Quiver News

The latest insights and financial news from Quiver Quantitative

We have seen 74 open market insider transactions reported today, October 17, 2025. You can track them all on the Quiver Quantitative Insider Trading dashboard. Here are some of the largest open market insider stock purchases we have seen.

JOHN HANCOCK GA MORTGAGE TRUST ($N/A)

Manulife (International) Ltd bought 695,719 shares on 10/15 for an estimated $13,000,009.

Past $N/A Insider Trades

JOHN HANCOCK GA MORTGAGE TRUST insiders have traded $N/A stock on the open market 80 times in the past 6 months. Of those trades, 68 have been purchases and 12 have been sales.

Here’s a breakdown of recent trading of $N/A stock by insiders over the last 6 months:

- FINANCIAL SERVICES INC PRINCIPAL has made 0 purchases and 3 sales selling 9,732,946 shares for an estimated $256,784,072.

- LIFE REINSURANCE LTD MANUFACTURERS has made 12 purchases buying 5,995,314 shares for an estimated $103,000,109 and 0 sales.

- (INTERNATIONAL) LTD MANULIFE has made 6 purchases buying 4,525,624 shares for an estimated $83,000,042 and 0 sales.

- PRIVATE CREDIT PLUS FUND MANULIFE has made 3 purchases buying 3,614,862 shares for an estimated $74,994,258 and 0 sales.

- EDWARD A MULE (Chairman and CEO) has made 1 purchase buying 1,298,060 shares for an estimated $18,484,374 and 1 sale selling 3,964,539 shares for an estimated $56,455,035.

- GROUP PRIVATE EQUITY II, LLC PARTNERS sold 22,265,764 shares for an estimated $50,097,969

- GROUP FINANCE USD IC LTD PARTNERS has made 3 purchases buying 24,606,650 shares for an estimated $45,935,768 and 0 sales.

- HANCOCK STABLE VALUE FUND COLLECTIVE INVESTMENT TRUST JOHN purchased 2,216,748 shares for an estimated $44,999,984

- LIFE INSURANCE CO (BERMUDA BRANCH) MANUFACTURERS has made 9 purchases buying 2,487,210 shares for an estimated $41,000,067 and 0 sales.

- RESOURCES INC FRANKLIN sold 1,519,097 shares for an estimated $17,499,999

- CALIFORNIA EMPLOYERS JOINT PENSION PLAN UFCW-NORTHERN has made 0 purchases and 5 sales selling 572,890 shares for an estimated $8,676,384.

- RETIREMENT SYSTEM OF THE STATE OF HAWAII EMPLOYEES' purchased 319,786 shares for an estimated $4,800,000

- CHRISTOPHER ZOOK has made 4 purchases buying 55,518 shares for an estimated $1,355,242 and 0 sales.

- BRYAN WEEKS purchased 39,777 shares for an estimated $999,993

- BRAD ALLEN (Treasurer) has made 4 purchases buying 5,706 shares for an estimated $563,400 and 0 sales.

- BRIAN WATKINS purchased 45,691 shares for an estimated $524,999

- DAREN SHAW purchased 5,060 shares for an estimated $500,000

- TAYLOR NADAULD purchased 39,651 shares for an estimated $499,999

- JOSEPH M OTTING has made 2 purchases buying 23,422 shares for an estimated $359,189 and 0 sales.

- RICHARD H. SCHAUPP has made 2 purchases buying 25,951 shares for an estimated $300,000 and 0 sales.

- HELEN YANKILEVICH (Chief Operating Officer) has made 2 purchases buying 102,540 shares for an estimated $198,999 and 0 sales.

- TYLER MAYFIELD purchased 7,675 shares for an estimated $193,410

- ANTHONY JOSEPH DINELLO (President) sold 13,469 shares for an estimated $191,798

- TIMOTHY WARRICK purchased 12,644 shares for an estimated $131,250

- MATTHEW DARRAH purchased 10,500 shares for an estimated $108,999

- RADIN AHMADIAN (Secretary) purchased 19,554 shares for an estimated $99,923

- ALAN L FRANK has made 2 purchases buying 6,260 shares for an estimated $96,000 and 0 sales.

- CHARLIE ROSE (President and Lead PM) purchased 2,500 shares for an estimated $63,942

- MARK BUFFINGTON (Chief Executive Officer) purchased 1,508 shares for an estimated $50,005

- SALVATORE DONA (Chief Financial Officer) purchased 1,980 shares for an estimated $50,000

- JOSH SCHNURMAN (Treasurer) purchased 8,784 shares for an estimated $49,999

- BRENT JENKINS purchased 4,321 shares for an estimated $49,999

- JANIS MANDARINO purchased 2,592 shares for an estimated $30,000

- AARON KLESS (Chief Executive Officer) has made 2 purchases buying 390 shares for an estimated $5,986 and 0 sales.

FIRST FINANCIAL CORP /IN/ ($THFF)

McDonald James O bought 2,295 shares on 10/13 for an estimated $119,913.

Past $THFF Insider Trades

FIRST FINANCIAL CORP /IN/ insiders have traded $THFF stock on the open market 8 times in the past 6 months. Of those trades, 8 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $THFF stock by insiders over the last 6 months:

- JAMES O MCDONALD purchased 2,295 shares for an estimated $119,913

- WILLIAM RANDOLPH KRIEBLE has made 3 purchases buying 440 shares for an estimated $21,160 and 0 sales.

- MARK JASON SR BLADE purchased 202 shares for an estimated $9,916

- SUSAN M JENSEN has made 3 purchases buying 101 shares for an estimated $5,010 and 0 sales.

EAGLE CAPITAL GROWTH FUND, INC. ($GRF)

Sims David C (CFO, CCO, Secretary, Treasurer) bought 3,000 shares on 10/15 for an estimated $31,650.

Past $GRF Insider Trades

EAGLE CAPITAL GROWTH FUND, INC. insiders have traded $GRF stock on the open market 16 times in the past 6 months. Of those trades, 12 have been purchases and 4 have been sales.

Here’s a breakdown of recent trading of $GRF stock by insiders over the last 6 months:

- DAVID C SIMS (CFO, CCO, Secretary, Treasurer) has made 10 purchases buying 15,385 shares for an estimated $158,061 and 0 sales.

- LUKE E SIMS (President & CEO) has made 2 purchases buying 6,600 shares for an estimated $64,370 and 0 sales.

- DONALD G TYLER has made 0 purchases and 4 sales selling 5,850 shares for an estimated $58,672.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

Senator Markey and colleagues urge adherence to the New START Treaty with Russia to prevent nuclear arms escalation.

Quiver AI Summary

Senator Edward Markey and a bipartisan group of lawmakers have urged Secretary of State Marco Rubio to ensure the Trump administration continues adherence to the New Strategic Arms Reduction Treaty (New START) with Russia, set to expire on February 5, 2026. They warn that without action, there will be no limits on U.S. and Russian nuclear forces.

The lawmakers emphasized that "time is running short" and noted Russia's willingness to adhere to New START limits, calling for an interim understanding to prevent an arms race. They referenced President Trump’s acknowledgment of the treaty's importance in maintaining global security.

Markey, along with other Senators and Representatives, highlighted past resolutions and efforts aimed at recommitting to nuclear arms control and expressed concern over the risks associated with an unconstrained arms race, advocating for both informal and formal agreements between the nations.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Edward J. Markey Bill Proposals

Here are some bills which have recently been proposed by Edward J. Markey:

- S.2997: A bill to protect the independent judgment of health care professionals acting in the scope of their practice in overriding AI/CDSS outputs, and for other purposes.

- S.2989: A bill to prohibit certain sales or leases of real property for a health care entity if the terms of such a sale or lease would lead to long-term weakened financial status of the health care entity or place the public health at risk, and for other purposes.

- S.2930: Smarter Approaches to Nuclear Expenditures Act

- S.2905: Pipeline Accountability Act of 2025

- S.2892: Jumpstart on College Act

- S.2890: GREEN Streets Act

You can track bills proposed by Edward J. Markey on Quiver Quantitative's politician page for Markey.

Edward J. Markey Fundraising

Edward J. Markey recently disclosed $508.8K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 160th most from all Q3 reports we have seen this year. 82.5% came from individual donors.

Markey disclosed $634.2K of spending. This was the 64th most from all Q3 reports we have seen from politicians so far this year.

Markey disclosed $2.7M of cash on hand at the end of the filing period. This was the 123rd most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Edward J. Markey's fundraising on Quiver Quantitative.

Senators Kaine, Paul, and Schiff introduce a resolution to prevent unauthorized military action in Venezuela.

Quiver AI Summary

U.S. Senators Tim Kaine, Rand Paul, and Adam Schiff have introduced a War Powers Resolution aimed at preventing unauthorized military action in Venezuela. The resolution is prompted by reports that the Trump Administration may consider land strikes in the country without congressional authorization.

Kaine expressed concern about potential illegal military actions, emphasizing the need for Congress to authorize any military use. Paul added that the American public desires a discussion before engaging in warfare, while Schiff noted the increasing threats of military action undermine constitutional authorization.

The resolution aligns with prior efforts from Kaine and Schiff regarding military strikes in the southern Caribbean that lacked congressional approval, though previous attempts for similar measures were blocked.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Tim Kaine Net Worth

Quiver Quantitative estimates that Tim Kaine is worth $2.2M, as of October 17th, 2025. This is the 244th highest net worth in Congress, per our live estimates.

Kaine has approximately $807.1K invested in publicly traded assets which Quiver is able to track live.

You can track Tim Kaine's net worth on Quiver Quantitative's politician page for Kaine.

Tim Kaine Bill Proposals

Here are some bills which have recently been proposed by Tim Kaine:

- S.2966: Emergency Relief for Federal Workers Act of 2025

- S.2827: Fair Housing Improvement Act of 2025

- S.2708: Appalachian Trail Centennial Act

- S.2578: Strengthening the Rule of Law in the Brazilian Amazon Act

- S.2513: OTC Monograph Drug User Fee Transparency Act

- S.2490: Strengthening Advocacy for Long-Term Care Residents Act

You can track bills proposed by Tim Kaine on Quiver Quantitative's politician page for Kaine.

Tim Kaine Fundraising

Tim Kaine recently disclosed $99.6K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 708th most from all Q3 reports we have seen this year. 85.9% came from individual donors.

Kaine disclosed $119.8K of spending. This was the 506th most from all Q3 reports we have seen from politicians so far this year.

Kaine disclosed $2.3M of cash on hand at the end of the filing period. This was the 150th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Tim Kaine's fundraising on Quiver Quantitative.

Rep. Mark Takano introduced bills to halt White House ballroom renovations during shutdown and limit private donor naming rights.

Quiver AI Summary

Representative Mark Takano (CA-39) has introduced two bills aimed at halting White House ballroom renovations during government shutdowns and regulating the display of private donors' names on White House property. The proposed "BALL" Act would prohibit federal funds for renovations during shutdowns, while the "NOT FOR SALE" Act would require congressional approval for donor recognition on White House grounds.

Takano criticized the planned $200 million ballroom construction, asserting, "The White House belongs to the people," and emphasizing that naming rights should be reserved for significant public figures, not wealthy donors. He claims the bills seek to address accountability in government spending and preserve the integrity of the White House.

For more information, the complete texts of both proposed acts are available on Takano's official website.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Mark Takano Net Worth

Quiver Quantitative estimates that Mark Takano is worth $332.0K, as of October 17th, 2025. This is the 426th highest net worth in Congress, per our live estimates.

Takano has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Mark Takano's net worth on Quiver Quantitative's politician page for Takano.

Mark Takano Bill Proposals

Here are some bills which have recently been proposed by Mark Takano:

- H.R.5723: To amend title 38, United States Code, to require the Secretary of Veterans Affairs to identify and report instances of fraud with respect to disability benefit questionnaire forms of the Department of Veterans Affairs, and for other purposes.

- H.R.5535: Veteran Service Recognition Act of 2025

- H.R.4114: EVEST Act

- H.R.4001: Prohibition on Funding to CECOT Act

- H.R.3261: VA Employee Fairness Act of 2025

- H.R.2963: FAIR Veterans Act of 2025

You can track bills proposed by Mark Takano on Quiver Quantitative's politician page for Takano.

Mark Takano Fundraising

Mark Takano recently disclosed $137.9K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 612th most from all Q3 reports we have seen this year. 51.8% came from individual donors.

Takano disclosed $179.9K of spending. This was the 336th most from all Q3 reports we have seen from politicians so far this year.

Takano disclosed $186.5K of cash on hand at the end of the filing period. This was the 776th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Mark Takano's fundraising on Quiver Quantitative.

Congressman Vern Buchanan praises the decision to delay a UN global carbon tax vote, citing U.S. pressure and its economic implications.

Quiver AI Summary

Congressman Vern Buchanan announced the postponement of a vote on a global carbon tax by the International Maritime Organization (IMO), attributing the delay to U.S. pressure against the proposal. He described the decision as a victory for American businesses and warned that the tax could impose unfair costs on shipping and trade, particularly benefiting China.

Buchanan expressed gratitude to U.S. officials for their efforts and emphasized that the delay allows for further opposition to this "inflationary policy." He previously criticized the tax as part of China's strategy in the global shipbuilding sector and advocated for its rejection in a letter to the U.S. Trade Representative.

This anticipated tax would have been the first of its kind and aims to address carbon emissions from maritime vessels, but Buchanan argues it could distort global trade and harm U.S. economic interests.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Vern Buchanan Net Worth

Quiver Quantitative estimates that Vern Buchanan is worth $261.5M, as of October 17th, 2025. This is the 6th highest net worth in Congress, per our live estimates.

Buchanan has approximately $4.5M invested in publicly traded assets which Quiver is able to track live.

You can track Vern Buchanan's net worth on Quiver Quantitative's politician page for Buchanan.

Vern Buchanan Bill Proposals

Here are some bills which have recently been proposed by Vern Buchanan:

- H.R.5347: Health Care Efficiency Through Flexibility Act

- H.R.4974: DETECT Act of 2025

- H.R.4548: Small Nonprofit Retirement Security Act of 2025

- H.R.4313: Hospital Inpatient Services Modernization Act

- H.R.3904: U.S. Bicycle Production and Assembly Act

- H.R.3750: FORCE-FIT Act

You can track bills proposed by Vern Buchanan on Quiver Quantitative's politician page for Buchanan.

Vern Buchanan Fundraising

Vern Buchanan recently disclosed $140.3K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 608th most from all Q3 reports we have seen this year. 20.9% came from individual donors.

Buchanan disclosed $118.0K of spending. This was the 518th most from all Q3 reports we have seen from politicians so far this year.

Buchanan disclosed $1.5M of cash on hand at the end of the filing period. This was the 246th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Vern Buchanan's fundraising on Quiver Quantitative.

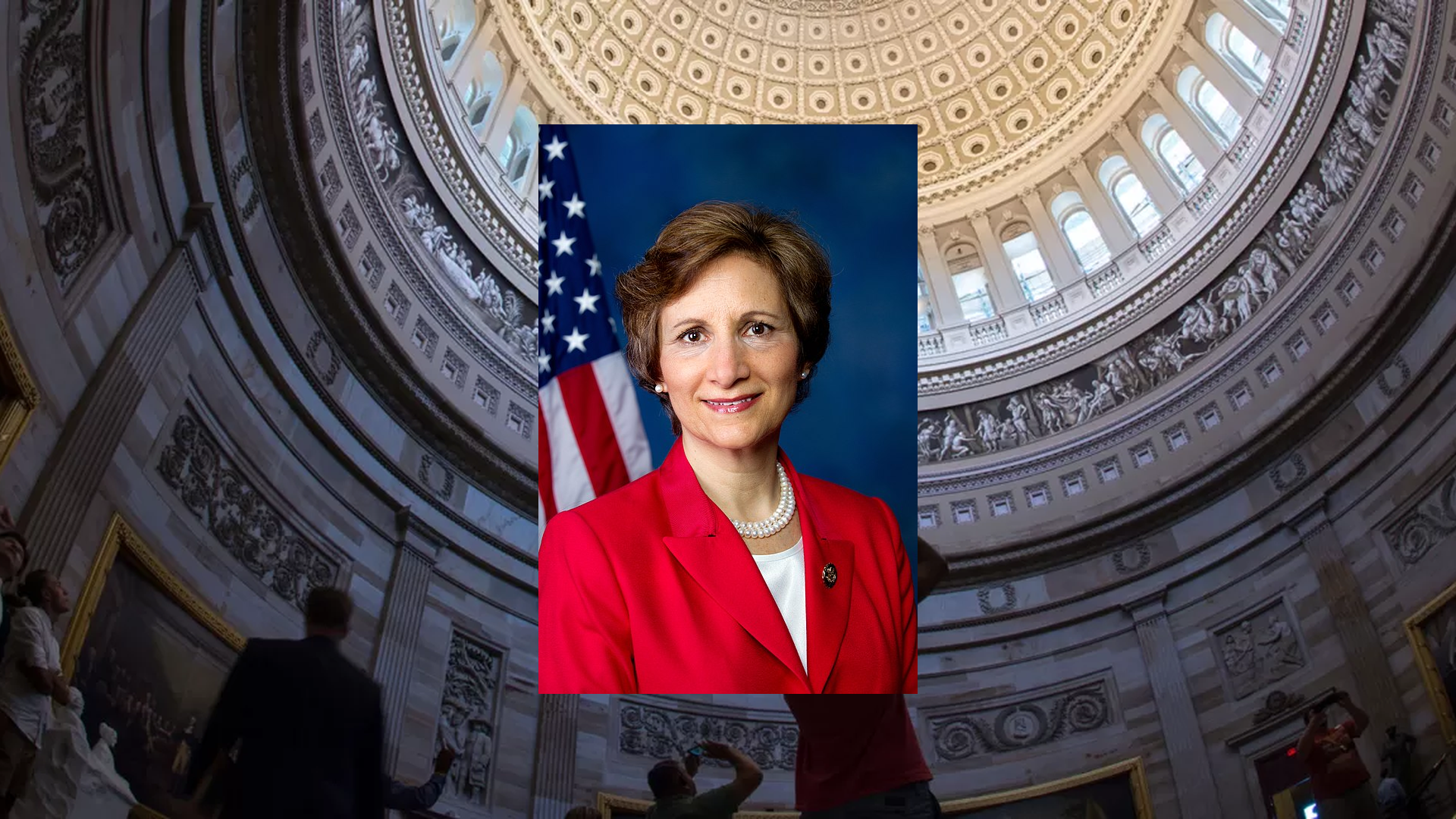

Congresswoman Miller-Meeks commends the Trump Administration for ensuring nutrition assistance for Iowa families during the government shutdown.

Quiver AI Summary

Congresswoman Mariannette Miller-Meeks (IA-01) praised the Trump Administration for its actions to maintain nutrition assistance for Iowa families during the ongoing government shutdown. Along with her colleagues, she sent a letter to Secretary of Agriculture Brooke Rollins acknowledging efforts to ensure continued funding for the WIC program, which serves over 62,000 participants in Iowa.

Miller-Meeks stated, “Iowa Families who depend on WIC should never have to worry about whether they can afford formula, food, or diapers because Democrats decided healthcare for illegal immigrants was more important.” The letter noted that the Administration has utilized available funding sources despite Senate Democrats voting against proposals to keep the government open.

“Families should not bear the consequences of inaction in Washington,” Miller-Meeks emphasized, advocating for critical nutrition programs. The letter to Secretary Rollins can be accessed online for further details.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Mariannette Miller-Meeks Net Worth

Quiver Quantitative estimates that Mariannette Miller-Meeks is worth $1.8M, as of October 17th, 2025. This is the 264th highest net worth in Congress, per our live estimates.

Miller-Meeks has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Mariannette Miller-Meeks's net worth on Quiver Quantitative's politician page for Miller-Meeks.

Mariannette Miller-Meeks Bill Proposals

Here are some bills which have recently been proposed by Mariannette Miller-Meeks:

- H.R.4895: Afghan Adjustment Act

- H.R.4764: Biochar Research Network Act of 2025

- H.R.4707: To designate the facility of the United States Postal Service located at 1019 Avenue H in Fort Madison, Iowa, as the "Martin L. Graber Post Office".

- H.R.4518: Cooper Davis and Devin Norring Act

- H.R.4194: Limiting Liability for Critical Infrastructure Manufacturers Act

- H.R.3726: Fisher House Availability Act of 2025

You can track bills proposed by Mariannette Miller-Meeks on Quiver Quantitative's politician page for Miller-Meeks.

Mariannette Miller-Meeks Fundraising

Mariannette Miller-Meeks recently disclosed $628.5K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 104th most from all Q3 reports we have seen this year. 61.9% came from individual donors.

Miller-Meeks disclosed $305.1K of spending. This was the 178th most from all Q3 reports we have seen from politicians so far this year.

Miller-Meeks disclosed $2.6M of cash on hand at the end of the filing period. This was the 126th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Mariannette Miller-Meeks's fundraising on Quiver Quantitative.

Congresswoman Rosa DeLauro requests information from ICE about an immigration raid in Hamden on October 15, 2025.

Quiver AI Summary

Congresswoman Rosa DeLauro (CT-03) has written to Acting Director Todd M. Lyons of U.S. Immigration and Customs Enforcement (ICE), seeking clarity on an immigration raid that occurred in Hamden on October 15, 2025. In her letter, she emphasizes that "everyone in the United States is entitled to due process under the law."

DeLauro expresses concerns that the "aggressive tactics" employed during such raids have heightened community tensions and fostered distrust towards law enforcement. She asserts that these actions have not contributed to community safety.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Rosa L. DeLauro Net Worth

Quiver Quantitative estimates that Rosa L. DeLauro is worth $3.2M, as of October 17th, 2025. This is the 213th highest net worth in Congress, per our live estimates.

DeLauro has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Rosa L. DeLauro's net worth on Quiver Quantitative's politician page for DeLauro.

Rosa L. DeLauro Bill Proposals

Here are some bills which have recently been proposed by Rosa L. DeLauro:

- H.R.5450: Continuing Appropriations and Extensions and Other Matters Act, 2026

- H.R.5390: FAMILY Act

- H.R.4648: Access to Fertility Treatment and Care Act

- H.R.4647: Captain Paul W. Bud Bucha VA Medical Center Act of 2025

- H.R.4557: BEACON Act

- H.R.4253: Expanding Access to Mental Health Services in Schools Act of 2025

You can track bills proposed by Rosa L. DeLauro on Quiver Quantitative's politician page for DeLauro.

Rosa L. DeLauro Fundraising

Rosa L. DeLauro recently disclosed $147.0K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 592nd most from all Q3 reports we have seen this year. 48.0% came from individual donors.

DeLauro disclosed $122.9K of spending. This was the 493rd most from all Q3 reports we have seen from politicians so far this year.

DeLauro disclosed $252.3K of cash on hand at the end of the filing period. This was the 699th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Rosa L. DeLauro's fundraising on Quiver Quantitative.

Rep. Mike Kennedy and Senators Lee and Curtis introduced a bill to enhance water storage in Price, Utah.

Quiver AI Summary

Representative Mike Kennedy (R-UT) and Senators Mike Lee and John Curtis have introduced the Upper Price River Watershed Project Act, proposing the transfer of 124 acres of Bureau of Land Management land to the City of Price. This land will be used to construct a reservoir aimed at boosting water storage and enhancing drought resilience in central Utah.

With nearly 80% of Utah experiencing severe or extreme drought, the reservoir, which will hold 7,000 acre-feet of water, is expected to support local agriculture and stabilize water supplies. This initiative is characterized as a practical solution to ongoing water shortages affecting communities in the state.

Key provisions of the act include the land transfer to Price for public water infrastructure purposes and the construction of the reservoir along with rerouting a local road. Supporters emphasize the importance of proactive water policies for Utah's future.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Mike Kennedy Net Worth

Quiver Quantitative estimates that Mike Kennedy is worth $1.4M, as of October 17th, 2025. This is the 293rd highest net worth in Congress, per our live estimates.

Kennedy has approximately $27.6K invested in publicly traded assets which Quiver is able to track live.

You can track Mike Kennedy's net worth on Quiver Quantitative's politician page for Kennedy.

Mike Kennedy Bill Proposals

Here are some bills which have recently been proposed by Mike Kennedy:

- H.R.5752: Upper Price River Watershed Project Act of 2025

- H.R.5639: Co-Location Energy Act

- H.R.5638: Geothermal Royalty Reform Act

- H.R.5637: No Work, No Pay Act of 2025

- H.R.5636: Protect Consumers from Reallocation Costs Act of 2025

- H.R.5585: Equal Detention Standards Act of 2025

You can track bills proposed by Mike Kennedy on Quiver Quantitative's politician page for Kennedy.

Mike Kennedy Fundraising

Mike Kennedy recently disclosed $0 of fundraising in a Q3 FEC disclosure filed on October 3rd, 2025. This was the 1454th most from all Q3 reports we have seen this year. nan% came from individual donors.

Kennedy disclosed $0.0 of spending. This was the 1801st most from all Q3 reports we have seen from politicians so far this year.

Kennedy disclosed $0 of cash on hand at the end of the filing period. This was the 2067th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Mike Kennedy's fundraising on Quiver Quantitative.

Congressman Krishnamoorthi demands DHS accountability over detention oversight suspension and journalist mistreatment during the government shutdown.

Quiver AI Summary

Congressman Raja Krishnamoorthi sent two letters to Homeland Security Secretary Kristi Noem, seeking accountability regarding the Department of Homeland Security's (DHS) operations during the ongoing government shutdown. He highlighted the furlough of the Office of Detention Oversight and raised concerns about journalists' treatment during immigration enforcement actions.

Krishnamoorthi criticized the furlough of detention oversight personnel while DHS continued most enforcement operations, stating that “suspending this critical oversight function... is indefensible." He also expressed concern over reported mistreatment of journalists, citing instances of violence against reporters covering events at the Broadview ICE facility.

In his letters, the Congressman requested details from DHS regarding personnel furloughs and proposed measures to uphold press freedoms and accountability during enforcement actions. He emphasized that “oversight and transparency are not optional; they are essential for maintaining public trust in the U.S. government.”

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Raja Krishnamoorthi Net Worth

Quiver Quantitative estimates that Raja Krishnamoorthi is worth $3.9M, as of October 17th, 2025. This is the 191st highest net worth in Congress, per our live estimates.

Krishnamoorthi has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Raja Krishnamoorthi's net worth on Quiver Quantitative's politician page for Krishnamoorthi.

Raja Krishnamoorthi Bill Proposals

Here are some bills which have recently been proposed by Raja Krishnamoorthi:

- H.R.5434: 988 LGBTQ+ Youth Access Act of 2025

- H.R.5043: Bringing Benefits Back Act of 2025

- H.R.5022: No Advanced Chips for the CCP Act of 2025.

- H.R.4890: Ending Trading and Holdings in Congressional Stocks (ETHICS) Act

- H.R.4806: College Transparency Act

- H.R.4688: COOL OFF Act

You can track bills proposed by Raja Krishnamoorthi on Quiver Quantitative's politician page for Krishnamoorthi.

Raja Krishnamoorthi Fundraising

Raja Krishnamoorthi recently disclosed $0 of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 1454th most from all Q3 reports we have seen this year. nan% came from individual donors.

Krishnamoorthi disclosed $9.1M of spending. This was the most from all Q3 reports we have seen from politicians so far this year.

Krishnamoorthi disclosed $276.0K of cash on hand at the end of the filing period. This was the 678th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Raja Krishnamoorthi's fundraising on Quiver Quantitative.

Congressman Jimmy Patronis issues a travel advisory for Floridians to avoid Washington, D.C. amid planned protests.

Quiver AI Summary

In a virtual press conference, Congressman Jimmy Patronis issued a travel advisory for Floridians heading to Washington, D.C., in light of the upcoming “No Kings Day” demonstrations. He warned that these protests may include pro-Hamas and Antifa participants, which he claims are associated with past riots and anti-American sentiment.

Patronis described the situation in Washington as a "political circus" linked to the ongoing Schumer Shutdown and advised against traveling to the city during the protests. He described the demonstrations as "Hate America Parades" and urged attendees to prioritize their safety by avoiding the area altogether.

He also called for prayers for the nation as Americans endure the ramifications of the government closure and expressed concerns regarding the impact of such protests on public safety. Patronis concluded by emphasizing the need for leadership that prioritizes the well-being of citizens over political agendas.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Jimmy Patronis Bill Proposals

Here are some bills which have recently been proposed by Jimmy Patronis:

- H.R.5095: HOMEFRONT Act of 2025

- H.R.5035: Veteran and Spouse Licensing Flexibility Act of 2025

- H.R.5029: Blue Angels Act

- H.R.4873: To codify Executive Order 14319 (relating to preventing woke AI in the Federal Government).

- H.R.3902: Restoring Federalism in Clean Water Permitting Act

You can track bills proposed by Jimmy Patronis on Quiver Quantitative's politician page for Patronis.

Rep. Ro Khanna introduces a resolution for ICE reform, enhancing oversight and accountability in immigration enforcement.

Quiver AI Summary

Rep. Ro Khanna has introduced the ICE Oversight and Reform Resolution aimed at promoting transparency and accountability in immigration enforcement. He expressed concern over recent ICE practices, stating, "These tactics are about avoiding accountability." The resolution includes mandates for body cameras, officer identification, and independent oversight boards.

Endorsed by organizations such as Hindus for Human Rights, the resolution demands improvements in operational standards for ICE and CBP personnel, including mandatory de-escalation training. The initiative has garnered support from various lawmakers, emphasizing the need for civil rights protections in immigration enforcement.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Ro Khanna Bill Proposals

Here are some bills which have recently been proposed by Ro Khanna:

- H.R.5516: No Coffee Tax Act

- H.R.5400: To amend title 10, United States Code, to require the Secretary of Defense to annually review the amount of financial assistance for child care and youth program services providers provided by the Secretary.

- H.R.5193: To direct the Chairman of the Joint Chiefs of Staff to conduct a feasibility study on incorporating militarily-relevant applications of emerging biotechnology into wargaming exercises, and for other purposes.

- H.R.5192: To modify the annual report on the Navy Shipyard Infrastructure Optimization Program.

- H.R.5191: To direct the Under Secretary of Defense for Research and Engineering to issue guidance for private entities on demonstrating how biobased products meet Department of Defense requirements, and for other purposes.

- H.R.5190: To expand the contested logistics demonstration and prototyping program to include commercial additive manufacturing facilities in contested logistics environments, and for other purposes.

You can track bills proposed by Ro Khanna on Quiver Quantitative's politician page for Khanna.

Ro Khanna Fundraising

Ro Khanna recently disclosed $1.7M of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 25th most from all Q3 reports we have seen this year. 100.0% came from individual donors.

Khanna disclosed $1.1M of spending. This was the 29th most from all Q3 reports we have seen from politicians so far this year.

Khanna disclosed $14.7M of cash on hand at the end of the filing period. This was the 8th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Ro Khanna's fundraising on Quiver Quantitative.

Pablo José Hernández hosted a phone town hall, engaging over 6,600 constituents about the federal government shutdown.

Quiver AI Summary

Pablo José Hernández, the Resident Commissioner, hosted a tele-town hall meeting to address concerns regarding the federal government shutdown, attended by over 6,600 constituents across Puerto Rico. The event aimed to provide updates on the shutdown's impact and to allow residents to ask questions directly.

Hernández explained that the tele-town hall serves as a tool for connection and information dissemination, emphasizing his commitment to ensuring Puerto Ricans are informed about how the shutdown affects jobs and services. The event also included participation from representatives of the National Treasury Employees Union, highlighting the uncertainty faced by federal workers.

The discussion focused on various essential programs affected by the shutdown, such as social services and military readiness. Hernández reiterated his dedication to advocating for fair treatment and job stability for federal workers and expressed his willingness to continue engaging with constituents for clarity and support.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Pablo Hernández Net Worth

Quiver Quantitative estimates that Pablo Hernández is worth $446.2K, as of October 17th, 2025. This is the 403rd highest net worth in Congress, per our live estimates.

Hernández has approximately $165.7K invested in publicly traded assets which Quiver is able to track live.

You can track Pablo Hernández's net worth on Quiver Quantitative's politician page for Hernández.

Pablo Hernández Bill Proposals

Here are some bills which have recently been proposed by Pablo Hernández:

- H.R.5464: Net Metering Protection Act

- H.R.5432: Puerto Rico Energy Oversight and Accountability Act

- H.R.5395: Disaster Relief Disbursement Accountability Act

- H.R.5168: Puerto Rico Nutrition Assistance Fairness Act

- H.R.3814: Puerto Rico BEACHES Act

- H.R.3238: HABLA Act of 2025

You can track bills proposed by Pablo Hernández on Quiver Quantitative's politician page for Hernández.

Pablo Hernández Fundraising

Pablo Hernández recently disclosed $83.3K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 755th most from all Q3 reports we have seen this year. 75.4% came from individual donors.

Hernández disclosed $114.4K of spending. This was the 529th most from all Q3 reports we have seen from politicians so far this year.

Hernández disclosed $138.4K of cash on hand at the end of the filing period. This was the 847th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Pablo Hernández's fundraising on Quiver Quantitative.

Senator Grassley's report covers topics including the Israel-Hamas ceasefire, aid for farmers, and a Supreme Court case.

Quiver AI Summary

In the latest Capitol Hill Report dated October 15, 2025, Senator Chuck Grassley addresses key issues, including the Israel-Hamas ceasefire, financial aid for farmers, the potential government shutdown, and an upcoming U.S. Supreme Court case concerning the Voting Rights Act. More information can be found in the full report.

Grassley's report emphasizes the significance of these topics to current political discourse, stating, "These issues are critical for our national wellbeing and the livelihood of many Americans." The report seeks to inform constituents about ongoing legislative matters and their implications.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Chuck Grassley Net Worth

Quiver Quantitative estimates that Chuck Grassley is worth $6.2M, as of October 17th, 2025. This is the 147th highest net worth in Congress, per our live estimates.

Grassley has approximately $71.4K invested in publicly traded assets which Quiver is able to track live.

You can track Chuck Grassley's net worth on Quiver Quantitative's politician page for Grassley.

Chuck Grassley Bill Proposals

Here are some bills which have recently been proposed by Chuck Grassley:

- S.2928: H–1B and L–1 Visa Reform Act of 2025

- S.2808: Fertilizer Research Act of 2025

- S.2800: Pharmacy and Medically Underserved Areas Enhancement Act

- S.2710: Open Payments Expansion Act

- S.2677: A bill to expand the sharing of information with respect to suspected violations of intellectual property rights in trade.

- S.2649: Psychiatric Hospital Inspection Transparency Act of 2025

You can track bills proposed by Chuck Grassley on Quiver Quantitative's politician page for Grassley.

Chuck Grassley Fundraising

Chuck Grassley recently disclosed $42.8K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 876th most from all Q3 reports we have seen this year. 91.8% came from individual donors.

Grassley disclosed $57.4K of spending. This was the 750th most from all Q3 reports we have seen from politicians so far this year.

Grassley disclosed $307.1K of cash on hand at the end of the filing period. This was the 655th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Chuck Grassley's fundraising on Quiver Quantitative.

Oregon lawmakers demand withdrawal of federal agents in Portland, citing excessive force and escalating violence during protests.

Quiver AI Summary

Oregon Democratic lawmakers, including Senators Ron Wyden and Jeff Merkley and Representatives Suzanne Bonamici, Janelle Bynum, and Maxine Dexter, have called for the withdrawal of federal agents outside the ICE facility in Portland. They argue that the agents’ actions, including excessive use of tear gas, have escalated violence rather than prevented it.

The lawmakers highlighted concerns raised by local constituents about the use of force against peaceful protestors and the impact on nearby schools and residential areas. They emphasized past incidents of excessive force by DHS agents and requested detailed information from Homeland Security about the federal presence in the area.

In their letter to Homeland Security, they asked for replies to questions about the agents’ deployment, authority, equipment used, and training by October 17, 2025. They expressed concerns about the environmental effects of chemical agents used during these incidents, including reported health issues among those exposed.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Suzanne Bonamici Net Worth

Quiver Quantitative estimates that Suzanne Bonamici is worth $10.3M, as of October 17th, 2025. This is the 103rd highest net worth in Congress, per our live estimates.

Bonamici has approximately $326.0K invested in publicly traded assets which Quiver is able to track live.

You can track Suzanne Bonamici's net worth on Quiver Quantitative's politician page for Bonamici.

Suzanne Bonamici Bill Proposals

Here are some bills which have recently been proposed by Suzanne Bonamici:

- H.R.5373: Alan Reinstein Ban Asbestos Now Act of 2025

- H.R.5297: PARTNERS Act

- H.R.5296: BUILDS Act

- H.R.5295: ACCESS Act

- H.R.5104: Preventing HEAT Illness and Deaths Act of 2025

- H.R.4477: PRICE Act

You can track bills proposed by Suzanne Bonamici on Quiver Quantitative's politician page for Bonamici.

Suzanne Bonamici Fundraising

Suzanne Bonamici recently disclosed $115.7K of fundraising in a Q3 FEC disclosure filed on October 14th, 2025. This was the 651st most from all Q3 reports we have seen this year. 60.2% came from individual donors.

Bonamici disclosed $106.4K of spending. This was the 550th most from all Q3 reports we have seen from politicians so far this year.

Bonamici disclosed $516.8K of cash on hand at the end of the filing period. This was the 516th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Suzanne Bonamici's fundraising on Quiver Quantitative.

We just received data on a new analyst forecast for $RGA. Raymond James gave a rating of 'Underperform' for $RGA.

$RGA Analyst Ratings

Wall Street analysts have issued reports on $RGA in the last several months. We have seen 2 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- Raymond James issued a "Underperform" rating on 10/17/2025

- Keefe, Bruyette & Woods issued a "Outperform" rating on 05/07/2025

- Wells Fargo issued a "Overweight" rating on 05/06/2025

To track analyst ratings and price targets for $RGA, check out Quiver Quantitative's $RGA forecast page.

$RGA Price Targets

Multiple analysts have issued price targets for $RGA recently. We have seen 5 analysts offer price targets for $RGA in the last 6 months, with a median target of $246.0.

Here are some recent targets:

- Alex Scott from Barclays set a target price of $246.0 on 10/08/2025

- Nigel Dally from Morgan Stanley set a target price of $195.0 on 08/18/2025

- Elyse Greenspan from Wells Fargo set a target price of $241.0 on 08/04/2025

- Jimmy Bhullar from JP Morgan set a target price of $264.0 on 07/08/2025

- Ryan Krueger from Keefe, Bruyette & Woods set a target price of $255.0 on 05/07/2025

$RGA Hedge Fund Activity

We have seen 257 institutional investors add shares of $RGA stock to their portfolio, and 325 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ROCKEFELLER CAPITAL MANAGEMENT L.P. removed 680,017 shares (-77.2%) from their portfolio in Q2 2025, for an estimated $134,888,172

- ORION PORFOLIO SOLUTIONS, LLC added 592,748 shares (+6076.4%) to their portfolio in Q2 2025, for an estimated $117,577,493

- AMERICAN CENTURY COMPANIES INC added 532,891 shares (+35.2%) to their portfolio in Q2 2025, for an estimated $105,704,258

- NORDEA INVESTMENT MANAGEMENT AB added 480,435 shares (+534.1%) to their portfolio in Q2 2025, for an estimated $95,299,086

- ADAGE CAPITAL PARTNERS GP, L.L.C. added 350,000 shares (+inf%) to their portfolio in Q2 2025, for an estimated $69,426,000

- SQUAREPOINT OPS LLC removed 253,241 shares (-97.2%) from their portfolio in Q2 2025, for an estimated $50,232,884

- HARRIS ASSOCIATES L P added 243,041 shares (+11.4%) to their portfolio in Q2 2025, for an estimated $48,209,612

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $OZK. Raymond James gave a rating of 'Market Perform' for $OZK.

$OZK Analyst Ratings

Wall Street analysts have issued reports on $OZK in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- TD Cowen issued a "Buy" rating on 09/25/2025

To track analyst ratings and price targets for $OZK, check out Quiver Quantitative's $OZK forecast page.

$OZK Price Targets

Multiple analysts have issued price targets for $OZK recently. We have seen 6 analysts offer price targets for $OZK in the last 6 months, with a median target of $60.5.

Here are some recent targets:

- Timur Braziler from Wells Fargo set a target price of $50.0 on 09/29/2025

- Manan Gosalia from Morgan Stanley set a target price of $63.0 on 09/29/2025

- Janet Lee from TD Cowen set a target price of $67.0 on 09/25/2025

- Matt Olney from Stephens & Co. set a target price of $65.0 on 08/20/2025

- Daniel Tamayo from Raymond James set a target price of $58.0 on 07/08/2025

- Catherine Mealor from Keefe, Bruyette & Woods set a target price of $48.0 on 04/22/2025

$OZK Hedge Fund Activity

We have seen 241 institutional investors add shares of $OZK stock to their portfolio, and 216 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- WASATCH ADVISORS LP removed 1,715,073 shares (-23.7%) from their portfolio in Q2 2025, for an estimated $80,711,335

- VICTORY CAPITAL MANAGEMENT INC removed 1,013,447 shares (-75.7%) from their portfolio in Q2 2025, for an estimated $47,692,815

- WELLINGTON MANAGEMENT GROUP LLP added 873,242 shares (+39.6%) to their portfolio in Q2 2025, for an estimated $41,094,768

- CAPTRUST FINANCIAL ADVISORS removed 726,771 shares (-40.2%) from their portfolio in Q2 2025, for an estimated $34,201,843

- MACKENZIE FINANCIAL CORP added 501,308 shares (+767.1%) to their portfolio in Q2 2025, for an estimated $23,591,554

- MILLENNIUM MANAGEMENT LLC added 405,869 shares (+54.6%) to their portfolio in Q2 2025, for an estimated $19,100,195

- AQR CAPITAL MANAGEMENT LLC removed 400,232 shares (-14.3%) from their portfolio in Q2 2025, for an estimated $18,834,917

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $SSNC. Patrick O'Shaughnessy from Raymond James set a price target of 101.0 for SSNC.

To track analyst ratings and price targets for $SSNC, check out Quiver Quantitative's $SSNC forecast page.

$SSNC Price Targets

Multiple analysts have issued price targets for $SSNC recently. We have seen 6 analysts offer price targets for $SSNC in the last 6 months, with a median target of $100.5.

Here are some recent targets:

- Patrick O'Shaughnessy from Raymond James set a target price of $101.0 on 10/17/2025

- Kevin Mcveigh from UBS set a target price of $110.0 on 08/22/2025

- Peter Heckmann from DA Davidson set a target price of $102.0 on 07/25/2025

- Alexei Gogolev from JP Morgan set a target price of $94.0 on 07/24/2025

- James Faucette from Morgan Stanley set a target price of $88.0 on 07/24/2025

- Mayank Tandon from Needham set a target price of $100.0 on 07/24/2025

$SSNC Insider Trading Activity

$SSNC insiders have traded $SSNC stock on the open market 4 times in the past 6 months. Of those trades, 1 have been purchases and 3 have been sales.

Here’s a breakdown of recent trading of $SSNC stock by insiders over the last 6 months:

- MICHAEL JAY ZAMKOW has made 0 purchases and 3 sales selling 31,400 shares for an estimated $2,462,365.

- JONATHAN E MICHAEL purchased 2,700 shares for an estimated $203,935

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$SSNC Hedge Fund Activity

We have seen 333 institutional investors add shares of $SSNC stock to their portfolio, and 332 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- DIAMOND HILL CAPITAL MANAGEMENT INC removed 1,445,882 shares (-25.0%) from their portfolio in Q2 2025, for an estimated $119,719,029

- CAISSE DE DEPOT ET PLACEMENT DU QUEBEC added 1,117,583 shares (+233.8%) to their portfolio in Q2 2025, for an estimated $92,535,872

- BLACKROCK, INC. added 1,020,618 shares (+3.6%) to their portfolio in Q2 2025, for an estimated $84,507,170

- GREENHOUSE FUNDS LLLP removed 932,405 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $77,203,134

- FMR LLC added 900,039 shares (+24.7%) to their portfolio in Q2 2025, for an estimated $74,523,229

- ROBECO INSTITUTIONAL ASSET MANAGEMENT B.V. added 834,393 shares (+87.6%) to their portfolio in Q2 2025, for an estimated $69,087,740

- BOSTON PARTNERS removed 655,388 shares (-12.7%) from their portfolio in Q2 2025, for an estimated $54,266,126

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $CEU. Jonathan Goldman from Scotiabank set a price target of 10.25 for CEU.

To track analyst ratings and price targets for $CEU, check out Quiver Quantitative's $CEU forecast page.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $PSTG. Simon Leopold from Raymond James set a price target of 99.0 for PSTG.

To track analyst ratings and price targets for $PSTG, check out Quiver Quantitative's $PSTG forecast page.

$PSTG Price Targets

Multiple analysts have issued price targets for $PSTG recently. We have seen 16 analysts offer price targets for $PSTG in the last 6 months, with a median target of $80.0.

Here are some recent targets:

- Simon Leopold from Raymond James set a target price of $99.0 on 10/17/2025

- Pinjalim Bora from JP Morgan set a target price of $105.0 on 10/16/2025

- Howard Ma from Guggenheim set a target price of $105.0 on 09/26/2025

- Mike Cikos from Needham set a target price of $100.0 on 09/26/2025

- Aaron Rakers from Wells Fargo set a target price of $100.0 on 09/26/2025

- Amit Daryanani from Evercore ISI Group set a target price of $90.0 on 09/26/2025

- Tim Long from Barclays set a target price of $70.0 on 08/29/2025

$PSTG Congressional Stock Trading

Members of Congress have traded $PSTG stock 1 times in the past 6 months. Of those trades, 1 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $PSTG stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 06/17.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$PSTG Insider Trading Activity

$PSTG insiders have traded $PSTG stock on the open market 32 times in the past 6 months. Of those trades, 0 have been purchases and 32 have been sales.

Here’s a breakdown of recent trading of $PSTG stock by insiders over the last 6 months:

- JOHN COLGROVE (Chief Visionary Officer) has made 0 purchases and 17 sales selling 800,000 shares for an estimated $53,259,249.

- MONA CHU (Chief Accounting Officer) has made 0 purchases and 4 sales selling 44,045 shares for an estimated $3,602,806.

- AJAY SINGH (Chief Product Officer) has made 0 purchases and 3 sales selling 47,895 shares for an estimated $3,361,283.

- DAN FITZSIMONS (Chief Revenue Officer) has made 0 purchases and 5 sales selling 19,900 shares for an estimated $1,169,205.

- JOHN FRANCIS MURPHY has made 0 purchases and 2 sales selling 18,193 shares for an estimated $1,010,217.

- ROXANNE TAYLOR sold 3,000 shares for an estimated $230,790

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$PSTG Hedge Fund Activity

We have seen 368 institutional investors add shares of $PSTG stock to their portfolio, and 299 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ATREIDES MANAGEMENT, LP added 3,552,486 shares (+inf%) to their portfolio in Q2 2025, for an estimated $204,552,143

- WILLIAM BLAIR INVESTMENT MANAGEMENT, LLC added 2,612,300 shares (+112.9%) to their portfolio in Q2 2025, for an estimated $150,416,234

- VICTORY CAPITAL MANAGEMENT INC added 2,274,504 shares (+918.4%) to their portfolio in Q2 2025, for an estimated $130,965,940

- INVESCO LTD. removed 2,203,555 shares (-78.3%) from their portfolio in Q2 2025, for an estimated $126,880,696

- CITADEL ADVISORS LLC removed 2,171,603 shares (-93.9%) from their portfolio in Q2 2025, for an estimated $125,040,900

- AMUNDI removed 2,116,492 shares (-49.1%) from their portfolio in Q2 2025, for an estimated $121,867,609

- MORGAN STANLEY removed 1,677,787 shares (-32.8%) from their portfolio in Q2 2025, for an estimated $96,606,975

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $KRO. Duffy Fischer from Goldman Sachs set a price target of 6.0 for KRO.

To track analyst ratings and price targets for $KRO, check out Quiver Quantitative's $KRO forecast page.

$KRO Price Targets

Multiple analysts have issued price targets for $KRO recently. We have seen 2 analysts offer price targets for $KRO in the last 6 months, with a median target of $6.5.

Here are some recent targets:

- Duffy Fischer from Goldman Sachs set a target price of $6.0 on 10/17/2025

- Michael Leithead from Barclays set a target price of $7.0 on 05/28/2025

$KRO Insider Trading Activity

$KRO insiders have traded $KRO stock on the open market 9 times in the past 6 months. Of those trades, 9 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $KRO stock by insiders over the last 6 months:

- BART W REICHERT (Vice President, Internal Audit) purchased 20,000 shares for an estimated $99,200

- MICHAEL SHAWN SIMMONS (Vice Chairman of the Board) purchased 5,000 shares for an estimated $24,350

- ANDREW B NACE (Executive Vice President) has made 4 purchases buying 3,000 shares for an estimated $17,500 and 0 sales.

- AMY A. SAMFORD (Executive VP, Finance) purchased 3,000 shares for an estimated $14,475

- BRYAN A. HANLEY (Senior VP and Treasurer) purchased 2,500 shares for an estimated $12,250

- KRISTIN B MCCOY (Executive VP, Global Tax) purchased 2,000 shares for an estimated $12,100

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$KRO Hedge Fund Activity

We have seen 65 institutional investors add shares of $KRO stock to their portfolio, and 59 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- LUMINUS MANAGEMENT LLC removed 435,459 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $2,499,534

- ROYAL BANK OF CANADA added 263,005 shares (+15997.9%) to their portfolio in Q2 2025, for an estimated $1,630,631

- ADVISORS ASSET MANAGEMENT, INC. removed 204,301 shares (-48.4%) from their portfolio in Q2 2025, for an estimated $1,266,666

- BOSTON PARTNERS added 169,039 shares (+10.7%) to their portfolio in Q2 2025, for an estimated $1,048,041

- NUVEEN, LLC removed 121,845 shares (-43.6%) from their portfolio in Q2 2025, for an estimated $755,439

- EXODUSPOINT CAPITAL MANAGEMENT, LP removed 121,747 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $754,831

- RENAISSANCE TECHNOLOGIES LLC removed 120,900 shares (-15.9%) from their portfolio in Q2 2025, for an estimated $749,580

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $HUN. Duffy Fischer from Goldman Sachs set a price target of 9.0 for HUN.

To track analyst ratings and price targets for $HUN, check out Quiver Quantitative's $HUN forecast page.

$HUN Price Targets

Multiple analysts have issued price targets for $HUN recently. We have seen 11 analysts offer price targets for $HUN in the last 6 months, with a median target of $9.0.

Here are some recent targets:

- Duffy Fischer from Goldman Sachs set a target price of $9.0 on 10/17/2025

- Steve Byrne from B of A Securities set a target price of $8.0 on 10/14/2025

- Joshua Spector from UBS set a target price of $9.0 on 10/06/2025

- John Roberts from Mizuho set a target price of $8.0 on 10/03/2025

- Patrick Cunningham from Citigroup set a target price of $8.5 on 10/02/2025

- Laurence Alexander from Jefferies set a target price of $14.0 on 09/10/2025

- Michael Sison from Wells Fargo set a target price of $9.0 on 08/05/2025

$HUN Insider Trading Activity

$HUN insiders have traded $HUN stock on the open market 3 times in the past 6 months. Of those trades, 3 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $HUN stock by insiders over the last 6 months:

- PETER R HUNTSMAN (Chairman, President & CEO) has made 3 purchases buying 87,000 shares for an estimated $996,359 and 0 sales.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$HUN Hedge Fund Activity

We have seen 190 institutional investors add shares of $HUN stock to their portfolio, and 161 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ILEX CAPITAL PARTNERS (UK) LLP removed 2,900,632 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $30,224,585

- QUBE RESEARCH & TECHNOLOGIES LTD added 2,106,774 shares (+inf%) to their portfolio in Q2 2025, for an estimated $21,952,585

- SG AMERICAS SECURITIES, LLC added 1,762,896 shares (+1113.4%) to their portfolio in Q2 2025, for an estimated $18,369,376

- MORGAN STANLEY added 1,633,418 shares (+57.7%) to their portfolio in Q2 2025, for an estimated $17,020,215

- UBS GROUP AG added 1,608,999 shares (+66.9%) to their portfolio in Q2 2025, for an estimated $16,765,769

- DEPRINCE RACE & ZOLLO INC removed 1,519,118 shares (-39.4%) from their portfolio in Q3 2025, for an estimated $13,641,679

- PRINCIPAL FINANCIAL GROUP INC removed 1,376,304 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $14,341,087

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $KNTK. Brandon Bingham from Scotiabank set a price target of 51.0 for KNTK.

To track analyst ratings and price targets for $KNTK, check out Quiver Quantitative's $KNTK forecast page.

$KNTK Price Targets

Multiple analysts have issued price targets for $KNTK recently. We have seen 6 analysts offer price targets for $KNTK in the last 6 months, with a median target of $52.0.

Here are some recent targets:

- Brandon Bingham from Scotiabank set a target price of $51.0 on 10/17/2025

- Theresa Chen from Barclays set a target price of $40.0 on 10/08/2025

- Gabriel Moreen from Mizuho set a target price of $53.0 on 08/29/2025

- Elvira Scotto from RBC Capital set a target price of $55.0 on 05/30/2025

- Spiro Dounis from Citigroup set a target price of $55.0 on 05/20/2025

- Manav Gupta from UBS set a target price of $49.0 on 04/29/2025

$KNTK Insider Trading Activity

$KNTK insiders have traded $KNTK stock on the open market 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $KNTK stock by insiders over the last 6 months:

- GLOBAL FUND II GP LLC ISQ sold 4,262,090 shares for an estimated $188,213,894

- JAMIE WELCH (See Remarks) purchased 5,000 shares for an estimated $195,650

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$KNTK Hedge Fund Activity

We have seen 166 institutional investors add shares of $KNTK stock to their portfolio, and 127 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- GOLDMAN SACHS GROUP INC added 2,454,958 shares (+89.3%) to their portfolio in Q2 2025, for an estimated $108,140,899

- ZIMMER PARTNERS, LP removed 1,531,037 shares (-77.9%) from their portfolio in Q2 2025, for an estimated $67,442,179

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. added 1,280,765 shares (+inf%) to their portfolio in Q2 2025, for an estimated $56,417,698

- BARCLAYS PLC removed 1,188,875 shares (-77.9%) from their portfolio in Q2 2025, for an estimated $52,369,943

- WESTWOOD HOLDINGS GROUP INC removed 1,126,832 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $49,636,949

- KAYNE ANDERSON CAPITAL ADVISORS LP removed 830,122 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $36,566,874

- BLACKROCK, INC. added 682,228 shares (+19.5%) to their portfolio in Q2 2025, for an estimated $30,052,143

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $MGA. Jonathan Goldman from Scotiabank set a price target of 47.0 for MGA.

To track analyst ratings and price targets for $MGA, check out Quiver Quantitative's $MGA forecast page.

$MGA Price Targets

Multiple analysts have issued price targets for $MGA recently. We have seen 13 analysts offer price targets for $MGA in the last 6 months, with a median target of $47.0.

Here are some recent targets:

- Jonathan Goldman from Scotiabank set a target price of $47.0 on 10/17/2025

- Chris McNally from Evercore ISI Group set a target price of $47.0 on 10/13/2025

- Dan Levy from Barclays set a target price of $52.0 on 10/10/2025

- Joseph Spak from UBS set a target price of $49.0 on 10/06/2025

- Colin Langan from Wells Fargo set a target price of $45.0 on 10/03/2025

- Ty Collin from CIBC set a target price of $47.0 on 08/26/2025

- Brian Morrison from TD Securities set a target price of $52.0 on 08/05/2025

$MGA Hedge Fund Activity

We have seen 189 institutional investors add shares of $MGA stock to their portfolio, and 179 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- BEUTEL, GOODMAN & CO LTD. removed 5,536,590 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $213,767,739

- ARROWSTREET CAPITAL, LIMITED PARTNERSHIP added 2,208,273 shares (+116.6%) to their portfolio in Q2 2025, for an estimated $85,261,420

- FIL LTD added 2,090,077 shares (+48.1%) to their portfolio in Q2 2025, for an estimated $80,697,872

- PRICE T ROWE ASSOCIATES INC /MD/ removed 1,763,906 shares (-33.8%) from their portfolio in Q2 2025, for an estimated $68,104,410

- CIBC ASSET MANAGEMENT INC removed 1,591,914 shares (-64.6%) from their portfolio in Q2 2025, for an estimated $61,463,799

- ROYAL BANK OF CANADA added 1,426,127 shares (+14.7%) to their portfolio in Q2 2025, for an estimated $55,062,763

- MACKENZIE FINANCIAL CORP removed 1,227,217 shares (-37.9%) from their portfolio in Q2 2025, for an estimated $47,382,848

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $LNR. Jonathan Goldman from Scotiabank set a price target of 83.0 for LNR.

To track analyst ratings and price targets for $LNR, check out Quiver Quantitative's $LNR forecast page.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $SJ. Jonathan Goldman from Scotiabank set a price target of 88.0 for SJ.

To track analyst ratings and price targets for $SJ, check out Quiver Quantitative's $SJ forecast page.

$SJ Price Targets

Multiple analysts have issued price targets for $SJ recently. We have seen 2 analysts offer price targets for $SJ in the last 6 months, with a median target of $82.0.

Here are some recent targets:

- Jonathan Goldman from Scotiabank set a target price of $88.0 on 10/17/2025

- James McGarragle from RBC Capital set a target price of $76.0 on 05/08/2025

$SJ Hedge Fund Activity

We have seen 3 institutional investors add shares of $SJ stock to their portfolio, and 3 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- CITADEL ADVISORS LLC added 61,169 shares (+inf%) to their portfolio in Q2 2025, for an estimated $49,485

- TWO SIGMA SECURITIES, LLC added 10,196 shares (+inf%) to their portfolio in Q2 2025, for an estimated $8,248

- UBS GROUP AG removed 9,053 shares (-26.6%) from their portfolio in Q2 2025, for an estimated $7,323

- GEODE CAPITAL MANAGEMENT, LLC removed 1,174 shares (-6.6%) from their portfolio in Q2 2025, for an estimated $949

- CAITONG INTERNATIONAL ASSET MANAGEMENT CO., LTD removed 323 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $261

- RENAISSANCE TECHNOLOGIES LLC added 100 shares (+0.3%) to their portfolio in Q2 2025, for an estimated $80

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $ERE/UN. Himanshu Gupta from Scotiabank set a price target of 1.25 for ERE/UN.

To track analyst ratings and price targets for $ERE/UN, check out Quiver Quantitative's $ERE/UN forecast page.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $STN. Jonathan Goldman from Scotiabank set a price target of 161.0 for STN.

To track analyst ratings and price targets for $STN, check out Quiver Quantitative's $STN forecast page.

$STN Price Targets

Multiple analysts have issued price targets for $STN recently. We have seen 4 analysts offer price targets for $STN in the last 6 months, with a median target of $158.5.

Here are some recent targets:

- Jonathan Goldman from Scotiabank set a target price of $161.0 on 10/17/2025

- Jacob Bout from CIBC set a target price of $168.0 on 07/18/2025

- Yuri Lynk from Canaccord Genuity set a target price of $150.0 on 05/15/2025

$STN Hedge Fund Activity

We have seen 142 institutional investors add shares of $STN stock to their portfolio, and 110 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ALLIANCEBERNSTEIN L.P. added 1,558,703 shares (+82.4%) to their portfolio in Q2 2025, for an estimated $169,399,842

- MANUFACTURERS LIFE INSURANCE COMPANY, THE removed 1,021,487 shares (-23.7%) from their portfolio in Q2 2025, for an estimated $111,015,207

- ALBERTA INVESTMENT MANAGEMENT CORP removed 781,609 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $84,945,266

- MACKENZIE FINANCIAL CORP removed 770,112 shares (-11.1%) from their portfolio in Q2 2025, for an estimated $83,695,772

- GOLDMAN SACHS GROUP INC added 702,230 shares (+120.6%) to their portfolio in Q2 2025, for an estimated $76,318,356

- JARISLOWSKY, FRASER LTD removed 676,400 shares (-12.0%) from their portfolio in Q2 2025, for an estimated $73,511,152

- PICTET ASSET MANAGEMENT HOLDING SA removed 597,515 shares (-14.2%) from their portfolio in Q2 2025, for an estimated $64,937,930

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $FTT. Jonathan Goldman from Scotiabank set a price target of 71.0 for FTT.

To track analyst ratings and price targets for $FTT, check out Quiver Quantitative's $FTT forecast page.

$FTT Price Targets

Multiple analysts have issued price targets for $FTT recently. We have seen 2 analysts offer price targets for $FTT in the last 6 months, with a median target of $69.0.

Here are some recent targets:

- Jonathan Goldman from Scotiabank set a target price of $71.0 on 10/17/2025

- Sabahat Khan from RBC Capital set a target price of $67.0 on 08/07/2025

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $ADEN. Jonathan Goldman from Scotiabank set a price target of 40.0 for ADEN.

To track analyst ratings and price targets for $ADEN, check out Quiver Quantitative's $ADEN forecast page.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $PARR. Justin Jenkins from Raymond James set a price target of 45.0 for PARR.

To track analyst ratings and price targets for $PARR, check out Quiver Quantitative's $PARR forecast page.

$PARR Price Targets

Multiple analysts have issued price targets for $PARR recently. We have seen 5 analysts offer price targets for $PARR in the last 6 months, with a median target of $40.0.

Here are some recent targets:

- Justin Jenkins from Raymond James set a target price of $45.0 on 10/17/2025

- Manav Gupta from UBS set a target price of $37.0 on 09/23/2025

- Nitin Kumar from Mizuho set a target price of $40.0 on 09/15/2025

- Nitin Kumar from Piper Sandler set a target price of $44.0 on 09/11/2025

- Neil Mehta from Goldman Sachs set a target price of $19.0 on 05/28/2025

$PARR Insider Trading Activity

$PARR insiders have traded $PARR stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $PARR stock by insiders over the last 6 months:

- SHAWN DAVID FLORES (See Remarks) sold 8,062 shares for an estimated $278,139

- IVAN DANIEL GUERRA (Chief Accounting Officer) sold 5,500 shares for an estimated $193,105

- JEFFREY RYAN HOLLIS (See Remarks) sold 5,228 shares for an estimated $180,627

- TERRILL PITKIN (SVP, Planning & Commercial) sold 5,164 shares for an estimated $144,437

- TIMOTHY CLOSSEY sold 2,000 shares for an estimated $66,740

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$PARR Hedge Fund Activity

We have seen 112 institutional investors add shares of $PARR stock to their portfolio, and 131 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ENCOMPASS CAPITAL ADVISORS LLC added 1,304,541 shares (+inf%) to their portfolio in Q2 2025, for an estimated $34,609,472

- BLACKROCK, INC. removed 1,118,141 shares (-11.8%) from their portfolio in Q2 2025, for an estimated $29,664,280

- FJ INVESTMENTS, LLC added 991,107 shares (+inf%) to their portfolio in Q2 2025, for an estimated $26,294,068

- AVENTAIL CAPITAL GROUP, LP added 782,015 shares (+668.5%) to their portfolio in Q2 2025, for an estimated $20,746,857

- SOLAS CAPITAL MANAGEMENT, LLC removed 693,577 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $18,400,597

- ARROWSTREET CAPITAL, LIMITED PARTNERSHIP added 681,190 shares (+89.9%) to their portfolio in Q2 2025, for an estimated $18,071,970

- CITADEL ADVISORS LLC removed 453,921 shares (-44.5%) from their portfolio in Q2 2025, for an estimated $12,042,524

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $LYB. Duffy Fischer from Goldman Sachs set a price target of 51.0 for LYB.

To track analyst ratings and price targets for $LYB, check out Quiver Quantitative's $LYB forecast page.

$LYB Price Targets

Multiple analysts have issued price targets for $LYB recently. We have seen 13 analysts offer price targets for $LYB in the last 6 months, with a median target of $54.0.

Here are some recent targets:

- Duffy Fischer from Goldman Sachs set a target price of $51.0 on 10/17/2025

- Steve Byrne from B of A Securities set a target price of $50.0 on 10/14/2025

- Joshua Spector from UBS set a target price of $43.0 on 10/06/2025

- John Roberts from Mizuho set a target price of $54.0 on 10/03/2025

- Patrick Cunningham from Citigroup set a target price of $51.0 on 10/02/2025

- Stephen Richardson from Evercore ISI Group set a target price of $65.0 on 09/23/2025

- John McNulty from BMO Capital set a target price of $58.0 on 08/06/2025

$LYB Congressional Stock Trading

Members of Congress have traded $LYB stock 4 times in the past 6 months. Of those trades, 2 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $LYB stock by members of Congress over the last 6 months:

- REPRESENTATIVE JULIE JOHNSON sold up to $15,000 on 09/25.

- REPRESENTATIVE LISA C. MCCLAIN has traded it 2 times. They made 1 purchase worth up to $15,000 on 06/09 and 1 sale worth up to $15,000 on 06/24.

- REPRESENTATIVE ROBERT BRESNAHAN purchased up to $15,000 on 05/15.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$LYB Insider Trading Activity

$LYB insiders have traded $LYB stock on the open market 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $LYB stock by insiders over the last 6 months:

- PETER Z. E. VANACKER (Chief Executive Officer) sold 20,000 shares for an estimated $1,071,422

- MICHAEL SEAN HANLEY purchased 3,500 shares for an estimated $199,535

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$LYB Hedge Fund Activity

We have seen 450 institutional investors add shares of $LYB stock to their portfolio, and 491 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- CAPITAL WORLD INVESTORS added 5,593,550 shares (+181.7%) to their portfolio in Q2 2025, for an estimated $323,642,803

- SOUNDWATCH CAPITAL LLC added 4,634,003 shares (+inf%) to their portfolio in Q2 2025, for an estimated $268,123,413

- NORGES BANK added 3,748,441 shares (+343.6%) to their portfolio in Q2 2025, for an estimated $216,884,796

- FEDERATED HERMES, INC. removed 2,329,494 shares (-49.1%) from their portfolio in Q2 2025, for an estimated $134,784,522

- WELLINGTON MANAGEMENT GROUP LLP removed 2,069,494 shares (-95.4%) from their portfolio in Q2 2025, for an estimated $119,740,922

- MORGAN STANLEY added 2,049,725 shares (+30.5%) to their portfolio in Q2 2025, for an estimated $118,597,088

- ALLIANCEBERNSTEIN L.P. removed 2,011,128 shares (-49.0%) from their portfolio in Q2 2025, for an estimated $116,363,866

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $SNA. Luke Junk from Baird set a price target of 365.0 for SNA.

To track analyst ratings and price targets for $SNA, check out Quiver Quantitative's $SNA forecast page.

$SNA Price Targets

Multiple analysts have issued price targets for $SNA recently. We have seen 4 analysts offer price targets for $SNA in the last 6 months, with a median target of $357.5.

Here are some recent targets:

- Luke Junk from Baird set a target price of $365.0 on 10/17/2025

- Gary Prestopino from Barrington Research set a target price of $350.0 on 10/15/2025

- Ivan Feinseth from Tigress Financial set a target price of $395.0 on 08/29/2025

- Elizabeth Suzuki from B of A Securities set a target price of $285.0 on 07/18/2025

$SNA Insider Trading Activity

$SNA insiders have traded $SNA stock on the open market 22 times in the past 6 months. Of those trades, 0 have been purchases and 22 have been sales.

Here’s a breakdown of recent trading of $SNA stock by insiders over the last 6 months:

- NICHOLAS T PINCHUK (Chairman, President and CEO) has made 0 purchases and 8 sales selling 46,214 shares for an estimated $14,712,584.

- ALDO JOHN PAGLIARI (Sr VP - Finance & CFO) has made 0 purchases and 13 sales selling 10,409 shares for an estimated $3,404,453.

- KAREN L DANIEL sold 1,090 shares for an estimated $348,716

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$SNA Hedge Fund Activity

We have seen 443 institutional investors add shares of $SNA stock to their portfolio, and 410 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- KINGSTONE CAPITAL PARTNERS TEXAS, LLC removed 1,397,706 shares (-100.0%) from their portfolio in Q3 2025, for an estimated $484,347,060

- AUTO-OWNERS INSURANCE CO removed 1,070,025 shares (-99.7%) from their portfolio in Q2 2025, for an estimated $332,970,379

- MAWER INVESTMENT MANAGEMENT LTD. removed 597,328 shares (-85.5%) from their portfolio in Q2 2025, for an estimated $185,876,527