H.R. 5516: No Coffee Tax Act

This bill, known as the No Coffee Tax Act, aims to prevent the introduction of new tariffs on coffee imported into the United States from countries with which the U.S. has normal trade relations. Here's a breakdown of its provisions:

Short Title

The bill is formally titled the "No Coffee Tax Act."

Prohibition on Additional Tariffs

The core purpose of the bill is to ensure that no tariffs or other duties on coffee products exceed the rates that were in place as of January 19, 2025. This applies to coffee products imported from countries that the United States has established normal trade relations with.

Definition of Coffee Products

For the purposes of this bill, the term "coffee products" includes the following:

- Coffee in its various forms, including roasted and decaffeinated.

- Coffee husks and skins.

- Coffee substitutes that contain coffee in any amount.

Overall, the No Coffee Tax Act seeks to stabilize the current tariff rates on coffee and related products, preventing any increases that could arise from future legislative or executive actions.

Relevant Companies

- SBUX - Starbucks Corporation: As a major retailer of coffee, any changes in tariffs could impact their import costs and pricing strategies.

- PEP - PepsiCo, Inc.: The company includes coffee brands in their portfolio and could be affected by tariff changes on coffee products.

- DNKN - Dunkin' Brands Group, Inc.: As a key player in coffee sales, further tariffs could influence their supply chain and pricing.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

TrackRo Khanna

Sponsor

-

TrackDon Bacon

Co-Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackMaggie Goodlander

Co-Sponsor

-

TrackGreg Landsman

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

TrackSeth Magaziner

Co-Sponsor

-

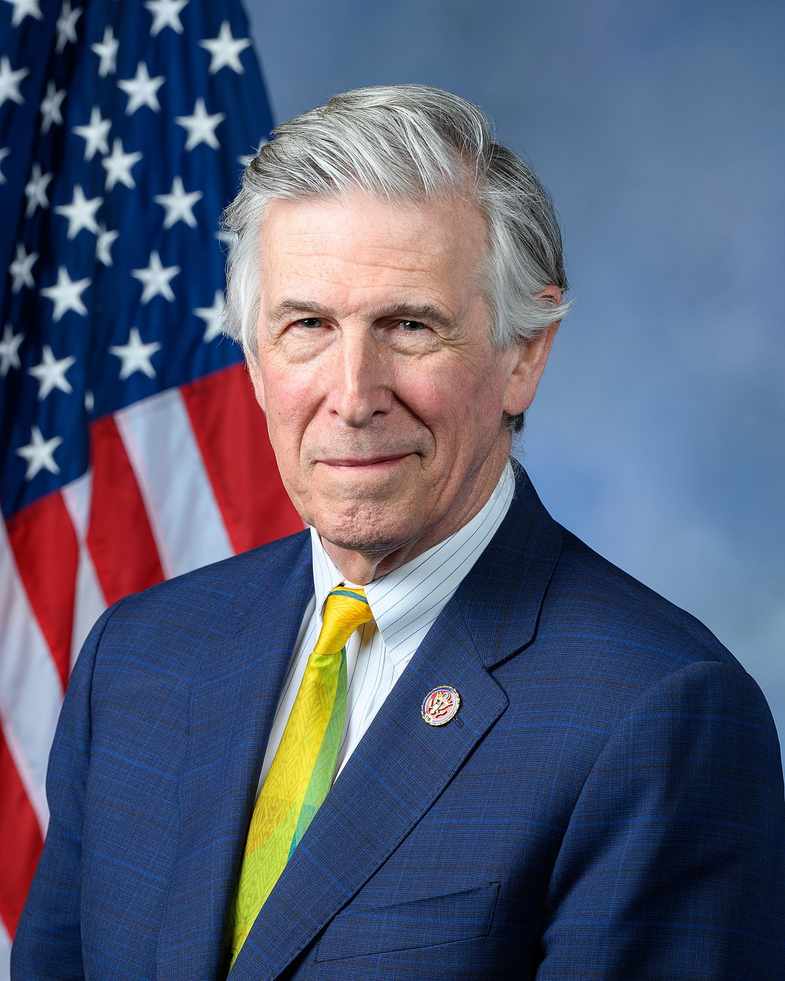

TrackJames P. McGovern

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackEmilia Strong Sykes

Co-Sponsor

-

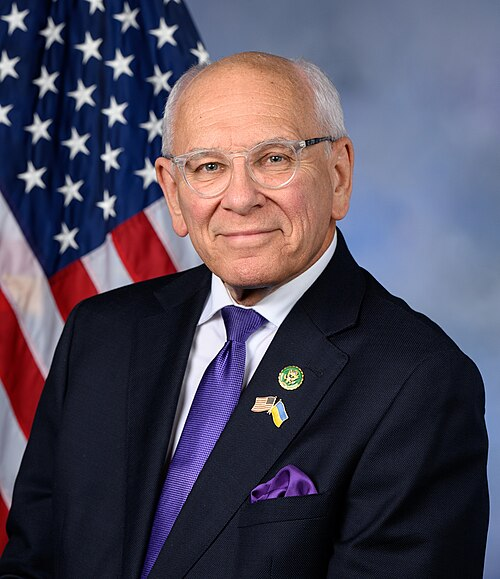

TrackPaul Tonko

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 19, 2025 | Introduced in House |

| Sep. 19, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.