We have received text from H.R. 6547: Least Cost Exception Act. This bill was received on 2025-12-10, and currently has no cosponsors.

Here is a short summary of the bill:

This bill, titled the

Least Cost Exception Act

, aims to amend the Federal Deposit Insurance Act. Its primary purpose is to create an exception to the requirement that any resolution process (such as dealing with failing banks) must be the least costly option for the Deposit Insurance Fund (DIF). Here’s a breakdown of its main components:

Key Provisions

- The bill allows the Corporation (a federal entity managing the DIF) to choose a resolution method that may not be the least expensive option if certain conditions are met.

- One of the main goals is to prevent the further concentration of the banking system among global systemically important banking organizations, which are large banks whose failure could destabilize the financial system.

- The Corporation must determine that the benefits of selecting a more costly resolution method outweigh the risks that additional costs might pose to the DIF.

Conditions for the Exception

For the Corporation to exercise this exception, the following conditions must be fulfilled:

- The selected alternative must comply with a set of criteria, including being the least costly option compared to other alternatives that do not involve a global systemically important banking organization.

- The difference in cost between the selected method and the least costly alternative must be below a maximum amount established by the Corporation.

- If an alternative method involves another organization purchasing the assets or liabilities of the bank in trouble, that organization must agree to pay an assessment to the DIF over a specified timeframe.

Reporting Requirements

Within 30 days of deciding on an alternative method, the Corporation must report to certain congressional committees. This report will include an analysis that compares the costs of the chosen alternative with the least costly alternative that would have been selected without this new exception.

Definitions

- Covered Alternative: A method that is least costly for the DIF among alternatives that involve asset sales to global systemically important banking organizations.

- Global Systemically Important Banking Organization: Defined by current regulations, this term refers to large banking organizations whose failure could have widespread impacts on the financial system.

Overall Purpose

The main goal of this bill is to provide greater flexibility in resolving banking institutions that are failing, with the consideration that stabilizing the banking system is a priority, even if it may not always be the least costly option initially.

Relevant Companies

- JPM - JPMorgan Chase & Co.: As a large global bank, changes in liability acquisition methods could directly impact their operations and asset management strategies.

- BAC - Bank of America Corporation: Being a major player in the banking sector, they may be involved in potential asset acquisitions under this amended resolution scheme.

- C - Citigroup Inc.: This company may also find itself in scenarios affected by the bill, particularly when it comes to absorbing assets from weaker banks.

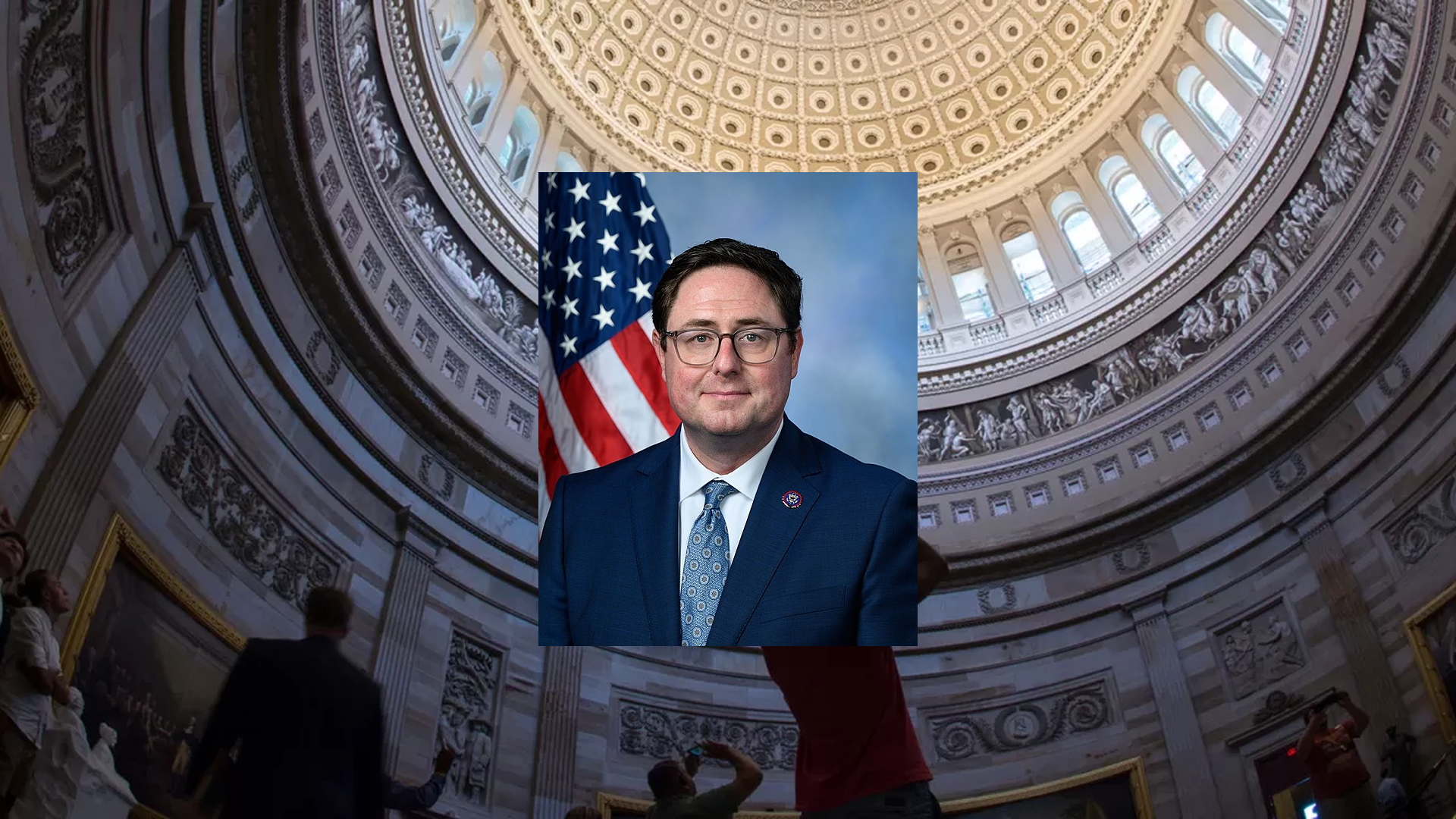

Representative Mike Flood Bill Proposals

Here are some bills which have recently been proposed by Representative Mike Flood:

- H.R.6547: Least Cost Exception Act

- H.R.5947: To designate the facility of the United States Postal Service located at 1201 Calvert Street in Lincoln, Nebraska, as the "Commodore Dixie Kiefer Memorial Post Office Building".

- H.R.5946: Stamp Out Veterans Medical Debt Act

- H.R.5945: USS Frank E. Evans Act

- H.R.5878: HOME Reform Act of 2025

- H.R.5798: HOME Reform Act of 2025

You can track bills proposed by Representative Mike Flood on Quiver Quantitative's politician page for Flood.

Representative Mike Flood Net Worth

Quiver Quantitative estimates that Representative Mike Flood is worth $8.2M, as of December 13th, 2025. This is the 124th highest net worth in Congress, per our live estimates.

Flood has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Representative Mike Flood's net worth on Quiver Quantitative's politician page for Flood.

Representative Mike Flood Stock Trading

We have data on up to $15.0K of trades from Representative Mike Flood, which we parsed from STOCK Act filings.

You can track Representative Mike Flood's stock trading on Quiver Quantitative's politician page for Flood.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.