S. 1532: To amend the Internal Revenue Code of 1986 to modify the railroad track maintenance credit.

This bill proposes changes to the Internal Revenue Code of 1986 specifically related to the railroad track maintenance credit. Here is a breakdown of the main components of the bill:

Modification of Railroad Track Maintenance Credit

Increase in Credit Amount

The bill seeks to increase the maintenance credit available for railroad track maintenance. Specifically:

- The current credit amount of $3,500 would be increased to $6,100.

Inflation Adjustment

The bill includes a provision for adjusting the credit amount for inflation. This means that:

- After 2025, the credit amount of $6,100 would be subject to annual adjustments based on the cost of living.

- The adjustments will ensure that the credit grows in line with inflation, rounded to the nearest multiple of $100.

Qualified Railroad Track Maintenance Expenditures

The bill changes the date related to the qualified expenditures associated with the maintenance credit:

- The current date reference of January 1, 2015, for eligible expenditures will be updated to January 1, 2024.

Effective Date

The changes proposed in this bill would apply to expenses incurred in taxable years beginning after December 31, 2024.

Relevant Companies

- UNP (Union Pacific Corporation): As a major railway operator, Union Pacific would likely benefit from the increased maintenance credit, aiding in funding their infrastructure improvements.

- CSX (CSX Corporation): Similar to Union Pacific, CSX could see advantages from an increased credit, potentially improving their financial position for track maintenance expenditures.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

37 bill sponsors

-

TrackMike Crapo

Sponsor

-

TrackMichael F. Bennet

Co-Sponsor

-

TrackLisa Blunt Rochester

Co-Sponsor

-

TrackJohn Boozman

Co-Sponsor

-

TrackTed Budd

Co-Sponsor

-

TrackShelley Moore Capito

Co-Sponsor

-

TrackChristopher A. Coons

Co-Sponsor

-

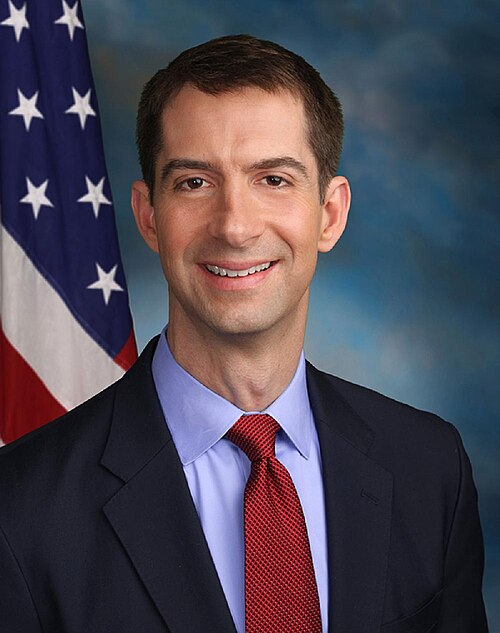

TrackTom Cotton

Co-Sponsor

-

TrackKevin Cramer

Co-Sponsor

-

TrackSteve Daines

Co-Sponsor

-

TrackDeb Fischer

Co-Sponsor

-

TrackRuben Gallego

Co-Sponsor

-

TrackMargaret Wood Hassan

Co-Sponsor

-

TrackMartin Heinrich

Co-Sponsor

-

TrackJohn Hoeven

Co-Sponsor

-

TrackJon Husted

Co-Sponsor

-

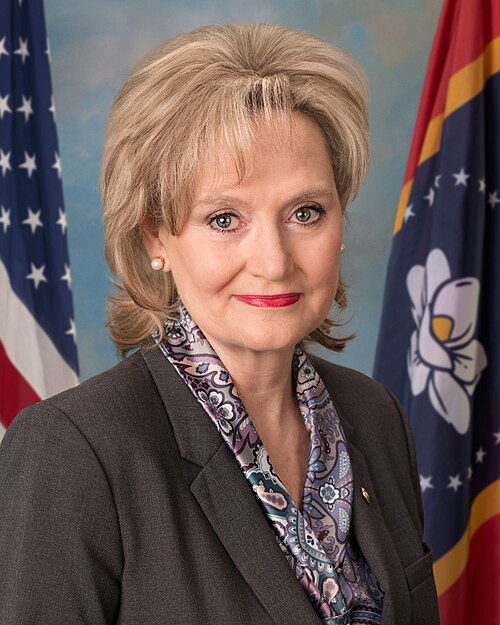

TrackCindy Hyde-Smith

Co-Sponsor

-

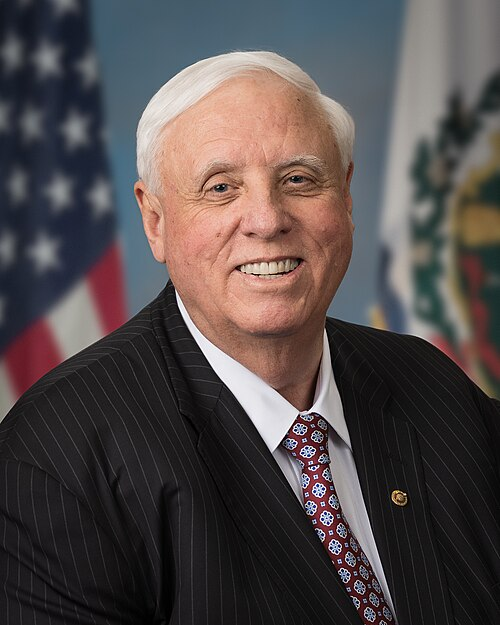

TrackJames C. Justice

Co-Sponsor

-

TrackAngus S. King Jr.

Co-Sponsor

-

TrackAmy Klobuchar

Co-Sponsor

-

TrackBen Ray Lujan

Co-Sponsor

-

TrackRoger Marshall

Co-Sponsor

-

TrackJerry Moran

Co-Sponsor

-

TrackMarkwayne Mullin

Co-Sponsor

-

TrackJon Ossoff

Co-Sponsor

-

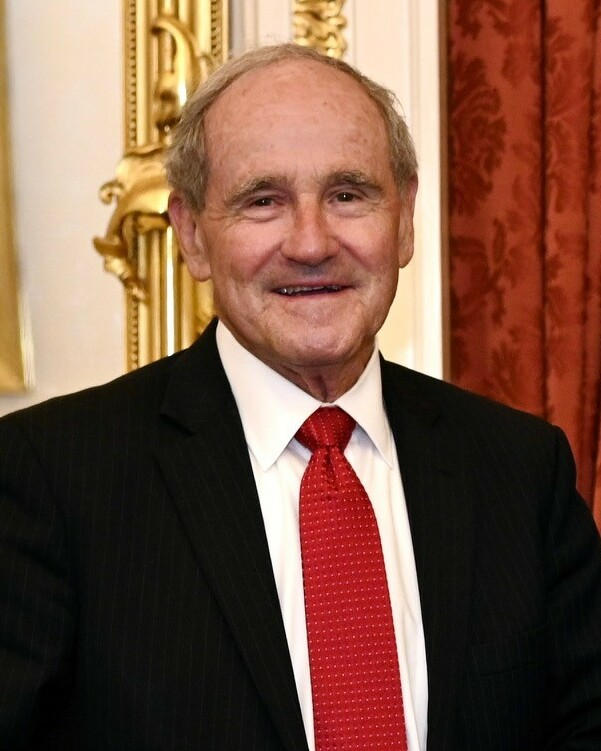

TrackJames E. Risch

Co-Sponsor

-

TrackMike Rounds

Co-Sponsor

-

TrackTim Scott

Co-Sponsor

-

TrackDan Sullivan

Co-Sponsor

-

TrackJohn Thune

Co-Sponsor

-

TrackThom Tillis

Co-Sponsor

-

TrackChris Van Hollen

Co-Sponsor

-

TrackRaphael G. Warnock

Co-Sponsor

-

TrackPeter Welch

Co-Sponsor

-

TrackRoger F. Wicker

Co-Sponsor

-

TrackRon Wyden

Co-Sponsor

-

TrackTodd Young

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 30, 2025 | Introduced in Senate |

| Apr. 30, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.