S. 2349: Incorporating National Support for Unprecedented Risks and Emergencies Act

This bill, named the "Incorporating National Support for Unprecedented Risks and Emergencies Act" (or "INSURE Act"), proposes the establishment of a federal program to provide reinsurance for catastrophic property losses. The following outlines the main components of the bill:

Establishment of a Catastrophic Property Loss Reinsurance Program

The Secretary of the Treasury is tasked with creating a program within four years of the enactment of the bill. This program will offer reinsurance to qualifying primary insurance companies that provide all-perils property insurance policies, which cover a broad range of catastrophic risks.

Eligibility Requirements

To participate in the reinsurance program, insurers must meet the following criteria:

- Offer all-perils property insurance policies for residential or commercial properties.

- Engage in loss prevention partnerships to help policyholders reduce risks associated with catastrophic events.

Catastrophe Perils Covered

The program will initially cover certain catastrophe perils, including:

- Wind and hurricanes (starting within four years after the bill's enactment)

- Severe convective storms and wildfires (within five years)

- Flood (within six years)

- Earthquakes (depending on the submission of a feasibility report)

Financial Threshold for Payments

The Secretary will establish a financial threshold to determine when an insurer can receive payments from the federal fund. This threshold will generally be set at no more than 40% of the probable maximum loss for each catastrophe peril covered by the program.

Premiums for Participation

Insurers participating in the reinsurance program must pay quarterly premiums. The premium amounts will be calculated based on expected losses and administrative costs, with provisions for minimum and maximum adjustments over time.

Loss Prevention Partnerships

The bill emphasizes forming partnerships for loss prevention between insurers and policyholders. These partnerships may include:

- Identifying loss prevention steps that make properties eligible for coverage.

- Making coverage contingent on the implementation of loss prevention activities.

Advisory Committee

An advisory committee will be established to advise the Secretary regarding the program. This committee will consist of a diverse group of stakeholders, including consumer advocates, insurance representatives, and government officials.

Federal Catastrophe Reinsurance Fund

A federal fund will be established to hold and invest the premiums collected from participating insurers. If the fund does not have enough resources to meet its obligations, the Secretary may issue notes and bonds guaranteed by the U.S. government to secure additional funds.

Data Collection and Reporting

The Secretary will implement a system for collecting and reporting data from participating insurers. This will include quarterly policy-level claim transaction data to assess risks associated with property insurance markets.

Reports on Specific Issues

Within specified timeframes, the Secretary is required to submit reports to Congress on:

- The feasibility of establishing a fund for relocating homes or businesses that cannot obtain insurance due to catastrophic risks.

- The feasibility of including earthquake coverage in property insurance policies.

Long-Term Policy Pilot Program

The Secretary will establish a pilot program for multi-year property insurance policies. These policies will have specific conditions regarding premiums, coverage, and loss mitigation partnerships.

Implementation Timeline

The program will be phased in over several years, with specific dates outlined for when coverage for each type of peril will commence.

Relevant Companies

- ALL - Allstate Corporation: As a major property and casualty insurer, Allstate may see changes in its underwriting processes and coverage options to align with the federal program.

- CB - Chubb Limited: As a global leader in insurance, Chubb might adjust its risk management strategies and offerings to incorporate insights from the federal reinsurance program.

- AXS - Axis Capital Holdings Limited: This company may face the need to re-evaluate its reinsurance options in light of the federal reinsurance program and its potential impacts on the market.

- ICE - Intercontinental Exchange, Inc.: If the bill affects the marketplace for catastrophe risk, ICE may need to adjust its operations related to risk assessment and capital markets.

This is an AI-generated summary of the bill text. There may be mistakes.

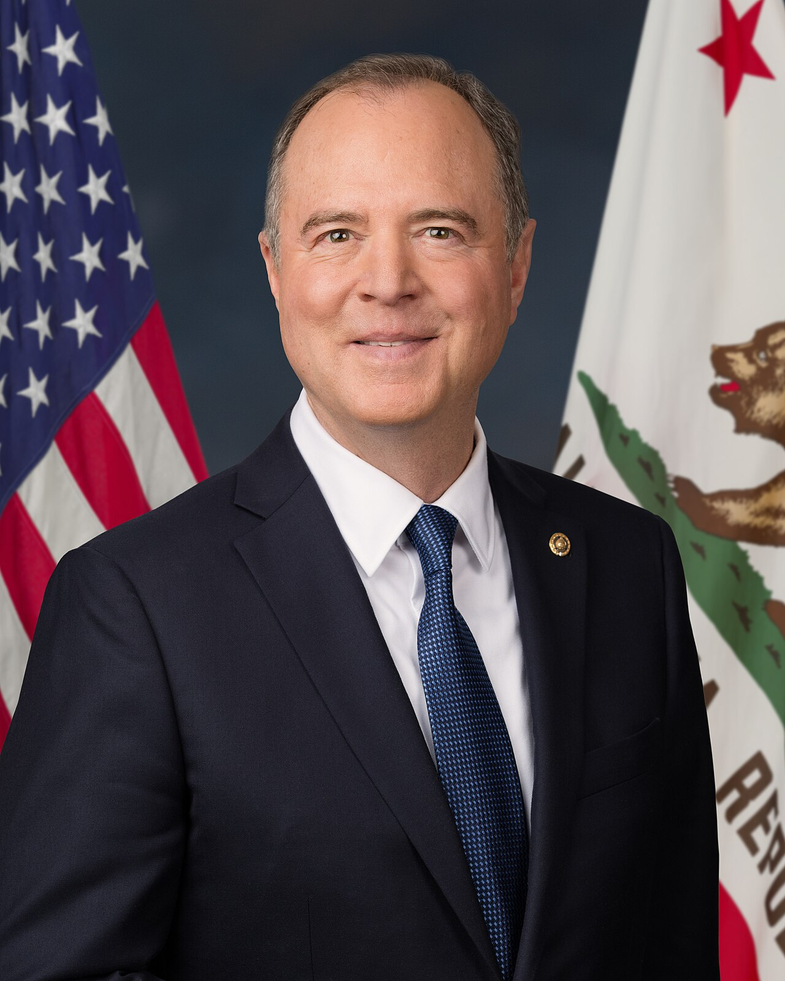

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 17, 2025 | Introduced in Senate |

| Jul. 17, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.