H.R. 5475: No Tax on Overtime for All Workers Act

This bill is known as the No Tax on Overtime for All Workers Act. Its main purpose is to amend the tax laws regarding overtime compensation. Specifically, it allows for a tax deduction of certain overtime pay that employees receive beyond their regular wages.

Key Provisions of the Bill

- Definition of Qualified Overtime Compensation: The bill defines "qualified overtime compensation" as any overtime pay that exceeds the regular pay rate for an employee. This includes:

- Overtime pay mandated under the Fair Labor Standards Act for hours worked beyond a standard workweek.

- Any pay that exceeds the normal rate agreed upon between the employee (or their labor organization) and the employer, as long as it meets certain conditions, such as:

- The overtime work must exceed 40 hours in a week, or

- For employees governed by the Railway Labor Act, the work must be beyond scheduled hours or the maximum hours set in an agreement.

- Effective Date: The changes made by this bill will take effect for tax years beginning after December 31, 2024. This means that the tax benefits would apply in tax filings starting in the year 2025.

Potential Impact

The bill aims to offer financial relief to employees who work overtime by allowing them or their employers to deduct certain overtime payments from their taxable income. This could lead to increased take-home pay for workers who earn overtime, potentially influencing work patterns or wage negotiations between employers and employees.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

27 bill sponsors

-

TrackNicole Malliotakis

Sponsor

-

TrackDon Bacon

Co-Sponsor

-

TrackBrendan F. Boyle

Co-Sponsor

-

TrackRobert Bresnahan

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

TrackKat Cammack

Co-Sponsor

-

TrackChristopher R. Deluzio

Co-Sponsor

-

TrackDebbie Dingell

Co-Sponsor

-

TrackChuck Edwards

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackAndrew R. Garbarino

Co-Sponsor

-

TrackSteven Horsford

Co-Sponsor

-

TrackThomas H. Kean, Jr.

Co-Sponsor

-

TrackTimothy M. Kennedy

Co-Sponsor

-

TrackJennifer Kiggans

Co-Sponsor

-

TrackNick LaLota

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackRyan Mackenzie

Co-Sponsor

-

TrackJoe Neguse

Co-Sponsor

-

TrackJosh Riley

Co-Sponsor

-

TrackChristopher H. Smith

Co-Sponsor

-

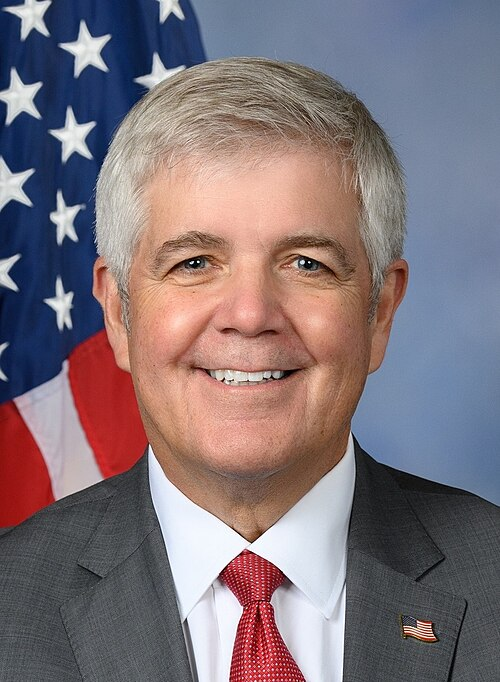

TrackPete Stauber

Co-Sponsor

-

TrackThomas R. Suozzi

Co-Sponsor

-

TrackEmilia Strong Sykes

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackMaxine Waters

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 18, 2025 | Introduced in House |

| Sep. 18, 2025 | Referred to the House Committee on Ways and Means. |

Corporate Lobbying

3 companies lobbying