H.R. 987: Fair Access to Banking Act

The Fair Access to Banking Act aims to ensure that individuals and businesses have fair access to financial services from banks and other financial institutions. Here’s a breakdown of what the bill proposes:

Overview and Purpose

The bill is designed to prevent financial institutions from denying services based on subjective criteria or political motivations. It emphasizes the need for fair treatment of customers and is intended to:

- Ensure that customers can access financial services without discrimination.

- Require financial institutions to operate safely and comply with laws while enabling fair access to services.

- Preclude banks from restricting legal commerce for achieving particular public policies.

- Support businesses that might be considered politically unpopular, as long as they are lawful under federal law.

- Mandate that decisions about providing financial services are based on impartial, risk-based analyses reflecting empirical data.

Key Provisions

The Act proposes several amendments to existing banking legislation, including:

Access to Financial Services

Financial institutions (including banks and credit unions) are required to:

- Make their offered services available to all customers based on impartial criteria.

- Assess individual customers on a case-by-case basis, rather than employing blanket category-based evaluations.

- Provide written justifications to any customer whose request for services is denied, specifying the basis for this decision.

Restrictions on Discount Window Lending

Financial institutions with over $50 billion in assets would be prohibited from accessing federal discount window lending programs if they deny services to any law-abiding customer based on subjective criteria.

Payment Card Networks

Payment card networks cannot inhibit lawful access to their services based on political or reputational risks. Violating this provision could result in penalties of up to 10% of the service's value, capped at $10,000 per violation.

Legal Recourse

The Act allows individuals to take civil action against banks that violate the terms established under this law. If successful, claimants may receive:

- Reasonable attorney fees.

- Treble damages (three times the amount of actual damages incurred).

Impact on Financial Institutions

By mandating that access to financial services cannot be denied based on political bias or subjective evaluations, the bill aims to promote a more equitable banking environment. The legislation emphasizes that financial institutions must adhere to established risk management standards when determining the eligibility for services.

Definitions of Key Terms

The bill outlines specific definitions for terms such as:

- Financial Service: Includes a variety of banking services from lending to payment processing.

- Process of Denying Services: Refers to the refusal to enter into or termination of a financial service relationship based on criteria not related to a customer's legal standing.

- Covered Bank: A bank with over $50 billion in total assets that must comply with the requirements set forth in this legislation.

Relevant Companies

- JPM - JPMorgan Chase: As a major bank with extensive services, it will need to adjust its policies to ensure compliance with fair access as defined by the bill.

- BAC - Bank of America: Similar to JPMorgan, this bank may face regulatory changes related to customer access to financial products.

- WFC - Wells Fargo: This institution will likely have to revise its internal policies to align with the implications of the bill regarding fair access.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

91 bill sponsors

-

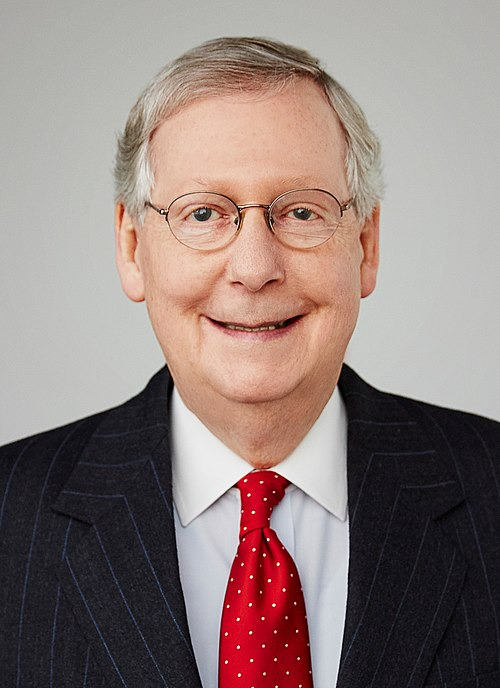

TrackAndy Barr

Sponsor

-

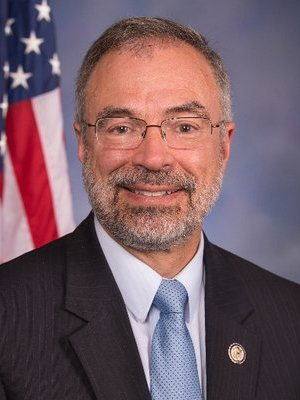

TrackRick W. Allen

Co-Sponsor

-

TrackMark E. Amodei

Co-Sponsor

-

TrackJodey C. Arrington

Co-Sponsor

-

TrackAaron Bean

Co-Sponsor

-

TrackJack Bergman

Co-Sponsor

-

TrackSheri Biggs

Co-Sponsor

-

TrackLauren Boebert

Co-Sponsor

-

TrackMike Bost

Co-Sponsor

-

TrackVern Buchanan

Co-Sponsor

-

TrackTim Burchett

Co-Sponsor

-

TrackEric Burlison

Co-Sponsor

-

TrackKen Calvert

Co-Sponsor

-

TrackEarl L. "Buddy" Carter

Co-Sponsor

-

TrackBen Cline

Co-Sponsor

-

TrackAndrew S. Clyde

Co-Sponsor

-

TrackMike Collins

Co-Sponsor

-

TrackJames Comer

Co-Sponsor

-

TrackDan Crenshaw

Co-Sponsor

-

TrackScott DesJarlais

Co-Sponsor

-

TrackByron Donalds

Co-Sponsor

-

TrackTroy Downing

Co-Sponsor

-

TrackRon Estes

Co-Sponsor

-

TrackGabe Evans

Co-Sponsor

-

TrackRandy Feenstra

Co-Sponsor

-

TrackBrad Finstad

Co-Sponsor

-

TrackMichelle Fischbach

Co-Sponsor

-

TrackScott Fitzgerald

Co-Sponsor

-

TrackVirginia Foxx

Co-Sponsor

-

TrackScott Franklin

Co-Sponsor

-

TrackRussell Fry

Co-Sponsor

-

TrackRuss Fulcher

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

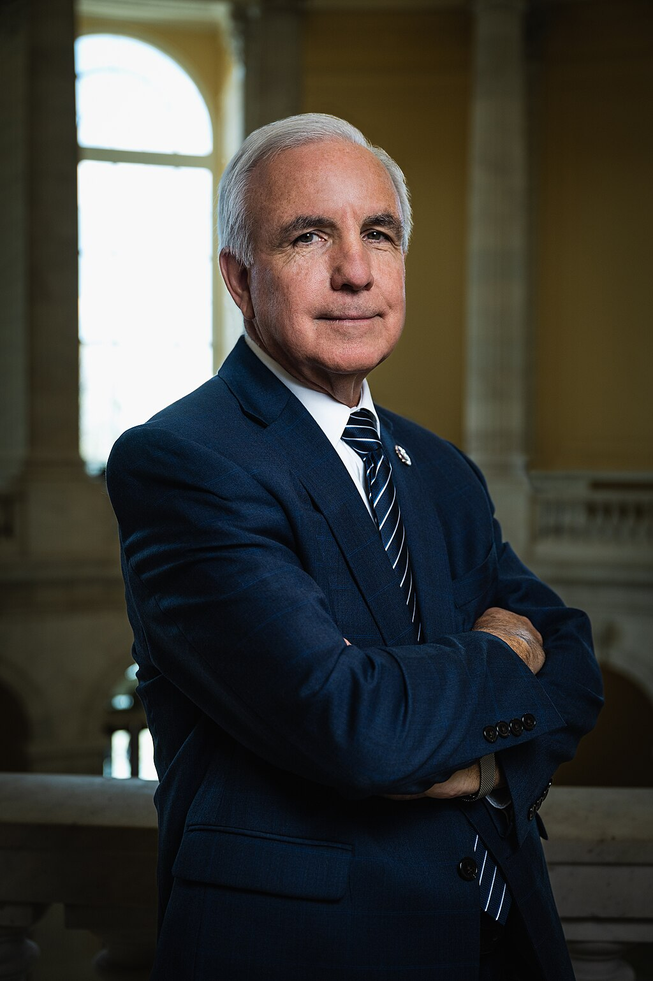

TrackCarlos A. Gimenez

Co-Sponsor

-

TrackCraig Goldman

Co-Sponsor

-

TrackLance Gooden

Co-Sponsor

-

TrackSam Graves

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackAbraham Hamadeh

Co-Sponsor

-

TrackMike Haridopolos

Co-Sponsor

-

TrackPat Harrigan

Co-Sponsor

-

TrackAndy Harris

Co-Sponsor

-

TrackDiana Harshbarger

Co-Sponsor

-

TrackKevin Hern

Co-Sponsor

-

TrackClay Higgins

Co-Sponsor

-

TrackAshley Hinson

Co-Sponsor

-

TrackRichard Hudson

Co-Sponsor

-

TrackBill Huizenga

Co-Sponsor

-

TrackDarrell Issa

Co-Sponsor

-

TrackBrian Jack

Co-Sponsor

-

TrackRonny Jackson

Co-Sponsor

-

TrackDavid P. Joyce

Co-Sponsor

-

TrackNicholas A. Langworthy

Co-Sponsor

-

TrackRobert E. Latta

Co-Sponsor

-

TrackLaurel M. Lee

Co-Sponsor

-

TrackTracey Mann

Co-Sponsor

-

TrackAddison McDowell

Co-Sponsor

-

TrackJohn McGuire

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackCarol D. Miller

Co-Sponsor

-

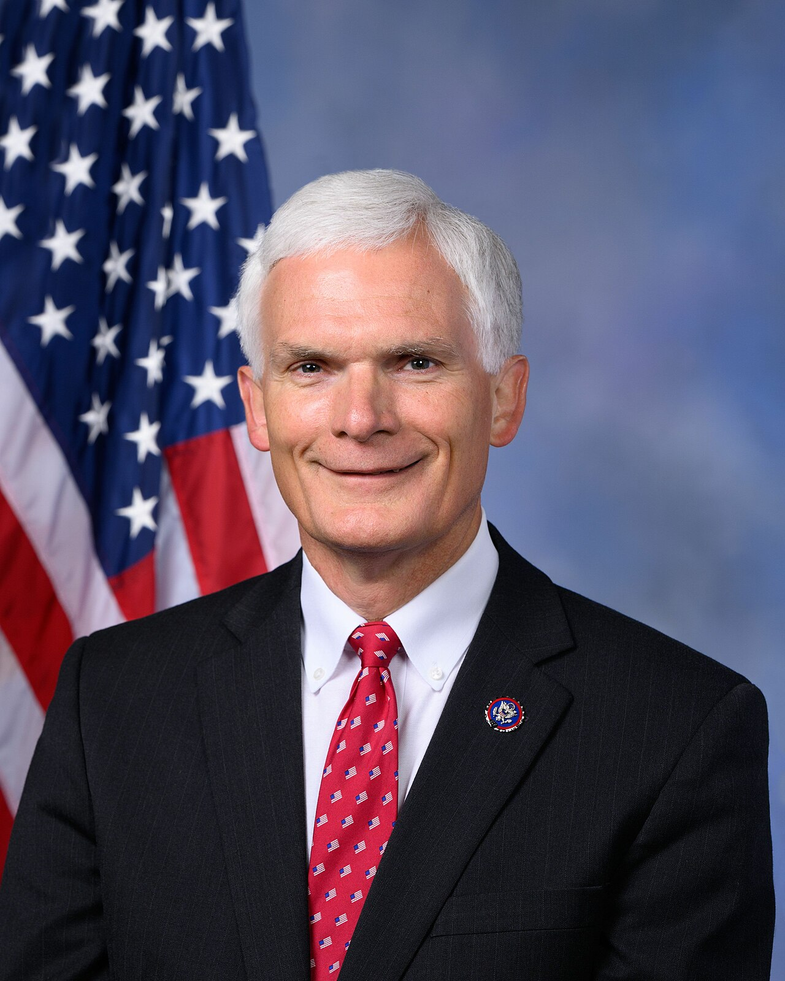

TrackJohn R. Moolenaar

Co-Sponsor

-

TrackBlake D. Moore

Co-Sponsor

-

TrackBarry Moore

Co-Sponsor

-

TrackTroy E. Nehls

Co-Sponsor

-

TrackDan Newhouse

Co-Sponsor

-

TrackAndrew Ogles

Co-Sponsor

-

TrackBurgess Owens

Co-Sponsor

-

TrackAugust Pfluger

Co-Sponsor

-

TrackMike Rogers

Co-Sponsor

-

TrackDavid Rouzer

Co-Sponsor

-

TrackJohn H. Rutherford

Co-Sponsor

-

TrackAustin Scott

Co-Sponsor

-

TrackKeith Self

Co-Sponsor

-

TrackPete Sessions

Co-Sponsor

-

TrackJefferson Shreve

Co-Sponsor

-

TrackMichael K. Simpson

Co-Sponsor

-

TrackAdrian Smith

Co-Sponsor

-

TrackElise M. Stefanik

Co-Sponsor

-

TrackW. Gregory Steube

Co-Sponsor

-

TrackDale W. Strong

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackWilliam R. Timmons IV

Co-Sponsor

-

TrackDavid G. Valadao

Co-Sponsor

-

TrackBeth Van Duyne

Co-Sponsor

-

TrackAnn Wagner

Co-Sponsor

-

TrackTim Walberg

Co-Sponsor

-

TrackRandy K. Weber, Sr.

Co-Sponsor

-

TrackTony Wied

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

-

TrackJoe Wilson

Co-Sponsor

-

TrackRudy Yakym III

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 05, 2025 | Introduced in House |

| Feb. 05, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.