S. 2486: Protecting Access to Credit for Small Businesses Act

This bill, titled the Protecting Access to Credit for Small Businesses Act, proposes to amend the Small Business Administration's (SBA) lending practices, specifically concerning the 7(a) loan program. Here’s a breakdown of its main provisions:

Prohibition on Direct Loans

The bill states that the Administrator of the Small Business Administration will no longer be allowed to directly issue loans under the 7(a) loan program. This means that the SBA cannot grant loans directly to small businesses. The 7(a) loan program is one of the SBA's primary lending programs, which provides loans to small businesses for various purposes, such as working capital, equipment purchases, and business expansion.

Service of Existing Loans

Despite the prohibition on new direct loans, the bill ensures that the SBA will continue to service any direct loans that were already issued before the bill becomes law. This means that any existing loans made under this program will be maintained and managed by the SBA, even though no new direct loans can be issued.

Impact on Lending Process

By prohibiting direct loans, the bill shifts the responsibility of loan distribution to lenders participating in the SBA program. Small businesses looking for loans under the 7(a) program would have to go through banks or other financial institutions instead of obtaining a loan directly from the SBA.

Overall Purpose

The purpose of the bill appears to be aimed at restructuring how small business loans are administered, possibly to encourage partnerships between small businesses and traditional lenders while removing the SBA from direct loan issuance. This could potentially streamline processes, focus on lender partnerships, and aim to safeguard credit access for small business owners.

Relevant Companies

- JPM (JPMorgan Chase & Co.): As one of the largest lenders, changes in the SBA's loan distribution could affect its business model regarding small business loans.

- BAC (Bank of America Corp.): This bank could see implications in its small business lending strategies due to the prohibition of direct SBA loans.

- WFC (Wells Fargo & Co.): Similarly, Wells Fargo's approach to small business lending might need to adapt to the new structure of the SBA loan program.

This is an AI-generated summary of the bill text. There may be mistakes.

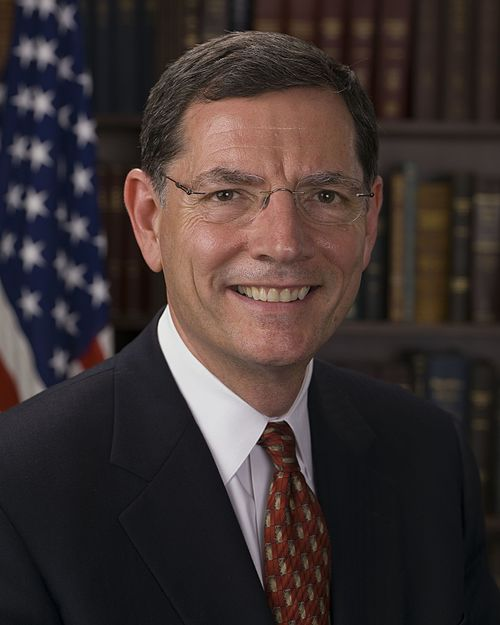

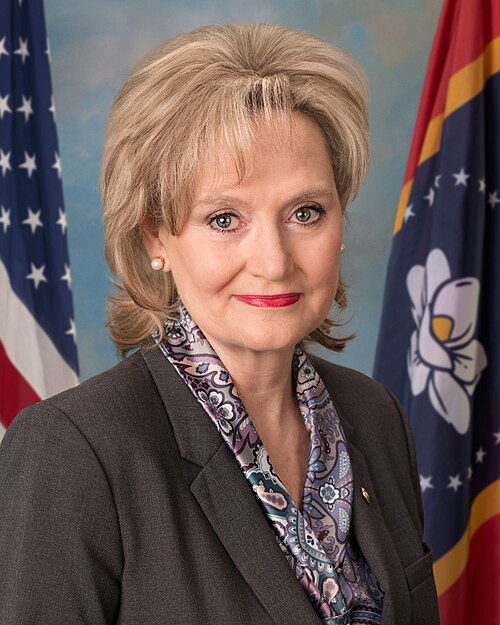

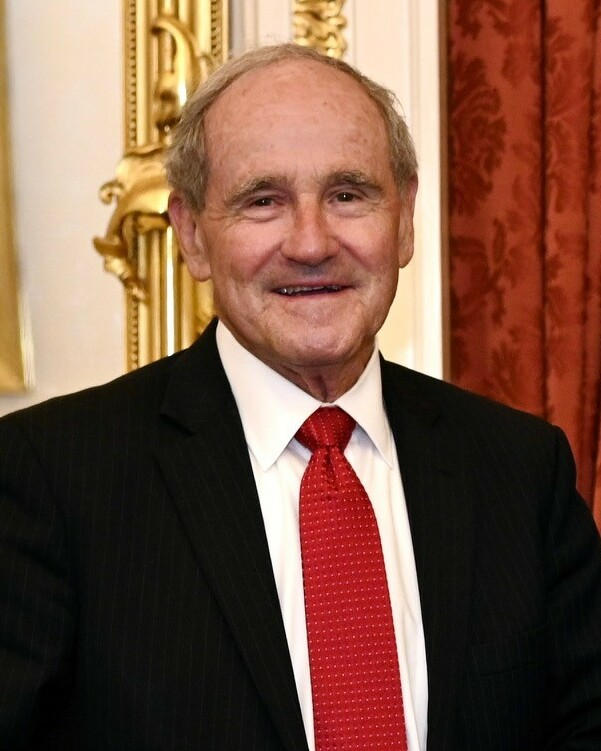

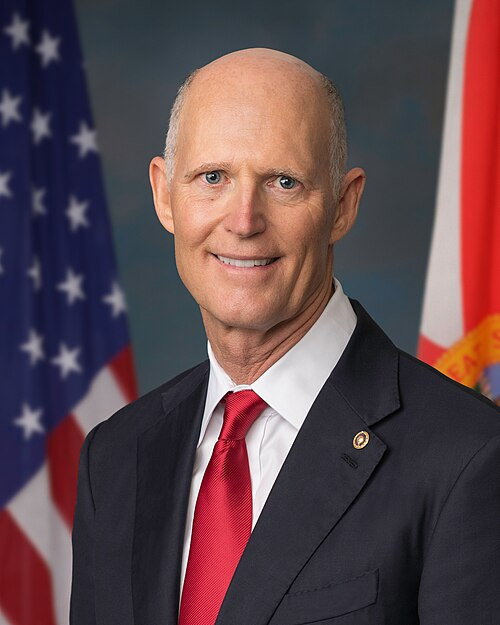

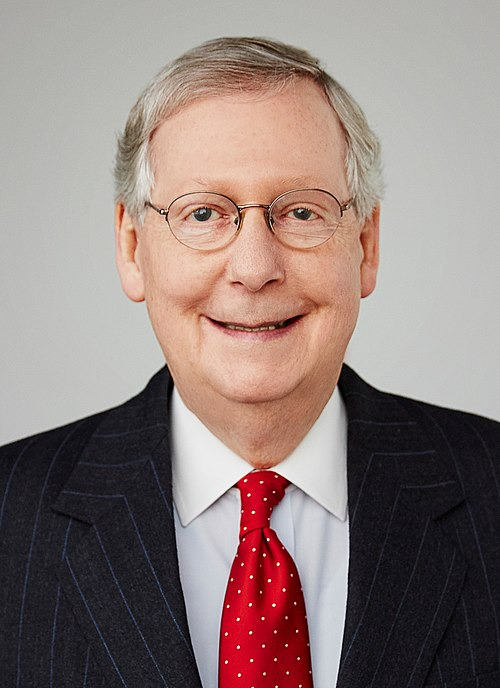

Sponsors

9 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 28, 2025 | Introduced in Senate |

| Jul. 28, 2025 | Read twice and referred to the Committee on Small Business and Entrepreneurship. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.