTW INVESTMENTS, LP removed 1,405,826 shares (-48.1%) from their portfolio in Q2 2025, for an estimated $146,754,176

- RA CAPITAL MANAGEMENT, L.P. removed 1,000,000 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $116,630,000

- DEEP TRACK CAPITAL, LP added 801,371 shares (+inf%) to their portfolio in Q2 2025, for an estimated $83,655,118

- PRICE T ROWE ASSOCIATES INC /MD/ added 580,766 shares (+1816.2%) to their portfolio in Q2 2025, for an estimated $60,626,162

- BOXER CAPITAL MANAGEMENT, LLC removed 470,000 shares (-100.0%) from their portfolio in Q1 2025, for an estimated $54,816,100

- ASSENAGON ASSET MANAGEMENT S.A. removed 446,458 shares (-71.2%) from their portfolio in Q2 2025, for an estimated $46,605,750

- ADAGE CAPITAL PARTNERS GP, L.L.C. added 399,000 shares (+831.2%) to their portfolio in Q2 2025, for an estimated $41,651,610

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$AXSM Analyst Ratings

Wall Street analysts have issued reports on $AXSM in the last several months. We have seen 10 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- B of A Securities issued a "Buy" rating on 08/05/2025

- RBC Capital issued a "Outperform" rating on 08/05/2025

- Needham issued a "Buy" rating on 08/04/2025

- Morgan Stanley issued a "Overweight" rating on 07/03/2025

- HC Wainwright & Co. issued a "Buy" rating on 06/10/2025

- Oppenheimer issued a "Outperform" rating on 06/03/2025

- Wells Fargo issued a "Overweight" rating on 05/06/2025

To track analyst ratings and price targets for $AXSM, check out Quiver Quantitative's $AXSM forecast page.

$AXSM Price Targets

Multiple analysts have issued price targets for $AXSM recently. We have seen 11 analysts offer price targets for $AXSM in the last 6 months, with a median target of $180.0.

Here are some recent targets:

- Benjamin Burnett from Wells Fargo set a target price of $163.0 on 09/03/2025

- Leonid Timashev from RBC Capital set a target price of $189.0 on 08/05/2025

- Jason Gerberry from B of A Securities set a target price of $176.0 on 08/05/2025

- Ami Fadia from Needham set a target price of $150.0 on 08/04/2025

- Sean Laaman from Morgan Stanley set a target price of $190.0 on 07/03/2025

- Raghuram Selvaraju from HC Wainwright & Co. set a target price of $180.0 on 06/10/2025

- Matthew Hershenhorn from Oppenheimer set a target price of $185.0 on 06/03/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Kalshi has reported 9,909 in volume over the last 24 hours on their market for “Will Angela Rayner be the next Prime Minister of United Kingdom?”, making it one of the hottest markets on the platform today.

The market currently is implying a 11% chance for "Angela Rayner", which is up from yesterday, when the market implied a 10% probability.

If Angela Rayner is the next Prime Minister of United Kingdom before 2030, then the market resolves to Yes.

In total, this market has seen a volume of 19,894 transactions since it was first opened on January 08, 2025. There are 3,865 positions of open interest in this market, and the overall liquidity is sitting at 20,131,010 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will the Federal Reserve Cut rates by >25bps at their September 2025 meeting? (24h volume: 1482050)

- Will Eric Adams drop out of the NYC Mayoral race? (24h volume: 461200)

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 306729)

- Will the Fed cut rates 0 times? (24h volume: 148734)

- Will Trump next nominate Stephen Miran as Fed Chair? (24h volume: 64475)

- Will average **gas prices** be above $3.190? (24h volume: 48748)

- Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race? (24h volume: 43257)

- Donald Trump out this year? (24h volume: 36534)

- Will the rate of CPI inflation be above 2.9% for the year ending in August 2025? (24h volume: 31942)

- Tesla robotaxi released to public before Jan 1, 2026? (24h volume: 30006)

Kalshi has reported 24,290 in volume over the last 24 hours on their market for “Will CPI rise more than 0.4% in August 2025?”, making it one of the hottest markets on the platform today.

The market currently is implying a 10% chance for "Above 0.4%", which is neutral from yesterday, when the market implied a 10% probability.

If the Consumer Price Index (CPI) increases by more than 0.4% in August 2025, then the market resolves to Yes.

In total, this market has seen a volume of 65,169 transactions since it was first opened on July 29, 2025. There are 44,740 positions of open interest in this market, and the overall liquidity is sitting at 2,851,723 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will the Federal Reserve Cut rates by >25bps at their September 2025 meeting? (24h volume: 1482050)

- Will Eric Adams drop out of the NYC Mayoral race? (24h volume: 461200)

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 306729)

- Will the Fed cut rates 0 times? (24h volume: 148734)

- Will Trump next nominate Stephen Miran as Fed Chair? (24h volume: 64475)

- Will average **gas prices** be above $3.190? (24h volume: 48748)

- Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race? (24h volume: 43257)

- Donald Trump out this year? (24h volume: 36534)

- Will the rate of CPI inflation be above 2.9% for the year ending in August 2025? (24h volume: 31942)

- Tesla robotaxi released to public before Jan 1, 2026? (24h volume: 30006)

Kalshi has reported 19,631 in volume over the last 24 hours on their market for “Powell leaves before 2026?”, making it one of the hottest markets on the platform today.

The market currently is implying a 9% chance for "Before 2026", which is neutral from yesterday, when the market implied a 9% probability.

If Jerome Powell is no longer Chair of the Federal Reserve Board of Governors (not merely announces he leaves office) by Dec 31, 2025, then the market resolves to Yes.

In total, this market has seen a volume of 4,630,278 transactions since it was first opened on May 01, 2024. There are 1,700,099 positions of open interest in this market, and the overall liquidity is sitting at 38,962,663 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will the Federal Reserve Cut rates by >25bps at their September 2025 meeting? (24h volume: 1482050)

- Will Eric Adams drop out of the NYC Mayoral race? (24h volume: 461200)

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 306729)

- Will the Fed cut rates 0 times? (24h volume: 148734)

- Will Trump next nominate Stephen Miran as Fed Chair? (24h volume: 64475)

- Will average **gas prices** be above $3.190? (24h volume: 48748)

- Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race? (24h volume: 43257)

- Donald Trump out this year? (24h volume: 36534)

- Will the rate of CPI inflation be above 2.9% for the year ending in August 2025? (24h volume: 31942)

- Tesla robotaxi released to public before Jan 1, 2026? (24h volume: 30006)

Kalshi has reported 30,006 in volume over the last 24 hours on their market for “Tesla robotaxi released to public before Jan 1, 2026?”, making it one of the hottest markets on the platform today.

The market currently is implying a 86% chance for "Before 2026", which is neutral from yesterday, when the market implied a 86% probability.

If Tesla has released its robotaxi service to the public before Jan 1, 2026, then the market resolves to Yes.

In total, this market has seen a volume of 617,554 transactions since it was first opened on April 12, 2024. There are 237,709 positions of open interest in this market, and the overall liquidity is sitting at 21,060,850 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will the Federal Reserve Cut rates by >25bps at their September 2025 meeting? (24h volume: 1482050)

- Will Eric Adams drop out of the NYC Mayoral race? (24h volume: 461200)

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 306729)

- Will the Fed cut rates 0 times? (24h volume: 148734)

- Will Trump next nominate Stephen Miran as Fed Chair? (24h volume: 64475)

- Will average **gas prices** be above $3.190? (24h volume: 48748)

- Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race? (24h volume: 43257)

- Donald Trump out this year? (24h volume: 36534)

- Will the rate of CPI inflation be above 2.9% for the year ending in August 2025? (24h volume: 31942)

- Tesla robotaxi released to public before Jan 1, 2026? (24h volume: 30006)

Kalshi has reported 43,257 in volume over the last 24 hours on their market for “Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race?”, making it one of the hottest markets on the platform today.

The market currently is implying a 13% chance for "Eric Adams", which is neutral from yesterday, when the market implied a 13% probability.

If Eric Adams endorses Andrew Cuomo in the 2025 NYC Mayoral Race before election day, then the market resolves to Yes.

In total, this market has seen a volume of 55,259 transactions since it was first opened on August 07, 2025. There are 23,907 positions of open interest in this market, and the overall liquidity is sitting at 4,825,110 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will the Federal Reserve Cut rates by >25bps at their September 2025 meeting? (24h volume: 1482050)

- Will Eric Adams drop out of the NYC Mayoral race? (24h volume: 461200)

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 306729)

- Will the Fed cut rates 0 times? (24h volume: 148734)

- Will Trump next nominate Stephen Miran as Fed Chair? (24h volume: 64475)

- Will average **gas prices** be above $3.190? (24h volume: 48748)

- Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race? (24h volume: 43257)

- Donald Trump out this year? (24h volume: 36534)

- Will the rate of CPI inflation be above 2.9% for the year ending in August 2025? (24h volume: 31942)

- Tesla robotaxi released to public before Jan 1, 2026? (24h volume: 30006)

Kalshi has reported 29,528 in volume over the last 24 hours on their market for “Who will get second place in the Mayor?”, making it one of the hottest markets on the platform today.

The market currently is implying a 4% chance for "Eric Adams", which is neutral from yesterday, when the market implied a 4% probability.

If Eric Adams is second place in the NYC Mayor in 2025, then the market resolves to Yes.

In total, this market has seen a volume of 215,101 transactions since it was first opened on June 11, 2025. There are 91,917 positions of open interest in this market, and the overall liquidity is sitting at 6,106,147 contracts.

Based on Quiver’s tracking, here are 10 of the finance and politics markets that have had the most volume on Kalshi over the last 24 hours:

- Will the Federal Reserve Cut rates by >25bps at their September 2025 meeting? (24h volume: 1482050)

- Will Eric Adams drop out of the NYC Mayoral race? (24h volume: 461200)

- Will a representative of the Andrew Cuomo party win the NYC Mayor race in 2025? (24h volume: 306729)

- Will the Fed cut rates 0 times? (24h volume: 148734)

- Will Trump next nominate Stephen Miran as Fed Chair? (24h volume: 64475)

- Will average **gas prices** be above $3.190? (24h volume: 48748)

- Will Eric Adams endorse Andrew Cuomo in 2025 NYC Mayoral Race? (24h volume: 43257)

- Donald Trump out this year? (24h volume: 36534)

- Will the rate of CPI inflation be above 2.9% for the year ending in August 2025? (24h volume: 31942)

- Tesla robotaxi released to public before Jan 1, 2026? (24h volume: 30006)

Kalshi has reported 10,266 in volume over the last 24 hours on their market for “Will Trump restore local control of DC police before Oct 2025”, making it one of the hottest markets on the platform today.