S. 1471: Climate Change Financial Risk Act of 2025

The Climate Change Financial Risk Act of 2025 aims to address the financial risks posed by climate change by requiring the Board of Governors of the Federal Reserve System to conduct analyses related to these risks. Here are the key provisions and objectives of the bill:

Purpose

The bill seeks to enhance awareness and management of the financial implications of climate change for banking and financial institutions. It recognizes that climate-related risks—both physical risks (like natural disasters affecting property and operations) and transition risks (such as the move away from fossil fuels)—can significantly impact the financial stability of organizations and the economy as a whole.

Risk Analysis Development

Within one year of the bill's enactment, the Federal Reserve must develop three distinct climate change risk scenarios. These scenarios will reflect different potential increases in global temperatures (e.g., 1.5 and 2 degrees Celsius above pre-industrial levels) and consider impacts from climate change mitigation actions.

Climate Risk Scenario Technical Development Group

A Technical Development Group will be established to help develop and refine the climate change risk scenarios. This group will include:

- Five climate scientists with expertise in climate modeling and risk assessment.

- Five economists knowledgeable about financial systems and climate-related financial risks.

Biennial Stress Tests

The Federal Reserve will conduct biennial analyses—referred to as stress tests—on covered entities. During these tests, financial institutions will be assessed for their ability to withstand losses under adverse climate-related conditions based on the developed risk scenarios. The tests aim to ensure these institutions maintain adequate capital levels to absorb potential financial losses derived from climate risks.

Climate Risk Resolution Plans

Each covered entity, prior to being evaluated under the stress tests, must prepare a climate risk resolution plan. This plan will outline how they intend to manage and mitigate climate-related risks, including their capital policy and specific targets to address vulnerabilities found in prior assessments.

Surveys of Financial Entities

The Federal Reserve will also administer surveys to assess the ability of financial entities to cope with climate risks. These surveys will identify which entities are heavily exposed to climate impacts and evaluate their plans to adapt to these risks.

Public Reporting

The results from both the stress tests and surveys will be compiled into public reports, analyzing the financial sector's resilience in the face of climate risks. However, individual entities that participated in the surveys will not be identified in these reports to protect their confidentiality.

Compliance and Evaluation

The Federal Reserve, along with other regulatory bodies, will evaluate the effectiveness of the financial institutions' prepared plans and their overall readiness to cope with climate challenges. If needed, they have the authority to require modifications to ensure sufficient risk management practices are in place.

Conclusion

This legislation represents a proactive approach by Congress to scrutinize and enhance the financial sector's preparedness for climate-related challenges, reinforcing the stability and safety of the overall financial system in light of increasing climate threats.

Relevant Companies

- JPM - JPMorgan Chase: As a major bank, JPMorgan Chase will be required to assess its climate-related financial risks under the stress tests mandated by this bill.

- BAC - Bank of America: Like JPMorgan, Bank of America will need to prepare climate risk resolution plans based on the analyses required by the legislation.

- GS - Goldman Sachs: Goldman Sachs will be impacted as it will have to conduct climate risk assessments to ensure compliance with the new provisions.

This is an AI-generated summary of the bill text. There may be mistakes.

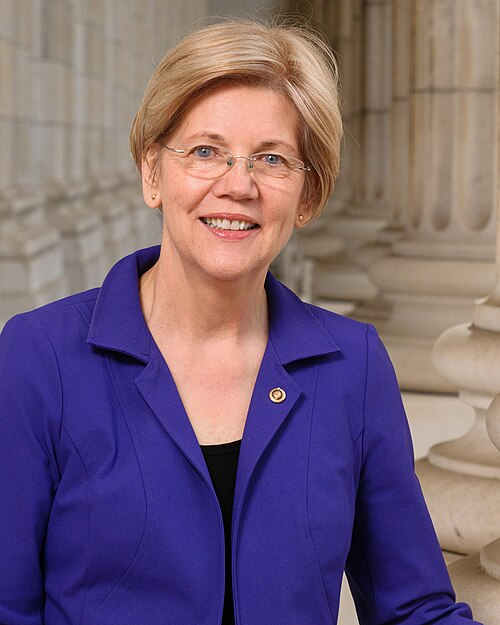

Sponsors

8 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 10, 2025 | Introduced in Senate |

| Apr. 10, 2025 | Read twice and referred to the Committee on Banking, Housing, and Urban Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.