H.R. 6550: American Financial Institution Regulatory Sovereignty and Transparency Act of 2025

The American Financial Institution Regulatory Sovereignty and Transparency Act of 2025 is a proposed piece of legislation aimed at enhancing transparency and accountability in how U.S. banking regulatory agencies interact with global financial regulatory bodies. The bill introduces several key requirements for the Federal Reserve, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (FDIC) regarding their participation in international financial discussions. It emphasizes the need for annual reporting and biannual congressional testimony regarding these interactions.

Annual Reporting Requirements

The bill mandates that the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, and the FDIC must each provide an annual report that includes:

- A list of global financial regulatory or supervisory forums they participated in during the reporting period.

- A description of the purposes of each of these forums, including current members and observers.

- A discussion of how the purposes of the forums align with U.S. financial regulatory goals.

- An identification of major funding sources for these forums.

- Details on the organizational structure and staff overseeing interactions with these forums.

- A summary of discussed regulatory standards and issues within these forums.

- Information on positions taken by U.S. representatives, including rationale and anticipated impacts.

- Details on meetings attended and any significant outcomes from those meetings.

- Documentation of any policies or standards adopted by these forums during the reporting period.

- A discussion of any necessary legislative and regulatory changes anticipated to implement adopted policies or standards.

- Any other additional information requested by Congress that pertains to these interactions.

Definitions and Exclusions

The bill defines what constitutes a "global financial regulatory or supervisory forum," which includes well-known organizations such as:

- The Bank for International Settlements

- The Basel Committee on Banking Supervision

- The Financial Stability Board

- The International Association of Insurance Supervisors

- The Network of Central Banks and Supervisors for Greening the Financial System

However, it explicitly excludes international financial institutions defined under U.S. law or any organizations the Comptroller engages with under treaties to which the U.S. is a party.

Biannual Testimony Requirement

In addition to the annual reports, the bill requires that representatives from the Federal Reserve testify before Congress twice a year regarding their interactions with these global financial regulatory forums, providing an additional layer of accountability and oversight.

Implications for Regulatory Agencies

The bill aims to ensure that U.S. banking regulatory agencies are not only engaged with global financial discussions but also that there is a clear record of these interactions. It seeks to balance participation in global forums while maintaining U.S. regulatory autonomy and ensuring Congress can oversee and evaluate how such engagements may impact U.S. financial stability and regulatory policies.

Relevant Companies

- JPM (JPMorgan Chase & Co.): As one of the largest financial institutions, changes in regulatory frameworks could impact its operations and policies significantly.

- BAC (Bank of America Corporation): Similar to JPMorgan, Bank of America may need to adjust to new regulations that arise from global discussions.

- WFC (Wells Fargo & Co.): Wells Fargo's international operations could be affected by changes in regulatory standards set at international forums.

This is an AI-generated summary of the bill text. There may be mistakes.

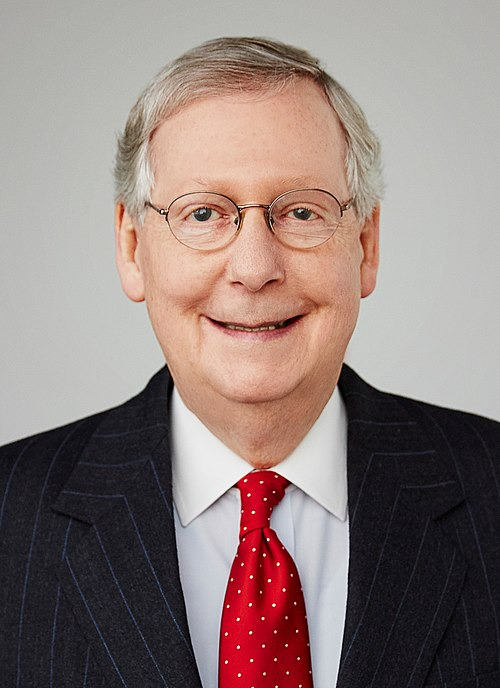

Sponsors

3 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Dec. 10, 2025 | Introduced in House |

| Dec. 10, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.