H.R. 4925: Original Securities and Exchange Atonement Act of 2025

This bill, titled the "Original Securities and Exchange Atonement Act of 2025," proposes amendments to the Securities Act of 1933 with a focus on promoting racial equity and addressing historical injustices related to slavery. The main provisions of the bill include:

Racial Equity Audits

Covered issuers, which are defined as companies with more than 100 employees or a capitalization of at least $300 million, will be required to conduct an independent audit every two years. These audits must assess:

- The issuer’s policies on civil rights, equity, diversity, and inclusion.

- The impact of these policies on the business.

- Any ties to or profits from the institution of slavery by the issuer, its predecessors, or affiliates.

Companies must then report their findings to the Securities and Exchange Commission (SEC), including any steps taken to reconcile ties to slavery. If no steps have been taken, the issuer must outline their plans for such reconciliation.

Punitive Measures for Non-compliance

If a covered issuer fails to issue the required report or submits false information, they will face fines of $20,000 per day until compliance is reached. Individual employees or officers may also incur fines of $2,000 per day for intentional non-compliance.

The fines collected will be split, with 50% going to the Secretary of the Treasury to fund minority-focused programs and initiatives, and the other 50% to the Secretary of Housing and Urban Development for housing assistance programs.

Legal Recourse and Whistleblower Protections

Individuals holding securities from a covered issuer can sue if the company fails to meet reporting requirements. Additionally, there are provisions for whistleblower awards for those who provide original information leading to successful enforcement actions.

Office of Minority Low to Moderate Income Programs

The bill establishes an Office within the Department of the Treasury aimed at providing grants and funding to initiatives that benefit low to moderate income minority communities. The Office will have a budget of up to $3 billion to support startup capital and savings programs, as well as initiate other programs focused on atonement measures for the descendants of enslaved individuals.

Definitions and Framework

The bill provides definitions for key terms such as:

- Area Median Income: The median income in an individual's locality.

- Low to Moderate Income: Individuals earning less than 80% of the area median income.

- Minority: Racial and ethnic groups underrepresented in the general population.

- Reconcile: The act of addressing and balancing historical ties to slavery equitably.

Funding and Administration

The bill authorizes appropriations of $3 billion to fund the initiatives of the new Office of Minority Low to Moderate Income Programs, with a provision that allows for 2% of that budget to be used for administrative costs.

Relevant Companies

- GS - Goldman Sachs: As a major financial services firm, they may need to conduct thorough audits and reporting if implicated in historical ties to slavery or inequitable practices.

- JPM - JPMorgan Chase: Similar to Goldman Sachs, JPMorgan may face direct implications due to their historical practices and policies regarding diversity and equity.

- BAC - Bank of America: As a large financial institution, they will also need to comply with the audit requirements and could be fined for non-compliance.

- WFC - Wells Fargo: Faces similar requirements and could be directly impacted by the financial audits mandated by this bill.

This is an AI-generated summary of the bill text. There may be mistakes.

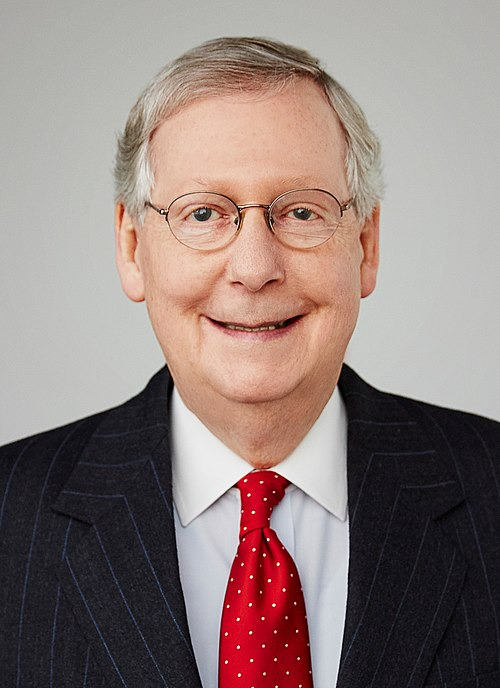

Sponsors

1 sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Aug. 08, 2025 | Introduced in House |

| Aug. 08, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.