H.R. 3437: Insurance Data Protection Act

This bill, known as the Insurance Data Protection Act

, is designed to restrict the ability of certain federal financial regulators to collect data directly from insurance companies. Below are the main provisions of the bill:

Key Provisions

- Limitations on Data Collection: The bill prohibits federal regulators, including the Federal Insurance Office, from subpoenaing or directly collecting information from insurance companies.

- Restrictions on Sharing Information: It aims to prevent the sharing of nonpublic, not publicly available data collected from insurance companies with other federal agencies, state insurance regulators, or any other entities.

- Confidentiality Protections: The legislation emphasizes that any nonpublic data shared with regulators shall maintain its confidentiality and not waive any legal privileges. This means that existing confidentiality agreements remain in place even after sharing data.

- Coordination with Other Agencies: Before collecting any data from insurance companies, financial regulators must coordinate with other federal and state agencies to check if the information is available from publicly accessible sources.

- Compliance with Existing Laws: If the necessary data cannot be obtained from other sources, only then can regulators collect data from insurance companies, and they must comply with specific regulations regarding data collection.

Amendments to Existing Laws

- Changes to existing provisions focus on ensuring that the Federal Insurance Office and the Office of Financial Research cannot initiate data collection or subpoenas directed at insurance companies.

- The bill amends the Financial Stability Act to define the roles and responsibilities regarding data collection from insurance companies, ensuring that they are treated differently than other financial companies.

Impact on Financial Regulators

The bill modifies how financial regulators, including the Federal Banking Agencies, approach data collection and data management, emphasizing a framework that prioritizes the confidentiality of insurance company data.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

23 bill sponsors

-

TrackScott Fitzgerald

Sponsor

-

TrackAndy Barr

Co-Sponsor

-

TrackWarren Davidson

Co-Sponsor

-

TrackMonica De La Cruz

Co-Sponsor

-

TrackByron Donalds

Co-Sponsor

-

TrackMike Flood

Co-Sponsor

-

TrackAndrew R. Garbarino

Co-Sponsor

-

TrackBrandon Gill

Co-Sponsor

-

TrackGlenn Grothman

Co-Sponsor

-

TrackHarriet M. Hageman

Co-Sponsor

-

TrackBill Huizenga

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackBarry Loudermilk

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackJohn R. Moolenaar

Co-Sponsor

-

TrackTim Moore

Co-Sponsor

-

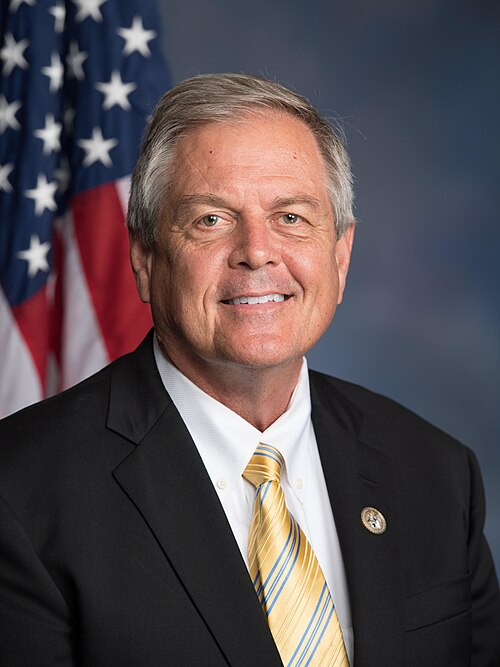

TrackRalph Norman

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackAndrew Ogles

Co-Sponsor

-

TrackPete Stauber

Co-Sponsor

-

TrackBryan Steil

Co-Sponsor

-

TrackWilliam R. Timmons IV

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| May. 15, 2025 | Introduced in House |

| May. 15, 2025 | Referred to the Committee on Financial Services, and in addition to the Committee on Agriculture, for a period to be subsequently determined by the Speaker, in each case for consideration of such provisions as fall within the jurisdiction of the committee concerned. |

Corporate Lobbying

2 companies lobbying