S. 2189: Equal Access to Reproductive Care Act

This bill, known as the Equal Access to Reproductive Care Act, proposes changes to the Internal Revenue Code of 1986 regarding medical expenses related to assisted reproduction. Below are the main points of what the bill aims to accomplish:

Definition of Assisted Reproduction

The bill defines "assisted reproduction" as a broad category of medical care that encompasses:

- Gamete and embryo donation

- Intrauterine insemination

- In vitro fertilization (IVF)

- Intracervical insemination

- Traditional reproductive surrogacy

- Gestational reproductive surrogacy

Tax Treatment of Assisted Reproduction Expenses

The central change introduced by the bill is that it would treat qualified expenses related to assisted reproduction as medical expenses. This classification allows taxpayers to potentially receive tax benefits for these expenses, similar to how other medical expenses are handled under the tax code.

Eligibility for Tax Benefits

Eligible taxpayers include:

- The taxpayer themselves

- The taxpayer's spouse

- Dependents of the taxpayer

To qualify for these benefits, the taxpayer or their spouse must intend to take legal custody or responsibility for any children born as a result of the assisted reproduction processes.

Coordination with Existing Tax Rules

The bill emphasizes that assisted reproduction should be recognized alongside other medical care provisions in the tax code, enhancing clarity around the treatment of related expenses in terms of transportation, insurance, and other associated regulations.

Effective Date

The changes proposed in the bill would take effect for taxable years beginning after the bill is enacted, meaning any tax year following its passage would be impacted.

Relevant Companies

- MDT (Medtronic): As a provider of medical devices used in various reproductive technologies, changes in tax treatment for assisted reproduction may affect the demand for its products.

- ALNY (Alnylam Pharmaceuticals): This company could see an impact as it develops treatments related to reproductive health, which may become more utilized with increased accessibility through tax benefits.

This is an AI-generated summary of the bill text. There may be mistakes.

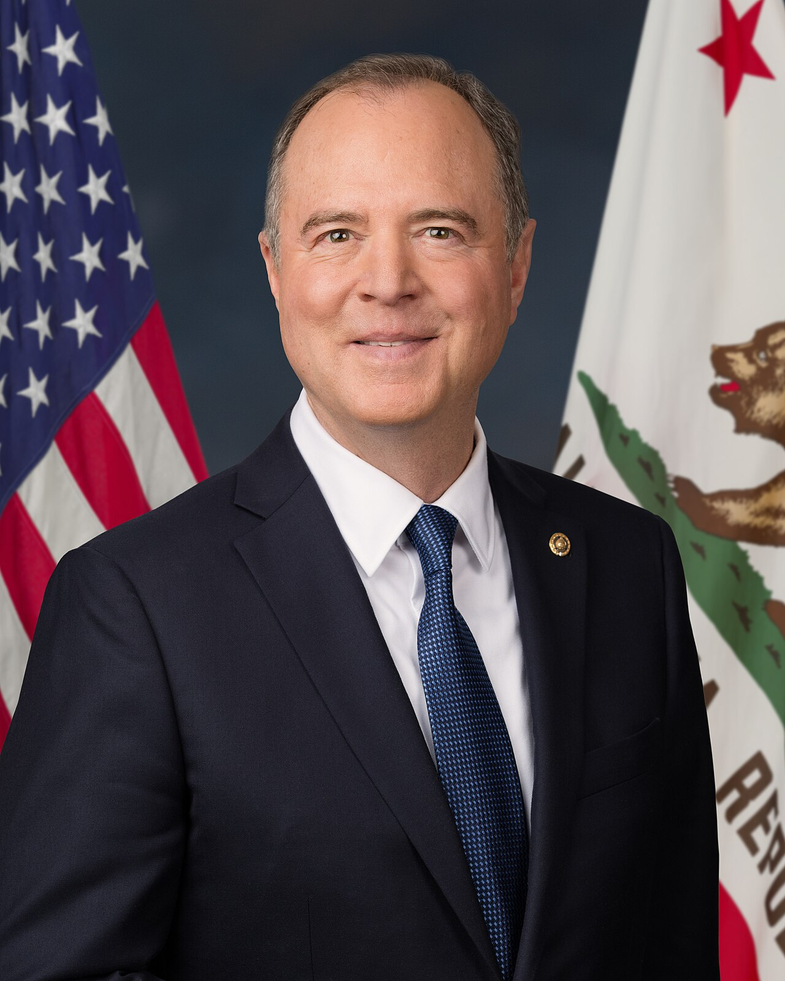

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 26, 2025 | Introduced in Senate |

| Jun. 26, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.