S. 2569: Mortgage Relief for Disaster Survivors Act

This bill, known as the **Mortgage Relief for Disaster Survivors Act**, aims to provide financial relief to borrowers with federally backed mortgage loans located in areas affected by major disasters. Below is a summary of the key provisions of the bill:

Definitions

- Covered mortgage loan: A mortgage loan or multifamily mortgage loan that is federally backed by various government agencies.

- Covered period: The time starting from the declaration of a disaster until it is officially ended.

- Disaster: Includes major disasters or emergencies declared by the President, state governors, or tribal governments.

- Disaster area: Any area affected by the disaster declaration.

Forbearance of Loan Payments

- Eligibility for Forbearance: Borrowers with covered mortgage loans in disaster areas can request forbearance during the covered period of a disaster.

- Request Process: The request can be made in writing, over the phone, or online, and borrowers must affirm their financial hardship.

- Grant of Forbearance: Upon receiving a request, lenders must grant a forbearance for 180 days without unreasonable delay, regardless of whether the loan is delinquent.

- Extension of Forbearance: Borrowers can request an extension of the forbearance for an additional 180 days during the initial forbearance period.

- Discontinuation: Borrowers have the right to discontinue their forbearance at any time.

- Accrual of Fees: During forbearance, no additional fees, penalties, or interest will accrue, other than what would normally be due if payments had been made on time.

Application

The provisions of this act apply to disasters declared on or after January 1, 2025.

Relevant Companies

- FNMA (Federal National Mortgage Association) - This entity could see changes in its loan support and regulatory requirements related to federally backed loans.

- FHLMC (Federal Home Loan Mortgage Corporation) - Similar to FNMA, this company may be affected by increased loan forbearance requests in disaster areas.

This is an AI-generated summary of the bill text. There may be mistakes.

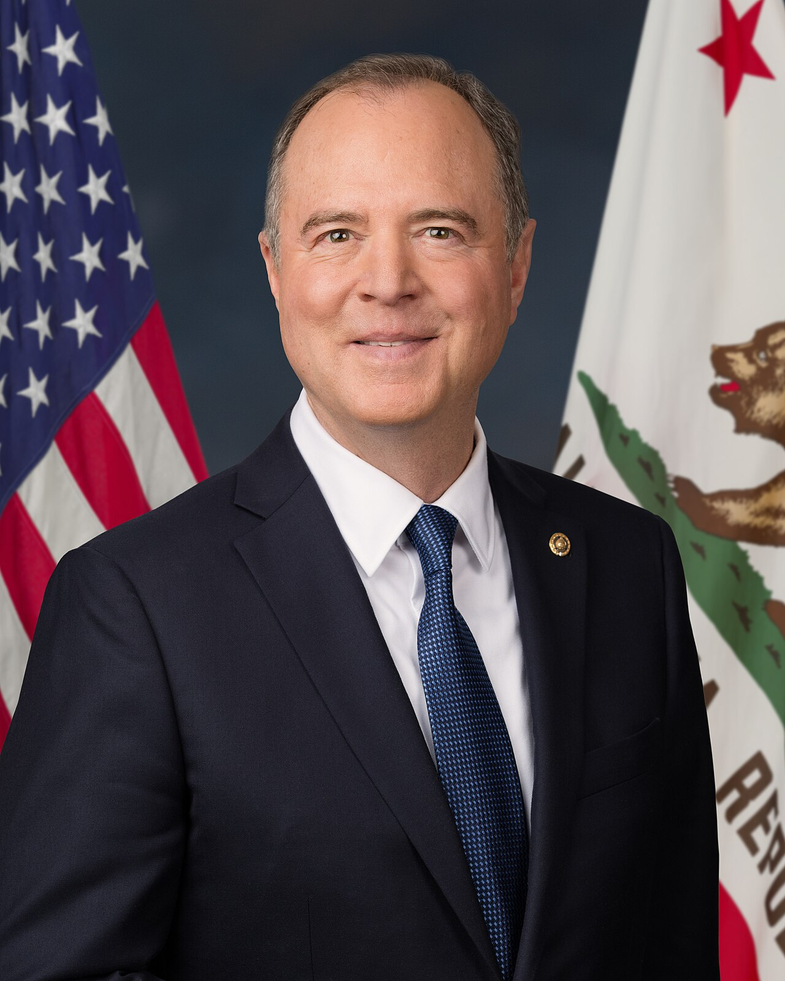

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 31, 2025 | Introduced in Senate |

| Jul. 31, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.