H.R. 4495: SBA Fraud Enforcement Extension Act

The SBA Fraud Enforcement Extension Act proposes to modify the time limits within which legal actions can be initiated against individuals or entities accused of fraud related to specific programs established during the COVID-19 pandemic. The key components of the bill are as follows:

1. Extension of Statute of Limitations

The bill extends the statute of limitations for prosecuting fraud related to two major pandemic relief programs:

- Shuttered Venue Operators Grant (SVOG): This program provided financial assistance to help eligible venues that were closed or had reduced operations due to the pandemic. Under the proposed amendments, any criminal or civil actions for violations connected to this grant can be initiated up to 10 years after the alleged violation or conspiracy took place.

- Restaurant Revitalization Fund (RRF): This program aimed to support restaurants and bars affected by the pandemic. Similar to the SVOG, the bill extends the time frame for legal actions related to this fund to also 10 years from the date of the alleged offense.

2. Legal Violations Covered

The bill specifies a list of legal violations that could be relevant for prosecutions and enforcement actions under these two programs. These include violations of various sections of the United States Code concerning fraud, conspiracy to commit fraud, and other related offenses.

3. Purpose of the Bill

The intent behind extending the statute of limitations is to provide law enforcement and regulatory agencies more time to investigate and prosecute potential fraud that may have occurred during the distribution of pandemic relief funds. This change acknowledges the complexities involved in uncovering fraudulent activities that may not come to light until years after the initial funding was disbursed.

Overall, the SBA Fraud Enforcement Extension Act aims to strengthen accountability and enhance the enforcement capabilities of agencies tasked with overseeing the use of pandemic-related financial aid.

Relevant Companies

None found.

This is an AI-generated summary of the bill text. There may be mistakes.

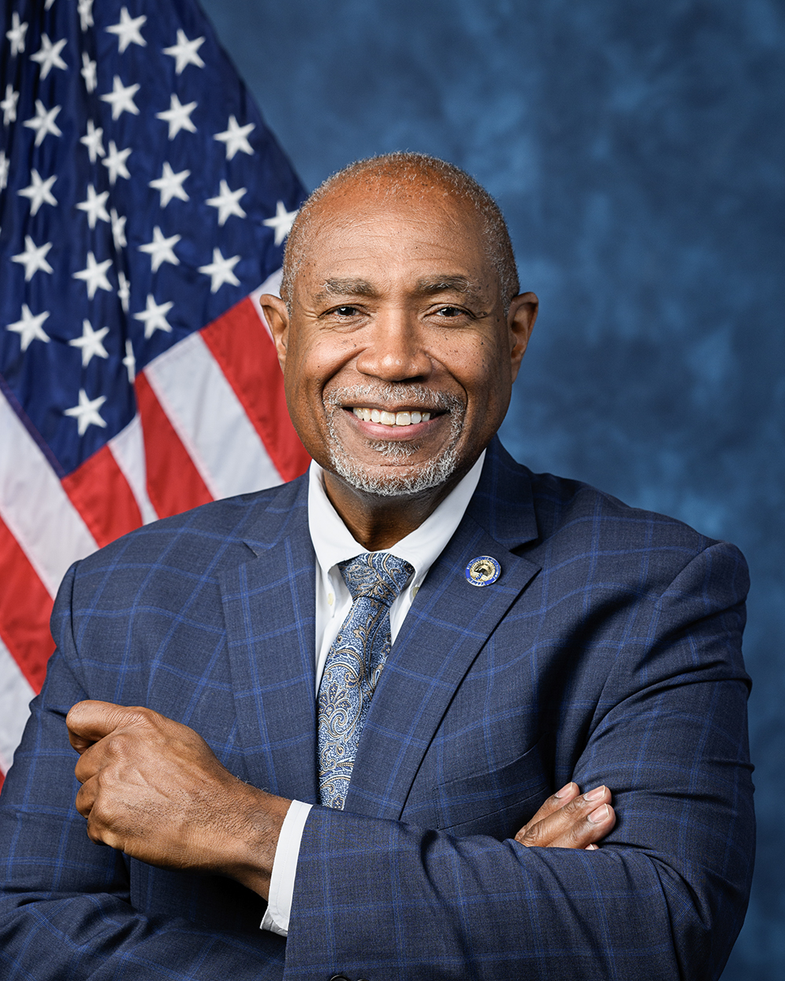

Sponsors

3 bill sponsors

Actions

6 actions

| Date | Action |

|---|---|

| Aug. 15, 2025 | Placed on the Union Calendar, Calendar No. 184. |

| Aug. 15, 2025 | Reported by the Committee on Small Business. H. Rept. 119-226. |

| Jul. 22, 2025 | Committee Consideration and Mark-up Session Held |

| Jul. 22, 2025 | Ordered to be Reported by the Yeas and Nays: 23 - 0. |

| Jul. 17, 2025 | Introduced in House |

| Jul. 17, 2025 | Referred to the House Committee on Small Business. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.