We have received text from H.R. 4167: Expanding Access to Lending Options Act. This bill was received on 2025-06-26, and currently has 7 cosponsors.

Here is a short summary of the bill:

This bill, titled the Expanding Access to Lending Options Act , aims to modify certain lending regulations for federally chartered credit unions in the United States. Here are the main points about what this bill proposes:

Loan Maturity Changes

The bill specifically seeks to amend the Federal Credit Union Act regarding the length of loans that credit unions can offer. Under the current law, the maximum loan maturity for certain loans is set at 15 years . This bill would increase that maximum to 20 years , or potentially longer if the National Credit Union Administration (NCUA) Board allows it through regulation. This change is intended to provide more flexible lending options for credit unions and their members.

Regulatory Oversight

Additionally, the bill emphasizes the importance of safety and soundness in the regulatory oversight of credit unions by the NCUA. It expresses the sense of Congress that while expanding lending options, maintaining the financial health and security of credit unions should remain a primary focus for the NCUA.

Types of Loans Affected

The amendment pertains to loans that are not strictly tied to a member's principal residence, thus broadening the scope of loans that can qualify for the extended maturity terms. This could potentially include various types of personal loans or business loans, subject to specific regulations that the NCUA may set forth.

Impact on Credit Unions and Members

The primary goal of this legislation is to enhance the lending capabilities of credit unions, which may lead to increased access to credit for their members. By allowing longer loan terms, members might benefit from lower monthly payments and the ability to borrow for larger purchases or investments over a more extended period.

Implementation and Further Regulations

If this legislation is enacted, the NCUA will have the authority to establish additional regulations related to the new loan terms, ensuring that the changes align with the overall safety and soundness standards for credit unions.

Relevant Companies

None found

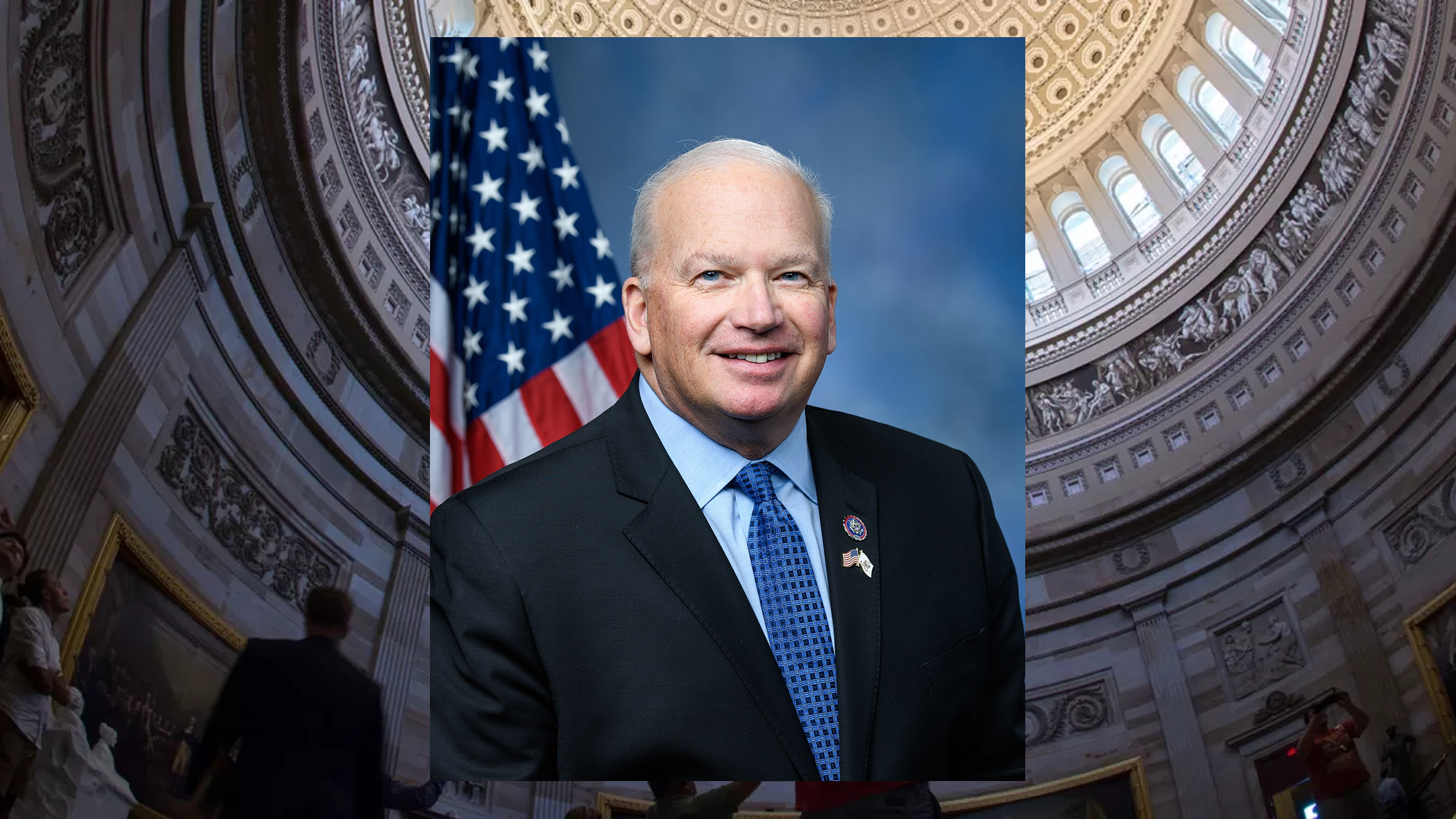

Representative Scott Fitzgerald Bill Proposals

Here are some bills which have recently been proposed by Representative Scott Fitzgerald:

- H.R.4279: To prohibit entities integral to the national interests of the United States from participating in any foreign sustainability due diligence regulation, including the Corporate Sustainability Due Diligence Directive of the European Union, and for other purposes.

- H.R.4278: To improve protections with respect to foreign regulation for certain entities integral to the national interests of the United States, and for other purposes.

- H.R.4167: To provide the National Credit Union Administration Board flexibility to increase Federal credit union loan maturities, and for other purposes.

- H.R.4098: Stopping Proxy Advisor Racketeering Act

- H.R.3437: Insurance Data Protection Act

- H.R.3379: HUMPS Act of 2025

You can track bills proposed by Representative Scott Fitzgerald on Quiver Quantitative's politician page for Fitzgerald.

Representative Scott Fitzgerald Net Worth

Quiver Quantitative estimates that Representative Scott Fitzgerald is worth $7.0M, as of July 15th, 2025. This is the 118th highest net worth in Congress, per our live estimates.

Fitzgerald has approximately $324.3K invested in publicly traded assets which Quiver is able to track live.

You can track Representative Scott Fitzgerald's net worth on Quiver Quantitative's politician page for Fitzgerald.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.