S. 2197: Refund Equality Act of 2025

This bill, titled the Refund Equality Act of 2025

, aims to allow legally married same-sex couples to amend their tax filing status for certain previous years beyond the usual deadline. The key provisions of the bill include:

Extension of Tax Filing Limitations

The bill proposes that if a same-sex couple was first treated as married based on a specific ruling (Revenue Ruling 2013–17) and they filed a tax return as individuals rather than jointly for years before September 16, 2013, they are allowed to amend those tax returns. Specifically:

- If these couples had the option to file jointly in those years but did not due to the legal status of same-sex marriage at the time, they can now treat their prior individual returns as separate returns as defined in the Internal Revenue Code.

- The usual time limits for amending these returns will be extended, allowing them to file joint returns for these earlier tax years without being restricted by the standard deadlines.

- For any joint returns filed under this amendment, the period for claiming any tax credits or refunds will also be extended until the deadline for tax returns that includes the date this bill is enacted.

Restrictions on Amendments

The ability to amend tax returns and claim refunds as mentioned in the above section applies only to changes in marital status for tax purposes. This means that any amendments must be related specifically to their marriage status, as recognized by the law.

Significance of the Bill

The main objective of the Refund Equality Act is to provide equitable tax treatment to same-sex couples who may have missed potential tax benefits due to the previous legal context surrounding same-sex marriage. This bill addresses the financial implications of filing taxes as married couples retroactively for those affected years.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

47 bill sponsors

-

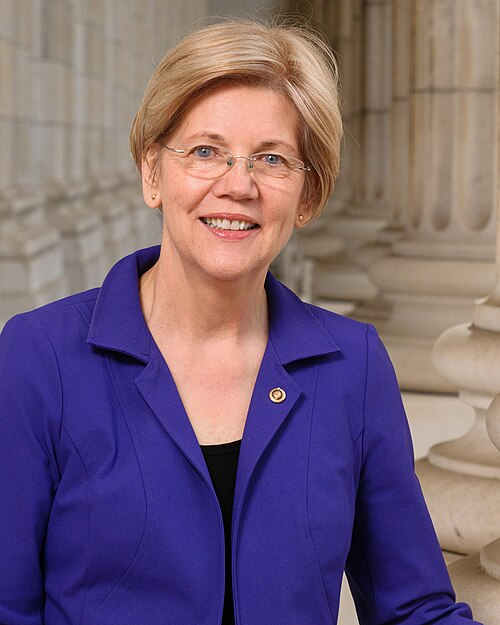

TrackElizabeth Warren

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackMaria Cantwell

Co-Sponsor

-

TrackSusan M. Collins

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

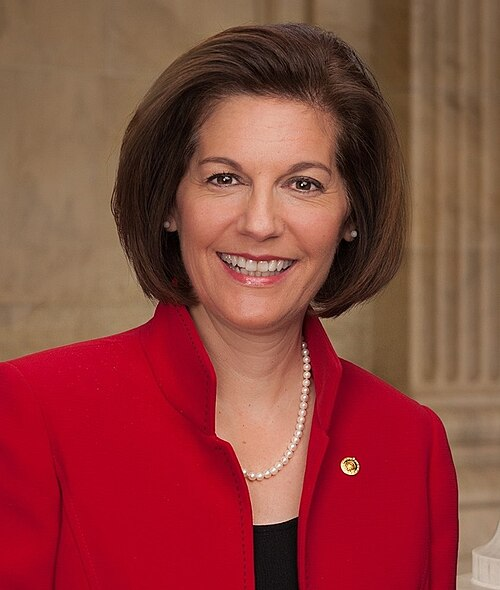

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

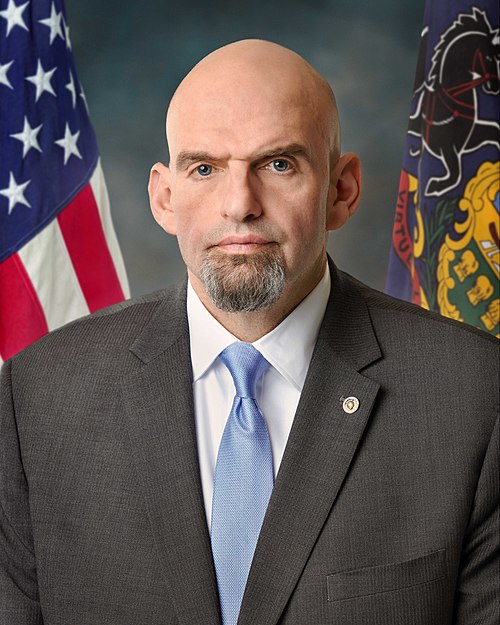

TrackJohn Fetterman

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

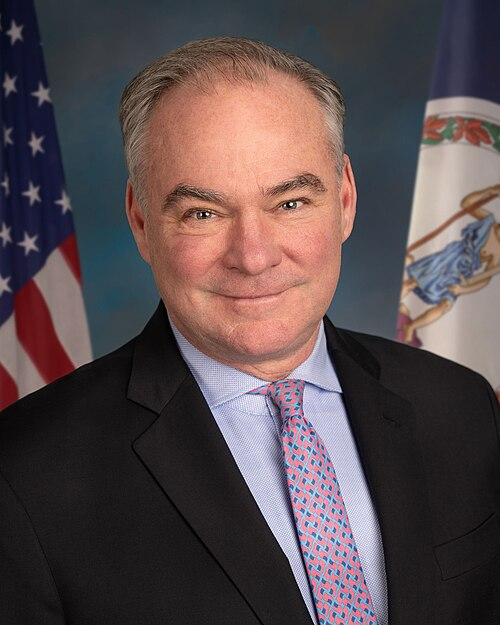

TrackTim Kaine

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackChristopher Murphy

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackJon Ossoff

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackGary C. Peters

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

TrackAdam B. Schiff

Co-Sponsor

-

TrackCharles E. Schumer

Co-Sponsor

-

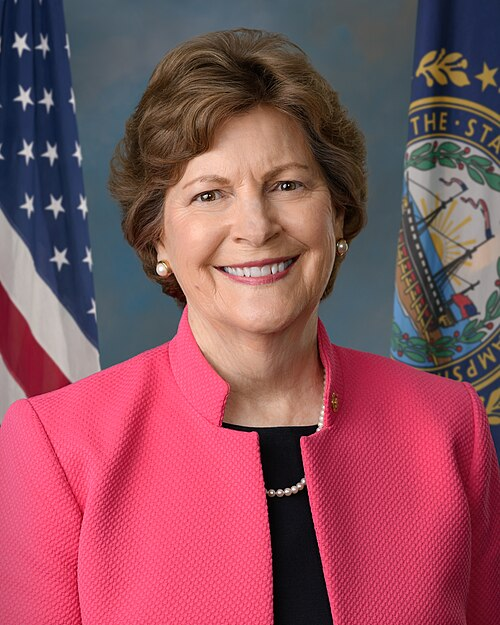

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

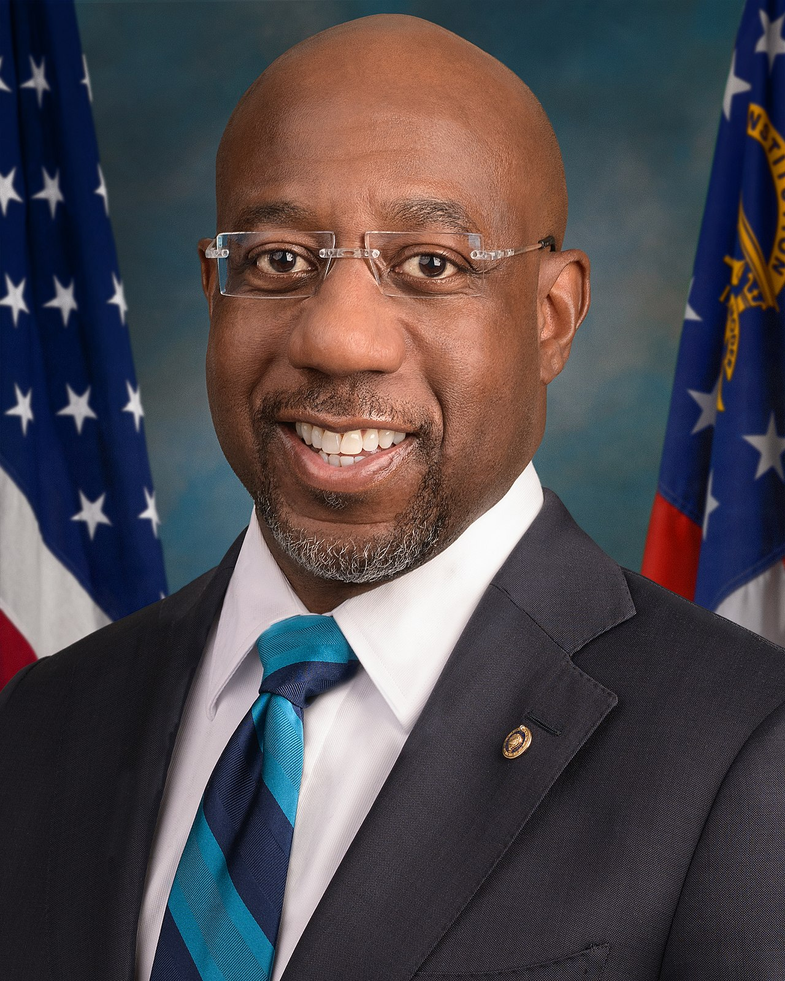

TrackRaphael G. Warnock

Co-Sponsor

-

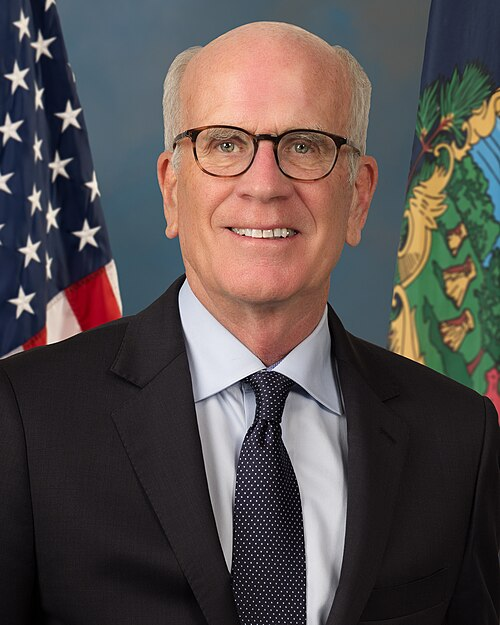

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 26, 2025 | Introduced in Senate |

| Jun. 26, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.