H.R. 2823: Climate Change Financial Risk Act of 2025

The Climate Change Financial Risk Act of 2025 aims to address the financial risks posed by climate change. Here are the key components of the bill:

1. Purpose and Scope

The bill requires the Board of Governors of the Federal Reserve System to evaluate financial risks associated with climate change. It emphasizes the need for financial institutions to understand and manage these risks to ensure the stability of the financial system. This involves collaboration with various federal agencies and experts in climate science and economics.

2. Climate Risk Analysis

By a deadline of one year after the enactment of the bill, the Board must develop three climate risk scenarios based on projected increases in global temperatures (1.5 degrees Celsius, 2 degrees Celsius, and other scenarios considering national policies). These scenarios will help assess the potential economic impacts of climate change.

3. Establishment of a Technical Development Group

A Climate Risk Scenario Technical Development Group will be created, consisting of 10 members: five climate scientists and five economists. This group will provide recommendations to the Board on climate risk assessment and help develop scenarios that inform financial institutions about potential risks.

4. Biennial Assessments

The bill mandates biennial analyses for covered entities (large bank holding companies and nonbank financial companies) to test their capital adequacy under adverse climate scenarios. These assessments will determine if these entities can withstand financial losses caused by climate-related events.

5. Surveys of Financial Entities

The Board will conduct surveys to assess the ability of financial institutions to handle risks associated with climate change. The first survey must be completed within 18 months after an initial analysis, with subsequent surveys taking place biennially. These surveys will focus on entities that are heavily involved in sectors or regions vulnerable to climate impacts.

6. Analysis and Reporting

The results of the surveys and assessments will be summarized in public reports, which will analyze the responses and strategies of financial institutions concerning climate risks. This transparency aims to promote better understanding and management of climate-related vulnerabilities.

7. Focus on Financial Stability

The bill recognizes that climate change poses significant threats to the financial sector, including credit and market risks. Financial institutions are urged to incorporate climate risk into their broader risk management frameworks. This includes evaluating the physical and transition risks arising from climate impacts, such as regulatory changes and shifts in market demand.

8. Effect on Financial Institutions

Institutions that do not manage climate risks effectively may face higher supervisory scrutiny, and failure to comply with requirements could lead to restrictions on capital distributions.

Relevant Companies

- JPM - JPMorgan Chase & Co.: As one of the largest banking institutions, it may face significant scrutiny regarding its exposure to climate-related risks and its capital planning under new climate stress tests.

- BAC - Bank of America Corp.: Similar to JPMorgan, Bank of America holds substantial assets and will need to adapt its risk management strategies to align with the new climate risk assessments.

- GS - The Goldman Sachs Group, Inc.: As a major investment and financial services firm, Goldman Sachs may need to evaluate its investments in climate-sensitive sectors and adjust its risk profile accordingly.

- C - Citigroup Inc.: With vast international exposure, Citigroup will need to implement the new requirements on climate risk management, impacting its operational and strategic planning.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

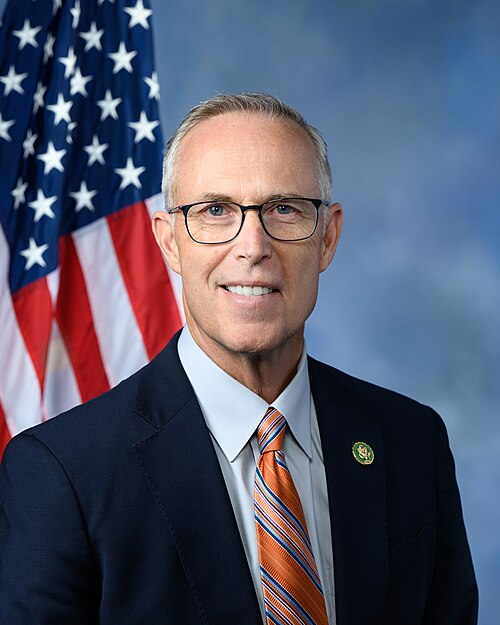

TrackSean Casten

Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackAndré Carson

Co-Sponsor

-

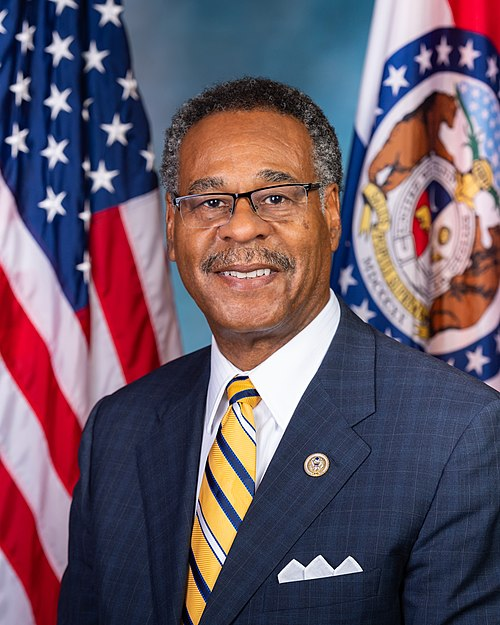

TrackEmanuel Cleaver

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

TrackAl Green

Co-Sponsor

-

TrackJared Huffman

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

TrackStephen F. Lynch

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

TrackKevin Mullin

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in House |

| Apr. 10, 2025 | Referred to the Committee on Financial Services, and in addition to the Committee on Energy and Commerce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.