S. 2966: Emergency Relief for Federal Workers Act of 2025

The "Emergency Relief for Federal Workers Act of 2025" is a legislative proposal aimed at providing financial assistance to federal employees during periods when the government is shut down due to lapses in appropriations. Here’s a breakdown of the main provisions of the bill:

Purpose of the Bill

The primary objective of this bill is to alleviate financial hardships faced by federal employees who are either furloughed or working without pay during a government shutdown. This includes enabling them to access their Thrift Savings Plan (TSP) funds without incurring additional penalties.

Waiving Penalties for Thrift Savings Plan Withdrawals

- Federal employees affected by a qualified lapse in appropriations (a shutdown lasting at least two weeks) will be allowed to withdraw funds from their TSP accounts without incurring the usual 10% additional tax on early withdrawals.

- These withdrawals can only total up to $30,000 during each qualified lapse in appropriations.

- For taxable years starting in 2026 and later, the $30,000 limit will be adjusted for inflation, ensuring that the limit keeps pace with economic changes.

Provisions for Withdrawal and Contribution

- The bill allows for "in-service" withdrawals, meaning employees can take funds from their TSP accounts while still working, if they are impacted by a shutdown.

- Employees can make multiple withdrawals during a shutdown, as long as the combined total does not exceed $30,000.

- Employees who withdraw from their TSP accounts may also reinvest some or all of that amount in the future, akin to a "rollover," without treating the initial withdrawal as a taxable distribution.

Loans from the Thrift Savings Plan

- The bill mandates that rules be established to allow federal employees who are furloughed or not receiving pay to obtain loans from their TSP accounts without concern for the duration of the lapse in appropriations.

- It also states that missed payments for loans during a shutdown will not be classified as taxable distributions.

Effective Date

The provisions in the bill will apply to withdrawals made after September 30, 2025, ensuring that the changes will only affect future lapses in appropriations.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

19 bill sponsors

-

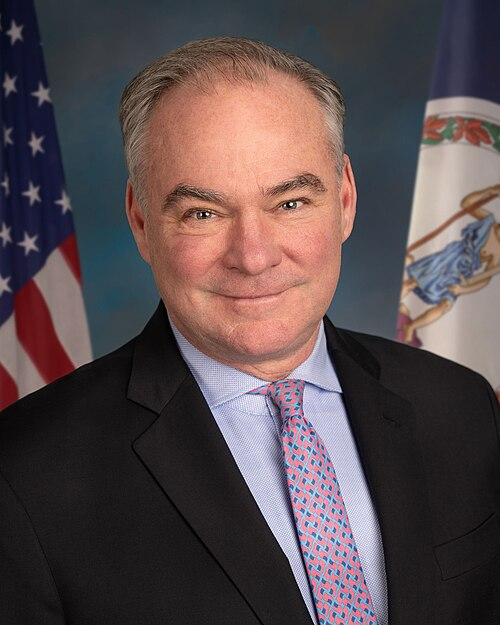

TrackTim Kaine

Sponsor

-

TrackAngela Alsobrooks

Co-Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackRichard Blumenthal

Co-Sponsor

-

TrackCory A. Booker

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

TrackCatherine Cortez Masto

Co-Sponsor

-

TrackTammy Duckworth

Co-Sponsor

-

TrackRichard J. Durbin

Co-Sponsor

-

TrackJohn W. Hickenlooper

Co-Sponsor

-

TrackMazie K. Hirono

Co-Sponsor

-

TrackEdward J. Markey

Co-Sponsor

-

TrackAlex Padilla

Co-Sponsor

-

TrackJacky Rosen

Co-Sponsor

-

TrackBrian Schatz

Co-Sponsor

-

TrackJeanne Shaheen

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackMark R. Warner

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 01, 2025 | Introduced in Senate |

| Oct. 01, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.