H.R. 3380: Taking Account of Institutions with Low Operation Risk Act of 2025

This bill, known as the Taking Account of Institutions with Low Operation Risk Act of 2025 (TAILOR Act), aims to adjust how federal financial regulatory agencies approach regulations based on the risk profiles and business models of different financial institutions. Here are the main points of the bill:

Purpose

The bill requires federal financial institutions regulatory agencies to consider the specific risk profiles and business models of institutions when enacting regulatory measures. This means that the regulations should be tailored to fit the unique circumstances of different types or classes of financial institutions.

Definitions

The bill defines two key terms:

- Federal financial institutions regulatory agency: This includes agencies such as the Office of the Comptroller of the Currency, the Federal Reserve, the Federal Deposit Insurance Corporation, the National Credit Union Administration, and the Bureau of Consumer Financial Protection.

- Regulatory action: This refers to any proposed, interim, or final rule or regulation, but excludes actions that apply solely to individual institutions, like enforcement actions or orders.

Tailoring Regulations

For any regulatory actions taken after the bill becomes law, each regulatory agency must:

- Consider the risk profile and business models of the institutions affected.

- Tailor the regulatory impacts, aiming to minimize costs, resource allocation, and other burdens on the institutions based on their specific risks and business models.

Factors to Consider

When tailoring regulations, agencies should take into account:

- The overall effect of regulations on the institutions' ability to serve their customers and local markets.

- The possible challenges that implementing regulatory actions and involving third-party services may present to customizing the regulations.

- The intentions of Congress when enacting the statutes authorizing the regulations and the policy goals behind those regulations.

Documentation and Reporting

The bill mandates that federal financial regulatory agencies document and disclose their considerations regarding the tailoring of regulations in proposed rules and final rule notices.

Furthermore, they must submit annual reports to Congress on how they have complied with these requirements within one year after the act is enacted and each year thereafter.

Review of Existing Regulations

Regulatory agencies are required to review all final regulations issued under statutes enacted in the 15 years prior to the introduction of the bill and apply the new tailoring requirements to those regulations. Any necessary revisions must be completed within three years of the bill's enactment.

Reduced Reporting Requirements for Community Banks

The bill directs federal banking agencies to create regulations that simplify reporting requirements for community banks eligible for the Community Bank Leverage Ratio. This simplification applies to the first and third reports of condition each year.

Report on Supervision Modernization

Within 18 months of the bill's enactment, federal banking agencies must produce a report on modernizing bank supervision. This report should address various factors, including:

- Changing business models in banking

- Workforce training for examiners

- The structure of supervisory activities

- Improving communication between banks and supervisors

- Utilizing technology in supervision

- Unique supervisory factors for community banks

- Needed changes to statutes for effective supervision

Relevant Companies

- JPM (JPMorgan Chase & Co.): This bank may see changes in its regulatory compliance practices based on its risk profile.

- BAC (Bank of America Corporation): The adjustments in regulatory oversight may affect operational costs and reporting obligations.

- WFC (Wells Fargo & Company): Regulatory adaptations could influence how this bank approaches its risk management and client service strategies.

- C (Citigroup Inc.): Changes to regulations could impact Citi’s operational framework and risk assessment methodologies.

This is an AI-generated summary of the bill text. There may be mistakes.

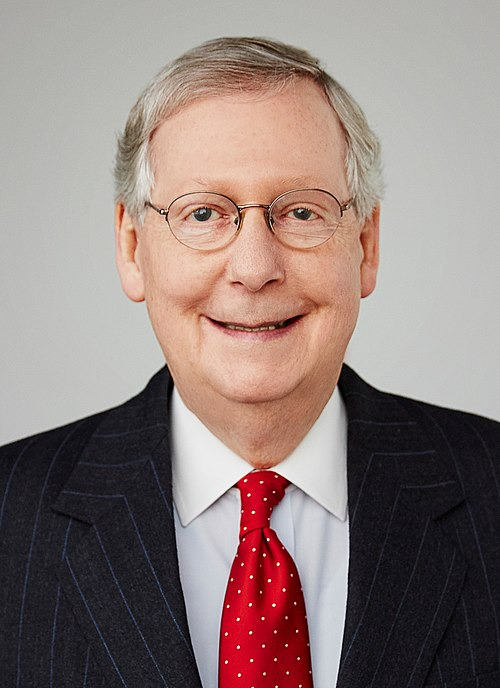

Sponsors

2 bill sponsors

Actions

6 actions

| Date | Action |

|---|---|

| Jun. 04, 2025 | Placed on the Union Calendar, Calendar No. 104. |

| Jun. 04, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-135. |

| May. 21, 2025 | Committee Consideration and Mark-up Session Held |

| May. 21, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 29 - 23. |

| May. 14, 2025 | Introduced in House |

| May. 14, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

2 companies lobbying