S. 2989: Stop Medical Profiteering and Theft Act

This bill, known as the Stop Medical Profiteering and Theft Act, aims to regulate transactions involving health care entities and real estate investment trusts (REITs) to ensure that the financial dealings of health care entities do not compromise their stability or public health. Below are the key components of the bill explained in simpler terms.

Prohibition of Certain Agreements

The bill prohibits health care entities and affiliated firms from entering into agreements to sell to or lease from a real estate investment trust if the terms of such agreements could:

- Weaken the long-term financial status of the health care entity.

- Endanger public health.

Review of Transactions

Before any health care entity can engage in a transaction with a REIT, it must submit the terms of the sale or lease to the Secretary of Health and Human Services for review. The Secretary will examine whether the deal could harm the financial status of the health care entity or pose a risk to public health. The Secretary may consult with state attorneys general if necessary.

Enforcement Actions

If a health care entity is found to violate these prohibitions, the Secretary has the authority to:

- Impose civil monetary penalties of up to $10,000 for each violation.

- Ensure that state authorities also enforce these provisions. If a state fails to do so, the Secretary will enforce the requirements directly.

Applicability

The bill maintains that its provisions do not supersede existing state laws unless those laws conflict with its specific requirements.

Definitions

The bill provides definitions for several key terms:

- Health care entity: Includes hospitals, physician practices, nursing facilities, hospices, mental health providers, and opioid treatment programs.

- Covered firm: Refers to for-profit corporations that own or are affiliated with health care entities.

- Affiliate: A person or entity that owns or controls 20 percent or more of another entity's voting securities.

Impact on Real Estate Investment Trusts

The bill also amends the Internal Revenue Code regarding how real estate investment trusts can manage their property related to health care, potentially impacting how these organizations operate and manage financial transactions in the health care sector.

Effective Date

The changes proposed by this bill would take effect from the date it is enacted, affecting taxable years that begin after that date.

Relevant Companies

- AVB (AvalonBay Communities, Inc.): A real estate investment trust that could be impacted by the regulations limiting health care-related transactions.

- AMT (American Tower Corporation): This REIT, involved in communication infrastructure, might also feel the impacts of the bill's restrictions on property dealings.

- HR (Healthcare Realty Trust Incorporated): A REIT focused on health care facilities, it would likely be directly affected by the provisions prohibiting certain transactions with health care entities.

This is an AI-generated summary of the bill text. There may be mistakes.

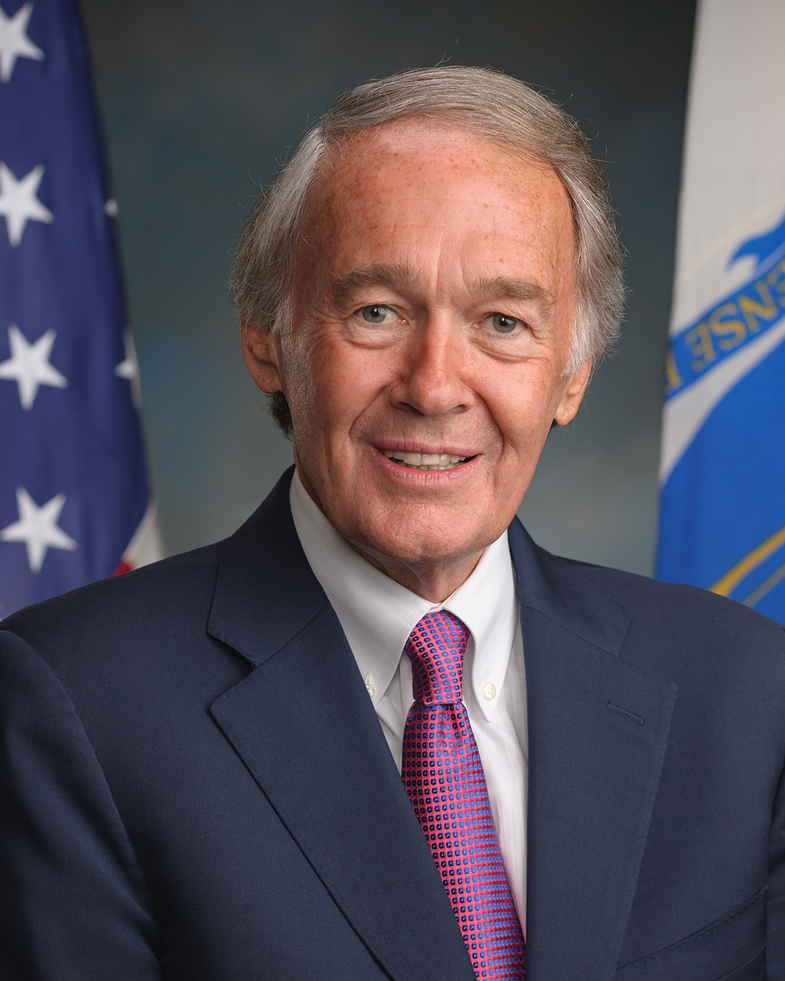

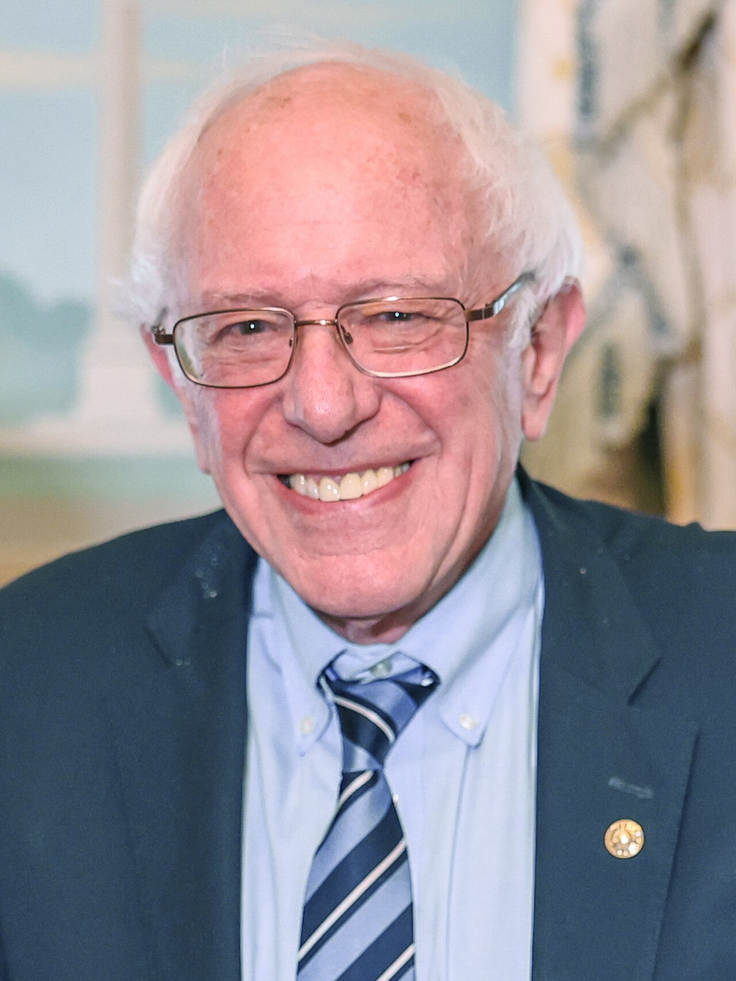

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 08, 2025 | Introduced in Senate |

| Oct. 08, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.