S. 2127: Wall Street Tax Act of 2025

The Wall Street Tax Act of 2025 aims to impose a tax on certain trading transactions involving various securities in the United States. Below is a summary of the key aspects of the bill:

Overview of the Tax Imposition

The bill introduces a tax that applies to "covered transactions," which include:

- Purchases of securities occurring on a qualified board or exchange in the United States

- Purchases executed by U.S. persons

- Transactions involving derivatives traded on U.S. exchanges

Tax Rates

The rates at which tax will be applied are progressive, changing over the years as follows:

- 0.02% for transactions occurring between January 1, 2026, and December 31, 2026

- 0.04% between January 1, 2027, and December 31, 2027

- 0.06% between January 1, 2028, and December 31, 2028

- 0.08% between January 1, 2029, and December 31, 2029

- 0.1% from January 1, 2030, onward

Definitions and Exemptions

The bill defines "securities" to include stocks, partnership interests, evidence of indebtedness, and derivatives. However, certain transactions are exempt, specifically:

- The initial issuance of securities

- Short-term debt instruments traded on U.S. exchanges with a maturity of 100 days or less

Tax Payment Responsibilities

Responsibilities for tax payment are established based on the nature of the transactions:

- For transactions on qualified boards, the boards are responsible for collecting taxes.

- For other purchases executed by brokers, the brokers are responsible for reporting and payment.

- In certain cases involving international transactions, U.S. shareholders of controlled foreign corporations may be required to pay the tax directly.

Reporting and Administration

The Secretary of the Treasury will coordinate with relevant regulatory bodies, such as the Securities and Exchange Commission, to ensure the tax is reported and administered correctly. Guidance will be provided for compliance, including reporting requirements regarding covered transactions.

Effective Date

The tax provisions outlined in this bill will apply to transactions carried out after December 31, 2025.

Relevant Companies

- GS: Goldman Sachs Group Inc. may be impacted as it is involved in numerous trading transactions and would need to adjust its operations to account for the new tax costs.

- JPM: JPMorgan Chase & Co. could see an impact on their trading services and strategies due to the additional tax burden on transactions.

- MS: Morgan Stanley may need to revise its trading fees and business models to accommodate the costs imposed by this tax.

- AMTD: Ameritrade Holding Corporation, as an online brokerage firm, may face changes in transaction volume and pricing strategies.

This is an AI-generated summary of the bill text. There may be mistakes.

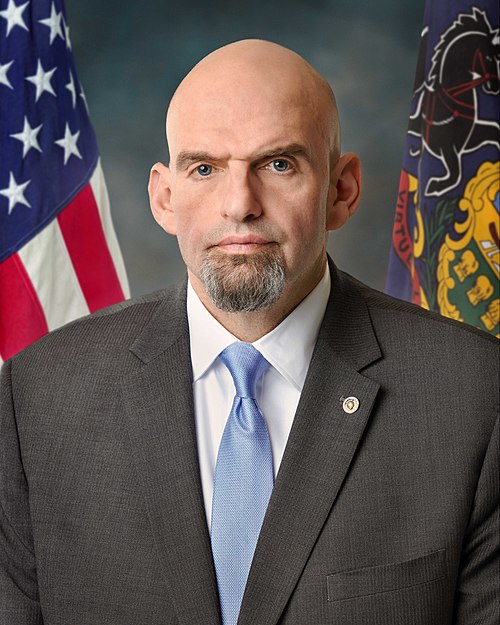

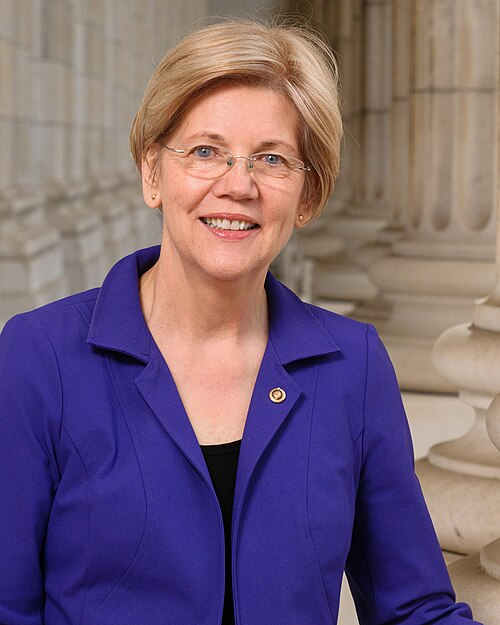

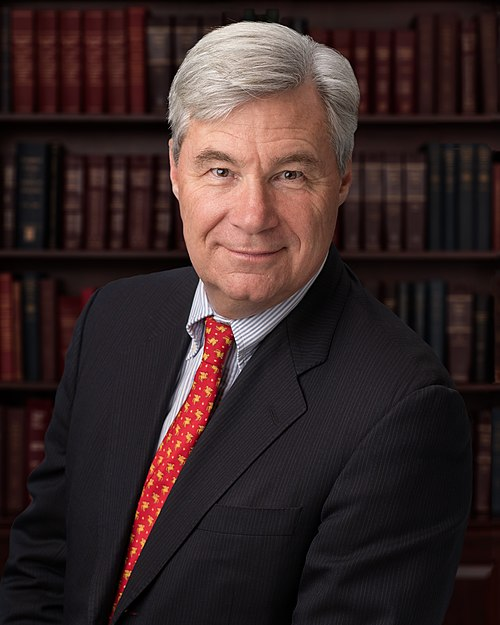

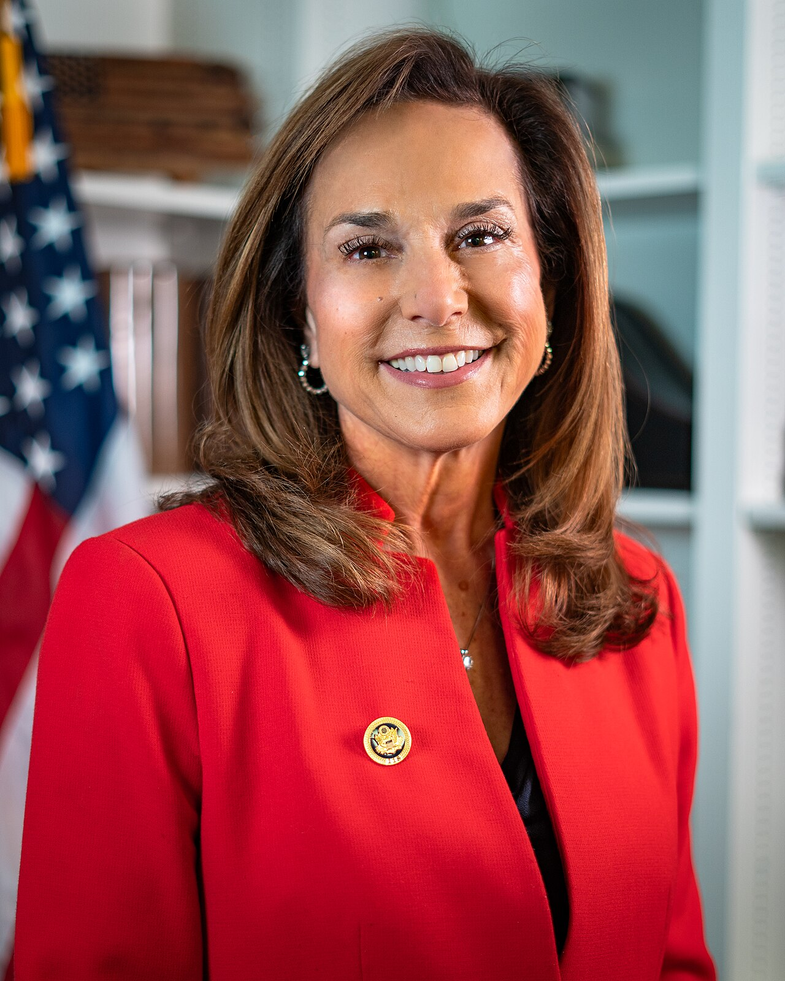

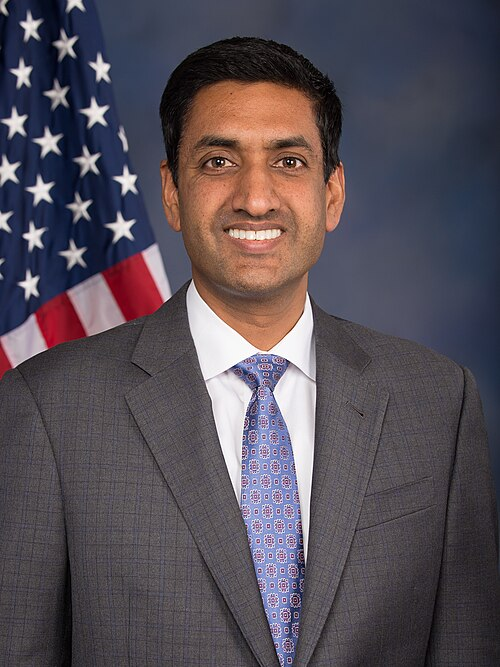

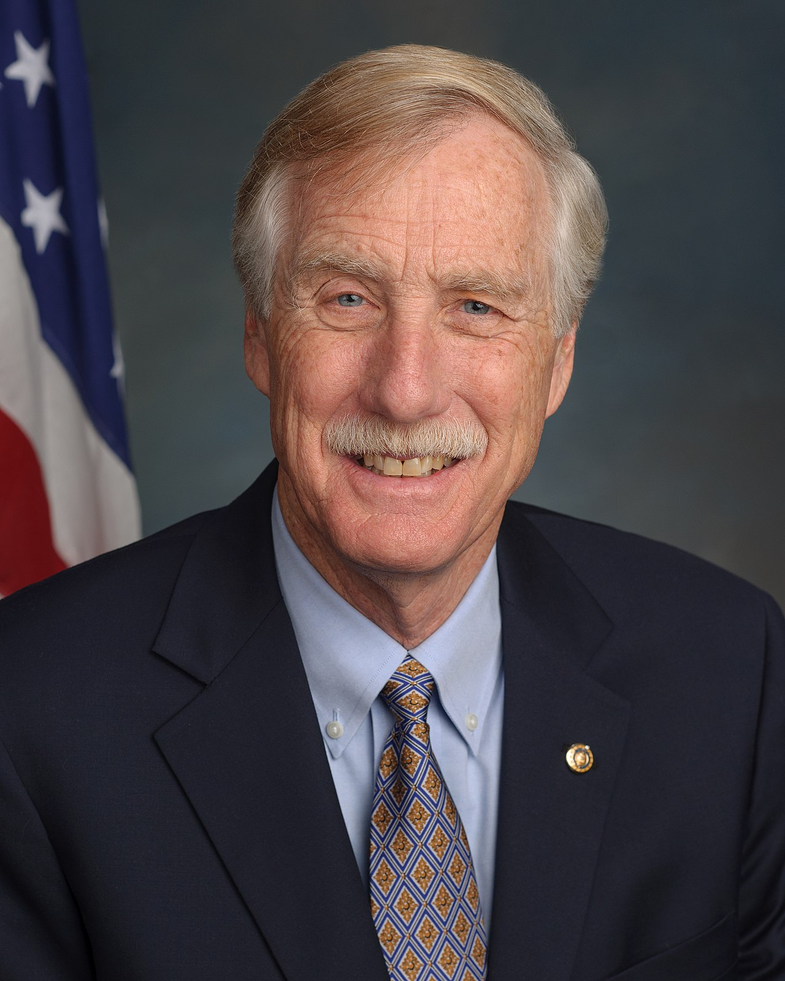

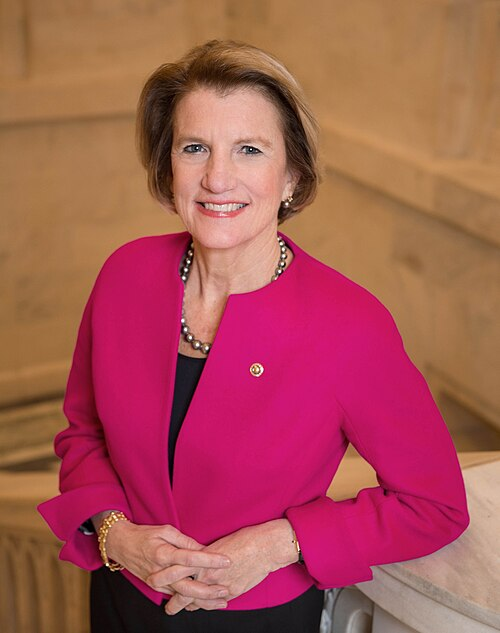

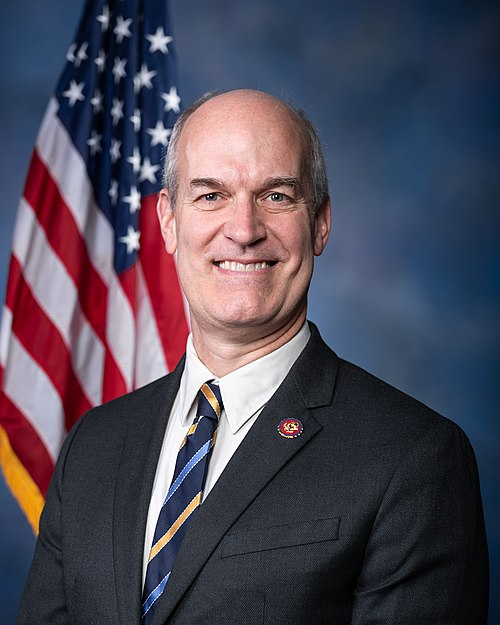

Sponsors

6 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 18, 2025 | Introduced in Senate |

| Jun. 18, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.