H.R. 2702: Financial Integrity and Regulation Management Act

This bill, known as the Financial Integrity and Regulation Management Act (FIRM Act), aims to modify how federal banking agencies supervise depository institutions by removing the consideration of "reputational risk" from their regulatory frameworks. Below are the key elements of the bill:

Purpose

The primary objective of this legislation is to eliminate the influence of reputational risk in the supervision of banks and other depository institutions. The bill asserts that financial regulation should focus solely on the safety and soundness of these institutions, rather than on their public image or perception.

Findings

The bill outlines several findings, including:

- The main goal of financial regulation is to ensure the security and stability of depository institutions.

- All law-abiding citizens and federally legal businesses should have equal access to financial services without facing discrimination.

- Financial service providers are private companies that should make business decisions free of unlawful bias or political pressure.

- Reputational risk was notably used in prior supervisory practices, such as "Operation Choke Point," which the bill critiques for limiting access to financial services based on perceived negative public opinion.

Definitions

The bill provides definitions for several terms, notably:

- Depository institution: Includes banks and credit unions as defined in relevant laws.

- Federal banking agency: Refers to regulatory bodies overseeing banks and includes the National Credit Union Administration and the Bureau of Consumer Financial Protection.

- Reputational risk: Defined as the potential adverse impact on a financial institution due to negative perceptions or publicity, except in cases involving unlawful transactions linked to terrorism.

Removal of Reputational Risk

The bill mandates that federal banking agencies must remove any references to reputational risk from their guidelines and examination standards. This means that such agencies will no longer consider reputational concerns when regulating or supervising banks, placing a stronger emphasis on operational soundness instead.

Prohibitions

The legislation places restrictions on federal banking agencies, prohibiting them from:

- Establishing any rules related to reputational risk management.

- Conducting assessments that involve evaluating reputational risk.

- Issuing findings or communications based on reputational considerations.

- Making supervisory ratings decisions based on reputational factors.

- Taking enforcement actions based on reputational issues.

Reporting Requirements

The bill requires federal banking agencies to submit a report within 180 days following enactment. This report must confirm the implementation of the bill and detail any changes to internal policies as a result of the new law.

Conclusion

The FIRM Act emphasizes a more direct and sound regulatory approach, aiming to prevent the regulatory oversight of depository institutions from being influenced by public perception or political agendas.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

20 bill sponsors

-

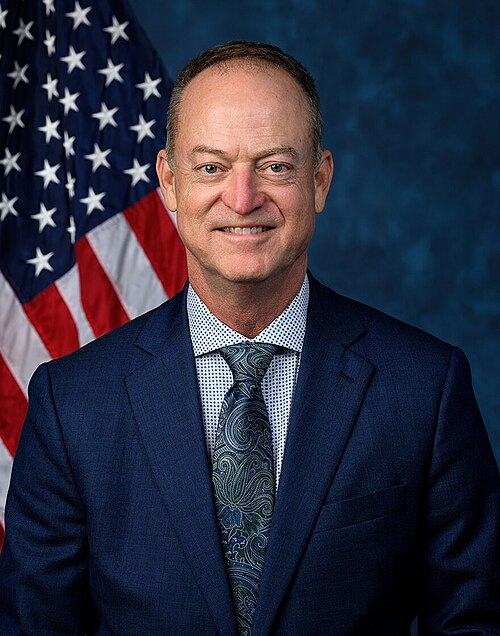

TrackAndy Barr

Sponsor

-

TrackTroy Downing

Co-Sponsor

-

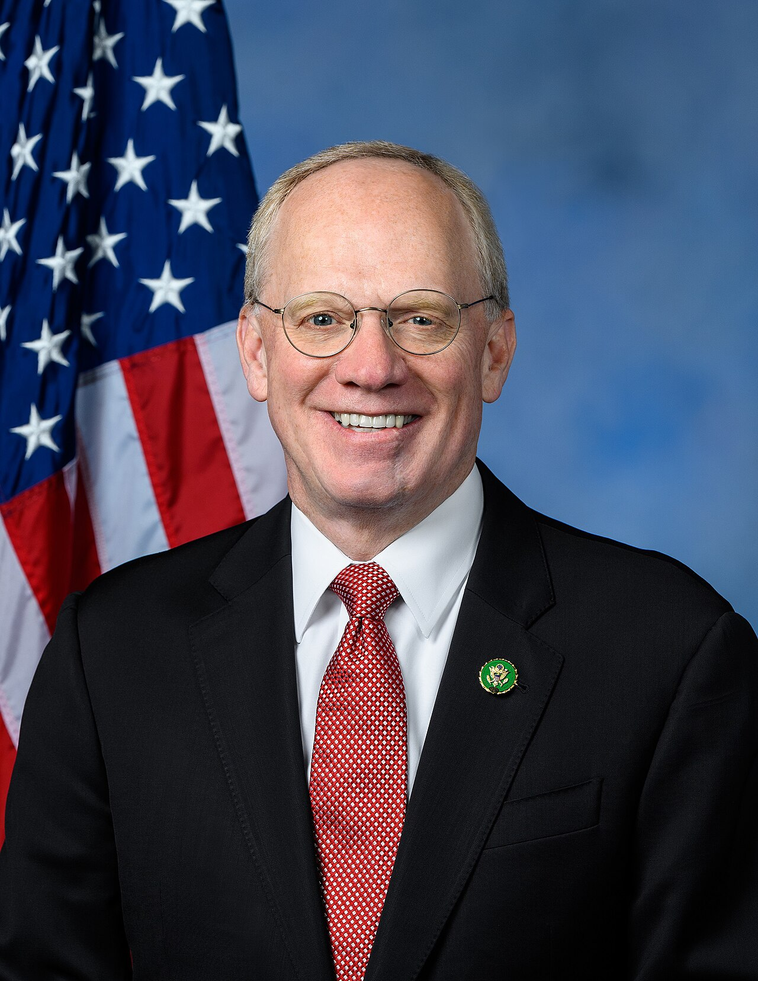

TrackScott Fitzgerald

Co-Sponsor

-

TrackAndrew R. Garbarino

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackDoug LaMalfa

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackFrank D. Lucas

Co-Sponsor

-

TrackLisa C. McClain

Co-Sponsor

-

TrackMark Messmer

Co-Sponsor

-

TrackTim Moore

Co-Sponsor

-

TrackAndrew Ogles

Co-Sponsor

-

TrackJohn W. Rose

Co-Sponsor

-

TrackDerek Schmidt

Co-Sponsor

-

TrackPete Sessions

Co-Sponsor

-

TrackMarlin A. Stutzman

Co-Sponsor

-

TrackWilliam R. Timmons IV

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

-

TrackAnn Wagner

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

Actions

6 actions

| Date | Action |

|---|---|

| Jun. 20, 2025 | Placed on the Union Calendar, Calendar No. 131. |

| Jun. 20, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-164. |

| May. 21, 2025 | Committee Consideration and Mark-up Session Held |

| May. 21, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 33 - 19. |

| Apr. 08, 2025 | Introduced in House |

| Apr. 08, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

3 companies lobbying