H.R. 3904: U.S. Bicycle Production and Assembly Act

This bill, known as the U.S. Bicycle Production and Assembly Act, aims to temporarily modify certain import duties related to bicycle manufacturing in the United States. The main objectives and provisions of the bill include:

1. Duty Suspension for Bicycle Parts

The bill proposes a new tariff heading (9903.87.11) that allows for the importation of bicycle parts specifically for use in assembling or manufacturing complete bicycles without incurring additional import duties. The parts covered include:

- Traditional bicycles

- Electric bicycles

- Bicycle trailers

Parts imported must be certified to U.S. Customs and Border Protection (CBP) for use in assembly or manufacturing.

2. Definitions and Applicability

The bill provides clear definitions regarding what constitutes bicycle parts and assembly processes. Key points include:

- Bicycle parts must be classified under specific tariff provisions.

- The assembly process must use standard industry methods to produce bikes suitable for sale.

- Importers claiming duty-free status must provide documentation demonstrating that the parts will be used for the intended purpose.

3. Exclusions from Additional Duties

The bill specifies that parts imported under the new heading will be excluded from any additional tariffs that may apply under existing laws, allowing for more competitive pricing of bicycles made from these parts.

4. Reporting Requirements

After the bill is enacted, a report must be submitted to Congress within five years to assess:

- The effectiveness of the amendments in increasing U.S. bicycle production.

- The goal of producing 2 million bicycles annually within five years and 5 million within ten years.

5. Regulatory Authority

The Commissioner of U.S. Customs and Border Protection is empowered to create rules to effectively administer this Act, including necessary information from importers claiming duty-free status.

6. Effective Date

This legislation will be effective for a period of ten years from the date it becomes law.

Relevant Companies

- GBX (The Greenbrier Companies, Inc.) - Could benefit from reduced costs of parts used in manufacturing bicycles due to the temporary duty suspension.

- BRB (Bridgestone Corporation) - May see changes in import costs for bicycle tires and parts, impacting pricing structures.

- THO (Thor Industries, Inc.) - As a manufacturer of recreational vehicles including bicycles, this may affect their cost structure and pricing.

This is an AI-generated summary of the bill text. There may be mistakes.

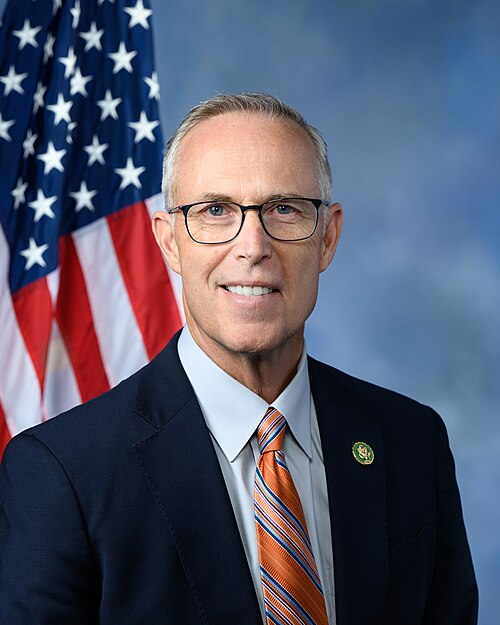

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 11, 2025 | Introduced in House |

| Jun. 11, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.