Quiver News

The latest insights and financial news from Quiver Quantitative

$IIIN stock has now fallen 14% today, according to our price data from Polygon. There has been approximately $4,734,542 of trading volume.

Here is what we see in our data on $IIIN (you can track the company live on Quiver's $IIIN stock page):$IIIN Insider Trading Activity

$IIIN insiders have traded $IIIN stock on the open market 3 times in the past 6 months. Of those trades, 0 have been purchases and 3 have been sales.

Here’s a breakdown of recent trading of $IIIN stock by insiders over the last 6 months:

- RICHARD WAGNER (Senior Vice President and COO) sold 4,366 shares for an estimated $167,741

- JAMES R. YORK (Senior Vice President) has made 0 purchases and 2 sales selling 3,600 shares for an estimated $138,600.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$IIIN Hedge Fund Activity

We have seen 92 institutional investors add shares of $IIIN stock to their portfolio, and 82 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- INVENOMIC CAPITAL MANAGEMENT LP removed 351,653 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $13,085,008

- MILLENNIUM MANAGEMENT LLC added 208,964 shares (+1490.7%) to their portfolio in Q2 2025, for an estimated $7,775,550

- OBERWEIS ASSET MANAGEMENT INC/ added 132,732 shares (+inf%) to their portfolio in Q2 2025, for an estimated $4,938,957

- PACER ADVISORS, INC. removed 123,616 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $4,599,751

- ROYCE & ASSOCIATES LP removed 118,372 shares (-15.7%) from their portfolio in Q2 2025, for an estimated $4,404,622

- FIRST EAGLE INVESTMENT MANAGEMENT, LLC removed 99,100 shares (-19.2%) from their portfolio in Q2 2025, for an estimated $3,687,511

- DIMENSIONAL FUND ADVISORS LP removed 89,058 shares (-7.6%) from their portfolio in Q2 2025, for an estimated $3,313,848

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

You can track data on $IIIN on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$UAMY stock has now fallen 5% today, according to our price data from Polygon. There has been approximately $131,109,159 of trading volume.

Here is what we see in our data on $UAMY (you can track the company live on Quiver's $UAMY stock page):$UAMY Insider Trading Activity

$UAMY insiders have traded $UAMY stock on the open market 1 times in the past 6 months. Of those trades, 1 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $UAMY stock by insiders over the last 6 months:

- GARY C EVANS (Chairman & CEO) purchased 100,000 shares for an estimated $613,200

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$UAMY Hedge Fund Activity

We have seen 89 institutional investors add shares of $UAMY stock to their portfolio, and 41 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- BLACKROCK, INC. added 4,732,100 shares (+258.9%) to their portfolio in Q2 2025, for an estimated $10,315,978

- MORGAN STANLEY added 1,788,290 shares (+274.9%) to their portfolio in Q2 2025, for an estimated $3,898,472

- PROSPECT CAPITAL ADVISORS, LLC added 1,299,000 shares (+inf%) to their portfolio in Q2 2025, for an estimated $2,831,820

- GEODE CAPITAL MANAGEMENT, LLC added 1,156,021 shares (+144.6%) to their portfolio in Q2 2025, for an estimated $2,520,125

- MILLENNIUM MANAGEMENT LLC removed 1,105,266 shares (-93.1%) from their portfolio in Q2 2025, for an estimated $2,409,479

- CITADEL ADVISORS LLC added 828,365 shares (+164.2%) to their portfolio in Q2 2025, for an estimated $1,805,835

- STATE STREET CORP added 804,759 shares (+262.8%) to their portfolio in Q2 2025, for an estimated $1,754,374

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$UAMY Analyst Ratings

Wall Street analysts have issued reports on $UAMY in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- HC Wainwright & Co. issued a "Buy" rating on 09/26/2025

- D. Boral Capital issued a "Buy" rating on 08/14/2025

To track analyst ratings and price targets for $UAMY, check out Quiver Quantitative's $UAMY forecast page.

$UAMY Price Targets

Multiple analysts have issued price targets for $UAMY recently. We have seen 3 analysts offer price targets for $UAMY in the last 6 months, with a median target of $5.0.

Here are some recent targets:

- Heiko F. Ihle from HC Wainwright & Co. set a target price of $8.5 on 09/26/2025

- Jesse Sobelson from D. Boral Capital set a target price of $5.0 on 08/14/2025

You can track data on $UAMY on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$FFIV stock has now fallen 8% today, according to our price data from Polygon. There has been approximately $156,163,717 of trading volume.

Here is what we see in our data on $FFIV (you can track the company live on Quiver's $FFIV stock page):$FFIV Insider Trading Activity

$FFIV insiders have traded $FFIV stock on the open market 17 times in the past 6 months. Of those trades, 0 have been purchases and 17 have been sales.

Here’s a breakdown of recent trading of $FFIV stock by insiders over the last 6 months:

- FRANCOIS LOCOH-DONOU (President, CEO & Director) has made 0 purchases and 6 sales selling 7,800 shares for an estimated $2,315,573.

- CHAD MICHAEL WHALEN (EVP, Worldwide Sales) has made 0 purchases and 5 sales selling 6,829 shares for an estimated $2,119,038.

- LYRA AMBER SCHRAMM (Chief People Officer) sold 2,701 shares for an estimated $855,055

- THOMAS DEAN FOUNTAIN (EVP Global Services & Strategy) has made 0 purchases and 2 sales selling 2,694 shares for an estimated $779,589.

- MICHAEL L DREYER sold 1,800 shares for an estimated $514,722

- ELIZABETH BUSE sold 1,500 shares for an estimated $440,301

- ALAN HIGGINSON sold 1,272 shares for an estimated $364,665

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$FFIV Hedge Fund Activity

We have seen 367 institutional investors add shares of $FFIV stock to their portfolio, and 296 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- CITADEL ADVISORS LLC removed 279,533 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $82,272,152

- ROBECO INSTITUTIONAL ASSET MANAGEMENT B.V. added 228,790 shares (+40.8%) to their portfolio in Q2 2025, for an estimated $67,337,472

- MORGAN STANLEY added 203,442 shares (+27.1%) to their portfolio in Q2 2025, for an estimated $59,877,049

- FRANKLIN RESOURCES INC removed 176,201 shares (-56.9%) from their portfolio in Q2 2025, for an estimated $51,859,478

- HOTCHKIS & WILEY CAPITAL MANAGEMENT LLC removed 158,500 shares (-2.9%) from their portfolio in Q2 2025, for an estimated $46,649,720

- MILLENNIUM MANAGEMENT LLC added 154,525 shares (+245.6%) to their portfolio in Q2 2025, for an estimated $45,479,798

- ASSENAGON ASSET MANAGEMENT S.A. added 136,445 shares (+503.9%) to their portfolio in Q3 2025, for an estimated $44,097,659

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$FFIV Analyst Ratings

Wall Street analysts have issued reports on $FFIV in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Needham issued a "Buy" rating on 07/31/2025

- Wolfe Research issued a "Outperform" rating on 07/08/2025

To track analyst ratings and price targets for $FFIV, check out Quiver Quantitative's $FFIV forecast page.

$FFIV Price Targets

Multiple analysts have issued price targets for $FFIV recently. We have seen 6 analysts offer price targets for $FFIV in the last 6 months, with a median target of $335.5.

Here are some recent targets:

- Meta Marshall from Morgan Stanley set a target price of $352.0 on 10/10/2025

- James Fish from Piper Sandler set a target price of $355.0 on 07/31/2025

- Matthew Hedberg from RBC Capital set a target price of $326.0 on 07/31/2025

- Ryan Koontz from Needham set a target price of $345.0 on 07/31/2025

- Tim Long from Barclays set a target price of $321.0 on 07/31/2025

- Samik Chatterjee from JP Morgan set a target price of $305.0 on 07/17/2025

You can track data on $FFIV on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$GIPR stock has now fallen 15% today, according to our price data from Polygon. There has been approximately $1,928,748 of trading volume.

Here is what we see in our data on $GIPR (you can track the company live on Quiver's $GIPR stock page):$GIPR Insider Trading Activity

$GIPR insiders have traded $GIPR stock on the open market 1 times in the past 6 months. Of those trades, 1 have been purchases and 0 have been sales.

Here’s a breakdown of recent trading of $GIPR stock by insiders over the last 6 months:

- DAVID SOBELMAN (Chairman, President, CEO) purchased 20,200 shares for an estimated $20,533

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$GIPR Hedge Fund Activity

We have seen 7 institutional investors add shares of $GIPR stock to their portfolio, and 6 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- GATOR CAPITAL MANAGEMENT, LLC added 24,443 shares (+12.0%) to their portfolio in Q2 2025, for an estimated $35,686

- CITADEL ADVISORS LLC removed 12,790 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $18,673

- RENAISSANCE TECHNOLOGIES LLC removed 10,800 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $15,768

- RAYMOND JAMES FINANCIAL INC added 3,529 shares (+inf%) to their portfolio in Q2 2025, for an estimated $5,152

- SUSQUEHANNA INTERNATIONAL GROUP, LLP added 2,144 shares (+16.2%) to their portfolio in Q2 2025, for an estimated $3,130

- TOWER RESEARCH CAPITAL LLC (TRC) added 1,017 shares (+35.7%) to their portfolio in Q2 2025, for an estimated $1,484

- OSAIC HOLDINGS, INC. removed 930 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $1,357

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

You can track data on $GIPR on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$HPE stock has now fallen 8% today, according to our price data from Polygon. There has been approximately $499,209,130 of trading volume.

Here is what we see in our data on $HPE (you can track the company live on Quiver's $HPE stock page):$HPE Insider Trading Activity

$HPE insiders have traded $HPE stock on the open market 10 times in the past 6 months. Of those trades, 0 have been purchases and 10 have been sales.

Here’s a breakdown of recent trading of $HPE stock by insiders over the last 6 months:

- ANTONIO F NERI (President and CEO) has made 0 purchases and 4 sales selling 500,000 shares for an estimated $11,846,649.

- JEREMY COX (SVP, Controller & CTO) sold 68,590 shares for an estimated $1,264,621

- PHIL MOTTRAM (EVP, GM, Intelligent Edge) has made 0 purchases and 2 sales selling 60,000 shares for an estimated $1,171,173.

- GARY M REINER sold 40,000 shares for an estimated $983,048

- NEIL B MACDONALD (EVP, GM, Server) sold 29,000 shares for an estimated $493,365

- MAEVE C CULLOTY (EVP, Pres & CEO Financial Serv) sold 3,738 shares for an estimated $93,898

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$HPE Hedge Fund Activity

We have seen 473 institutional investors add shares of $HPE stock to their portfolio, and 452 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- UBS GROUP AG removed 35,242,074 shares (-82.8%) from their portfolio in Q2 2025, for an estimated $720,700,413

- GOLDMAN SACHS GROUP INC removed 24,326,499 shares (-48.3%) from their portfolio in Q2 2025, for an estimated $497,476,904

- ELLIOTT INVESTMENT MANAGEMENT L.P. added 18,630,978 shares (+inf%) to their portfolio in Q2 2025, for an estimated $381,003,500

- NOMURA HOLDINGS INC added 11,519,208 shares (+146.1%) to their portfolio in Q2 2025, for an estimated $235,567,803

- JPMORGAN CHASE & CO removed 9,913,572 shares (-17.4%) from their portfolio in Q2 2025, for an estimated $202,732,547

- BARCLAYS PLC added 9,530,376 shares (+157.2%) to their portfolio in Q2 2025, for an estimated $194,896,189

- BLACKROCK, INC. added 8,516,497 shares (+6.6%) to their portfolio in Q2 2025, for an estimated $174,162,363

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$HPE Government Contracts

We have seen $2,018,796 of award payments to $HPE over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- IPCS - OPTION PERIOD ONE: $763,050

- IPCS - BASE PERIOD YEAR FIVE: $325,000

- BASE SUPERCOMPUTER SYSTEM FOR THE NAVY DOD SUPERCOMPUTING RESOURCE CENTER: $264,800

- TI 22 ARL: $254,800

- TI-24 SYSTEM ADMINISTRATION FOR TI-24 BASE SYSTEM AND TEST AND DEVLOPMENT SYSTEM.: $243,697

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$HPE Congressional Stock Trading

Members of Congress have traded $HPE stock 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $HPE stock by members of Congress over the last 6 months:

- REPRESENTATIVE RITCHIE TORRES sold up to $15,000 on 07/11.

- REPRESENTATIVE LISA C. MCCLAIN purchased up to $15,000 on 06/17.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$HPE Analyst Ratings

Wall Street analysts have issued reports on $HPE in the last several months. We have seen 8 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- B of A Securities issued a "Buy" rating on 09/02/2025

- Morgan Stanley issued a "Overweight" rating on 08/21/2025

- Citigroup issued a "Buy" rating on 07/25/2025

- Deutsche Bank issued a "Buy" rating on 07/23/2025

- JP Morgan issued a "Overweight" rating on 07/17/2025

- Evercore ISI Group issued a "Outperform" rating on 07/11/2025

- Barclays issued a "Overweight" rating on 07/03/2025

To track analyst ratings and price targets for $HPE, check out Quiver Quantitative's $HPE forecast page.

$HPE Price Targets

Multiple analysts have issued price targets for $HPE recently. We have seen 14 analysts offer price targets for $HPE in the last 6 months, with a median target of $26.5.

Here are some recent targets:

- Tim Long from Barclays set a target price of $27.0 on 10/16/2025

- Asiya Merchant from Citigroup set a target price of $28.0 on 10/06/2025

- Michael Ng from Goldman Sachs set a target price of $27.0 on 10/02/2025

- Toni Sacconaghi from Bernstein set a target price of $24.0 on 09/16/2025

- Aaron Rakers from Wells Fargo set a target price of $26.0 on 09/04/2025

- Simon Leopold from Raymond James set a target price of $30.0 on 09/04/2025

- David Vogt from UBS set a target price of $23.0 on 09/04/2025

You can track data on $HPE on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$ATLX stock has now fallen 10% today, according to our price data from Polygon. There has been approximately $5,423,754 of trading volume.

Here is what we see in our data on $ATLX (you can track the company live on Quiver's $ATLX stock page):$ATLX Insider Trading Activity

$ATLX insiders have traded $ATLX stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $ATLX stock by insiders over the last 6 months:

- ROGER NORIEGA has made 0 purchases and 5 sales selling 50,000 shares for an estimated $253,206.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$ATLX Hedge Fund Activity

We have seen 16 institutional investors add shares of $ATLX stock to their portfolio, and 14 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- INVESCO LTD. added 127,531 shares (+63.0%) to their portfolio in Q2 2025, for an estimated $482,067

- WARBERG ASSET MANAGEMENT LLC removed 126,999 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $480,056

- FIRST WILSHIRE SECURITIES MANAGEMENT INC added 126,994 shares (+210.3%) to their portfolio in Q2 2025, for an estimated $480,037

- WARATAH CAPITAL ADVISORS LTD. removed 119,676 shares (-21.0%) from their portfolio in Q2 2025, for an estimated $452,375

- THOMIST CAPITAL MANAGEMENT, LP removed 96,956 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $366,493

- CITADEL ADVISORS LLC added 95,422 shares (+412.7%) to their portfolio in Q2 2025, for an estimated $360,695

- ROYAL BANK OF CANADA added 92,552 shares (+1834.9%) to their portfolio in Q2 2025, for an estimated $349,846

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

You can track data on $ATLX on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$BTM stock has now fallen 8% today, according to our price data from Polygon. There has been approximately $1,820,446 of trading volume.

Here is what we see in our data on $BTM (you can track the company live on Quiver's $BTM stock page):$BTM Insider Trading Activity

$BTM insiders have traded $BTM stock on the open market 18 times in the past 6 months. Of those trades, 0 have been purchases and 18 have been sales.

Here’s a breakdown of recent trading of $BTM stock by insiders over the last 6 months:

- BRANDON TAYLOR MINTZ (Chief Executive Officer) has made 0 purchases and 14 sales selling 3,140,159 shares for an estimated $11,721,729.

- CHRISTOPHER SCOTT BUCHANAN (COO and President) has made 0 purchases and 3 sales selling 36,000 shares for an estimated $144,082.

- MARK JAMES SMALLEY (Chief Compliance Officer) sold 3,188 shares for an estimated $12,688

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$BTM Hedge Fund Activity

We have seen 46 institutional investors add shares of $BTM stock to their portfolio, and 11 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- METEORA CAPITAL, LLC removed 2,071,016 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $10,500,051

- MARSHALL WACE, LLP added 808,127 shares (+inf%) to their portfolio in Q2 2025, for an estimated $4,097,203

- RENAISSANCE TECHNOLOGIES LLC added 721,900 shares (+345.7%) to their portfolio in Q2 2025, for an estimated $3,660,033

- WESTERN STANDARD LLC removed 615,433 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $3,120,245

- SHAOLIN CAPITAL MANAGEMENT LLC removed 379,981 shares (-59.9%) from their portfolio in Q2 2025, for an estimated $1,926,503

- OWL CREEK ASSET MANAGEMENT, L.P. removed 357,044 shares (-51.5%) from their portfolio in Q2 2025, for an estimated $1,810,213

- MORGAN STANLEY added 346,314 shares (+34631400.0%) to their portfolio in Q2 2025, for an estimated $1,755,811

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$BTM Analyst Ratings

Wall Street analysts have issued reports on $BTM in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- B. Riley Securities issued a "Buy" rating on 10/02/2025

To track analyst ratings and price targets for $BTM, check out Quiver Quantitative's $BTM forecast page.

$BTM Price Targets

Multiple analysts have issued price targets for $BTM recently. We have seen 2 analysts offer price targets for $BTM in the last 6 months, with a median target of $6.25.

Here are some recent targets:

- Harold Goetsch from B. Riley Securities set a target price of $6.0 on 10/02/2025

- Mike Colonnese from HC Wainwright & Co. set a target price of $6.5 on 08/13/2025

You can track data on $BTM on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$HYPR stock has now fallen 40% today, according to our price data from Polygon. There has been approximately $5,342,898 of trading volume.

Here is what we see in our data on $HYPR (you can track the company live on Quiver's $HYPR stock page):$HYPR Insider Trading Activity

$HYPR insiders have traded $HYPR stock on the open market 2 times in the past 6 months. Of those trades, 0 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $HYPR stock by insiders over the last 6 months:

- THOMAS TEISSEYRE (Chief Operating Officer) has made 0 purchases and 2 sales selling 3,927 shares for an estimated $3,140.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$HYPR Hedge Fund Activity

We have seen 11 institutional investors add shares of $HYPR stock to their portfolio, and 8 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- NORTHERN TRUST CORP added 1,000,000 shares (+866.4%) to their portfolio in Q2 2025, for an estimated $719,600

- SUSQUEHANNA INTERNATIONAL GROUP, LLP added 223,794 shares (+inf%) to their portfolio in Q2 2025, for an estimated $161,042

- AVIDITY PARTNERS MANAGEMENT LP removed 222,174 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $159,876

- AMH EQUITY LTD removed 125,084 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $90,010

- TWO SIGMA SECURITIES, LLC added 36,369 shares (+inf%) to their portfolio in Q2 2025, for an estimated $26,171

- SIMPLEX TRADING, LLC added 29,090 shares (+13103.6%) to their portfolio in Q2 2025, for an estimated $20,933

- RENAISSANCE TECHNOLOGIES LLC added 28,600 shares (+156.3%) to their portfolio in Q2 2025, for an estimated $20,580

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$HYPR Government Contracts

We have seen $10,000 of award payments to $HYPR over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$HYPR Analyst Ratings

Wall Street analysts have issued reports on $HYPR in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Lake Street issued a "Buy" rating on 08/14/2025

- B. Riley Securities issued a "Buy" rating on 05/15/2025

To track analyst ratings and price targets for $HYPR, check out Quiver Quantitative's $HYPR forecast page.

$HYPR Price Targets

Multiple analysts have issued price targets for $HYPR recently. We have seen 3 analysts offer price targets for $HYPR in the last 6 months, with a median target of $1.0.

Here are some recent targets:

- Larry Biegelsen from Wells Fargo set a target price of $0.85 on 08/15/2025

- Frank Takkinen from Lake Street set a target price of $2.0 on 08/14/2025

- Yuan Zhi from B. Riley Securities set a target price of $1.0 on 05/15/2025

You can track data on $HYPR on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$MMC stock has now fallen 9% today, according to our price data from Polygon. There has been approximately $423,783,948 of trading volume.

Here is what we see in our data on $MMC (you can track the company live on Quiver's $MMC stock page):$MMC Insider Trading Activity

$MMC insiders have traded $MMC stock on the open market 3 times in the past 6 months. Of those trades, 2 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $MMC stock by insiders over the last 6 months:

- JOHN Q DOYLE (President and CEO) sold 21,080 shares for an estimated $4,891,614

- ANTHONY ANDERSON has made 2 purchases buying 1,000 shares for an estimated $201,612 and 0 sales.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$MMC Hedge Fund Activity

We have seen 702 institutional investors add shares of $MMC stock to their portfolio, and 740 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- CAPITAL RESEARCH GLOBAL INVESTORS added 3,211,310 shares (+48.8%) to their portfolio in Q2 2025, for an estimated $702,120,818

- VALEO FINANCIAL ADVISORS, LLC added 2,623,745 shares (+48212.9%) to their portfolio in Q2 2025, for an estimated $573,655,606

- SOUNDWATCH CAPITAL LLC added 2,565,037 shares (+inf%) to their portfolio in Q2 2025, for an estimated $560,819,689

- FMR LLC removed 2,114,616 shares (-9.5%) from their portfolio in Q2 2025, for an estimated $462,339,642

- MACKENZIE FINANCIAL CORP added 1,554,114 shares (+212.6%) to their portfolio in Q2 2025, for an estimated $339,791,484

- PRICE T ROWE ASSOCIATES INC /MD/ added 1,515,596 shares (+17.8%) to their portfolio in Q2 2025, for an estimated $331,369,909

- AMUNDI added 1,363,706 shares (+89.2%) to their portfolio in Q2 2025, for an estimated $298,160,679

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$MMC Congressional Stock Trading

Members of Congress have traded $MMC stock 3 times in the past 6 months. Of those trades, 0 have been purchases and 3 have been sales.

Here’s a breakdown of recent trading of $MMC stock by members of Congress over the last 6 months:

- REPRESENTATIVE VAL T. HOYLE sold up to $15,000 on 09/23.

- REPRESENTATIVE GILBERT RAY CISNEROS, JR. sold up to $15,000 on 09/16.

- REPRESENTATIVE ROBERT BRESNAHAN sold up to $15,000 on 05/15.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$MMC Analyst Ratings

Wall Street analysts have issued reports on $MMC in the last several months. We have seen 2 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- JP Morgan issued a "Overweight" rating on 10/09/2025

- UBS issued a "Buy" rating on 07/21/2025

- Keefe, Bruyette & Woods issued a "Underperform" rating on 07/09/2025

To track analyst ratings and price targets for $MMC, check out Quiver Quantitative's $MMC forecast page.

$MMC Price Targets

Multiple analysts have issued price targets for $MMC recently. We have seen 7 analysts offer price targets for $MMC in the last 6 months, with a median target of $222.0.

Here are some recent targets:

- Jimmy Bhullar from JP Morgan set a target price of $242.0 on 10/09/2025

- Elyse Greenspan from Wells Fargo set a target price of $222.0 on 10/08/2025

- Brian Meredith from UBS set a target price of $257.0 on 10/08/2025

- Alex Scott from Barclays set a target price of $221.0 on 10/08/2025

- Michael Phillips from Morgan Stanley set a target price of $215.0 on 10/07/2025

- Matthew Heimermann from Citigroup set a target price of $226.0 on 08/13/2025

- Meyer Shields from Keefe, Bruyette & Woods set a target price of $210.0 on 07/21/2025

You can track data on $MMC on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$WAL stock has now fallen 8% today, according to our price data from Polygon. There has been approximately $189,218,981 of trading volume.

Here is what we see in our data on $WAL (you can track the company live on Quiver's $WAL stock page):$WAL Insider Trading Activity

$WAL insiders have traded $WAL stock on the open market 1 times in the past 6 months. Of those trades, 0 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $WAL stock by insiders over the last 6 months:

- TIM R BRUCKNER (CBO for Regional Banking) sold 2,500 shares for an estimated $209,775

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$WAL Hedge Fund Activity

We have seen 221 institutional investors add shares of $WAL stock to their portfolio, and 188 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- THRIVENT FINANCIAL FOR LUTHERANS removed 1,376,610 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $107,348,047

- CITADEL ADVISORS LLC added 1,284,503 shares (+598.3%) to their portfolio in Q2 2025, for an estimated $100,165,543

- PRICE T ROWE ASSOCIATES INC /MD/ added 966,229 shares (+18.1%) to their portfolio in Q2 2025, for an estimated $75,346,537

- HOOD RIVER CAPITAL MANAGEMENT LLC removed 784,266 shares (-57.4%) from their portfolio in Q2 2025, for an estimated $61,157,062

- 140 SUMMER PARTNERS LP added 780,978 shares (+inf%) to their portfolio in Q2 2025, for an estimated $60,900,664

- JANUS HENDERSON GROUP PLC removed 571,849 shares (-24.3%) from their portfolio in Q2 2025, for an estimated $44,592,785

- MORGAN STANLEY removed 558,784 shares (-41.1%) from their portfolio in Q2 2025, for an estimated $43,573,976

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$WAL Congressional Stock Trading

Members of Congress have traded $WAL stock 2 times in the past 6 months. Of those trades, 1 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $WAL stock by members of Congress over the last 6 months:

- REPRESENTATIVE LISA C. MCCLAIN has traded it 2 times. They made 1 purchase worth up to $15,000 on 07/16 and 1 sale worth up to $15,000 on 07/22.

To track congressional stock trading, check out Quiver Quantitative's congressional trading dashboard.

$WAL Analyst Ratings

Wall Street analysts have issued reports on $WAL in the last several months. We have seen 10 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- RBC Capital issued a "Outperform" rating on 10/10/2025

- JP Morgan issued a "Overweight" rating on 10/01/2025

- Wells Fargo issued a "Underweight" rating on 09/29/2025

- TD Cowen issued a "Buy" rating on 09/25/2025

- Citigroup issued a "Buy" rating on 08/26/2025

- DA Davidson issued a "Buy" rating on 07/21/2025

- Piper Sandler issued a "Overweight" rating on 07/21/2025

To track analyst ratings and price targets for $WAL, check out Quiver Quantitative's $WAL forecast page.

$WAL Price Targets

Multiple analysts have issued price targets for $WAL recently. We have seen 12 analysts offer price targets for $WAL in the last 6 months, with a median target of $99.0.

Here are some recent targets:

- Jon G. Arfstrom from RBC Capital set a target price of $100.0 on 10/10/2025

- Anthony Elian from JP Morgan set a target price of $105.0 on 10/01/2025

- Timur Braziler from Wells Fargo set a target price of $90.0 on 09/29/2025

- Janet Lee from TD Cowen set a target price of $118.0 on 09/25/2025

- Benjamin Gerlinger from Citigroup set a target price of $104.0 on 08/26/2025

- Gary Tenner from DA Davidson set a target price of $98.0 on 07/21/2025

- Brandon King from Truist Securities set a target price of $93.0 on 07/21/2025

You can track data on $WAL on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$BKSY stock has now fallen 9% today, according to our price data from Polygon. There has been approximately $21,995,589 of trading volume.

Here is what we see in our data on $BKSY (you can track the company live on Quiver's $BKSY stock page):$BKSY Insider Trading Activity

$BKSY insiders have traded $BKSY stock on the open market 4 times in the past 6 months. Of those trades, 0 have been purchases and 4 have been sales.

Here’s a breakdown of recent trading of $BKSY stock by insiders over the last 6 months:

- BRIAN E O'TOOLE (CEO and President) sold 33,292 shares for an estimated $580,945

- HENRY EDWARD DUBOIS (Chief Financial Officer) sold 31,646 shares for an estimated $552,222

- CHRISTIANA L LIN (General Counsel & CAO) sold 24,036 shares for an estimated $419,428

- TRACY WARD (SVP & Controller) sold 720 shares for an estimated $12,564

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$BKSY Hedge Fund Activity

We have seen 0 institutional investors add shares of $BKSY stock to their portfolio, and 0 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- TURIM 21 INVESTIMENTOS LTDA. added 0 shares (+0.0%) to their portfolio in Q2 2025, for an estimated $0

- OAKMONT CORP added 0 shares (+0.0%) to their portfolio in Q2 2025, for an estimated $0

- MITHRIL II GP LP added 0 shares (+0.0%) to their portfolio in Q2 2025, for an estimated $0

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$BKSY Analyst Ratings

Wall Street analysts have issued reports on $BKSY in the last several months. We have seen 4 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- HC Wainwright & Co. issued a "Buy" rating on 10/10/2025

- Lake Street issued a "Buy" rating on 07/24/2025

- Canaccord Genuity issued a "Buy" rating on 06/26/2025

- Benchmark issued a "Buy" rating on 05/13/2025

To track analyst ratings and price targets for $BKSY, check out Quiver Quantitative's $BKSY forecast page.

$BKSY Price Targets

Multiple analysts have issued price targets for $BKSY recently. We have seen 4 analysts offer price targets for $BKSY in the last 6 months, with a median target of $27.5.

Here are some recent targets:

- Scott Buck from HC Wainwright & Co. set a target price of $42.0 on 10/10/2025

- Jaeson Schmidt from Lake Street set a target price of $28.0 on 07/24/2025

- Austin Moeller from Canaccord Genuity set a target price of $27.0 on 07/22/2025

- Josh Sullivan from Benchmark set a target price of $18.0 on 05/13/2025

You can track data on $BKSY on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$JBHT stock has now risen 18% today, according to our price data from Polygon. There has been approximately $309,736,610 of trading volume.

Here is what we see in our data on $JBHT (you can track the company live on Quiver's $JBHT stock page):$JBHT Insider Trading Activity

$JBHT insiders have traded $JBHT stock on the open market 4 times in the past 6 months. Of those trades, 3 have been purchases and 1 have been sales.

Here’s a breakdown of recent trading of $JBHT stock by insiders over the last 6 months:

- NICHOLAS HOBBS (EVP and COO) has made 2 purchases buying 3,038 shares for an estimated $399,746 and 0 sales.

- ERIC MCGEE (EVP of ICS) purchased 1,147 shares for an estimated $161,552

- DAVID KEEFAUVER (EVP of People) sold 989 shares for an estimated $150,298

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$JBHT Hedge Fund Activity

We have seen 346 institutional investors add shares of $JBHT stock to their portfolio, and 265 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- JPMORGAN CHASE & CO removed 2,597,199 shares (-53.5%) from their portfolio in Q2 2025, for an estimated $372,957,776

- AQR CAPITAL MANAGEMENT LLC added 1,447,993 shares (+411.5%) to their portfolio in Q2 2025, for an estimated $207,931,794

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. removed 899,033 shares (-28.7%) from their portfolio in Q2 2025, for an estimated $129,101,138

- DEMARS FINANCIAL GROUP, LLC removed 525,302 shares (-99.3%) from their portfolio in Q2 2025, for an estimated $75,433,367

- THRIVENT FINANCIAL FOR LUTHERANS removed 518,181 shares (-97.4%) from their portfolio in Q2 2025, for an estimated $74,410,791

- MILLENNIUM MANAGEMENT LLC added 510,098 shares (+104.4%) to their portfolio in Q2 2025, for an estimated $73,250,072

- ANOMALY CAPITAL MANAGEMENT, LP added 451,069 shares (+inf%) to their portfolio in Q2 2025, for an estimated $64,773,508

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$JBHT Analyst Ratings

Wall Street analysts have issued reports on $JBHT in the last several months. We have seen 7 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Wells Fargo issued a "Overweight" rating on 10/16/2025

- B of A Securities issued a "Buy" rating on 10/16/2025

- Raymond James issued a "Outperform" rating on 10/14/2025

- Citigroup issued a "Buy" rating on 10/13/2025

- Evercore ISI Group issued a "Outperform" rating on 09/30/2025

- JP Morgan issued a "Overweight" rating on 07/16/2025

- Baird issued a "Outperformer" rating on 07/01/2025

To track analyst ratings and price targets for $JBHT, check out Quiver Quantitative's $JBHT forecast page.

$JBHT Price Targets

Multiple analysts have issued price targets for $JBHT recently. We have seen 15 analysts offer price targets for $JBHT in the last 6 months, with a median target of $164.0.

Here are some recent targets:

- Ken Hoexter from B of A Securities set a target price of $175.0 on 10/16/2025

- Christian Wetherbee from Wells Fargo set a target price of $170.0 on 10/16/2025

- Brian Ossenbeck from JP Morgan set a target price of $176.0 on 10/16/2025

- Ariel Rosa from Citigroup set a target price of $175.0 on 10/16/2025

- J. Bruce Chan from Stifel set a target price of $147.0 on 10/16/2025

- Fadi Chamoun from BMO Capital set a target price of $180.0 on 10/16/2025

- Patrick Tyler Brown from Raymond James set a target price of $175.0 on 10/14/2025

You can track data on $JBHT on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$RGP stock has now risen 4% today, according to our price data from Polygon. There has been approximately $1,439,370 of trading volume.

Here is what we see in our data on $RGP (you can track the company live on Quiver's $RGP stock page):$RGP Insider Trading Activity

$RGP insiders have traded $RGP stock on the open market 3 times in the past 6 months. Of those trades, 1 have been purchases and 2 have been sales.

Here’s a breakdown of recent trading of $RGP stock by insiders over the last 6 months:

- KATE W DUCHENE (President & CEO) purchased 23,015 shares for an estimated $100,451

- ANTHONY CHERBAK sold 10,000 shares for an estimated $45,008

- DAVID P WHITE sold 5,204 shares for an estimated $27,352

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$RGP Hedge Fund Activity

We have seen 69 institutional investors add shares of $RGP stock to their portfolio, and 77 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- HOTCHKIS & WILEY CAPITAL MANAGEMENT LLC added 445,430 shares (+37.5%) to their portfolio in Q2 2025, for an estimated $2,391,959

- GSA CAPITAL PARTNERS LLP added 256,985 shares (+inf%) to their portfolio in Q2 2025, for an estimated $1,380,009

- MARSHALL WACE, LLP removed 245,619 shares (-74.1%) from their portfolio in Q2 2025, for an estimated $1,318,974

- CIRCUMFERENCE GROUP LLC added 229,243 shares (+21.6%) to their portfolio in Q2 2025, for an estimated $1,231,034

- CHARLES SCHWAB INVESTMENT MANAGEMENT INC added 225,962 shares (+46.8%) to their portfolio in Q2 2025, for an estimated $1,213,415

- ROYAL BANK OF CANADA added 185,444 shares (+1139.5%) to their portfolio in Q2 2025, for an estimated $995,834

- MORGAN STANLEY added 175,631 shares (+47.2%) to their portfolio in Q2 2025, for an estimated $943,138

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$RGP Analyst Ratings

Wall Street analysts have issued reports on $RGP in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Northcoast Research issued a "Buy" rating on 09/24/2025

To track analyst ratings and price targets for $RGP, check out Quiver Quantitative's $RGP forecast page.

You can track data on $RGP on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$PSNL stock has now risen 8% today, according to our price data from Polygon. There has been approximately $4,753,637 of trading volume.

Here is what we see in our data on $PSNL (you can track the company live on Quiver's $PSNL stock page):$PSNL Insider Trading Activity

$PSNL insiders have traded $PSNL stock on the open market 5 times in the past 6 months. Of those trades, 0 have been purchases and 5 have been sales.

Here’s a breakdown of recent trading of $PSNL stock by insiders over the last 6 months:

- AARON TACHIBANA (CFO AND COO) has made 0 purchases and 2 sales selling 1,932 shares for an estimated $10,601.

- STEPHEN MICHAEL MOORE (SVP and Chief Legal Officer) sold 1,675 shares for an estimated $8,291

- RICHARD CHEN (CHIEF MEDICAL OFFICER AND EVP) has made 0 purchases and 2 sales selling 1,362 shares for an estimated $7,474.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$PSNL Hedge Fund Activity

We have seen 67 institutional investors add shares of $PSNL stock to their portfolio, and 57 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- BLACKROCK, INC. added 2,205,471 shares (+73.6%) to their portfolio in Q2 2025, for an estimated $14,467,889

- VANGUARD GROUP INC added 1,846,470 shares (+143.1%) to their portfolio in Q2 2025, for an estimated $12,112,843

- T. ROWE PRICE INVESTMENT MANAGEMENT, INC. added 1,264,455 shares (+inf%) to their portfolio in Q2 2025, for an estimated $8,294,824

- SUSQUEHANNA INTERNATIONAL GROUP, LLP removed 885,972 shares (-93.3%) from their portfolio in Q2 2025, for an estimated $5,811,976

- GEODE CAPITAL MANAGEMENT, LLC added 851,422 shares (+165.6%) to their portfolio in Q2 2025, for an estimated $5,585,328

- MARSHALL WACE, LLP removed 696,286 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $4,567,636

- NUVEEN, LLC added 635,571 shares (+inf%) to their portfolio in Q2 2025, for an estimated $4,169,345

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$PSNL Government Contracts

We have seen $13,834,000 of award payments to $PSNL over the last year.

Here are some of the awards which we have have seen pay out the most over the last year:

- WHOLE GENOME SEQUENCING: $13,500,000

- WHOLE GENOME SEQUENCING: $334,000

To track government contracts to publicy traded companies, check out Quiver Quantitative's government contracts dashboard.

$PSNL Analyst Ratings

Wall Street analysts have issued reports on $PSNL in the last several months. We have seen 1 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- HC Wainwright & Co. issued a "Buy" rating on 09/08/2025

To track analyst ratings and price targets for $PSNL, check out Quiver Quantitative's $PSNL forecast page.

You can track data on $PSNL on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$MUX stock has now risen 15% today, according to our price data from Polygon. There has been approximately $39,291,196 of trading volume.

Here is what we see in our data on $MUX (you can track the company live on Quiver's $MUX stock page):$MUX Insider Trading Activity

$MUX insiders have traded $MUX stock on the open market 6 times in the past 6 months. Of those trades, 0 have been purchases and 6 have been sales.

Here’s a breakdown of recent trading of $MUX stock by insiders over the last 6 months:

- ROBERT ROSS MCEWEN (Chairman and CEO) sold 50,000 shares for an estimated $717,335

- CARMEN L DIGES (General Counsel/Corp Sec) sold 21,000 shares for an estimated $301,236

- JEFFREY CHAN (VP - Finance) sold 13,333 shares for an estimated $198,525

- RICHARD W. BRISSENDEN has made 0 purchases and 2 sales selling 11,203 shares for an estimated $166,771.

- IAN J BALL sold 2,656 shares for an estimated $27,861

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$MUX Hedge Fund Activity

We have seen 68 institutional investors add shares of $MUX stock to their portfolio, and 49 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- PERRITT CAPITAL MANAGEMENT INC added 769,669 shares (+757.0%) to their portfolio in Q2 2025, for an estimated $7,396,519

- DF DENT & CO INC removed 585,000 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $5,621,850

- MILLENNIUM MANAGEMENT LLC added 580,837 shares (+548.2%) to their portfolio in Q2 2025, for an estimated $5,581,843

- U S GLOBAL INVESTORS INC removed 405,584 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $3,897,662

- STATE STREET CORP added 402,209 shares (+34.2%) to their portfolio in Q2 2025, for an estimated $3,865,228

- DIMENSIONAL FUND ADVISORS LP added 341,366 shares (+36.8%) to their portfolio in Q2 2025, for an estimated $3,280,527

- MONASHEE INVESTMENT MANAGEMENT LLC removed 275,000 shares (-100.0%) from their portfolio in Q2 2025, for an estimated $2,642,750

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

$MUX Analyst Ratings

Wall Street analysts have issued reports on $MUX in the last several months. We have seen 2 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- HC Wainwright & Co. issued a "Buy" rating on 10/10/2025

- Roth Capital issued a "Buy" rating on 07/01/2025

To track analyst ratings and price targets for $MUX, check out Quiver Quantitative's $MUX forecast page.

$MUX Price Targets

Multiple analysts have issued price targets for $MUX recently. We have seen 4 analysts offer price targets for $MUX in the last 6 months, with a median target of $19.25.

Here are some recent targets:

- Jeremy Hoy from Canaccord Genuity set a target price of $25.0 on 10/15/2025

- Heiko F. Ihle from HC Wainwright & Co. set a target price of $21.5 on 10/10/2025

- Joe Reagor from Roth Capital set a target price of $15.0 on 07/01/2025

You can track data on $MUX on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$HYMC stock has now risen 9% today, according to our price data from Polygon. There has been approximately $7,692,395 of trading volume.

Here is what we see in our data on $HYMC (you can track the company live on Quiver's $HYMC stock page):$HYMC Insider Trading Activity

$HYMC insiders have traded $HYMC stock on the open market 14 times in the past 6 months. Of those trades, 2 have been purchases and 12 have been sales.

Here’s a breakdown of recent trading of $HYMC stock by insiders over the last 6 months:

- ERIC SPROTT has made 2 purchases buying 15,694,704 shares for an estimated $62,220,333 and 0 sales.

- REBECCA JENNINGS (SVP & General Counsel) has made 0 purchases and 3 sales selling 36,643 shares for an estimated $217,524.

- DIANE R GARRETT (President & CEO) has made 0 purchases and 3 sales selling 19,592 shares for an estimated $59,307.

- STANTON K RIDEOUT (Executive Vice President & CFO) has made 0 purchases and 3 sales selling 15,073 shares for an estimated $48,722.

- DAVID BRIAN THOMAS (SVP, General Manager) has made 0 purchases and 3 sales selling 6,682 shares for an estimated $21,175.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$HYMC Hedge Fund Activity

We have seen 32 institutional investors add shares of $HYMC stock to their portfolio, and 12 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- ALYESKA INVESTMENT GROUP, L.P. added 1,000,000 shares (+inf%) to their portfolio in Q2 2025, for an estimated $3,130,000

- GHISALLO CAPITAL MANAGEMENT LLC added 850,000 shares (+inf%) to their portfolio in Q2 2025, for an estimated $2,660,500

- SPROTT INC. added 730,763 shares (+inf%) to their portfolio in Q2 2025, for an estimated $2,287,288

- LM ASSET (IM) INC. added 380,000 shares (+inf%) to their portfolio in Q2 2025, for an estimated $1,189,400

- ANSON FUNDS MANAGEMENT LP added 345,916 shares (+inf%) to their portfolio in Q2 2025, for an estimated $1,082,717

- UBS GROUP AG removed 219,913 shares (-65.4%) from their portfolio in Q2 2025, for an estimated $688,327

- VANGUARD GROUP INC added 160,310 shares (+20.2%) to their portfolio in Q2 2025, for an estimated $501,770

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

You can track data on $HYMC on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$VOO stock has risen 0.1% today, according to our price data from Polygon. It has been bolstered by CRM stock rising 7.2%.

Here are some of the largest contributors to VOO's gains:

- $NVDA (7.8% of VOO holdings) has risen 1.2%

- $AVGO (2.6%) has risen 1.7%

- $AMZN (4.0%) has risen 0.9%

- $GOOGL (2.3%) has risen 1.5%

- $CRM (0.4%) has risen 7.2%

- $GOOG (1.8%) has risen 1.4%

- $ORCL (0.7%) has risen 2.1%

- $PG (0.7%) has risen 1.9%

- $META (2.9%) has risen 0.4%

- $PLTR (0.6%) has risen 1.9%

You can track more data on $VOO on Quiver Quantitative's $VOO data dashboard.

$CRM Insider Trading Activity

$CRM insiders have traded $CRM stock on the open market 418 times in the past 6 months. Of those trades, 1 have been purchases and 417 have been sales.

Here’s a breakdown of recent trading of $CRM stock by insiders over the last 6 months:

- MARC BENIOFF (Chair and CEO) has made 0 purchases and 394 sales selling 166,500 shares for an estimated $41,753,478.

- SRINIVAS TALLAPRAGADA (Chief Eng/Cust Success Officer) has made 0 purchases and 4 sales selling 8,863 shares for an estimated $2,536,070.

- R DAVID SCHMAIER (Chief Product & Impact Officer) has made 0 purchases and 2 sales selling 4,586 shares for an estimated $1,163,301.

- DAVID BLAIR KIRK purchased 3,400 shares for an estimated $865,827

- SUNDEEP G. REDDY (EVP & Chief Accounting Officer) has made 0 purchases and 6 sales selling 2,286 shares for an estimated $592,809.

- SABASTIAN NILES (President and CLO) has made 0 purchases and 4 sales selling 2,049 shares for an estimated $559,184.

- PARKER HARRIS (Co-Founder and CTO, Slack) has made 0 purchases and 3 sales selling 2,039 shares for an estimated $527,137.

- MIGUEL MILANO (President and CRO) has made 0 purchases and 3 sales selling 1,110 shares for an estimated $303,253.

- BRIAN MILLHAM (Advisor to CEO) sold 979 shares for an estimated $248,336

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$CRM Analyst Ratings

Wall Street analysts have issued reports on $CRM in the last several months. We have seen 16 firms issue buy ratings on the stock, and 1 firms issue sell ratings.

Here are some recent analyst ratings:

- Wedbush issued a "Outperform" rating on 10/16/2025

- Cantor Fitzgerald issued a "Overweight" rating on 10/16/2025

- Piper Sandler issued a "Overweight" rating on 10/16/2025

- Stifel issued a "Buy" rating on 10/09/2025

- Bernstein issued a "Underperform" rating on 09/04/2025

- JMP Securities issued a "Market Outperform" rating on 09/02/2025

- Morgan Stanley issued a "Overweight" rating on 09/02/2025

To track analyst ratings and price targets for $CRM, check out Quiver Quantitative's $CRM forecast page.

$CRM Price Targets

Multiple analysts have issued price targets for $CRM recently. We have seen 28 analysts offer price targets for $CRM in the last 6 months, with a median target of $322.5.

Here are some recent targets:

- Daniel Ives from Wedbush set a target price of $375.0 on 10/16/2025

- Brent Bracelin from Piper Sandler set a target price of $315.0 on 10/16/2025

- Scott Berg from Needham set a target price of $400.0 on 10/16/2025

- Matthew Vanvliet from Cantor Fitzgerald set a target price of $325.0 on 10/16/2025

- Parker Lane from Stifel set a target price of $300.0 on 10/09/2025

- Tyler Radke from Citigroup set a target price of $276.0 on 09/09/2025

- Steve Koenig from Macquarie set a target price of $250.0 on 09/05/2025

You can track data on $CRM on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

$QQQ stock has risen 0.5% today, according to our price data from Polygon. It has been bolstered by MU stock rising 4.0%.

Here are some of the largest contributors to QQQ's gains:

- $NVDA (9.9% of QQQ holdings) has risen 1.2%

- $AVGO (6.0%) has risen 1.7%

- $MU (1.2%) has risen 4.0%

- $AMZN (5.1%) has risen 0.9%

- $GOOGL (3.1%) has risen 1.5%

- $GOOG (2.9%) has risen 1.4%

- $PLTR (2.2%) has risen 1.9%

- $SHOP (1.0%) has risen 3.3%

- $DASH (0.6%) has risen 3.0%

- $GILD (0.8%) has risen 2.1%

You can track more data on $QQQ on Quiver Quantitative's $QQQ data dashboard.

$MU Insider Trading Activity

$MU insiders have traded $MU stock on the open market 69 times in the past 6 months. Of those trades, 0 have been purchases and 69 have been sales.

Here’s a breakdown of recent trading of $MU stock by insiders over the last 6 months:

- SANJAY MEHROTRA (President and CEO) has made 0 purchases and 51 sales selling 112,500 shares for an estimated $18,401,019.

- SUMIT SADANA (EVP and Chief Business Officer) sold 92,638 shares for an estimated $11,625,142

- MANISH H BHATIA (EVP, Global Operations) sold 80,000 shares for an estimated $9,852,800

- SCOTT J DEBOER (EVP, CTO and Products Officer) has made 0 purchases and 2 sales selling 40,000 shares for an estimated $4,702,200.

- APRIL S ARNZEN (EVP and Chief People Officer) has made 0 purchases and 2 sales selling 30,000 shares for an estimated $4,337,400.

- MARK J. MURPHY (EVP & Chief Financial Officer) has made 0 purchases and 5 sales selling 34,000 shares for an estimated $3,716,823.

- STEVEN J GOMO sold 7,000 shares for an estimated $876,050

- RICHARD M BEYER sold 5,552 shares for an estimated $864,335

- MARY PAT MCCARTHY has made 0 purchases and 5 sales selling 7,212 shares for an estimated $761,952.

To track insider transactions, check out Quiver Quantitative's insider trading dashboard.

$MU Analyst Ratings

Wall Street analysts have issued reports on $MU in the last several months. We have seen 20 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Itau BBA issued a "Outperform" rating on 10/07/2025

- Morgan Stanley issued a "Overweight" rating on 10/06/2025

- Needham issued a "Buy" rating on 09/24/2025

- Wedbush issued a "Outperform" rating on 09/24/2025

- Mizuho issued a "Outperform" rating on 09/24/2025

- Raymond James issued a "Outperform" rating on 09/24/2025

- Stifel issued a "Buy" rating on 09/24/2025

To track analyst ratings and price targets for $MU, check out Quiver Quantitative's $MU forecast page.

$MU Price Targets

Multiple analysts have issued price targets for $MU recently. We have seen 28 analysts offer price targets for $MU in the last 6 months, with a median target of $200.0.

Here are some recent targets:

- Christopher Danely from Citigroup set a target price of $240.0 on 10/16/2025

- James Sheehan from Goldman Sachs set a target price of $180.0 on 10/09/2025

- Timothy Arcuri from UBS set a target price of $225.0 on 10/08/2025

- An analyst from Itau BBA set a target price of $249.0 on 10/07/2025

- Joseph Moore from Morgan Stanley set a target price of $220.0 on 10/06/2025

- Vivek Arya from B of A Securities set a target price of $180.0 on 09/24/2025

- John Vinh from Keybanc set a target price of $215.0 on 09/24/2025

You can track data on $MU on Quiver Quantitative.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information. Note that there may be inaccuracies due to mistakes in ticker-mapping, and other anomalies.

Congressman Griffith and Virginia House Republicans criticize Democratic tactics during the ongoing government shutdown in a joint op-ed.

Quiver AI Summary

As the government shutdown enters its third week, U.S. Congressman Morgan Griffith and the Virginia House Republican delegation have issued a joint op-ed criticizing what they describe as "Democratic political theater" affecting Virginians. They emphasize the urgent need for Senate Democrats to take action to resolve the shutdown.

In the op-ed, the lawmakers assert, "Every single Republican member of Virginia’s House delegation voted to fund the government," highlighting their support for a short-term funding resolution. They claim that Democrats have chosen to "manufacture a crisis" rather than collaborate on a solution.

The full op-ed can be read in *The Hill*, where they express concern over the economic impacts of the shutdown. Griffith also previously addressed the shutdown in a separate piece featured in Cardinal News.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

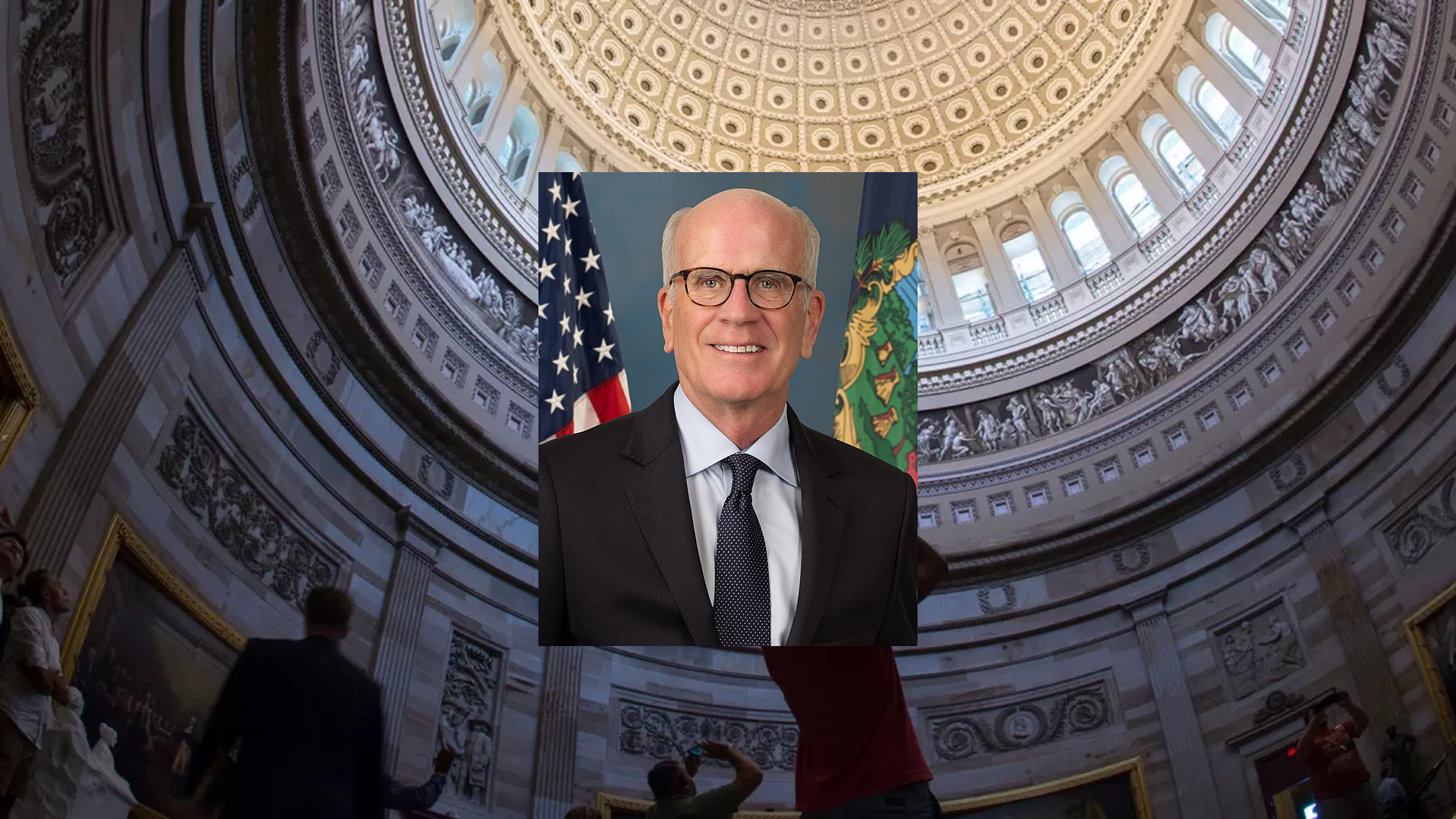

H. Morgan Griffith Net Worth

Quiver Quantitative estimates that H. Morgan Griffith is worth $665.5K, as of October 16th, 2025. This is the 371st highest net worth in Congress, per our live estimates.

Griffith has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track H. Morgan Griffith's net worth on Quiver Quantitative's politician page for Griffith.

H. Morgan Griffith Bill Proposals

Here are some bills which have recently been proposed by H. Morgan Griffith:

- H.R.5736: To amend title XVIII of the Social Security Act to include penicillin allergy verification and evaluation as part of the initial preventive physical examination under the Medicare program.

- H.R.5549: Efficient Nuclear Licensing Hearings Act

- H.R.4282: Contact Lens Prescription Verification Modernization Act

- H.R.3877: Washington, D.C. Residents Voting Act

- H.R.3632: Power Plant Reliability Act of 2025

- H.R.3268: Federal Bird Safe Buildings Act of 2025

You can track bills proposed by H. Morgan Griffith on Quiver Quantitative's politician page for Griffith.

H. Morgan Griffith Fundraising

H. Morgan Griffith recently disclosed $190.6K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 450th most from all Q2 reports we have seen this year. 21.8% came from individual donors.

Griffith disclosed $222.0K of spending. This was the 239th most from all Q2 reports we have seen from politicians so far this year.

Griffith disclosed $474.3K of cash on hand at the end of the filing period. This was the 482nd most from all Q2 reports we have seen this year.

You can see the disclosure here, or track H. Morgan Griffith's fundraising on Quiver Quantitative.

Congressman Pat Harrigan held a telephone town hall, engaging 15,012 constituents about the government shutdown and federal operations.

Quiver AI Summary

On October 16, 2025, Congressman Pat Harrigan of North Carolina held a telephone town hall attended by over 15,000 constituents. During the call, he addressed topics such as the ongoing government shutdown, federal operations, and assistance available for affected families. Harrigan emphasized the importance of fiscal discipline and accountability in government spending.

“North Carolinians deserve honesty about why this shutdown happened and what’s being done to fix it,” said Harrigan. He reassured attendees that his office remains operational to assist those facing hardships as a result of the shutdown and encouraged constituents to reach out for support.

For those unable to join the town hall, Harrigan's offices in Washington, D.C., and Hickory offer resources for federal services. Constituents can also subscribe to his weekly newsletter for ongoing updates.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Pat Harrigan Net Worth

Quiver Quantitative estimates that Pat Harrigan is worth $8.8M, as of October 16th, 2025. This is the 119th highest net worth in Congress, per our live estimates.

Harrigan has approximately $7.9K invested in publicly traded assets which Quiver is able to track live.

You can track Pat Harrigan's net worth on Quiver Quantitative's politician page for Harrigan.

Pat Harrigan Bill Proposals

Here are some bills which have recently been proposed by Pat Harrigan:

- H.R.5394: Freedom from Automated Speed Enforcement Act of 2025

- H.R.5086: SkyFoundry Act of 2025

- H.R.4081: Foreign Adversary Federal Offense Act of 2025

- H.R.4080: GUARD Act

- H.R.3588: Real Estate Reciprocity Act

- H.R.3066: FINS Act

You can track bills proposed by Pat Harrigan on Quiver Quantitative's politician page for Harrigan.

Pat Harrigan Fundraising

Pat Harrigan recently disclosed $131.1K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 438th most from all Q3 reports we have seen this year. 48.1% came from individual donors.

Harrigan disclosed $118.1K of spending. This was the 369th most from all Q3 reports we have seen from politicians so far this year.

Harrigan disclosed $259.6K of cash on hand at the end of the filing period. This was the 499th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Pat Harrigan's fundraising on Quiver Quantitative.

Senator Peter Welch urges Republicans to assist in extending ACA tax credits, emphasizing immediate action is crucial for families’ healthcare affordability.

Quiver AI Summary

U.S. Senator Peter Welch (D-Vt.) has called on Republicans to collaborate with Democrats in renewing Affordable Care Act (ACA) tax credits, emphasizing a crucial deadline. He pointed out that failure to extend these subsidies could lead to significant healthcare premium hikes for American families, particularly affecting low and moderate-income individuals in Vermont. "There is absolutely no excuse for us to delay—this is the urgency of now," Welch stated.

Welch noted that approximately 27,000 Vermonters benefit from these subsidies, and without action, millions of Americans could face increased costs for healthcare. He highlighted the bipartisan nature of healthcare access, asserting that "this is about American families," regardless of political affiliation. Welch has previously introduced several bills aimed at making healthcare more accessible.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Peter Welch Net Worth

Quiver Quantitative estimates that Peter Welch is worth $10.1M, as of October 16th, 2025. This is the 107th highest net worth in Congress, per our live estimates.

Welch has approximately $5.8M invested in publicly traded assets which Quiver is able to track live.

You can track Peter Welch's net worth on Quiver Quantitative's politician page for Welch.

Peter Welch Bill Proposals

Here are some bills which have recently been proposed by Peter Welch:

- S.2835: Energizing Our Communities Act

- S.2797: Capital for Beginning Farmers and Ranchers Act of 2025

- S.2775: Measuring the Cost of Disasters Act of 2025

- S.2717: Student Loan Deduction Act of 2025

- S.2672: SANCTIONS in the West Bank Act

- S.2455: TRAIN Act

You can track bills proposed by Peter Welch on Quiver Quantitative's politician page for Welch.

Peter Welch Fundraising

Peter Welch recently disclosed $7.2K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 779th most from all Q3 reports we have seen this year. 31.0% came from individual donors.

Welch disclosed $35.9K of spending. This was the 602nd most from all Q3 reports we have seen from politicians so far this year.

Welch disclosed $1.7M of cash on hand at the end of the filing period. This was the 157th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Peter Welch's fundraising on Quiver Quantitative.

Senator Rick Scott urges Treasury Secretary Bessent to investigate China's land purchases in fire-affected California.

Quiver AI Summary

On October 16, 2025, Senator Rick Scott contacted Treasury Secretary Scott Bessent, urging a review of potential Chinese investments in fire-damaged California lands. Citing reports of Communist China-affiliated businesses acquiring property, Scott expressed concerns about national security, highlighting the implications of such acquisitions on American communities.

Scott emphasized the importance of the Committee on Foreign Investment in the United States (CFIUS) in monitoring foreign transactions, especially concerning sensitive areas near military sites. His letter reflects ongoing investigations into the aftermath of devastating wildfires in Pacific Palisades, California.

In his correspondence, Scott contended that increasing Chinese influence poses risks to American data security and property, advocating for legislative support to confront these challenges and safeguard national interests.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Rick Scott Net Worth

Quiver Quantitative estimates that Rick Scott is worth $507.2M, as of October 16th, 2025. This is the 3rd highest net worth in Congress, per our live estimates.

Scott has approximately $55.2M invested in publicly traded assets which Quiver is able to track live.

You can track Rick Scott's net worth on Quiver Quantitative's politician page for Scott.

Rick Scott Bill Proposals

Here are some bills which have recently been proposed by Rick Scott:

- S.2972: A bill to amend the Internal Revenue Code of 1986 to provide a reduced excise tax rate for portable, electronically-aerated bait containers.

- S.2936: Stop ANTIFA Act of 2025

- S.2935: Sovereign Enforcement Integrity Act of 2025

- S.2908: Lifting Local Communities Act

- S.2843: FRAME Act

- S.2744: Federal Disaster Tax Relief Act of 2025

You can track bills proposed by Rick Scott on Quiver Quantitative's politician page for Scott.

Rick Scott Fundraising

Rick Scott recently disclosed $155.0K of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 400th most from all Q3 reports we have seen this year. 22.6% came from individual donors.

Scott disclosed $248.8K of spending. This was the 155th most from all Q3 reports we have seen from politicians so far this year.

Scott disclosed $721.8K of cash on hand at the end of the filing period. This was the 312th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Rick Scott's fundraising on Quiver Quantitative.

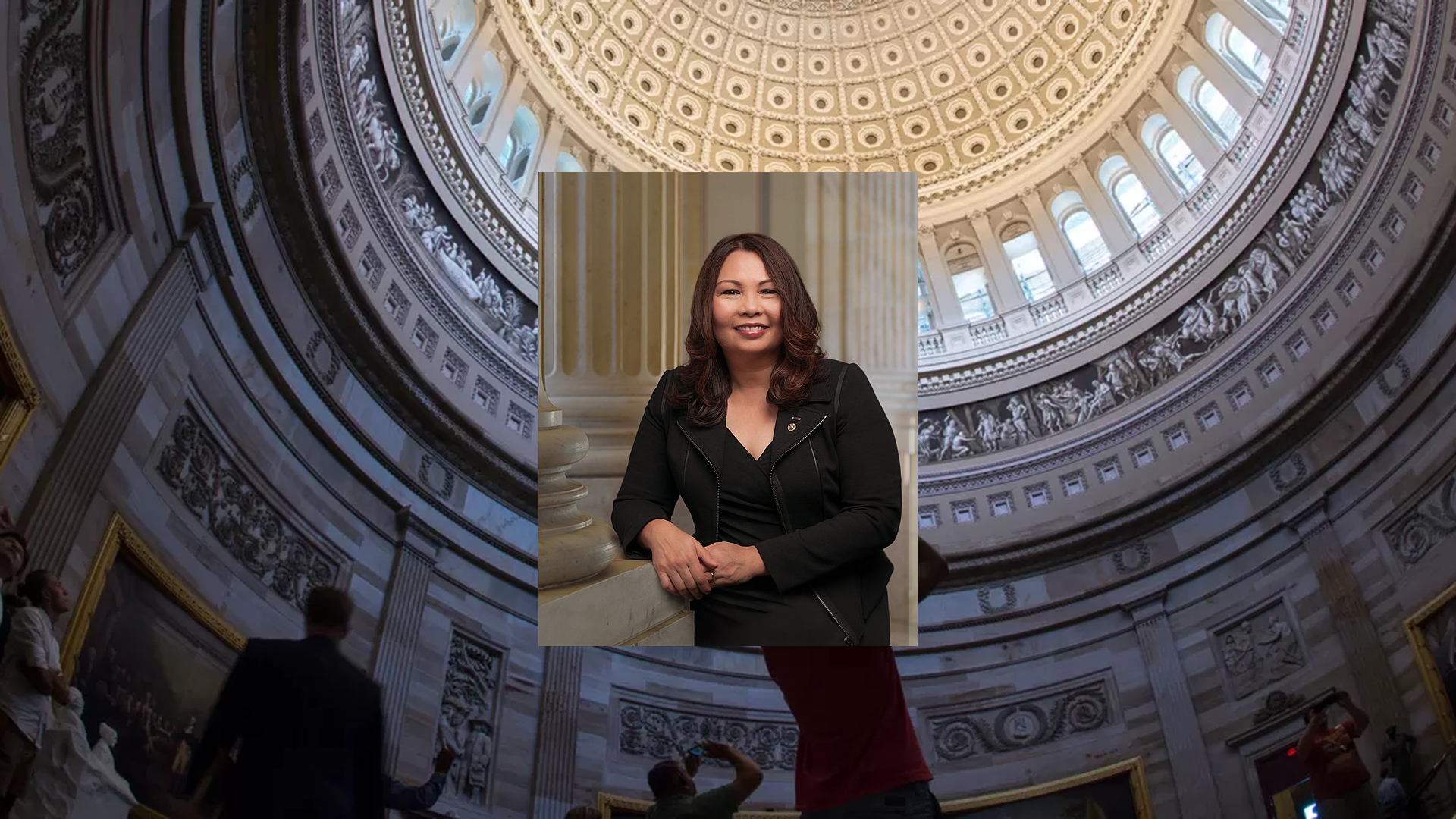

Senator Tammy Duckworth visits Japan to strengthen Illinois' position in quantum technology, competing against China.

Quiver AI Summary

Senator Tammy Duckworth visited Japan to enhance Illinois' role in the competitive quantum technology sector and strengthen supply chain ties. The visit, her 11th to Asia, included discussions with SK Group on significant investments in U.S. technology and energy sectors, aiming to attract these projects back to Illinois.

Duckworth emphasized the urgency of maintaining U.S. leadership in quantum computing, expressing concerns about China's advancements in the technology. "We can’t let the PRC get ahead of us," she stated, highlighting the implications for national security.

In addition to meetings with SK and discussions on collaboration opportunities, Duckworth will engage with Mitsubishi Heavy Industries and participate in a roundtable concerning quantum industry alliances to foster growth in Illinois' quantum research initiatives.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Tammy Duckworth Net Worth

Quiver Quantitative estimates that Tammy Duckworth is worth $1.3M, as of October 16th, 2025. This is the 297th highest net worth in Congress, per our live estimates.

Duckworth has approximately $808.1K invested in publicly traded assets which Quiver is able to track live.

You can track Tammy Duckworth's net worth on Quiver Quantitative's politician page for Duckworth.

Tammy Duckworth Bill Proposals

Here are some bills which have recently been proposed by Tammy Duckworth:

- S.2943: A bill to amend chapter 17 of title 38, United States Code, to direct the Secretary of Veterans Affairs to allow a veteran to receive a full-year supply of contraceptive pills, transdermal patches, vaginal rings, and other contraceptive products, and for other purposes.

- S.2863: RRLEF Act of 2025

- S.2862: CCAMPIS Reauthorization Act

- S.2738: ESP, Paraprofessional, and Education Support Staff Family Leave Act

- S.2377: EACH Act of 2025

- S.2239: Improving Access to Prenatal Care for Military Families Act

You can track bills proposed by Tammy Duckworth on Quiver Quantitative's politician page for Duckworth.

Tammy Duckworth Fundraising

Tammy Duckworth recently disclosed $0 of fundraising in a Q3 FEC disclosure filed on October 15th, 2025. This was the 1035th most from all Q3 reports we have seen this year. nan% came from individual donors.

Duckworth disclosed $101.68 of spending. This was the 1195th most from all Q3 reports we have seen from politicians so far this year.

Duckworth disclosed $7.7K of cash on hand at the end of the filing period. This was the 998th most from all Q3 reports we have seen this year.

You can see the disclosure here, or track Tammy Duckworth's fundraising on Quiver Quantitative.

We just received data on a new analyst forecast for $RACE. Citigroup gave a rating of 'Buy' for $RACE.

$RACE Analyst Ratings

Wall Street analysts have issued reports on $RACE in the last several months. We have seen 5 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Citigroup issued a "Buy" rating on 10/16/2025

- Bernstein issued a "Outperform" rating on 10/10/2025

- HSBC issued a "Buy" rating on 10/02/2025

- Deutsche Bank issued a "Buy" rating on 09/02/2025

- UBS issued a "Buy" rating on 05/07/2025

To track analyst ratings and price targets for $RACE, check out Quiver Quantitative's $RACE forecast page.

$RACE Price Targets

Multiple analysts have issued price targets for $RACE recently. We have seen 3 analysts offer price targets for $RACE in the last 6 months, with a median target of $529.0.

Here are some recent targets:

- Susy Tibaldi from Citigroup set a target price of $529.0 on 10/16/2025

- Stephen Reitman from Bernstein set a target price of $475.0 on 10/10/2025

- Susy Tibaldi from UBS set a target price of $579.0 on 10/03/2025

$RACE Hedge Fund Activity

We have seen 352 institutional investors add shares of $RACE stock to their portfolio, and 333 decrease their positions in their most recent quarter.

Here are some of the largest recent moves:

- BANK OF AMERICA CORP /DE/ removed 786,742 shares (-22.0%) from their portfolio in Q2 2025, for an estimated $386,085,769

- GOLDMAN SACHS GROUP INC removed 739,970 shares (-32.5%) from their portfolio in Q2 2025, for an estimated $363,132,877

- VIKING GLOBAL INVESTORS LP added 585,872 shares (+432.7%) to their portfolio in Q2 2025, for an estimated $287,510,825

- JPMORGAN CHASE & CO removed 548,280 shares (-27.0%) from their portfolio in Q2 2025, for an estimated $269,062,927

- BAILLIE GIFFORD & CO removed 367,363 shares (-7.9%) from their portfolio in Q2 2025, for an estimated $180,279,718

- WCM INVESTMENT MANAGEMENT, LLC removed 297,316 shares (-39.6%) from their portfolio in Q2 2025, for an estimated $145,904,853

- MANNING & NAPIER ADVISORS LLC added 267,825 shares (+inf%) to their portfolio in Q2 2025, for an estimated $131,432,440

To track hedge funds' stock portfolios, check out Quiver Quantitative's institutional holdings dashboard.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.

We just received data on a new analyst forecast for $RVTY. Guggenheim gave a rating of 'Neutral' for $RVTY.

$RVTY Analyst Ratings

Wall Street analysts have issued reports on $RVTY in the last several months. We have seen 7 firms issue buy ratings on the stock, and 0 firms issue sell ratings.

Here are some recent analyst ratings:

- Evercore ISI Group issued a "Outperform" rating on 10/07/2025

- Barclays issued a "Overweight" rating on 10/02/2025

- B of A Securities issued a "Buy" rating on 09/22/2025

- Raymond James issued a "Outperform" rating on 07/29/2025

- UBS issued a "Buy" rating on 05/01/2025

- Goldman Sachs issued a "Buy" rating on 04/29/2025

- Baird issued a "Outperform" rating on 04/29/2025

To track analyst ratings and price targets for $RVTY, check out Quiver Quantitative's $RVTY forecast page.

$RVTY Price Targets

Multiple analysts have issued price targets for $RVTY recently. We have seen 10 analysts offer price targets for $RVTY in the last 6 months, with a median target of $110.0.

Here are some recent targets:

- Vijay Kumar from Evercore ISI Group set a target price of $106.0 on 10/07/2025

- Luke Sergott from Barclays set a target price of $100.0 on 10/02/2025