H.R. 4167: Expanding Access to Lending Options Act

This bill, titled the Expanding Access to Lending Options Act, aims to modify certain lending regulations for federally chartered credit unions in the United States. Here are the main points about what this bill proposes:

Loan Maturity Changes

The bill specifically seeks to amend the Federal Credit Union Act regarding the length of loans that credit unions can offer. Under the current law, the maximum loan maturity for certain loans is set at 15 years. This bill would increase that maximum to 20 years, or potentially longer if the National Credit Union Administration (NCUA) Board allows it through regulation. This change is intended to provide more flexible lending options for credit unions and their members.

Regulatory Oversight

Additionally, the bill emphasizes the importance of safety and soundness in the regulatory oversight of credit unions by the NCUA. It expresses the sense of Congress that while expanding lending options, maintaining the financial health and security of credit unions should remain a primary focus for the NCUA.

Types of Loans Affected

The amendment pertains to loans that are not strictly tied to a member's principal residence, thus broadening the scope of loans that can qualify for the extended maturity terms. This could potentially include various types of personal loans or business loans, subject to specific regulations that the NCUA may set forth.

Impact on Credit Unions and Members

The primary goal of this legislation is to enhance the lending capabilities of credit unions, which may lead to increased access to credit for their members. By allowing longer loan terms, members might benefit from lower monthly payments and the ability to borrow for larger purchases or investments over a more extended period.

Implementation and Further Regulations

If this legislation is enacted, the NCUA will have the authority to establish additional regulations related to the new loan terms, ensuring that the changes align with the overall safety and soundness standards for credit unions.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

21 bill sponsors

-

TrackScott Fitzgerald

Sponsor

-

TrackAmi Bera

Co-Sponsor

-

TrackSalud O. Carbajal

Co-Sponsor

-

TrackJ. Luis Correa

Co-Sponsor

-

TrackChuck Edwards

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackJosh Harder

Co-Sponsor

-

TrackYoung Kim

Co-Sponsor

-

TrackMichael Lawler

Co-Sponsor

-

TrackRyan Mackenzie

Co-Sponsor

-

TrackSarah McBride

Co-Sponsor

-

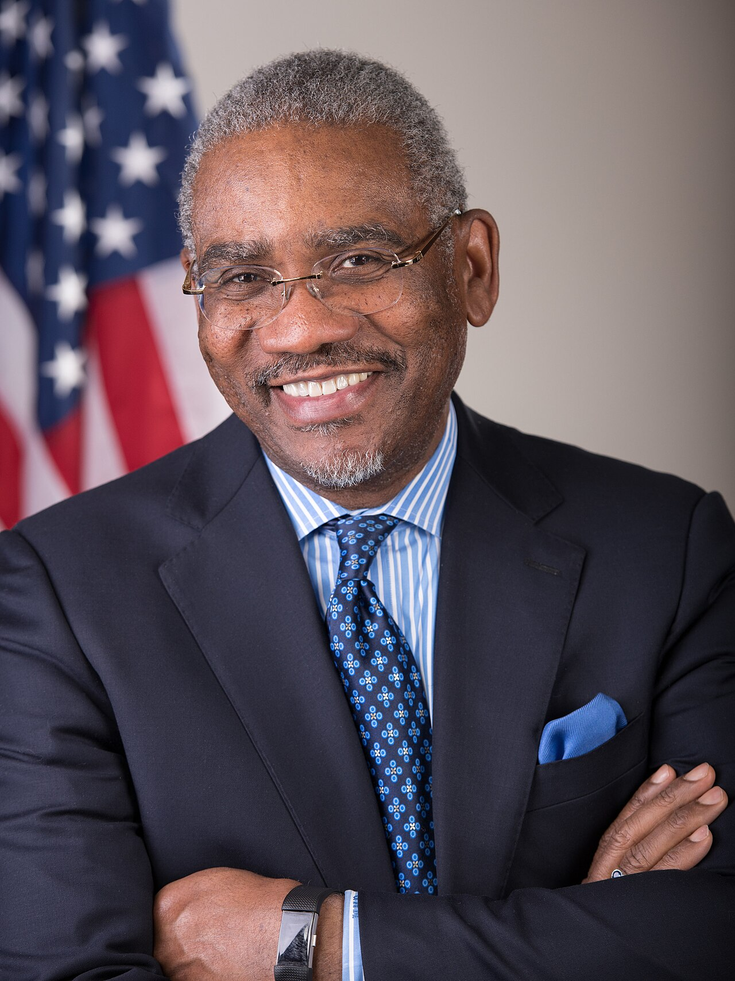

TrackGregory W. Meeks

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackZachary Nunn

Co-Sponsor

-

TrackJimmy Panetta

Co-Sponsor

-

TrackBrad Sherman

Co-Sponsor

-

TrackMarlin A. Stutzman

Co-Sponsor

-

TrackWilliam R. Timmons IV

Co-Sponsor

-

TrackJuan Vargas

Co-Sponsor

-

TrackEugene Vindman

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

Actions

2 actions

| Date | Action |

|---|---|

| Jun. 26, 2025 | Introduced in House |

| Jun. 26, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.