We have received text from H.R. 5689: Shutdown Guidance for Financial Institutions Act. This bill was received on 2025-10-03, and currently has 13 cosponsors.

Here is a short summary of the bill:

This bill, titled the Shutdown Guidance for Financial Institutions Act , aims to provide guidance to financial institutions in the event of a federal government shutdown. It focuses on supporting consumers and businesses financially affected by such shutdowns. Here are the key provisions of the bill:

Guidance for Financial Institutions

Within 180 days of the bill's enactment, federal financial regulators, in collaboration with state banking regulators and relevant agencies, are required to issue guidance encouraging financial institutions to:

- Work with consumers and businesses impacted by a federal government shutdown.

- Recognize that individuals and businesses affected may face difficulties in maintaining payments on debts—such as mortgages, car loans, and credit cards—due to loss of income or access to credit during a shutdown.

- Consider modifying the terms of existing loans or providing new credit offerings to assist affected consumers and businesses, while ensuring these actions align with sound lending practices.

- Prevent any negative credit reporting that could harm the credit ratings of consumers who are receiving modified financial assistance during the shutdown.

Notification during a Shutdown

When a federal shutdown starts, within 24 hours, federal regulators must issue a press release. This announcement will inform financial institutions, consumers, and businesses about the guidance aimed at helping those impacted by the shutdown.

Post-Shutdown Actions

After a shutdown concludes, federal regulators must:

- Submit a report to Congress within 90 days, analyzing the effectiveness of the released guidance.

- If any issues or shortcomings are identified in this report, they are required to update the guidance within 180 days of submitting the report.

Definitions

The bill contains specific definitions to clarify terms, such as:

- Consumers affected by a shutdown: This includes federal employees who are furloughed or not paid during the shutdown, employees from D.C. experiencing non-payment, and federal contractors or similar entities with significant income reductions due to the shutdown.

- Federal financial regulators: Refers to the Board of Governors of the Federal Reserve System, among other financial regulatory agencies.

- Shutdown: Defined as any period where there is a lapse in appropriations lasting more than 24 hours due to failure to pass a budget or continuing resolution.

Budgetary Effects

The bill also outlines that the budgetary effects for compliance with the Statutory Pay-As-You-Go Act of 2010 will be determined based on a statement provided by the House Budget Committee's Chairman, prior to voting on the bill's passage.

Relevant Companies

- JPM (JPMorgan Chase & Co.): May experience changes in loan modification processes and credit issuance as they adjust to the guidance aimed at supporting consumers during a shutdown.

- BAC (Bank of America Corporation): Could see alterations in how they handle customer debt and credit support during a federal shutdown in compliance with new guidance.

- UNP (Union Pacific Corporation): May have to navigate changes due to potential reductions in federal contracts or income during a shutdown impacting their business operations.

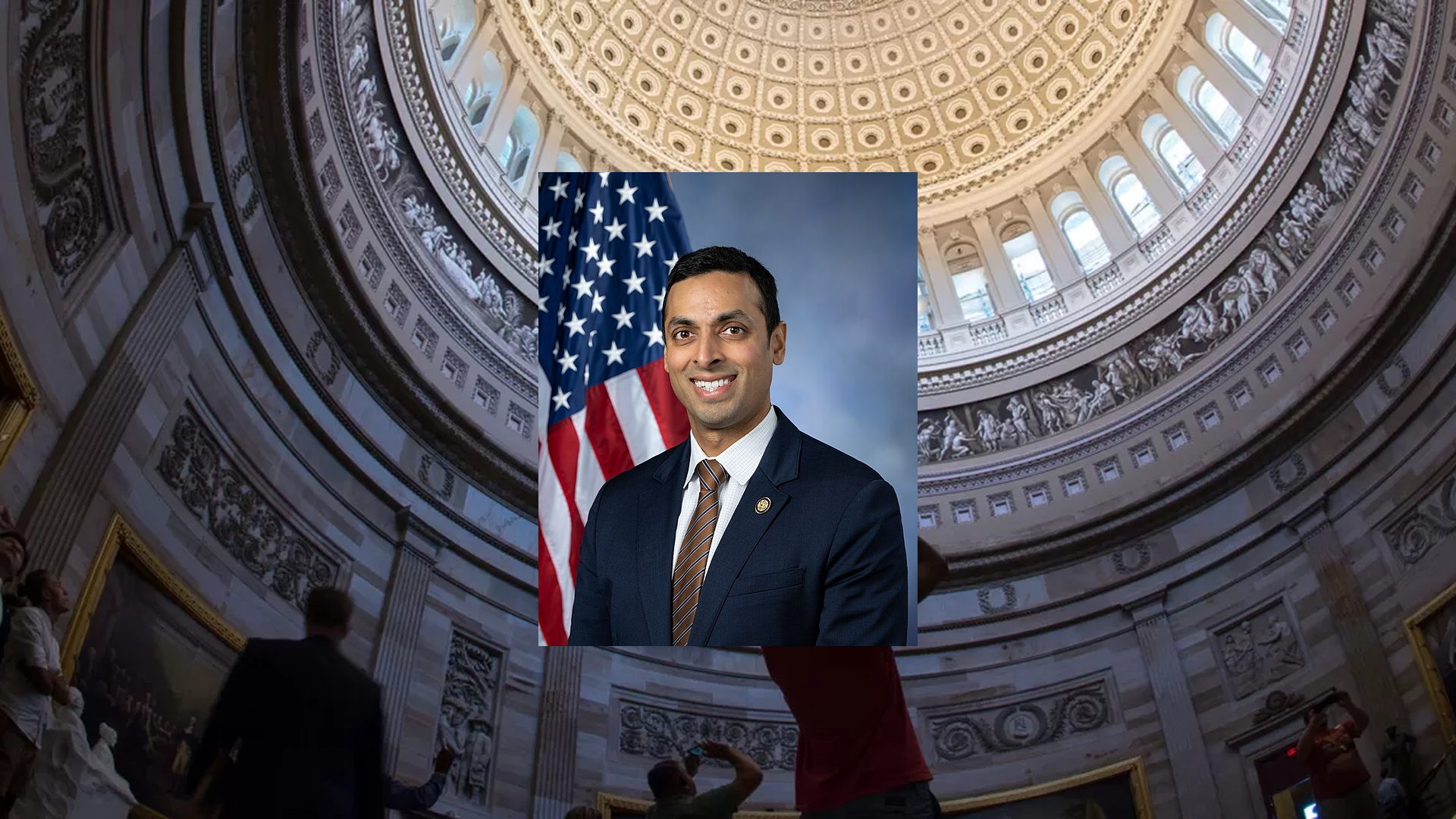

Representative Suhas Subramanyam Bill Proposals

Here are some bills which have recently been proposed by Representative Suhas Subramanyam:

- H.R.5690: Emergency Relief for Federal Contractors Act of 2025

- H.R.5689: Shutdown Guidance for Financial Institutions Act

- H.R.5560: Statutes of Limitation for Child Sexual Abuse Reform Act

- H.R.5339: Susan E. Lukas 9/11 Servicemember Fairness Act

- H.R.5058: To designate the facility of the United States Postal Service located at 46164 Westlake Drive in Sterling, Virginia, as the "Firefighter Trevor Brown Post Office Building".

- H.R.5008: Affordable Commutes Act of 2025

You can track bills proposed by Representative Suhas Subramanyam on Quiver Quantitative's politician page for Subramanyam.

Representative Suhas Subramanyam Net Worth

Quiver Quantitative estimates that Representative Suhas Subramanyam is worth $2.7M, as of October 16th, 2025. This is the 227th highest net worth in Congress, per our live estimates.

Subramanyam has approximately $1.0M invested in publicly traded assets which Quiver is able to track live.

You can track Representative Suhas Subramanyam's net worth on Quiver Quantitative's politician page for Subramanyam.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.