H.R. 5690: Emergency Relief for Federal Contractors Act of 2025

This bill, known as the "Emergency Relief for Federal Contractors Act of 2025," proposes certain provisions for federal contractors and their employees who are adversely affected by federal government shutdowns.

Key Provisions

1. Penalty-Free Withdrawals

The bill allows individuals who are federal contractors or employees of federal contractors to take money from their retirement accounts without incurring penalties if they are affected by a federal government shutdown. This means that if they are placed on unpaid leave or are working without pay due to a government shutdown, they can withdraw funds from their retirement plans without facing the usual penalties.

2. Withdrawal Limits

There is a limit on how much money can be withdrawn under this provision. Specifically, an individual can withdraw up to $30,000. Starting in 2026, this amount will be adjusted for inflation, ensuring that it keeps pace with the cost of living. If the adjusted amount is not a multiple of $500, it will be rounded to the nearest multiple of $500.

3. Repayment of Withdrawn Funds

If an individual takes a distribution due to a government shutdown, they are allowed to repay that amount back into an eligible retirement plan within a three-year window. This flexibility can help individuals restore their retirement savings after they have withdrawn funds during a shutdown.

4. Definitions and Conditions

The bill outlines specific terms to clarify who can benefit from these provisions:

- Federal Government Shutdown Distribution: This refers to any distribution taken from a retirement account during a period of federal appropriations lapse.

- Applicable Individual: This includes federal contractors, their employees, and certain others affected by a shutdown, such as employees of federal grant recipients or the District of Columbia government who are furloughed or working without pay.

- Federal Appropriations Lapse: This is defined as a continuous period of at least two weeks where there is a halt in federal funding.

- Eligible Retirement Plan: This refers to retirement accounts that qualify for the distribution rules as specified by existing law.

5. Tax Implications

Any amounts withdrawn from retirement accounts will be included as income, but individuals can choose to spread this income inclusion over three years, which may lessen the immediate tax burden.

6. Additional Rules

The bill also states that these distributions will not be treated as eligible rollover distributions for tax purposes and will meet the requirements set out for retirement plan distributions in the tax code.

Relevant Companies

- BA - Boeing: Federal contractor that could see impacts due to workforce management during government shutdowns.

- GS - Goldman Sachs: Potentially affected due to financial services provided to federal contractors.

- LMT - Lockheed Martin: As a large defense contractor, shutdowns could affect its contracts and workforce.

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

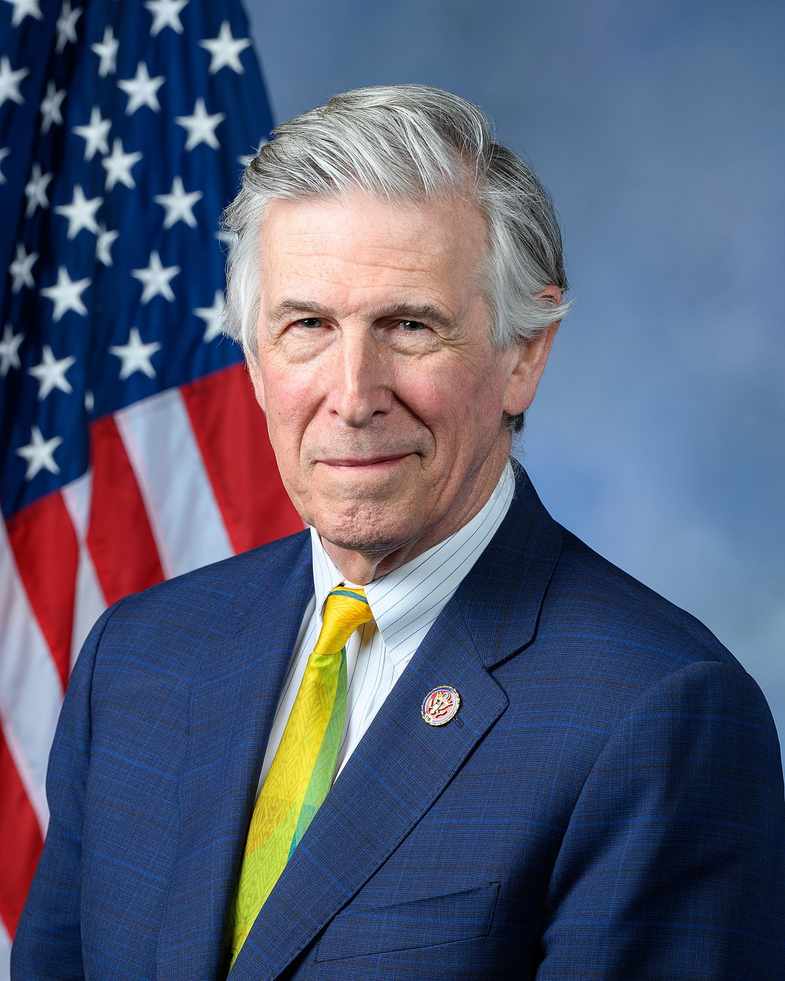

11 bill sponsors

-

TrackSuhas Subramanyam

Sponsor

-

TrackWesley Bell

Co-Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackJohn B. Larson

Co-Sponsor

-

TrackJennifer L. McClellan

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackEric Swalwell

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackJames R. Walkinshaw

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Oct. 03, 2025 | Introduced in House |

| Oct. 03, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.