H.R. 3042: Medical Manufacturing, Economic Development, and Sustainability Act of 2025

This bill, titled the Medical Manufacturing, Economic Development, and Sustainability Act of 2025, aims to bolster medical manufacturing in economically distressed areas across the United States. It provides various tax incentives to encourage job creation and revitalization of these locations. The key components of the bill include:

Tax Credits for Medical Manufacturing

The bill introduces a new tax credit for businesses engaged in medical manufacturing in economically distressed zones. This includes:

- 40% Credit on Wages and Expenses: A credit of 40% on wages paid to employees, employee fringe benefits, and depreciation on qualified facilities located within these zones.

- 30% Credit for Local Products and Services: A credit of 30% on amounts paid for products or services acquired from economically distressed zones integrated into medical products.

- Increased Credit for Special Facilities: Facilities that have been repatriated (brought back to the U.S.) or that specifically focus on population health products may qualify for higher credits of up to 60% on wages and 50% on local products.

Designation of Economically Distressed Zones

The legislation establishes criteria for identifying economically distressed zones based on poverty rates and other socioeconomic indicators. A state or local government can apply for designation, which can remain valid for 15 years, assisting areas that struggle with high poverty and unemployment rates.

Support for Population Health Products

The bill emphasizes the production of population health products, which are essential during public health emergencies, particularly for vulnerable populations. It expands the definition of "qualified countermeasures" to include additional medical products aimed at addressing infectious diseases and other threats to public health.

Administrative Oversight and Reporting

The bill mandates that the Secretary of Health and Human Services will oversee the program, ensuring that population health products are developed and distributed promptly. A report will be required within 90 days of enactment to assess the needs of vulnerable populations in light of past public health crises.

General Structure for Implementation

The Secretary of Treasury is tasked with establishing regulations for implementing these tax credit provisions, while also ensuring compliance with the criteria for economically distressed zones.

Conclusion

This legislation aims to stimulate the domestic medical manufacturing sector within economically challenged communities by providing targeted tax breaks and supporting the expansion of production for essential health products.

Relevant Companies

- PFE: Pfizer Inc. may see increased demand due to its involvement in vaccine production and medical products, potentially benefiting from the tax credits for domestic manufacturing.

- MDT: Medtronic's operations in manufacturing medical devices could qualify for the proposed tax incentives, enhancing its ability to invest in economically distressed areas.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

11 bill sponsors

-

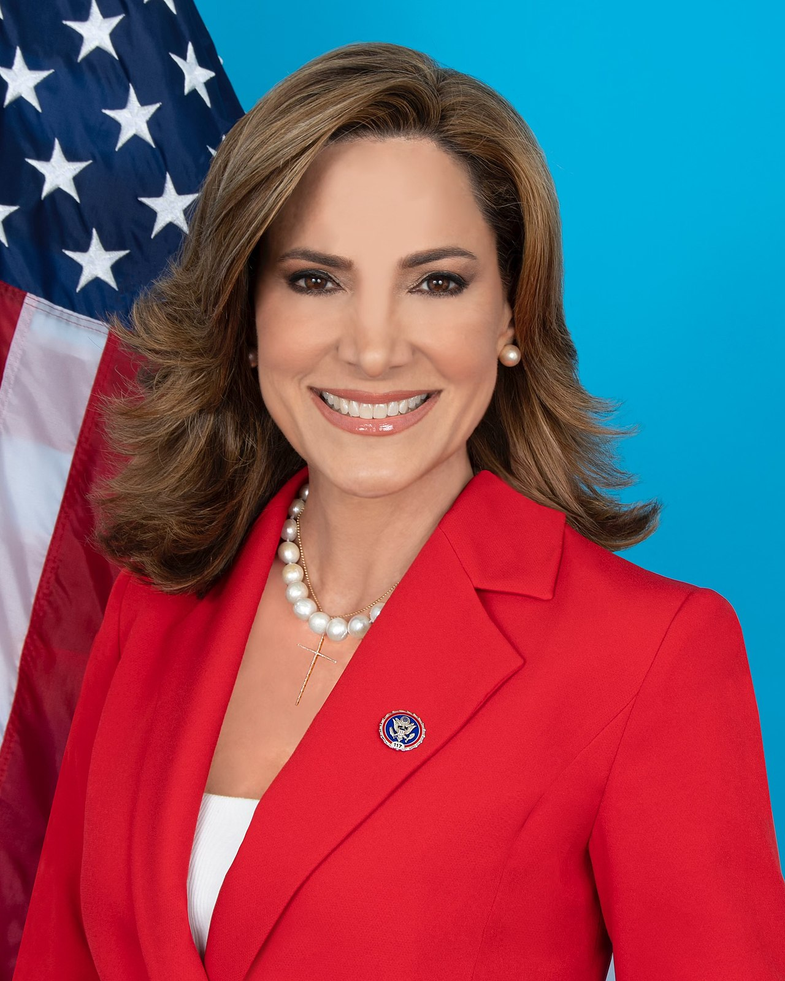

TrackNicole Malliotakis

Sponsor

-

TrackVern Buchanan

Co-Sponsor

-

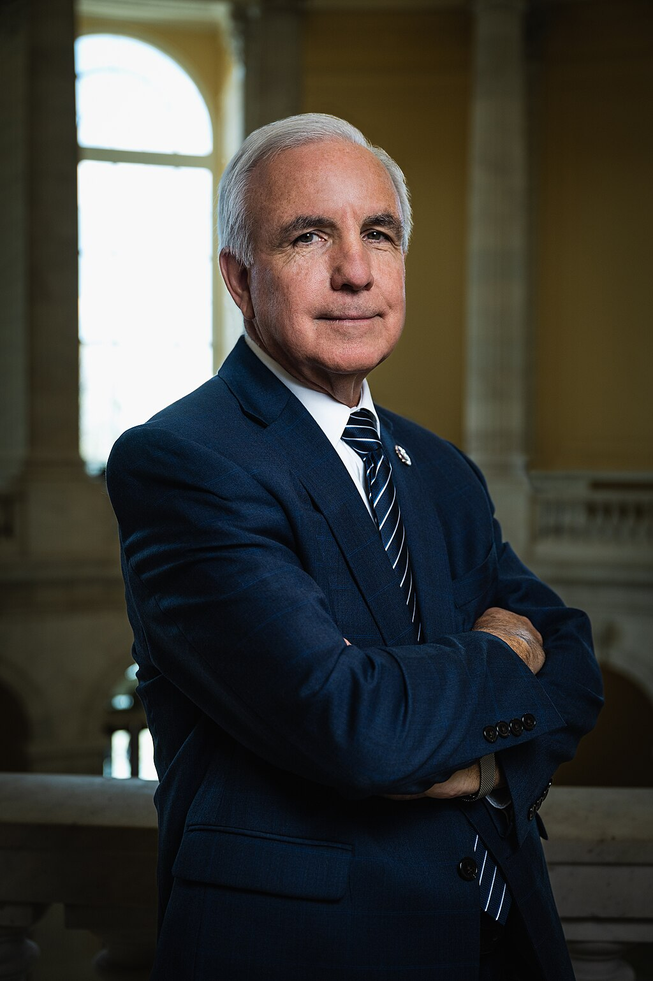

TrackCarlos A. Gimenez

Co-Sponsor

-

TrackLance Gooden

Co-Sponsor

-

TrackPablo Hernández

Co-Sponsor

-

TrackJeff Hurd

Co-Sponsor

-

TrackMike Quigley

Co-Sponsor

-

TrackMaria Elvira Salazar

Co-Sponsor

-

TrackDarren Soto

Co-Sponsor

-

TrackClaudia Tenney

Co-Sponsor

-

TrackRitchie Torres

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Apr. 28, 2025 | Introduced in House |

| Apr. 28, 2025 | Referred to the Committee on Ways and Means, and in addition to the Committee on Energy and Commerce, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.