Quiver News

The latest insights and financial news from Quiver Quantitative

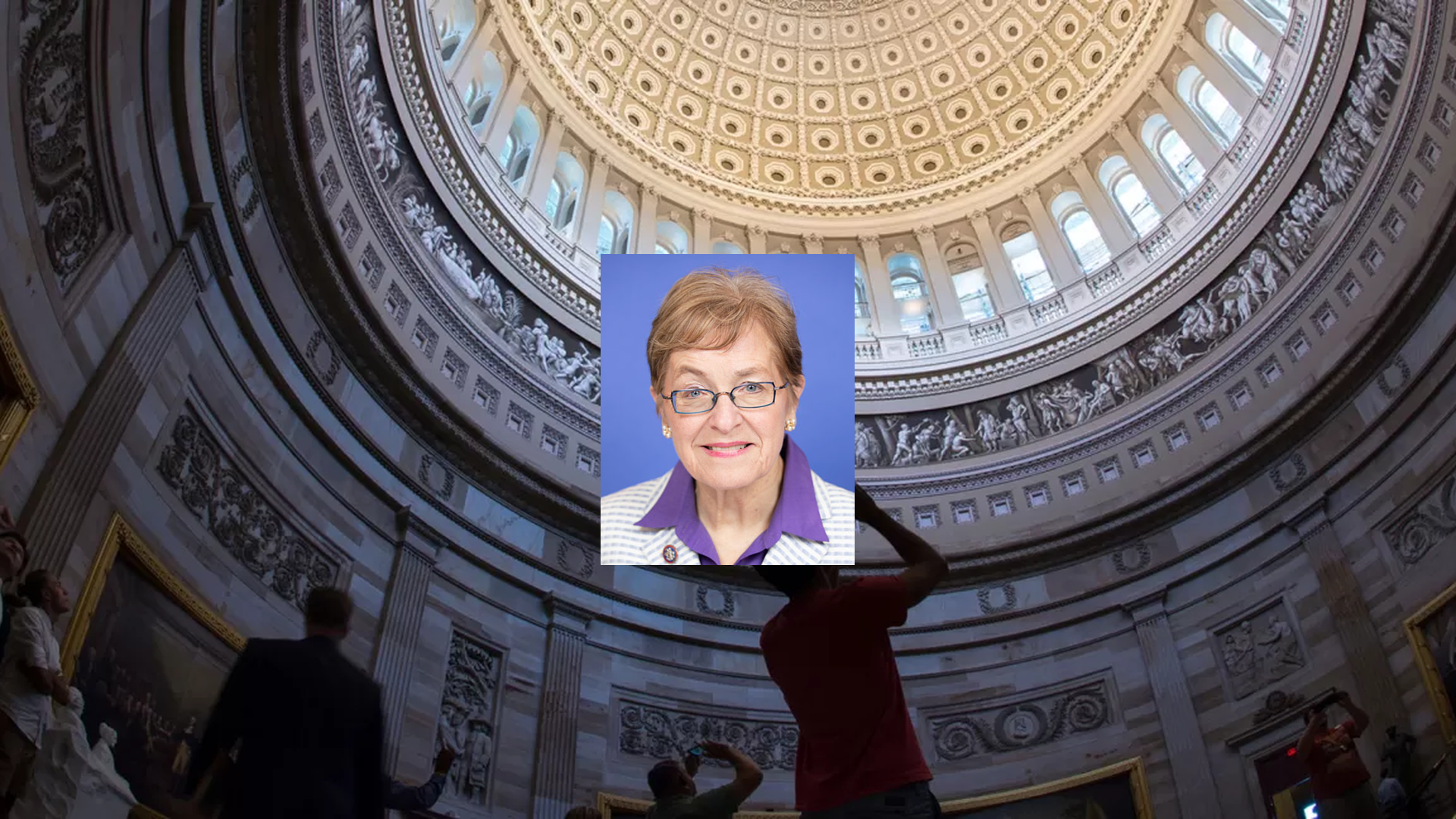

McGovern's bill proposes increased federal reimbursements for school meals, enhancing nutritional options and local food access for children.

Quiver AI Summary

Representative Jim McGovern (D-MA) has introduced the Healthy Meals Help Kids Learn Act, aiming to permanently increase federal reimbursements for school meals by 45 cents per lunch and 28 cents per breakfast. This legislative effort seeks to improve nutrition, address funding challenges, and support fresh, locally sourced food in schools.

McGovern highlighted the rising food costs and their impact on school nutrition programs, stating, "Current reimbursement rates do not adequately cover food and labor costs for meal programs." The legislation has garnered endorsements from organizations like the School Nutrition Association and the American Heart Association.

Stakeholders believe that better funding will enable schools to provide healthier meals and support educational success, with nutrition advocates stressing the importance of investing in both meal quality and school food professionals to foster lifelong healthy eating habits.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

James P. McGovern Net Worth

Quiver Quantitative estimates that James P. McGovern is worth $3.6M, as of October 15th, 2025. This is the 200th highest net worth in Congress, per our live estimates.

McGovern has approximately $6.1K invested in publicly traded assets which Quiver is able to track live.

You can track James P. McGovern's net worth on Quiver Quantitative's politician page for McGovern.

James P. McGovern Bill Proposals

Here are some bills which have recently been proposed by James P. McGovern:

- H.R.5684: To provide for the coverage of medical food and vitamins and individual amino acids for digestive and inherited metabolic disorders under Federal health programs, to ensure State and Federal protection for existing coverage, and for other purposes.

- H.R.5439: Medically Tailored Home-Delivered Meals Program Pilot Act

- H.R.2451: Deerfield River Wild and Scenic River Study Act of 2025

- H.R.1834: Breaking the Gridlock Act

- H.R.185: Responsible Legislating Act

You can track bills proposed by James P. McGovern on Quiver Quantitative's politician page for McGovern.

James P. McGovern Fundraising

James P. McGovern recently disclosed $157.2K of fundraising in a Q3 FEC disclosure filed on October 13th, 2025. This was the 12th most from all Q3 reports we have seen this year. 74.6% came from individual donors.

McGovern disclosed $120.5K of spending. This was the 11th most from all Q3 reports we have seen from politicians so far this year.

McGovern disclosed $358.9K of cash on hand at the end of the filing period. This was the 30th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track James P. McGovern's fundraising on Quiver Quantitative.

Senator Pete Ricketts toured St. Francis Memorial Hospital, highlighting rural healthcare's significance and a new funding initiative.

Quiver AI Summary

U.S. Senator Pete Ricketts recently toured St. Francis Memorial Hospital in West Point, Nebraska, highlighting the significance of rural hospitals. Ricketts called St. Francis a “pillar of the West Point community,” serving a diverse patient base. He announced a new rural healthcare fund, part of the One Big Beautiful Bill, aimed at providing $50 billion over five years for rural medical care.

“I’ll keep fighting to improve healthcare access, quality, and outcomes across Nebraska,” Ricketts stated, emphasizing the importance of such facilities for local care. The new fund is expected to allocate at least $100 million annually for Nebraska hospitals like St. Francis.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Pete Ricketts Net Worth

Quiver Quantitative estimates that Pete Ricketts is worth $204.1M, as of October 15th, 2025. This is the 8th highest net worth in Congress, per our live estimates.

Ricketts has approximately $117.0M invested in publicly traded assets which Quiver is able to track live.

You can track Pete Ricketts's net worth on Quiver Quantitative's politician page for Ricketts.

Pete Ricketts Bill Proposals

Here are some bills which have recently been proposed by Pete Ricketts:

- S.2804: Strengthen Wood Products Supply Chain Act of 2025

- S.2722: Taiwan Energy Security and Anti-Embargo Act of 2025

- S.2691: Rural Microentrepreneur Assistance Act of 2025

- S.2424: THINK TWICE Act of 2025

- S.2397: CARING for Our Veterans Health Act of 2025

- S.2130: AUKUS Improvement Act of 2025

You can track bills proposed by Pete Ricketts on Quiver Quantitative's politician page for Ricketts.

Pete Ricketts Fundraising

Pete Ricketts recently disclosed $656.3K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 102nd most from all Q2 reports we have seen this year. 41.3% came from individual donors.

Ricketts disclosed $414.4K of spending. This was the 113th most from all Q2 reports we have seen from politicians so far this year.

Ricketts disclosed $1.5M of cash on hand at the end of the filing period. This was the 207th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Pete Ricketts's fundraising on Quiver Quantitative.

Senator Kevin Cramer announces Grand Forks Air Force Base as the new Point Defense Battle Lab during UAS Summit.

Quiver AI Summary

U.S. Senator Kevin Cramer delivered virtual remarks at the 19th Annual UAS Summit and Expo, highlighting the significance of the unmanned aircraft systems industry. He emphasized the collaborative efforts of industry leaders and policymakers in this field and thanked them for their contributions during his speech.

Cramer announced that the Grand Forks Air Force Base will host the new Point Defense Battle Lab, aimed at advancing counter-drone technology. He described this initiative as vital for military readiness and showcased North Dakota's growing expertise in this area.

In his remarks, he referenced a directive from Secretary of War Pete Hegseth to establish a Joint Interagency Task Force to improve U.S. military capabilities against unmanned aerial threats. Cramer urged progress on this front, underscoring the urgency of enhancing defenses for military installations.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Kevin Cramer Net Worth

Quiver Quantitative estimates that Kevin Cramer is worth $896.0K, as of October 15th, 2025. This is the 341st highest net worth in Congress, per our live estimates.

Cramer has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Kevin Cramer's net worth on Quiver Quantitative's politician page for Cramer.

Kevin Cramer Bill Proposals

Here are some bills which have recently been proposed by Kevin Cramer:

- S.2326: Payment Choice Act of 2025

- S.2268: Agricultural Risk Review Act of 2025

- S.1868: Critical Access for Veterans Care Act

- S.1828: Safe Routes Improvement Act

- S.1733: Highway Funding Transferability Improvement Act

- S.1716: Vision Lab Choice Act of 2025

You can track bills proposed by Kevin Cramer on Quiver Quantitative's politician page for Cramer.

Kevin Cramer Fundraising

Kevin Cramer recently disclosed $0 of fundraising in a Q2 FEC disclosure filed on July 12th, 2025. This was the 1183rd most from all Q2 reports we have seen this year. nan% came from individual donors.

Cramer disclosed $780.0 of spending. This was the 1296th most from all Q2 reports we have seen from politicians so far this year.

Cramer disclosed $330.9K of cash on hand at the end of the filing period. This was the 558th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Kevin Cramer's fundraising on Quiver Quantitative.

Senators Kelly and Cornyn's Counternarcotics Enhancement Act passes the Senate, enhancing U.S.-Mexico collaboration against drug trafficking.

Quiver AI Summary

Senators Mark Kelly (D-AZ) and John Cornyn (R-TX) announced the Senate's passing of the Counternarcotics Enhancement Act, part of the Intelligence Authorization Act. This legislation mandates the Director of National Intelligence to present an action plan to Congress aimed at improving collaboration between the U.S. and Mexico in combatting drug trafficking.

Senator Kelly emphasized the importance of U.S.-Mexico cooperation in fighting drug cartels, stating, "This effort... will make our country safer by keeping drugs off our streets." Senator Cornyn added that any loss of life linked to narcotics is unacceptable and highlighted the necessity for the Intelligence Community to tackle these issues effectively.

The act includes provisions for a detailed assessment of relationships with Mexican government elements and strategies to enhance cooperation in counternarcotics efforts. For further details, the bill text is available online.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Mark Kelly Net Worth

Quiver Quantitative estimates that Mark Kelly is worth $20.4M, as of October 15th, 2025. This is the 63rd highest net worth in Congress, per our live estimates.

Kelly has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Mark Kelly's net worth on Quiver Quantitative's politician page for Kelly.

Mark Kelly Bill Proposals

Here are some bills which have recently been proposed by Mark Kelly:

- S.2741: Legacy Mine Cleanup Act of 2025

- S.2673: MEDIC Careers Act of 2025

- S.2515: Ban Corporate PACs Act

- S.2448: Health Care Fairness for Military Families Act of 2025

- S.2319: A bill to designate the Federal building located at 300 West Congress Street in Tucson, Arizona, as the "Raul M. Grijalva Federal Building".

- S.1752: EdCOPS Act of 2025

You can track bills proposed by Mark Kelly on Quiver Quantitative's politician page for Kelly.

Mark Kelly Fundraising

Mark Kelly recently disclosed $3.2M of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 5th most from all Q2 reports we have seen this year. 99.9% came from individual donors.

Kelly disclosed $1.9M of spending. This was the 13th most from all Q2 reports we have seen from politicians so far this year.

Kelly disclosed $8.0M of cash on hand at the end of the filing period. This was the 22nd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Mark Kelly's fundraising on Quiver Quantitative.

$10,000 of FAIR ISAAC CORPORATION lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Lobbying related to financial services and credit score issues."

You can find more data on corporate lobbying on Quiver Quantitative.

FICO Insider Trading Activity

FICO insiders have traded $FICO stock on the open market 150 times in the past 6 months. Of those trades, 0 have been purchases and 150 have been sales.

Here’s a breakdown of recent trading of $FICO stock by insiders over the last 6 months:

- WILLIAM J LANSING (President and CEO) has made 0 purchases and 134 sales selling 30,053 shares for an estimated $51,702,267.

- THOMAS A. BOWERS (Executive Vice President) has made 0 purchases and 13 sales selling 4,077 shares for an estimated $8,386,603.

- STEVEN P. WEBER (Executive Vice President & CFO) has made 0 purchases and 2 sales selling 2,000 shares for an estimated $3,476,500.

- MARC F MCMORRIS sold 797 shares for an estimated $1,663,737

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

FICO Hedge Fund Activity

We have seen 476 institutional investors add shares of FICO stock to their portfolio, and 474 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- EDGEWOOD MANAGEMENT LLC added 335,229 shares (+inf%) to their portfolio in Q2 2025, for an estimated $612,785,202

- CITADEL ADVISORS LLC removed 202,034 shares (-96.1%) from their portfolio in Q2 2025, for an estimated $369,310,070

- BLACKROCK, INC. added 196,264 shares (+8.4%) to their portfolio in Q2 2025, for an estimated $358,762,741

- MILLENNIUM MANAGEMENT LLC removed 154,269 shares (-93.8%) from their portfolio in Q2 2025, for an estimated $281,997,561

- AF ADVISORS, INC. removed 140,759 shares (-50.2%) from their portfolio in Q2 2025, for an estimated $257,301,821

- SQUAREPOINT OPS LLC removed 104,751 shares (-96.7%) from their portfolio in Q2 2025, for an estimated $191,480,637

- PRICE T ROWE ASSOCIATES INC /MD/ added 97,142 shares (+11.8%) to their portfolio in Q2 2025, for an estimated $177,571,690

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

FICO Analyst Ratings

Wall Street analysts have issued reports on $FICO in the last several months. We have seen 8 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Needham issued a "Buy" rating on 10/02/2025

- Seaport Global issued a "Buy" rating on 10/01/2025

- Raymond James issued a "Outperform" rating on 07/31/2025

- Oppenheimer issued a "Outperform" rating on 07/31/2025

- Wells Fargo issued a "Overweight" rating on 07/09/2025

- Barclays issued a "Overweight" rating on 07/09/2025

- Baird issued a "Outperform" rating on 05/28/2025

To track analyst ratings and price targets for FICO, check out Quiver Quantitative's $FICO forecast page.

FICO Price Targets

Multiple analysts have issued price targets for $FICO recently. We have seen 10 analysts offer price targets for $FICO in the last 6 months, with a median target of $1925.0.

Here are some recent targets:

- Jason Haas from Wells Fargo set a target price of $2400.0 on 10/14/2025

- Manav Patnaik from Barclays set a target price of $2400.0 on 10/02/2025

- Kyle Peterson from Needham set a target price of $1950.0 on 10/02/2025

- John Mazzoni from Seaport Global set a target price of $1600.0 on 10/01/2025

- Kevin Mcveigh from UBS set a target price of $1640.0 on 09/15/2025

- Ryan Griffin from BMO Capital set a target price of $1800.0 on 08/18/2025

- Owen Lau from Oppenheimer set a target price of $1953.0 on 07/31/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$90,000 of ASSURED GUARANTY INC. lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Disaster relief."

You can find more data on corporate lobbying on Quiver Quantitative.

AGO Insider Trading Activity

AGO insiders have traded $AGO stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $AGO stock by insiders over the last 6 months:

- DOMINIC FREDERICO (President/CEO/Deputy Chairman) has made 0 purchases and 3 sales selling 107,355 shares for an estimated $9,187,547.

- ROBERT BAILENSON (Chief Operating Officer) sold 40,000 shares for an estimated $3,260,400

- LAURA BIELING (Chief Accounting Officer) sold 2,649 shares for an estimated $232,476

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

AGO Hedge Fund Activity

We have seen 154 institutional investors add shares of AGO stock to their portfolio, and 158 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- NUVEEN, LLC removed 3,250,757 shares (-97.5%) from their portfolio in Q2 2025, for an estimated $283,140,934

- WELLINGTON MANAGEMENT GROUP LLP removed 1,337,887 shares (-31.2%) from their portfolio in Q2 2025, for an estimated $116,529,957

- RIVER ROAD ASSET MANAGEMENT, LLC added 660,009 shares (+58.3%) to their portfolio in Q2 2025, for an estimated $57,486,783

- BLACKROCK, INC. removed 476,411 shares (-7.7%) from their portfolio in Q2 2025, for an estimated $41,495,398

- AQR CAPITAL MANAGEMENT LLC removed 244,594 shares (-36.1%) from their portfolio in Q2 2025, for an estimated $21,304,137

- QUBE RESEARCH & TECHNOLOGIES LTD added 233,966 shares (+176.3%) to their portfolio in Q2 2025, for an estimated $20,378,438

- DEUTSCHE BANK AG\ added 198,841 shares (+2006.5%) to their portfolio in Q2 2025, for an estimated $17,319,051

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$10,000 of HUNTSMAN CORPORATION lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Petrochemical industry, taxation and exports Petrochemical industry, taxation and exports Petrochemical industry, taxation and exports Petrochemical industry, taxation and exports CMS Medicare"

You can find more data on corporate lobbying on Quiver Quantitative.

HUN Insider Trading Activity

HUN insiders have traded $HUN stock on the open market 3 times in the past 6 months. Of those trades, 3 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $HUN stock by insiders over the last 6 months:

- PETER R HUNTSMAN (Chairman, President & CEO) has made 3 purchases buying 87,000 shares for an estimated $996,359 and 0 sales.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

HUN Hedge Fund Activity

We have seen 184 institutional investors add shares of HUN stock to their portfolio, and 163 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ILEX CAPITAL PARTNERS (UK) LLP removed 2,900,632 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $30,224,585

- QUBE RESEARCH & TECHNOLOGIES LTD added 2,106,774 shares (+inf%) to their portfolio in Q2 2025, for an estimated $21,952,585

- SG AMERICAS SECURITIES, LLC added 1,762,896 shares (+1113.4%) to their portfolio in Q2 2025, for an estimated $18,369,376

- MORGAN STANLEY added 1,633,418 shares (+57.7%) to their portfolio in Q2 2025, for an estimated $17,020,215

- UBS GROUP AG added 1,608,999 shares (+66.9%) to their portfolio in Q2 2025, for an estimated $16,765,769

- PRINCIPAL FINANCIAL GROUP INC removed 1,376,304 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $14,341,087

- CITADEL ADVISORS LLC removed 1,301,221 shares (-51.9%) from their portfolio in Q2 2025, for an estimated $13,558,722

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

HUN Analyst Ratings

Wall Street analysts have issued reports on $HUN in the last several months. We have seen 2 firms issue buy ratings on the stock, and 2 firms issue sell ratings.

Here are some recent analyst ratings:

- Mizuho issued a "Underperform" rating on 09/12/2025

- Jefferies issued a "Buy" rating on 09/10/2025

- Goldman Sachs issued a "Sell" rating on 08/07/2025

- JP Morgan issued a "Overweight" rating on 05/05/2025

To track analyst ratings and price targets for HUN, check out Quiver Quantitative's $HUN forecast page.

HUN Price Targets

Multiple analysts have issued price targets for $HUN recently. We have seen 11 analysts offer price targets for $HUN in the last 6 months, with a median target of $10.0.

Here are some recent targets:

- Steve Byrne from B of A Securities set a target price of $8.0 on 10/14/2025

- Joshua Spector from UBS set a target price of $9.0 on 10/06/2025

- John Roberts from Mizuho set a target price of $8.0 on 10/03/2025

- Patrick Cunningham from Citigroup set a target price of $8.5 on 10/02/2025

- Laurence Alexander from Jefferies set a target price of $14.0 on 09/10/2025

- Duffy Fischer from Goldman Sachs set a target price of $10.0 on 08/07/2025

- Michael Sison from Wells Fargo set a target price of $9.0 on 08/05/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$120,000 of ADVANCED MICRO DEVICES INC. lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Advocacy on issues regarding domestic manufacturing."

You can find more data on corporate lobbying on Quiver Quantitative.

AMD Congressional Stock Trading

Members of Congress have traded $AMD stock 12 times in the past 6 months. Of those trades, 11 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $AMD stock by members of Congress over the last 6 months:

- REPRESENTATIVE DAN NEWHOUSE purchased up to $15,000 on 08/18.

- REPRESENTATIVE CLEO FIELDS has traded it 3 times. They made 3 purchases worth up to $150,000 on 08/15, 08/01, 07/30 and 0 sales.

- SENATOR JOHN BOOZMAN purchased up to $15,000 on 08/07.

- SENATOR ANGUS S. KING JR. purchased up to $15,000 on 07/21.

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 06/17.

- REPRESENTATIVE ROBERT BRESNAHAN purchased up to $50,000 on 05/15.

- REPRESENTATIVE MARJORIE TAYLOR GREENE has traded it 2 times. They made 2 purchases worth up to $30,000 on 05/14, 05/05 and 0 sales.

- REPRESENTATIVE JEFFERSON SHREVE has traded it 2 times. They made 1 purchase worth up to $50,000 on 05/08 and 1 sale worth up to $100,000 on 05/12.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

AMD Insider Trading Activity

AMD insiders have traded $AMD stock on the open market 30 times in the past 6 months. Of those trades, 1 have been purchases and 29 have been sales.

Here’s a breakdown of recent trading of $AMD stock by insiders over the last 6 months:

- LISA T SU (Chair, President & CEO) has made 0 purchases and 4 sales selling 225,000 shares for an estimated $36,893,351.

- MARK D PAPERMASTER (Chief Technology Officer & EVP) has made 0 purchases and 16 sales selling 104,098 shares for an estimated $14,197,903.

- FORREST EUGENE NORROD (EVP & GM DESG) has made 0 purchases and 6 sales selling 19,450 shares for an estimated $3,139,293.

- PAUL DARREN GRASBY (EVP & CSO) sold 10,000 shares for an estimated $1,732,100

- PHILIP GUIDO (EVP & Chief Commercial Officer) purchased 8,800 shares for an estimated $999,328

- AVA HAHN (SVP, GC & Corporate Secretary) has made 0 purchases and 2 sales selling 3,011 shares for an estimated $670,804.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

AMD Hedge Fund Activity

We have seen 1,349 institutional investors add shares of AMD stock to their portfolio, and 1,053 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- PRICE T ROWE ASSOCIATES INC /MD/ added 13,526,953 shares (+106.2%) to their portfolio in Q2 2025, for an estimated $1,919,474,630

- VICTORY CAPITAL MANAGEMENT INC added 7,886,163 shares (+651.5%) to their portfolio in Q2 2025, for an estimated $1,119,046,529

- INFINITUM ASSET MANAGEMENT, LLC removed 7,121,800 shares (-99.0%) from their portfolio in Q2 2025, for an estimated $1,010,583,420

- KINGSTONE CAPITAL PARTNERS TEXAS, LLC added 6,870,480 shares (+inf%) to their portfolio in Q2 2025, for an estimated $974,921,112

- AMUNDI removed 6,355,648 shares (-35.6%) from their portfolio in Q2 2025, for an estimated $901,866,451

- FMR LLC added 5,312,149 shares (+57.5%) to their portfolio in Q2 2025, for an estimated $753,793,943

- BNP PARIBAS FINANCIAL MARKETS removed 3,993,194 shares (-36.5%) from their portfolio in Q2 2025, for an estimated $566,634,228

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

AMD Analyst Ratings

Wall Street analysts have issued reports on $AMD in the last several months. We have seen 21 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- UBS issued a "Buy" rating on 10/07/2025

- Evercore ISI Group issued a "Outperform" rating on 10/07/2025

- Jefferies issued a "Buy" rating on 10/07/2025

- Wells Fargo issued a "Overweight" rating on 10/07/2025

- HSBC issued a "Buy" rating on 09/09/2025

- Truist Securities issued a "Buy" rating on 08/26/2025

- Mizuho issued a "Outperform" rating on 08/14/2025

To track analyst ratings and price targets for AMD, check out Quiver Quantitative's $AMD forecast page.

AMD Price Targets

Multiple analysts have issued price targets for $AMD recently. We have seen 32 analysts offer price targets for $AMD in the last 6 months, with a median target of $200.0.

Here are some recent targets:

- Chris Caso from Wolfe Research set a target price of $300.0 on 10/14/2025

- Vijay Rakesh from Mizuho set a target price of $275.0 on 10/13/2025

- James Schneider from Goldman Sachs set a target price of $210.0 on 10/08/2025

- Aaron Rakers from Wells Fargo set a target price of $275.0 on 10/07/2025

- Christopher Danely from Citigroup set a target price of $215.0 on 10/07/2025

- Timothy Arcuri from UBS set a target price of $265.0 on 10/07/2025

- William Stein from Truist Securities set a target price of $273.0 on 10/07/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$10,000 of THE GEO GROUP INC. lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Monitoring and advising client on Judiciary-related bills, crime, CJS - Appropriations; Issues related to the treatment of government services providers by financial institutions. Additionally, GEO's political and governmental relations activities focus on promoting the use of public-private partnerships in the delivery of correctional services including evidence-based rehabilitation programs, both in-custody and post-release, aimed at reducing recidivism and helping the men and women in GEOs care successfully reintegrate into their communities. GEO does not take a position on or advocate for or against criminal justice policy related to criminalizing certain behaviors or determining the length of criminal sentences. Furthermore, GEO does not take a position on, nor advocate for or against, immigration enforcement policies such as the basis or length of an individuals detention."

You can find more data on corporate lobbying on Quiver Quantitative.

GEO Insider Trading Activity

GEO insiders have traded $GEO stock on the open market 20 times in the past 6 months. Of those trades, 0 have been purchases and 20 have been sales.

Here’s a breakdown of recent trading of $GEO stock by insiders over the last 6 months:

- GEORGE C ZOLEY (Executive Chairman) has made 0 purchases and 20 sales selling 385,499 shares for an estimated $8,120,559.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

GEO Hedge Fund Activity

We have seen 145 institutional investors add shares of GEO stock to their portfolio, and 147 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- WOLF HILL CAPITAL MANAGEMENT, LP removed 4,424,135 shares (-57.6%) from their portfolio in Q2 2025, for an estimated $105,958,033

- UBS GROUP AG removed 3,243,820 shares (-58.9%) from their portfolio in Q2 2025, for an estimated $77,689,489

- FMR LLC removed 3,113,967 shares (-52.2%) from their portfolio in Q2 2025, for an estimated $74,579,509

- ANOMALY CAPITAL MANAGEMENT, LP added 2,402,352 shares (+249.4%) to their portfolio in Q2 2025, for an estimated $57,536,330

- PENTWATER CAPITAL MANAGEMENT LP added 2,025,000 shares (+168.0%) to their portfolio in Q2 2025, for an estimated $48,498,750

- POINT72 ASSET MANAGEMENT, L.P. removed 1,465,886 shares (-84.7%) from their portfolio in Q2 2025, for an estimated $35,107,969

- HIGHLAND PEAK CAPITAL, LLC added 917,867 shares (+251.7%) to their portfolio in Q2 2025, for an estimated $21,982,914

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

GEO Analyst Ratings

Wall Street analysts have issued reports on $GEO in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Jones Trading issued a "Buy" rating on 08/07/2025

- Wedbush issued a "Outperform" rating on 06/23/2025

To track analyst ratings and price targets for GEO, check out Quiver Quantitative's $GEO forecast page.

GEO Price Targets

Multiple analysts have issued price targets for $GEO recently. We have seen 3 analysts offer price targets for $GEO in the last 6 months, with a median target of $45.0.

Here are some recent targets:

- Jason Weaver from Jones Trading set a target price of $45.0 on 08/07/2025

- Jay McCanless from Wedbush set a target price of $36.0 on 06/23/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$60,000 of AECOM lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"FEMA Payment Issue. Infrastructure; Appropriations, NEPA. Infrastructure; Appropriations, NEPA."

You can find more data on corporate lobbying on Quiver Quantitative.

ACM Insider Trading Activity

ACM insiders have traded $ACM stock on the open market 2 times in the past 6 months. Of those trades, 0 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $ACM stock by insiders over the last 6 months:

- TROY RUDD (CHIEF EXECUTIVE OFFICER) has made 0 purchases and 2 sales selling 53,097 shares for an estimated $6,348,193.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

ACM Hedge Fund Activity

We have seen 324 institutional investors add shares of ACM stock to their portfolio, and 233 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ORION PORFOLIO SOLUTIONS, LLC added 5,316,844 shares (+28246.5%) to their portfolio in Q2 2025, for an estimated $600,059,013

- INVESCO LTD. added 1,926,466 shares (+79.1%) to their portfolio in Q2 2025, for an estimated $217,420,952

- PICTET ASSET MANAGEMENT HOLDING SA removed 1,004,361 shares (-21.6%) from their portfolio in Q2 2025, for an estimated $113,352,182

- AGF MANAGEMENT LTD removed 964,757 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $108,882,475

- LORD, ABBETT & CO. LLC added 712,763 shares (+inf%) to their portfolio in Q2 2025, for an estimated $80,442,432

- FIRST TRUST ADVISORS LP removed 702,667 shares (-25.5%) from their portfolio in Q2 2025, for an estimated $79,302,997

- UBS GROUP AG removed 677,846 shares (-41.8%) from their portfolio in Q2 2025, for an estimated $76,501,699

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

ACM Analyst Ratings

Wall Street analysts have issued reports on $ACM in the last several months. We have seen 8 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Truist Securities issued a "Buy" rating on 10/08/2025

- Barclays issued a "Overweight" rating on 08/12/2025

- UBS issued a "Buy" rating on 08/06/2025

- B of A Securities issued a "Buy" rating on 08/05/2025

- Citigroup issued a "Buy" rating on 07/28/2025

- Keybanc issued a "Overweight" rating on 07/16/2025

- RBC Capital issued a "Outperform" rating on 05/07/2025

To track analyst ratings and price targets for ACM, check out Quiver Quantitative's $ACM forecast page.

ACM Price Targets

Multiple analysts have issued price targets for $ACM recently. We have seen 9 analysts offer price targets for $ACM in the last 6 months, with a median target of $130.0.

Here are some recent targets:

- Jamie Cook from Truist Securities set a target price of $146.0 on 10/08/2025

- Adam Seiden from Barclays set a target price of $130.0 on 08/12/2025

- Sangita Jain from Keybanc set a target price of $131.0 on 08/06/2025

- Steven Fisher from UBS set a target price of $139.0 on 08/06/2025

- Michael Feniger from B of A Securities set a target price of $124.0 on 08/05/2025

- Andrew Kaplowitz from Citigroup set a target price of $137.0 on 07/28/2025

- Sabahat Khan from RBC Capital set a target price of $126.0 on 05/07/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$10,000 of FOX CHASE THERAPEUTICS DISCOVERY INC lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"NIH appropriations"

You can find more data on corporate lobbying on Quiver Quantitative.

LAW Insider Trading Activity

LAW insiders have traded $LAW stock on the open market 14 times in the past 6 months. Of those trades, 6 have been purchases and 8 have been sales.

Here’s a breakdown of recent trading of $LAW stock by insiders over the last 6 months:

- ERIC FRIEDRICHSEN (Chief Executive Officer) has made 1 purchase buying 10,000 shares for an estimated $45,100 and 1 sale selling 118,054 shares for an estimated $463,952.

- THOMAS F BOGAN has made 4 purchases buying 68,168 shares for an estimated $401,899 and 0 sales.

- MICHAEL LAFAIR (EVP, Chief Financial Officer) has made 0 purchases and 2 sales selling 30,239 shares for an estimated $132,050.

- MELANIE ANTOON (EVP, Chief Customer Officer) has made 0 purchases and 2 sales selling 14,053 shares for an estimated $61,367.

- RICHARD FRANCIS CRUM (EVP, Chief Prod & Tech Officer) sold 10,552 shares for an estimated $50,860

- KAREN HERCKIS (EVP, Chief HR Officer) has made 0 purchases and 2 sales selling 11,552 shares for an estimated $50,451.

- JAMES OFFERDAHL purchased 6,500 shares for an estimated $31,980

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

LAW Hedge Fund Activity

We have seen 55 institutional investors add shares of LAW stock to their portfolio, and 40 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- TOPLINE CAPITAL MANAGEMENT, LLC added 1,181,046 shares (+66.2%) to their portfolio in Q2 2025, for an estimated $5,161,171

- NORGES BANK removed 1,119,141 shares (-63.1%) from their portfolio in Q2 2025, for an estimated $4,890,646

- FRANKLIN RESOURCES INC removed 971,342 shares (-66.1%) from their portfolio in Q2 2025, for an estimated $4,244,764

- MILLENNIUM MANAGEMENT LLC added 228,268 shares (+925.0%) to their portfolio in Q2 2025, for an estimated $997,531

- MONETA GROUP INVESTMENT ADVISORS LLC added 226,011 shares (+inf%) to their portfolio in Q2 2025, for an estimated $987,668

- CITADEL ADVISORS LLC added 159,961 shares (+217.9%) to their portfolio in Q2 2025, for an estimated $699,029

- ARROWMARK COLORADO HOLDINGS LLC added 128,910 shares (+17.9%) to their portfolio in Q2 2025, for an estimated $563,336

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

LAW Analyst Ratings

Wall Street analysts have issued reports on $LAW in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Needham issued a "Buy" rating on 05/08/2025

To track analyst ratings and price targets for LAW, check out Quiver Quantitative's $LAW forecast page.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$45,000 of AKEBIA THERAPEUTICS INC. lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Provided legislative advocacy specific to the payment of innovative drugs, such as phosphate binders and anemia management drugs in the Medicare End-Stage Renal Dialysis Prospective Payment System (ESRD PPS). Provided legislative advocacy specific to the payment of innovative drugs, such as phosphate binders and anemia management drugs in the Medicare End-Stage Renal Dialysis Prospective Payment System (ESRD PPS)."

You can find more data on corporate lobbying on Quiver Quantitative.

AKBA Insider Trading Activity

AKBA insiders have traded $AKBA stock on the open market 3 times in the past 6 months. Of those trades, 0 have been purchases and 3 have been sales.

Here’s a breakdown of recent trading of $AKBA stock by insiders over the last 6 months:

- ERIK OSTROWSKI (SVP, CFO, CBO & Treasurer) sold 41,314 shares for an estimated $151,622

- RICHARD C MALABRE (SVP, Chief Accounting Officer) has made 0 purchases and 2 sales selling 28,334 shares for an estimated $107,219.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

AKBA Hedge Fund Activity

We have seen 110 institutional investors add shares of AKBA stock to their portfolio, and 43 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- BLACKROCK, INC. added 3,041,798 shares (+19.8%) to their portfolio in Q2 2025, for an estimated $11,072,144

- GREAT POINT PARTNERS LLC removed 2,987,925 shares (-60.1%) from their portfolio in Q2 2025, for an estimated $10,876,047

- AIGH CAPITAL MANAGEMENT LLC removed 2,925,000 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $10,647,000

- MPM BIOIMPACT LLC added 2,889,125 shares (+inf%) to their portfolio in Q2 2025, for an estimated $10,516,415

- MORGAN STANLEY added 2,658,456 shares (+99.2%) to their portfolio in Q2 2025, for an estimated $9,676,779

- NUVEEN, LLC added 2,358,263 shares (+673.0%) to their portfolio in Q2 2025, for an estimated $8,584,077

- VANGUARD GROUP INC added 1,925,663 shares (+15.2%) to their portfolio in Q2 2025, for an estimated $7,009,413

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

AKBA Analyst Ratings

Wall Street analysts have issued reports on $AKBA in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- HC Wainwright & Co. issued a "Buy" rating on 06/04/2025

- Leerink Partners issued a "Outperform" rating on 04/28/2025

To track analyst ratings and price targets for AKBA, check out Quiver Quantitative's $AKBA forecast page.

AKBA Price Targets

Multiple analysts have issued price targets for $AKBA recently. We have seen 2 analysts offer price targets for $AKBA in the last 6 months, with a median target of $7.5.

Here are some recent targets:

- Matthew Caufield from HC Wainwright & Co. set a target price of $8.0 on 06/04/2025

- Roanna Ruiz from Leerink Partners set a target price of $7.0 on 04/28/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

$10,000 of INSPERITY lobbying was just disclosed, from Q3 of 2025, in a new Lobbying Disclosure Act filing.

This included lobbying on issues like:

"Proposals clarifying the status of professional employer organizations. PEO provisions in tax reform proposals. Title IV, Division B, Section 206 of P.L. 113-295. Proposals relatedto MEPs. CPEO certification and improvements. Issues related to payroll tax credits and deferrals, including the Employee Retention Tax Credit enacted by H.R. 748, CARES Act(116th Congress). H.R.7024, Tax Relief for American Families and Workers Act of 2024 (118th Congress) Technical Corrections to the SECURE 2.0 Act of 2022. H.R. 3223, To amend the Internal Revenue Code of 1986 to establish procedures relating to the attribution of errors in the case of third party payors of payroll taxes, and for other purposes. H.R. 1, To provide for reconciliation pursuant to title II of H. Con. Res. 14, provisions pertaining to PEOs."

You can find more data on corporate lobbying on Quiver Quantitative.

NSP Insider Trading Activity

NSP insiders have traded $NSP stock on the open market 15 times in the past 6 months. Of those trades, 9 have been purchases and 6 have been sales.

Here’s a breakdown of recent trading of $NSP stock by insiders over the last 6 months:

- PAUL J SARVADI (Chairman of the Board & CEO) has made 0 purchases and 6 sales selling 44,791 shares for an estimated $2,777,774.

- JOHN L LUMELLEAU purchased 5,500 shares for an estimated $249,480

- CAROL R KAUFMAN purchased 5,000 shares for an estimated $226,200

- JAMES D ALLISON (EVP, Finance, CFO & Treasurer) purchased 4,000 shares for an estimated $187,280

- ELI JONES has made 2 purchases buying 2,204 shares for an estimated $100,092 and 0 sales.

- TIM CLIFFORD purchased 1,935 shares for an estimated $100,039

- RANDALL MEHL purchased 2,000 shares for an estimated $90,100

- LATHA RAMCHAND purchased 1,000 shares for an estimated $50,640

- ELLEN H MASTERSON purchased 490 shares for an estimated $22,197

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

NSP Hedge Fund Activity

We have seen 131 institutional investors add shares of NSP stock to their portfolio, and 185 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- HAWK RIDGE CAPITAL MANAGEMENT LP added 791,500 shares (+inf%) to their portfolio in Q2 2025, for an estimated $47,584,980

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. removed 520,637 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $31,300,696

- BLACKROCK, INC. removed 494,634 shares (-10.4%) from their portfolio in Q2 2025, for an estimated $29,737,396

- COPELAND CAPITAL MANAGEMENT, LLC removed 468,978 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $28,194,957

- ROYCE & ASSOCIATES LP added 386,139 shares (+1457.7%) to their portfolio in Q2 2025, for an estimated $23,214,676

- DIAMOND HILL CAPITAL MANAGEMENT INC removed 357,174 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $21,473,300

- REINHART PARTNERS, LLC. added 302,893 shares (+20.4%) to their portfolio in Q2 2025, for an estimated $18,209,927

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

NSP Analyst Ratings

Wall Street analysts have issued reports on $NSP in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Roth Capital issued a "Buy" rating on 08/04/2025

To track analyst ratings and price targets for NSP, check out Quiver Quantitative's $NSP forecast page.

NSP Price Targets

Multiple analysts have issued price targets for $NSP recently. We have seen 3 analysts offer price targets for $NSP in the last 6 months, with a median target of $51.0.

Here are some recent targets:

- Andrew Polkowitz from JP Morgan set a target price of $51.0 on 08/04/2025

- Tobey Sommer from Truist Securities set a target price of $50.0 on 08/04/2025

- Jeff Martin from Roth Capital set a target price of $74.0 on 08/04/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Stuart Levey, the EVP of $ORCL, sold 19,758 shares of the company on 10-10-2025 for an estimated $5,927,400. We received data on the trade from a recent SEC filing. This was a sale of approximately 51.7% of their shares of this class of stock. Following this trade, they now own 18,429 shares of this class of $ORCL stock.

$ORCL Insider Trading Activity

$ORCL insiders have traded $ORCL stock on the open market 47 times in the past 6 months. Of those trades, 1 have been purchases and 46 have been sales.

Here’s a breakdown of recent trading of $ORCL stock by insiders over the last 6 months:

- SAFRA CATZ (Chief Executive Officer) has made 0 purchases and 31 sales selling 8,694,918 shares for an estimated $1,825,887,891.

- JEFFREY HENLEY (Vice Chairman) has made 0 purchases and 2 sales selling 400,000 shares for an estimated $76,169,016.

- MICHAEL D. SICILIA (President, Industries) has made 0 purchases and 3 sales selling 66,048 shares for an estimated $20,029,695.

- CLAYTON M. MAGOUYRK (President, OCI) has made 0 purchases and 2 sales selling 36,241 shares for an estimated $9,522,348.

- STUART LEVEY (EVP, Chief Legal Officer) sold 19,758 shares for an estimated $5,927,400

- WILLIAM G PARRETT sold 11,500 shares for an estimated $3,519,000

- LEON E PANETTA sold 17,500 shares for an estimated $2,646,651

- MARIA SMITH (EVP, Chief Accounting Officer) sold 10,000 shares for an estimated $2,329,897

- NAOMI O SELIGMAN has made 0 purchases and 3 sales selling 8,391 shares for an estimated $1,841,175.

- GEORGE H CONRADES sold 8,169 shares for an estimated $1,743,999

- RONA ALISON FAIRHEAD purchased 480 shares for an estimated $112,257

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$ORCL Hedge Fund Activity

We have seen 1,808 institutional investors add shares of $ORCL stock to their portfolio, and 1,422 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- FISHER ASSET MANAGEMENT, LLC removed 8,714,141 shares (-49.5%) from their portfolio in Q2 2025, for an estimated $1,905,172,646

- FMR LLC removed 7,143,518 shares (-22.3%) from their portfolio in Q2 2025, for an estimated $1,561,787,340

- NORGES BANK added 6,255,302 shares (+47.0%) to their portfolio in Q2 2025, for an estimated $1,367,596,676

- FRANKLIN RESOURCES INC removed 6,076,996 shares (-38.1%) from their portfolio in Q2 2025, for an estimated $1,328,613,635

- VICTORY CAPITAL MANAGEMENT INC added 5,925,776 shares (+683.5%) to their portfolio in Q2 2025, for an estimated $1,295,552,406

- AMUNDI removed 5,486,321 shares (-43.1%) from their portfolio in Q2 2025, for an estimated $1,199,474,360

- CAPITAL RESEARCH GLOBAL INVESTORS added 4,033,717 shares (+21.2%) to their portfolio in Q2 2025, for an estimated $881,891,547

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$ORCL Congressional Stock Trading

Members of Congress have traded $ORCL stock 11 times in the past 6 months. Of those trades, 6 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $ORCL stock by members of Congress over the last 6 months:

- REPRESENTATIVE CLEO FIELDS has traded it 3 times. They made 3 purchases worth up to $200,000 on 09/23, 09/18, 09/17 and 0 sales.

- REPRESENTATIVE VAL T. HOYLE sold up to $15,000 on 09/23.

- SENATOR JOHN BOOZMAN has traded it 2 times. They made 1 purchase worth up to $15,000 on 04/16 and 1 sale worth up to $15,000 on 09/12.

- REPRESENTATIVE RITCHIE TORRES sold up to $15,000 on 07/11.

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 06/17.

- REPRESENTATIVE JEFFERSON SHREVE has traded it 2 times. They made 1 purchase worth up to $50,000 on 05/08 and 1 sale worth up to $50,000 on 05/12.

- REPRESENTATIVE BRUCE WESTERMAN sold up to $15,000 on 04/21.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$ORCL Analyst Ratings

Wall Street analysts have issued reports on $ORCL in the last several months. We have seen 22 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- Evercore ISI Group issued a "Outperform" rating on 10/10/2025

- Baird issued a "Outperform" rating on 10/09/2025

- Bernstein issued a "Outperform" rating on 09/26/2025

- Rothschild & Co issued a "Sell" rating on 09/25/2025

- JMP Securities issued a "Market Outperform" rating on 09/24/2025

- Barclays issued a "Overweight" rating on 09/11/2025

- UBS issued a "Buy" rating on 09/10/2025

To track analyst ratings and price targets for $ORCL, check out Quiver Quantitative's $ORCL forecast page.

$ORCL Price Targets

Multiple analysts have issued price targets for $ORCL recently. We have seen 29 analysts offer price targets for $ORCL in the last 6 months, with a median target of $350.0.

Here are some recent targets:

- Kirk Materne from Evercore ISI Group set a target price of $350.0 on 10/10/2025

- Rob Oliver from Baird set a target price of $365.0 on 10/09/2025

- Mark L. Moerdler from Bernstein set a target price of $364.0 on 09/26/2025

- Alex Haissl from Rothschild & Co set a target price of $175.0 on 09/25/2025

- Patrick Walravens from JMP Securities set a target price of $342.0 on 09/24/2025

- Keith Weiss from Morgan Stanley set a target price of $320.0 on 09/23/2025

- Nay Soe Naing from Berenberg set a target price of $306.0 on 09/15/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

North Dakota's Insurance Commissioner urges Congress to extend ACA tax credits before the November 1 open enrollment deadline.

Quiver AI Summary

North Dakota's Republican Insurance Commissioner Jon Godfread urged Congress to quickly extend the Affordable Care Act (ACA) enhanced premium tax credits before the November 1 open enrollment deadline. He emphasized the urgency, stating, "Lawmakers need to do this now," and warned that delays could lead to higher premiums for consumers.

Godfread noted a consensus among the National Association of Insurance Commissioners in support of extending these tax credits and mentioned that most states are prepared to implement this extension. Senator Jeanne Shaheen remarked on the need to act swiftly to prevent increased healthcare costs for Americans.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Jeanne Shaheen Net Worth

Quiver Quantitative estimates that Jeanne Shaheen is worth $7.8M, as of October 15th, 2025. This is the 126th highest net worth in Congress, per our live estimates.

Shaheen has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Jeanne Shaheen's net worth on Quiver Quantitative's politician page for Shaheen.

Jeanne Shaheen Bill Proposals

Here are some bills which have recently been proposed by Jeanne Shaheen:

- S.2657: STOP China and Russia Act of 2025

- S.2648: Protecting Public Naval Shipyards Act of 2025

- S.2627: A bill to require the United States Postal Service to designate a single, unique ZIP Code for Swanzey, New Hampshire.

- S.2611: Safeguarding the Integrity of the Human Rights Reports Act of 2025

- S.2592: Supporting Ukraine Act of 2025

- S.2252: Saving Lives and Taxpayer Dollars Act

You can track bills proposed by Jeanne Shaheen on Quiver Quantitative's politician page for Shaheen.

Jeanne Shaheen Fundraising

Jeanne Shaheen recently disclosed $0 of fundraising in a Q2 FEC disclosure filed on July 14th, 2025. This was the 1183rd most from all Q2 reports we have seen this year. nan% came from individual donors.

Shaheen disclosed $343.4K of spending. This was the 135th most from all Q2 reports we have seen from politicians so far this year.

Shaheen disclosed $1.1M of cash on hand at the end of the filing period. This was the 278th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Jeanne Shaheen's fundraising on Quiver Quantitative.

Senator Schumer highlights significant health insurance premium increases for New Yorkers due to stalled ACA tax credit negotiations.

Quiver AI Summary

U.S. Senator Chuck Schumer highlighted significant increases in health insurance premiums for New Yorkers, attributing the spikes to Republican opposition to extending Affordable Care Act (ACA) tax credits. Schumer pointed out that these increases could cost families over $1,000 more monthly, stressing the urgency of bipartisan negotiations to address the healthcare crisis.

According to Schumer, "Many New Yorkers... are seeing their only option is to pay thousands more than they did last year," as the “window shopping” period for 2026 health insurance begins. He criticized Republican lawmakers for their lack of action, stating, "This is a crisis that will upend the lives of nearly 24 million Americans."

The press release claims that nearly 80% of Americans, including 60% of Republicans, support the extension of ACA tax credits. Schumer urged Republicans to collaborate with Democrats to mitigate rising healthcare costs, which, if left unaddressed, may lead to millions losing coverage over the next decade.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Charles E. Schumer Net Worth

Quiver Quantitative estimates that Charles E. Schumer is worth $2.0M, as of October 15th, 2025. This is the 256th highest net worth in Congress, per our live estimates.

Schumer has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Charles E. Schumer's net worth on Quiver Quantitative's politician page for Schumer.

Charles E. Schumer Bill Proposals

Here are some bills which have recently been proposed by Charles E. Schumer:

- S.2925: MIND Act of 2025

- S.2681: Lowering Electric Bills Act

- S.2556: Protecting Health Care and Lowering Costs Act

- S.2009: Charles B. Rangel Congressional Gold Medal Act

- S.1929: SEPSIS Act

- S.1804: Presidential Airlift Security Act of 2025

You can track bills proposed by Charles E. Schumer on Quiver Quantitative's politician page for Schumer.

Charles E. Schumer Fundraising

Charles E. Schumer recently disclosed $102.1K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 610th most from all Q2 reports we have seen this year. 96.6% came from individual donors.

Schumer disclosed $450.5K of spending. This was the 99th most from all Q2 reports we have seen from politicians so far this year.

Schumer disclosed $8.7M of cash on hand at the end of the filing period. This was the 19th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Charles E. Schumer's fundraising on Quiver Quantitative.

Senator John Hoeven announces Grand Forks as the home for a new Air Force Battle Lab and AeroVironment's AV Halo system.

Quiver AI Summary

Senator John Hoeven announced two significant developments in counter-drone operations for the Grand Forks region, disclosed during the Unmanned Aerial Systems Summit. The U.S. Air Force has selected Grand Forks Air Force Base for a new Point Defense Battle Lab aimed at testing defense technologies against small unmanned aircraft systems.

Additionally, AeroVironment will bring its AV Halo counter-UAS system to GrandSKY, enhancing local capabilities with advanced surveillance technology. Hoeven emphasized the importance of these initiatives in addressing evolving drone threats, drawing parallels to their use in conflict zones.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

John Hoeven Net Worth

Quiver Quantitative estimates that John Hoeven is worth $48.5M, as of October 15th, 2025. This is the 32nd highest net worth in Congress, per our live estimates.

Hoeven has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track John Hoeven's net worth on Quiver Quantitative's politician page for Hoeven.

John Hoeven Bill Proposals

Here are some bills which have recently been proposed by John Hoeven:

- S.2256: Agriculture, Rural Development, Food and Drug Administration, and Related Agencies Appropriations Act, 2026

- S.1693: FARMER Act of 2025

- S.1485: North American Energy Act

- S.1377: Theodore Roosevelt National Park Wild Horses Protection Act

- S.1084: North Dakota Trust Lands Completion Act of 2025

- S.899: Producer and Agricultural Credit Enhancement Act of 2025

You can track bills proposed by John Hoeven on Quiver Quantitative's politician page for Hoeven.

John Hoeven Fundraising

John Hoeven recently disclosed $71.2K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 675th most from all Q2 reports we have seen this year. 52.9% came from individual donors.

Hoeven disclosed $44.7K of spending. This was the 699th most from all Q2 reports we have seen from politicians so far this year.

Hoeven disclosed $581.4K of cash on hand at the end of the filing period. This was the 432nd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track John Hoeven's fundraising on Quiver Quantitative.

Grassley requests telecommunications companies and federal entities to release records provided to Jack Smith for oversight investigation.

Quiver AI Summary

Senate Judiciary Committee Chairman Chuck Grassley has requested records from four telecommunications companies and five federal entities related to former Special Counsel Jack Smith's investigation concerning President Trump. This request is part of Grassley's oversight efforts regarding the investigation codenamed "Arctic Frost."

Grassley's oversight revealed that Smith and the FBI had allegedly subpoenaed phone records from nine Republican members of Congress and other documents as part of the probe. Grassley is seeking transparency regarding these actions.

The letter addressing the telecommunications companies includes Verizon, AT&T, T-Mobile, and Lumen. Grassley was joined by several Senate and House Republicans who co-signed these requests for information to ensure accountability in the oversight process.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Chuck Grassley Net Worth

Quiver Quantitative estimates that Chuck Grassley is worth $6.2M, as of October 15th, 2025. This is the 147th highest net worth in Congress, per our live estimates.

Grassley has approximately $71.9K invested in publicly traded assets which Quiver is able to track live.

You can track Chuck Grassley's net worth on Quiver Quantitative's politician page for Grassley.

Chuck Grassley Bill Proposals

Here are some bills which have recently been proposed by Chuck Grassley:

- S.2928: H–1B and L–1 Visa Reform Act of 2025

- S.2808: Fertilizer Research Act of 2025

- S.2800: Pharmacy and Medically Underserved Areas Enhancement Act

- S.2710: Open Payments Expansion Act

- S.2677: A bill to expand the sharing of information with respect to suspected violations of intellectual property rights in trade.

- S.2649: Psychiatric Hospital Inspection Transparency Act of 2025

You can track bills proposed by Chuck Grassley on Quiver Quantitative's politician page for Grassley.

Chuck Grassley Fundraising

Chuck Grassley recently disclosed $39.0K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 745th most from all Q2 reports we have seen this year. 76.9% came from individual donors.

Grassley disclosed $44.3K of spending. This was the 700th most from all Q2 reports we have seen from politicians so far this year.

Grassley disclosed $318.3K of cash on hand at the end of the filing period. This was the 569th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Chuck Grassley's fundraising on Quiver Quantitative.

Senator Elizabeth Warren discusses the "No Argentina Bailout Act," emphasizing support for American farmers and families.

Quiver AI Summary

U.S. Senator Elizabeth Warren has introduced the "No Argentina Bailout Act," criticizing President Trump for allegedly prioritizing aid to a foreign government while domestic issues remain unresolved. During a Senate speech, she stated, "It is shameful that President Trump is propping up a foreign government, while he shuts down our own."

The act aims to hold Trump accountable to his pledge to "put America First," and Warren emphasizes a need to support American farmers and families instead of foreign nations like Argentina.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Elizabeth Warren Net Worth

Quiver Quantitative estimates that Elizabeth Warren is worth $7.1M, as of October 15th, 2025. This is the 135th highest net worth in Congress, per our live estimates.

Warren has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Elizabeth Warren's net worth on Quiver Quantitative's politician page for Warren.

Elizabeth Warren Bill Proposals

Here are some bills which have recently been proposed by Elizabeth Warren:

- S.2965: A bill to prohibit the use of the Exchange Stabilization Fund of the Department of the Treasury to bail out Argentina's financial markets.

- S.2939: A bill to establish universal child care and early learning programs.

- S.2894: Reconciliation in Place Names Act

- S.2809: Transparency in Contracting Act of 2025

- S.2798: Equal Employment for All Act of 2025

- S.2729: Nationwide Right To Unionize Act

You can track bills proposed by Elizabeth Warren on Quiver Quantitative's politician page for Warren.

Elizabeth Warren Fundraising

Elizabeth Warren recently disclosed $686.3K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 89th most from all Q2 reports we have seen this year. 98.9% came from individual donors.

Warren disclosed $670.2K of spending. This was the 56th most from all Q2 reports we have seen from politicians so far this year.

Warren disclosed $3.9M of cash on hand at the end of the filing period. This was the 61st most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Elizabeth Warren's fundraising on Quiver Quantitative.

Pressley condemns ICE's detainment of a 13-year-old boy, advocating for immigrant rights and due process.

Quiver AI Summary

Congresswoman Ayanna Pressley has condemned the detainment of a 13-year-old boy from Everett by ICE, stating the child was transferred to a detention facility in Virginia without his family's knowledge. Pressley criticized the conditions he allegedly faced, urging for adherence to due process and respect for the child's constitutional rights.

In her statement, Pressley emphasized, "It is absolutely alarming... that a 13-year-old child... would be subjected to inhumane conditions," and called for his immediate return to his family. She reiterated her advocacy for immigrant families and against criminalizing children, citing similar past actions and legislative efforts to protect vulnerable youth.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Ayanna Pressley Net Worth

Quiver Quantitative estimates that Ayanna Pressley is worth $5.2M, as of October 15th, 2025. This is the 166th highest net worth in Congress, per our live estimates.

Pressley has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Ayanna Pressley's net worth on Quiver Quantitative's politician page for Pressley.

Ayanna Pressley Bill Proposals

Here are some bills which have recently been proposed by Ayanna Pressley:

- H.R.5657: Fair Pay for Federal Contractors Act of 2025

- H.R.4719: Freedom to Move Act

- H.R.4611: EACH Act of 2025

- H.R.4524: Equity in Government Act

- H.R.4111: MASS Act

- H.R.3603: Andrew Kearse Accountability for Denial of Medical Care Act of 2025

You can track bills proposed by Ayanna Pressley on Quiver Quantitative's politician page for Pressley.

Ayanna Pressley Fundraising

Ayanna Pressley recently disclosed $106.3K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 602nd most from all Q2 reports we have seen this year. 92.0% came from individual donors.

Pressley disclosed $163.2K of spending. This was the 339th most from all Q2 reports we have seen from politicians so far this year.

Pressley disclosed $125.1K of cash on hand at the end of the filing period. This was the 749th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Ayanna Pressley's fundraising on Quiver Quantitative.

Congresswoman Marcy Kaptur praises Jeep Stellantis for a $13 billion investment, creating over 900 jobs in Toledo.

Quiver AI Summary

Congresswoman Marcy Kaptur has expressed support following the announcement of a $13 billion investment by Jeep Stellantis in its North American operations. This includes $400 million earmarked for the Toledo Assembly Complex, aimed at the assembly of a new midsize truck and the creation of over 900 jobs.

Kaptur described the investment as a victory for American autoworkers, highlighting Toledo's workforce and its role in revitalizing the automotive industry. She emphasized the ongoing importance of such investments for the region and the sector as a whole.

The investment builds on previous commitments made by Stellantis in the current year to enhance operations and job opportunities in the area.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Marcy Kaptur Net Worth

Quiver Quantitative estimates that Marcy Kaptur is worth $1.1M, as of October 15th, 2025. This is the 328th highest net worth in Congress, per our live estimates.

Kaptur has approximately $96.1K invested in publicly traded assets which Quiver is able to track live.

You can track Marcy Kaptur's net worth on Quiver Quantitative's politician page for Kaptur.

Marcy Kaptur Bill Proposals

Here are some bills which have recently been proposed by Marcy Kaptur:

- H.R.4230: the Appropriations Compliance and Training Act

- H.R.3594: Gold Star Spouses Health Care Enhancement Act

- H.R.2502: Law Enforcement Training for Mental Health Crisis Response Act of 2025

- H.R.1073: Great Lakes Gateways Network Act of 2025

You can track bills proposed by Marcy Kaptur on Quiver Quantitative's politician page for Kaptur.

Marcy Kaptur Fundraising

Marcy Kaptur recently disclosed $386.9K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 226th most from all Q2 reports we have seen this year. 59.0% came from individual donors.

Kaptur disclosed $91.1K of spending. This was the 534th most from all Q2 reports we have seen from politicians so far this year.

Kaptur disclosed $941.5K of cash on hand at the end of the filing period. This was the 312th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Marcy Kaptur's fundraising on Quiver Quantitative.

Sen. Rick Scott announces significant achievements for Florida in the Senate-passed FY 2026 National Defense Authorization Act.

Quiver AI Summary

Senator Rick Scott announced significant achievements for Florida and the military following the Senate's passage of the Fiscal Year 2026 National Defense Authorization Act (NDAA). He highlighted measures that support U.S. military personnel, enhance national security, and address concerns related to Communist China. Key provisions include prohibiting certain technology purchases from Chinese companies and securing funding for military construction projects in Florida.

Scott emphasized the importance of military personnel, stating, "They wake up every day... to fight for the freedoms that make our country great." He noted the NDAA includes a pay raise for service members and initiatives aimed at improving military family support, asserting a commitment to the safety of future generations.

The senator expressed gratitude to his Senate colleagues for their efforts in passing the bill and looks forward to its approval in the House and subsequent enactment. The NDAA reflects Scott's ongoing priority to prioritize national defense and military readiness as critical components of U.S. security strategy.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Rick Scott Net Worth

Quiver Quantitative estimates that Rick Scott is worth $506.0M, as of October 15th, 2025. This is the 3rd highest net worth in Congress, per our live estimates.

Scott has approximately $54.0M invested in publicly traded assets which Quiver is able to track live.

You can track Rick Scott's net worth on Quiver Quantitative's politician page for Scott.

Rick Scott Bill Proposals

Here are some bills which have recently been proposed by Rick Scott:

- S.2972: A bill to amend the Internal Revenue Code of 1986 to provide a reduced excise tax rate for portable, electronically-aerated bait containers.

- S.2936: Stop ANTIFA Act of 2025

- S.2935: Sovereign Enforcement Integrity Act of 2025

- S.2908: Lifting Local Communities Act

- S.2843: FRAME Act

- S.2744: Federal Disaster Tax Relief Act of 2025

You can track bills proposed by Rick Scott on Quiver Quantitative's politician page for Scott.

Rick Scott Fundraising

Rick Scott recently disclosed $242.1K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 356th most from all Q2 reports we have seen this year. 37.2% came from individual donors.

Scott disclosed $343.5K of spending. This was the 134th most from all Q2 reports we have seen from politicians so far this year.

Scott disclosed $732.9K of cash on hand at the end of the filing period. This was the 368th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Rick Scott's fundraising on Quiver Quantitative.

Andrew Cheng, the President and CEO of $AKRO, sold 30,000 shares of the company on 10-10-2025 for an estimated $1,619,340. We received data on the trade from a recent SEC filing. This was a sale of approximately 5.4% of their shares of this class of stock. Following this trade, they now own 526,114 shares of this class of $AKRO stock.

$AKRO Insider Trading Activity

$AKRO insiders have traded $AKRO stock on the open market 72 times in the past 6 months. Of those trades, 0 have been purchases and 72 have been sales.

Here’s a breakdown of recent trading of $AKRO stock by insiders over the last 6 months:

- ANDREW CHENG (President and CEO) has made 0 purchases and 16 sales selling 196,253 shares for an estimated $9,638,931.

- TIMOTHY ROLPH (Chief Scientific Officer) has made 0 purchases and 19 sales selling 110,290 shares for an estimated $5,440,059.

- JONATHAN YOUNG (Chief Operating Officer) has made 0 purchases and 10 sales selling 42,032 shares for an estimated $2,009,836.

- CATRIONA YALE (Chief Development Officer) has made 0 purchases and 11 sales selling 35,095 shares for an estimated $1,734,006.

- PATRICK LAMY (Senior VP, Commercial Strategy) has made 0 purchases and 11 sales selling 21,794 shares for an estimated $1,052,630.

- WILLIAM RICHARD WHITE (Chief Financial Officer) has made 0 purchases and 3 sales selling 5,097 shares for an estimated $269,360.

- JANE HENDERSON sold 3,000 shares for an estimated $142,371

- SCOTT A. GANGLOFF (Chief Technology Officer) sold 848 shares for an estimated $46,504

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$AKRO Hedge Fund Activity

We have seen 138 institutional investors add shares of $AKRO stock to their portfolio, and 126 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- AVORO CAPITAL ADVISORS LLC added 3,500,000 shares (+inf%) to their portfolio in Q2 2025, for an estimated $186,760,000

- WELLINGTON MANAGEMENT GROUP LLP removed 2,526,294 shares (-42.6%) from their portfolio in Q2 2025, for an estimated $134,803,047

- POINT72 ASSET MANAGEMENT, L.P. added 2,202,589 shares (+433.3%) to their portfolio in Q2 2025, for an estimated $117,530,149

- WOODLINE PARTNERS LP added 1,986,614 shares (+413.2%) to their portfolio in Q2 2025, for an estimated $106,005,723

- RTW INVESTMENTS, LP removed 1,941,779 shares (-26.2%) from their portfolio in Q2 2025, for an estimated $103,613,327

- SG AMERICAS SECURITIES, LLC removed 1,150,442 shares (-99.5%) from their portfolio in Q2 2025, for an estimated $61,387,585

- HOLOCENE ADVISORS, LP added 1,075,642 shares (+inf%) to their portfolio in Q2 2025, for an estimated $57,396,257

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$AKRO Analyst Ratings

Wall Street analysts have issued reports on $AKRO in the last several months. We have seen 3 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- TD Cowen issued a "Buy" rating on 08/04/2025

- B of A Securities issued a "Buy" rating on 05/27/2025

- Citigroup issued a "Buy" rating on 05/13/2025

To track analyst ratings and price targets for $AKRO, check out Quiver Quantitative's $AKRO forecast page.

$AKRO Price Targets

Multiple analysts have issued price targets for $AKRO recently. We have seen 6 analysts offer price targets for $AKRO in the last 6 months, with a median target of $60.0.

Here are some recent targets:

- Andrew S. Fein from HC Wainwright & Co. set a target price of $54.0 on 10/10/2025

- Edward Nash from Canaccord Genuity set a target price of $54.0 on 10/09/2025

- Andrew Tsai from Jefferies set a target price of $56.0 on 10/09/2025

- Ritu Baral from TD Cowen set a target price of $76.0 on 08/04/2025

- Alexandria Hammond from B of A Securities set a target price of $64.0 on 05/27/2025

- Jonathan Woo from Citigroup set a target price of $78.0 on 05/13/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

Herbert Hughes, a director at $BYRN, sold 5,000 shares of the company on 10-10-2025 for an estimated $145,000. We received data on the trade from a recent SEC filing. This was a sale of approximately 3.7% of their shares of this class of stock. Following this trade, they now own 130,226 shares of this class of $BYRN stock.

$BYRN Insider Trading Activity

$BYRN insiders have traded $BYRN stock on the open market 3 times in the past 6 months. Of those trades, 1 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $BYRN stock by insiders over the last 6 months:

- BRYAN GANZ (President and CEO) sold 40,000 shares for an estimated $1,196,000

- HERBERT HUGHES sold 5,000 shares for an estimated $145,000

- EMILY ROONEY purchased 2,500 shares for an estimated $51,237

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$BYRN Hedge Fund Activity

We have seen 84 institutional investors add shares of $BYRN stock to their portfolio, and 66 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- FMR LLC added 1,065,372 shares (+45.8%) to their portfolio in Q2 2025, for an estimated $32,898,687

- INVESCO LTD. added 423,538 shares (+inf%) to their portfolio in Q2 2025, for an estimated $13,078,853

- DRIEHAUS CAPITAL MANAGEMENT LLC added 168,104 shares (+37.4%) to their portfolio in Q2 2025, for an estimated $5,191,051

- WEALTHSPIRE ADVISORS, LLC removed 160,156 shares (-35.3%) from their portfolio in Q2 2025, for an estimated $4,945,617

- MILLENNIUM MANAGEMENT LLC removed 121,464 shares (-37.2%) from their portfolio in Q2 2025, for an estimated $3,750,808

- RENAISSANCE TECHNOLOGIES LLC removed 112,500 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $3,474,000

- MAVERICK CAPITAL LTD added 111,794 shares (+inf%) to their portfolio in Q2 2025, for an estimated $3,452,198

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$BYRN Analyst Ratings

Wall Street analysts have issued reports on $BYRN in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.