S. 2681: Lowering Electric Bills Act

The Lowering Electric Bills Act aims to amend the Internal Revenue Code to extend certain clean energy tax credits. Here are the key points of the bill:

Residential Clean Energy Credit

- The deadline for the residential clean energy credit is extended from December 31, 2025, to December 31, 2034. This credit can help homeowners who invest in clean energy technologies, such as solar panels, reduce their tax burden.

- This extension is intended to encourage more individuals to adopt clean energy solutions over the next several years.

Clean Electricity Production Credit

- The bill modifies the clean electricity production credit, which is a tax benefit available to electricity producers that generate power through clean energy sources.

- The eligibility for this credit will be determined based on annual greenhouse gas emissions from electricity production in the U.S. The credit will apply if emissions fall to 25% or less of the levels from 2022 or by 2032, whichever is later.

- This aims to incentivize significant reductions in greenhouse gas emissions from the power sector.

Clean Electricity Investment Credit

- The clean electricity investment credit is also amended, allowing tax benefits for investments in clean energy technologies.

- Similar to the production credit, this will help promote investments in clean energy infrastructure and technologies.

- Changes include removing certain limitations in how the credit is calculated to allow a broader application of the tax benefit.

Effective Date

- All amendments made by the bill will take effect as if they had been included in previous legislation focused on clean energy credits.

- This ensures a seamless transition for taxpayers looking to benefit from the extended timeframes and amended conditions.

Impact on Electric Bills

- The intent behind these amendments is to lower electric bills for consumers by promoting the adoption of renewable energy sources, ultimately leading to cleaner and potentially less expensive energy.

- By providing tax credits, the bill aims to encourage both individuals and companies to invest in renewable energy, which may contribute to reducing overall electricity costs.

Relevant Companies

- NMBL - This company could be impacted as it is involved in clean energy technologies, which might see increased demand due to favorable tax provisions.

- SOL - A solar energy provider that could benefit from an extended residential clean energy credit as homeowners are incentivized to install solar panels.

- ORAD - This company’s focus on renewable energy investments may see increased fiscal opportunities due to tax credit extensions.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

40 bill sponsors

-

TrackCharles E. Schumer

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackTammy Baldwin

Co-Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackMaria Cantwell

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

TrackJohn Fetterman

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackKirsten E. Gillibrand

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackTim Kaine

Co-Sponsor

-

TrackMark Kelly

Co-Sponsor

-

TrackAndy Kim

Co-Sponsor

-

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackJeff Merkley

Co-Sponsor

-

TrackPatty Murray

Co-Sponsor

-

TrackJon Ossoff

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackJack Reed

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

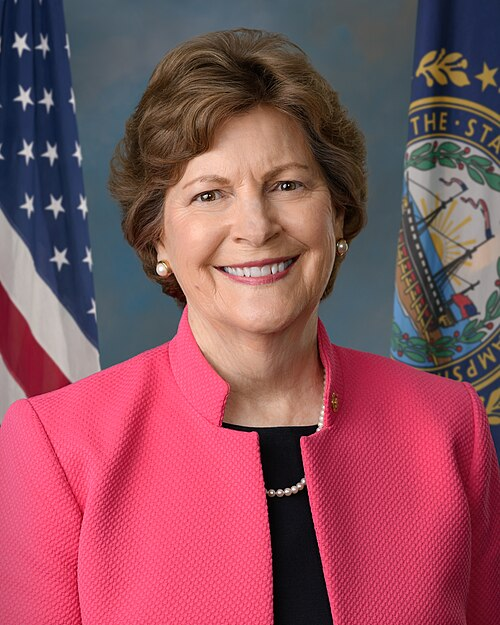

TrackJeanne Shaheen

Co-Sponsor

-

TrackElissa Slotkin

Co-Sponsor

-

TrackTina Smith

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

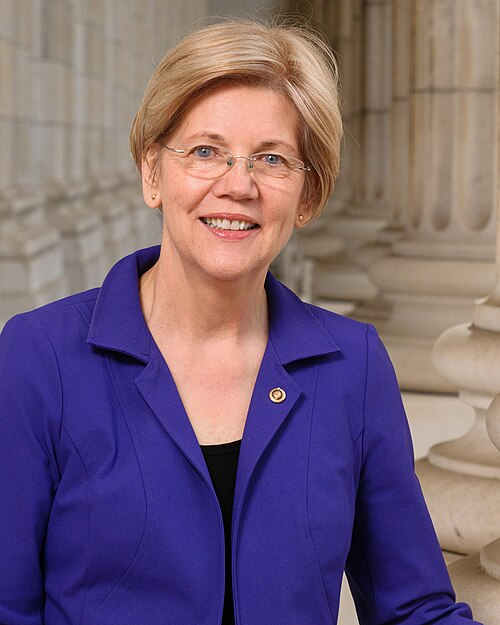

TrackElizabeth Warren

Co-Sponsor

-

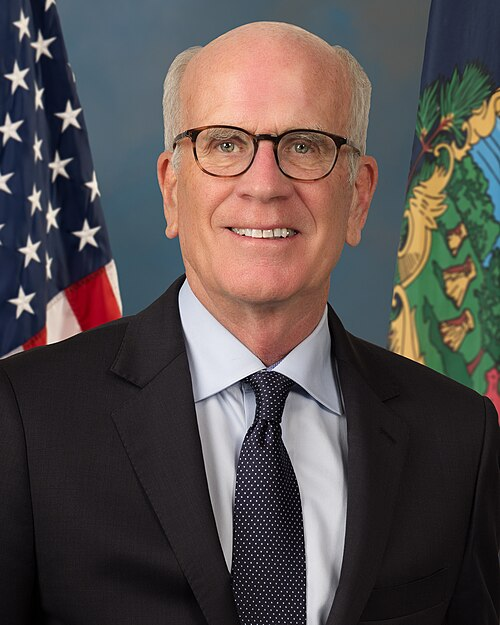

TrackPeter Welch

Co-Sponsor

-

TrackSheldon Whitehouse

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Aug. 02, 2025 | Introduced in Senate |

| Aug. 02, 2025 | Read twice and referred to the Committee on Finance. (text: CR S5515) |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.