S. 2556: Protecting Health Care and Lowering Costs Act

This bill, titled the Protecting Health Care and Lowering Costs Act

, proposes several key changes related to health care policy and tax incentives for individuals purchasing health insurance. Below are the main provisions included in the bill:

Repeal of Previous Changes

The bill seeks to repeal specific changes made by the health subtitle of a previous law known as the One Big Beautiful Bill Act (Public Law 119-21). This means that the current laws and regulations that were altered by that subtitle will remain as they were before the changes were made.

Permanent Extension of Enhanced Tax Credit

The bill aims to permanently extend and modify certain tax credits available to individuals under the Internal Revenue Code. This primarily affects those purchasing health insurance through the marketplace.

- Income Limits Change: The bill removes the existing upper income limit for receiving these tax credits, which was previously capped at 400% of the federal poverty level. This change allows more individuals, regardless of income, to qualify for financial assistance when purchasing insurance.

- Adjustments to Applicable Percentages: The bill establishes a new sliding scale for determining how much individuals are expected to pay for their premiums, based on their income. For example, those earning up to 150% of the poverty line would not pay anything for their premiums, while the expected costs increase gradually for higher income brackets.

Effective Date

The modifications concerning the tax credits are set to take effect for taxable years beginning after December 31, 2025. This means that the new rules would start to apply to individuals' tax situations from the 2026 tax year onward.

Summary of Tax Credit Adjustments

To summarize the changes regarding tax credits:

- Individuals with household incomes up to 150% of the poverty line will pay 0% of their income toward premiums.

- For incomes between 150% and 200%, the expected premium payment starts at 0% and rises to 2%.

- As income increases, the percentage of income that individuals are expected to pay for premiums will increase gradually, reaching a cap of 8.5% for those at 400% of the poverty line or higher.

Relevant Companies

- UNH (UnitedHealth Group): This company may be impacted by changes in health insurance purchasing patterns due to the modified tax credits, potentially altering demand for their plans.

- ANTM (Anthem, Inc.): As health insurance providers, changes in premium costs and tax credits may influence competition and pricing strategies.

- CNC (Centene Corporation): Similar to other insurers, modifications in subsidies and eligibility could affect enrollment numbers and revenue.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

47 bill sponsors

-

TrackCharles E. Schumer

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackMaria Cantwell

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

TrackJohn Fetterman

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMargaret Wood Hassan

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackTim Kaine

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackChristopher Murphy

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackJon Ossoff

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackGary C. Peters

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBernard Sanders

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

TrackAdam B. Schiff

Co-Sponsor

-

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

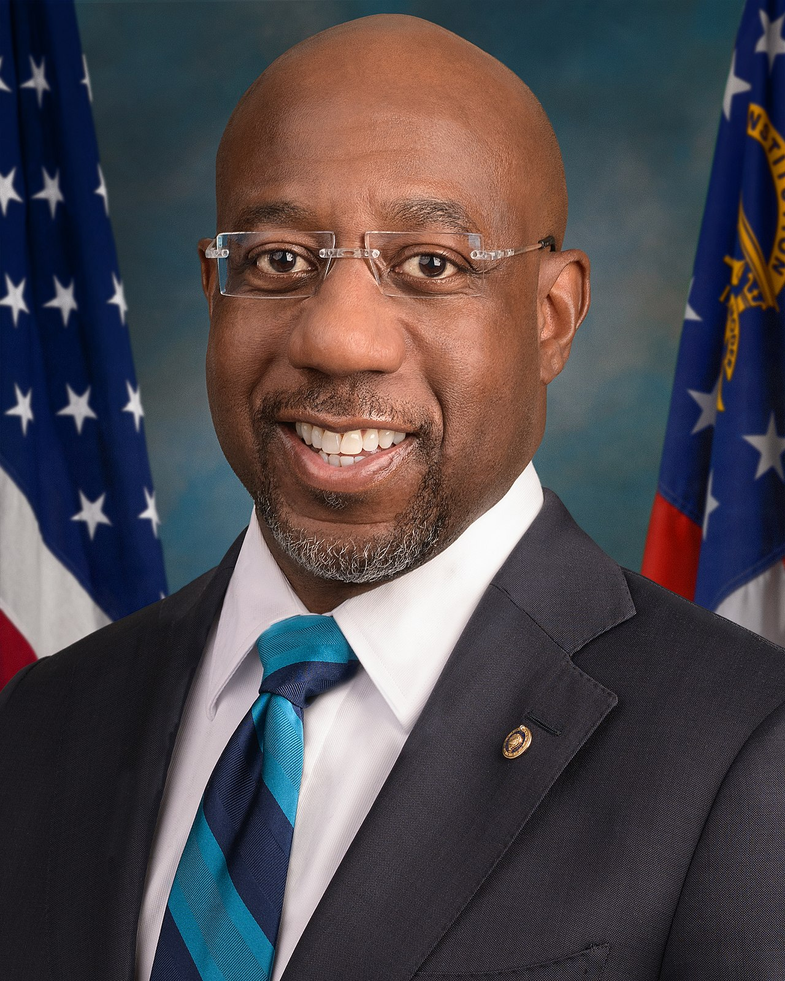

TrackRaphael G. Warnock

Co-Sponsor

-

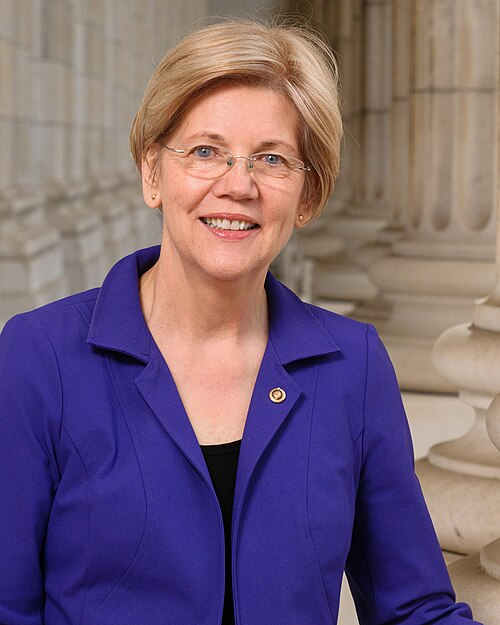

TrackElizabeth Warren

Co-Sponsor

-

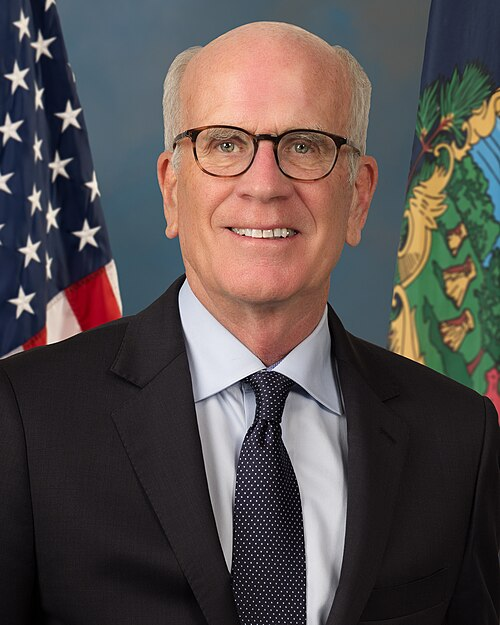

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 30, 2025 | Introduced in Senate |

| Jul. 30, 2025 | Read twice and referred to the Committee on Finance. (text: CR S4908) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.