S. 2744: Federal Disaster Tax Relief Act of 2025

The Federal Disaster Tax Relief Act of 2025 proposes changes to the Internal Revenue Code to assist individuals and families affected by major disasters and wildfires through tax relief. Here are the key components of the bill:

Casualty Losses from Major Disasters

- Qualified Net Disaster Losses: The bill defines "qualified net disaster loss" as the amount by which personal casualty losses related to a qualified disaster exceed any personal casualty gains. This aims to simplify and enhance the relief available to affected individuals.

- Qualified Disaster Areas: Individuals can claim losses only if they occur in an area designated as a "qualified disaster area" after a major disaster declared by the President, with the incident period starting after July 4, 2025, and before January 1, 2027.

- Deduction Amounts: The bill proposes a change to the maximum casualty loss deduction. It reduces the threshold from $500 to $100 while allowing higher amounts under certain disaster conditions (like $500 for specific net disaster losses).

Disaster Loss Deductions

- Inclusion in Standard Deductions: The disaster loss deduction will be included in the standard deduction calculations, meaning those affected can claim these losses alongside their normal deductions when filing taxes.

- Alternative Minimum Tax Treatment: The Act clarifies that disaster loss deductions are not affected by alternative minimum tax rules, enhancing the relief for those impacted by disasters.

Compensation for Wildfire Losses

- Exclusion from Gross Income: The legislation will exclude certain wildfire relief payments from gross income for tax purposes. This means individuals receiving payments for losses or damages resulting from specific wildfires will not have to count those payments as taxable income.

- Definition of Qualified Wildfire Relief Payments: Payments classified as qualified wildfire relief payments may cover various expenses, such as additional living costs, emotional distress, or damages incurred due to a declared wildfire disaster. However, they do not cover amounts already compensated by insurance or similar means.

- Timeframe for Relief: This section of the bill only applies to payments received during taxable years beginning after December 31, 2025, and before January 1, 2031.

Future Implications

The amendments proposed by the bill aim to provide financial relief for individuals who have suffered losses due to major disasters and wildfires. This legislation focuses on simplifying tax treatment and expanding the available deductions during tough times for those affected by natural disasters.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

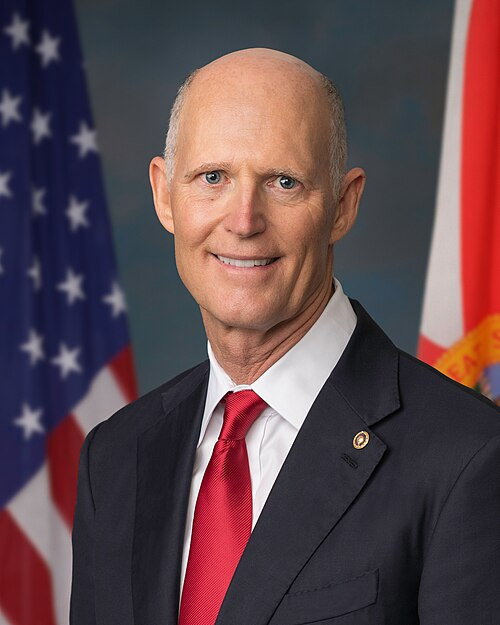

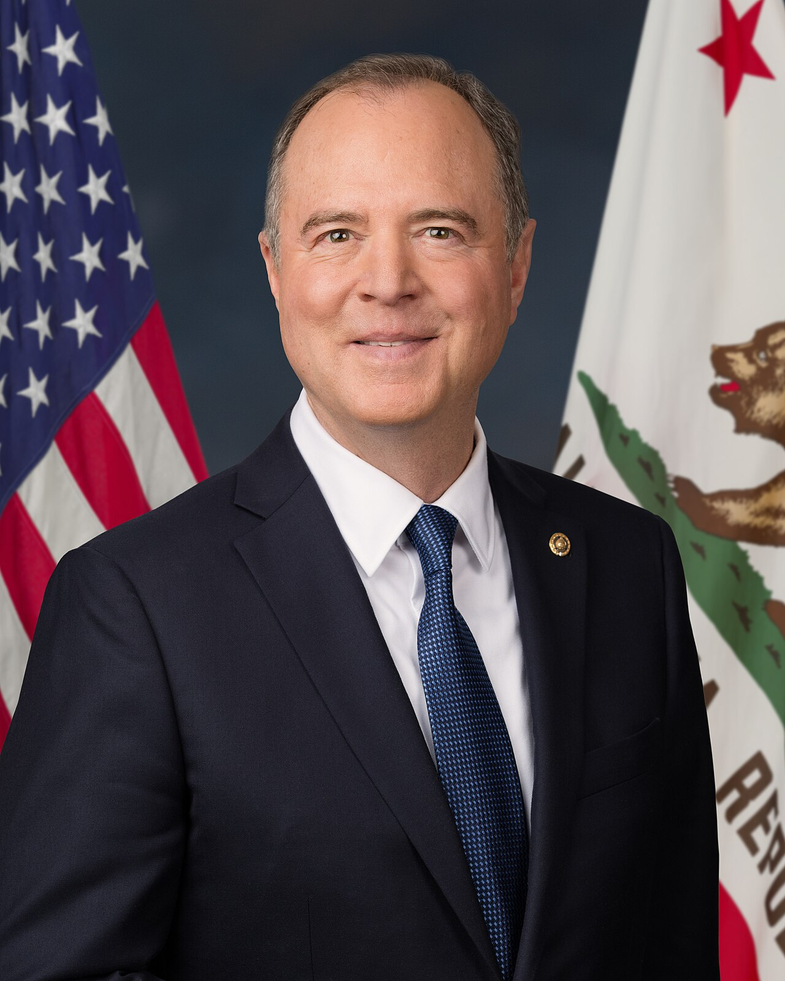

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 09, 2025 | Introduced in Senate |

| Sep. 09, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.