We have received text from H.R. 5748: Retirement Investment Choice Act. This bill was received on 2025-10-14, and currently has 5 cosponsors.

Here is a short summary of the bill:

This bill is titled the Retirement Investment Choice Act. Its main purpose is to make certain provisions of Executive Order 14330 legally binding. This executive order aims to expand access for people investing their retirement savings in 401(k) plans to alternative assets.

Key Provisions

- Codification of Executive Order: The bill formally establishes the guidelines set out in Executive Order 14330 as law. This means that the goals outlined in the executive order will carry legal weight and enforcement.

- Democratizing Access: The focus of the order is to democratize access to alternative investments for 401(k) investors. Alternative assets can include things like real estate, commodities, or private equity, which are not typically part of standard 401(k) investment options.

- Impact on 401(k) Plans: The bill aims to modify how 401(k) plans can offer investment choices, likely making it easier for individuals to invest in a wider range of assets beyond traditional stocks and bonds.

Context and Implications

The intention behind this bill is to enable more options for investors, allowing for potentially greater diversification of retirement portfolios. By making alternative assets accessible under 401(k) plans, the bill could influence the way individuals approach their retirement savings and investments.

Administration and Oversight

The implementation and details regarding how these alternative investments will be handled in 401(k) plans would be determined by relevant regulatory bodies, which will oversee their compliance with the new legal framework established by the bill.

Opposition and Support

The text of the bill does not provide details regarding any specific stakeholders or potential controversies surrounding its implementation. However, it is typical for legislation affecting investment and retirement plans to have varying support and opposition based on the types of assets involved and their associated risks.

Relevant Companies

- BLK - BlackRock, Inc.: As a major player in investment management, changes to 401(k) asset options could influence BlackRock's offerings and client strategies.

- Vanguard - While not publicly traded, Vanguard's policies may be impacted as it manages numerous retirement plans and could adapt its products accordingly.

- FNF - Fidelity National Financial: Changes in investment options could affect Fidelity's retirement offerings and client acquisition strategies.

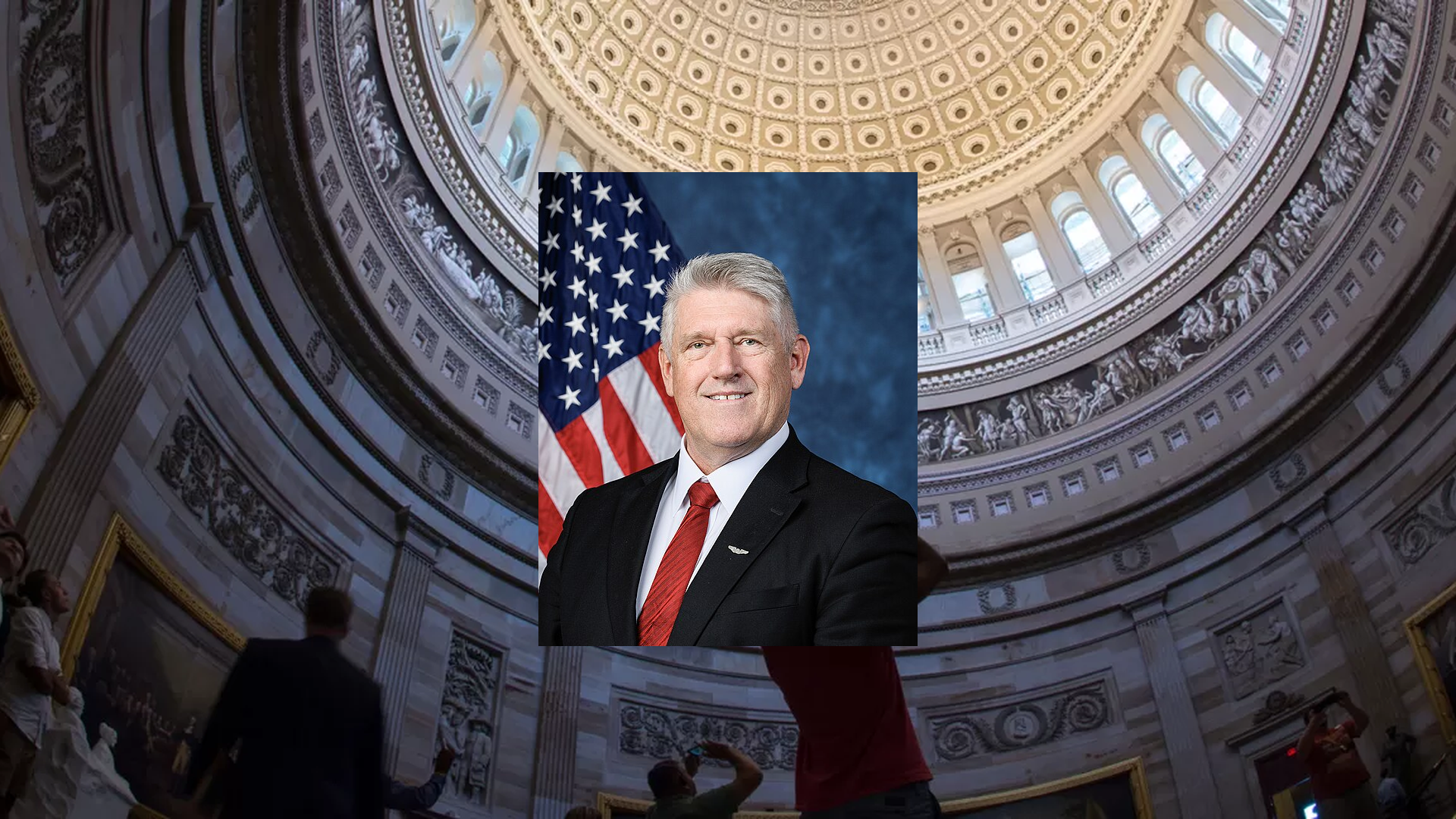

Representative Troy Downing Bill Proposals

Here are some bills which have recently been proposed by Representative Troy Downing:

- H.R.5748: Retirement Investment Choice Act

- H.R.5229: IMAGES Act of 2025

- H.R.4495: SBA Fraud Enforcement Extension Act

- H.R.3959: Protecting Private Job Creators Act

- H.R.3870: COAL POWER Act

- H.R.3318: SEC Modernization Act

You can track bills proposed by Representative Troy Downing on Quiver Quantitative's politician page for Downing.

Representative Troy Downing Net Worth

Quiver Quantitative estimates that Representative Troy Downing is worth $8.9M, as of October 17th, 2025. This is the 117th highest net worth in Congress, per our live estimates.

Downing has approximately $634.3K invested in publicly traded assets which Quiver is able to track live.

You can track Representative Troy Downing's net worth on Quiver Quantitative's politician page for Downing.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.