S. 2461: Promotion and Expansion of Private Employee Ownership Act of 2025

This bill, known as the Promotion and Expansion of Private Employee Ownership Act of 2025, aims to support and enhance employee ownership in small companies, specifically those structured as S corporations, through Employee Stock Ownership Plans (ESOPs). Below are the main components and provisions of the bill.

Key Findings

The bill highlights several important points:

- Since the late 1990s, legislation has allowed employees to own shares in S corporations through ESOPs, leading to increased employee ownership across various sectors.

- Many employees of ESOP-owned companies have better job stability and accumulate significant retirement savings through these ownership plans.

- A large portion of American workers currently do not have formal retirement savings accounts.

- Employee ownership can improve job security and retirement savings, making it a viable option for business succession planning.

Tax Provisions

The bill seeks to make changes to the taxation of sales of employer stock to ESOPs:

- It accelerates tax deferral on certain sales of employer stock to ESOPs, allowing these deferrals to apply immediately upon the enactment of the bill, rather than waiting until 2027.

- It also removes current limitations on tax deferrals, which could encourage more businesses to consider selling to ESOPs.

Department of Treasury Initiatives

To promote employee ownership of S corporations, the bill proposes the establishment of an S Corporation Employee Ownership Assistance Office within the Department of the Treasury. This office will:

- Provide education and outreach to promote awareness of employee ownership benefits.

- Offer technical assistance to S corporations that want to implement ESOPs.

Small Business Administration Changes

In amending the Small Business Act, the bill ensures that businesses that adopt ESOPs remain eligible for small business programs. Specifically:

- Each ESOP participant will be treated as directly owning their proportionate share of the business, thus maintaining the business's status as a small business concern even after an ESOP acquires more than 49% of the business.

Advocate for Employee Ownership

The bill establishes an Advocate for Employee Ownership within the Department of Labor. This advocate will:

- Facilitate communication among stakeholders involved in employee ownership.

- Enhance public education on employee ownership and assist in resolving disputes related to employee stock ownership plans.

- Provide recommendations for legislative or administrative changes to promote employee ownership further.

Reporting Requirements

The Advocate for Employee Ownership is required to submit annual reports on the activities promoting employee ownership, summarizing challenges faced and recommending solutions to improve employee stock ownership plans.

Effective Dates

The provisions of this bill are set to take effect at various points, notably, certain tax amendments will apply to sales after the bill's enactment, while others will take effect on January 1 of the year following the bill’s enactment.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

24 bill sponsors

-

TrackSteve Daines

Sponsor

-

TrackMarsha Blackburn

Co-Sponsor

-

TrackMaria Cantwell

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

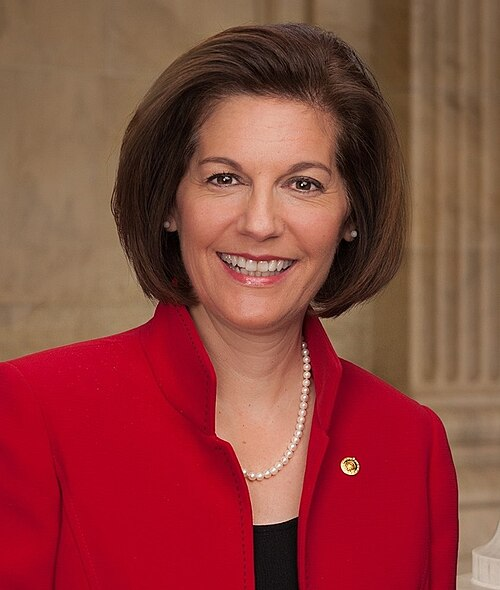

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackMike Crapo

Co-Sponsor

-

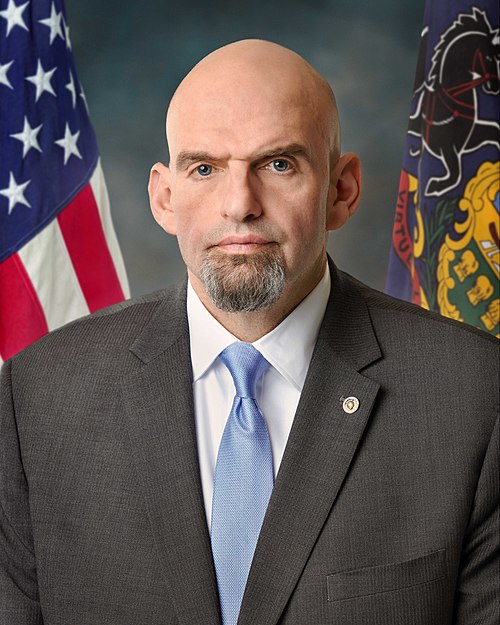

TrackJohn Fetterman

Co-Sponsor

-

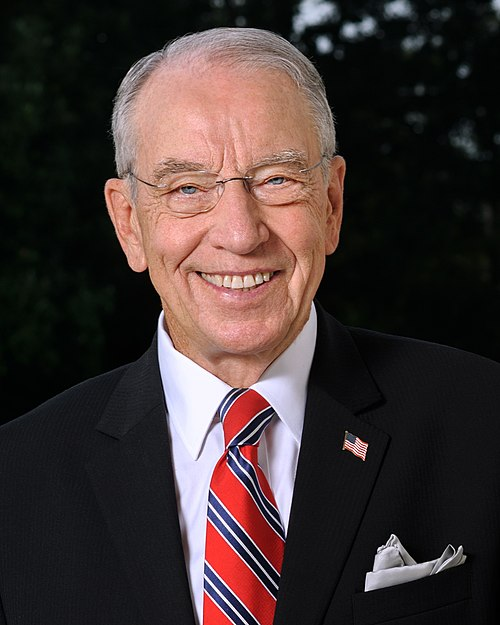

TrackChuck Grassley

Co-Sponsor

-

TrackMargaret Wood Hassan

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackJon Husted

Co-Sponsor

-

TrackJohn Kennedy

Co-Sponsor

-

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackPete Ricketts

Co-Sponsor

-

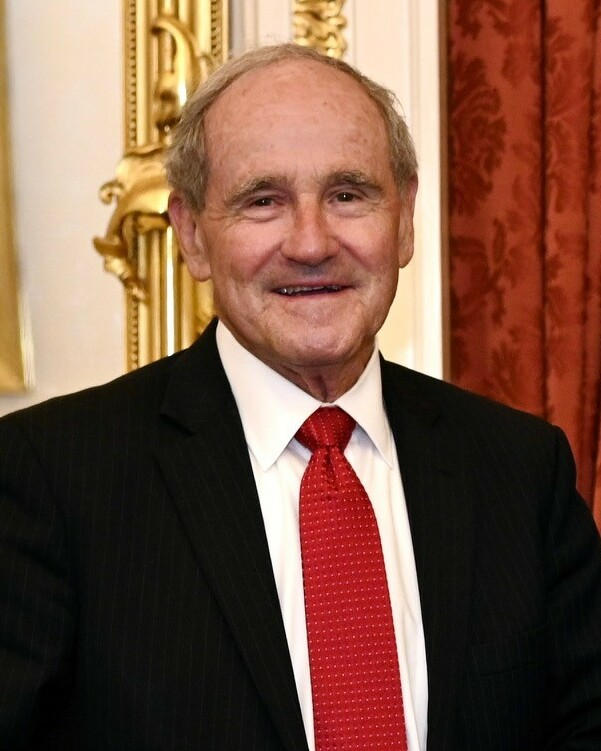

TrackJames E. Risch

Co-Sponsor

-

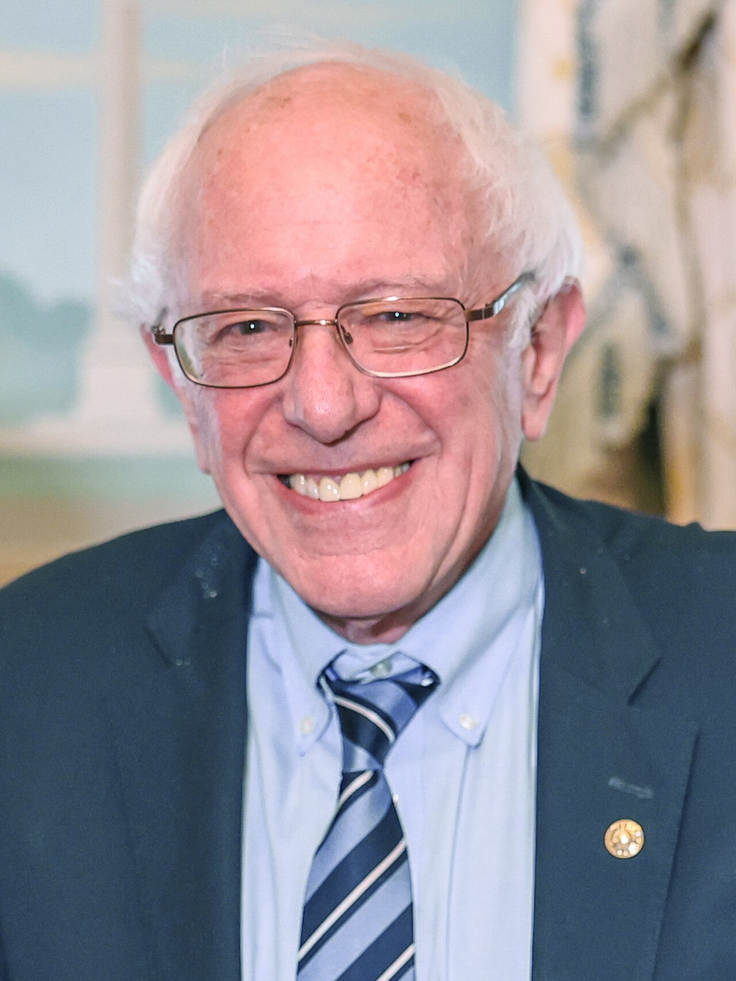

TrackBernard Sanders

Co-Sponsor

-

TrackEric Schmitt

Co-Sponsor

-

TrackTim Sheehy

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackThom Tillis

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

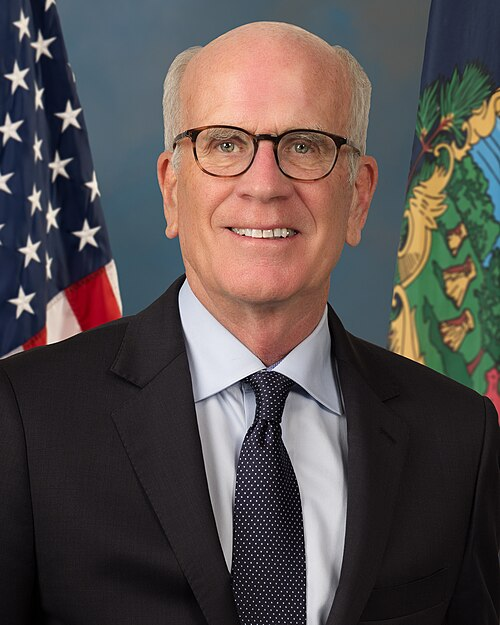

TrackPeter Welch

Co-Sponsor

-

TrackTodd Young

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 24, 2025 | Introduced in Senate |

| Jul. 24, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.