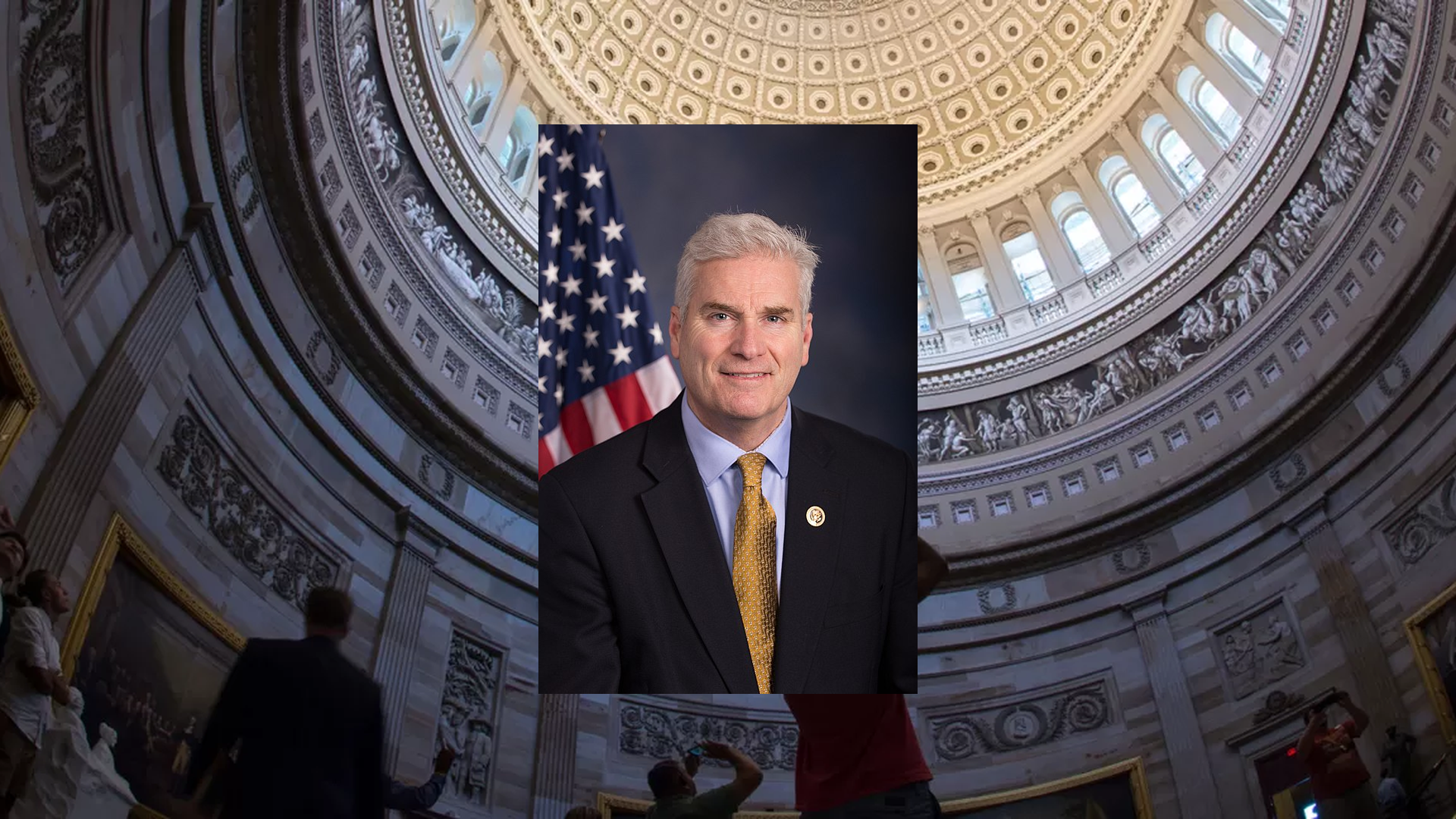

The House has passed H.R. 1919 - Anti-CBDC Surveillance State Act. This bill was introduced by Representative Tom Emmer.

The vote was 219-210.

You can track corporate lobbying on this bill and relevant congressional stock trades on Quiver Quantitative's H.R. 1919 bill page.

Here is a short summary of a May 6, 2025 version of the bill.

H.R. 1919 - Anti-CBDC Surveillance State Act Summary

This bill, known as the Anti-CBDC Surveillance State Act, seeks to enact several significant changes regarding the role of the Federal Reserve in relation to individual financial services and the introduction of central bank digital currencies (CBDCs). Here are the key provisions of the bill:

Prohibitions on Federal Reserve Banks

The bill prohibits Federal Reserve banks from:

- Offering financial products or services directly to individuals.

- Maintaining accounts on behalf of individuals.

- Issuing a central bank digital currency or any similar digital asset.

Indirect Prohibition on CBDCs

Additionally, it prohibits Federal Reserve banks from indirectly issuing a central bank digital currency to individuals through any financial institutions or other intermediaries. This means that even if a CBDC were to be created, it could not be provided to consumers through banks or other financial services providers.

Research and Monetary Policy Restrictions

The bill also restricts the Federal Reserve from:

- Testing, studying, developing, creating, or implementing any central bank digital currency or similar digital asset.

- Using any form of central bank digital currency to implement monetary policy.

However, the bill does allow for the existence of a dollar-denominated currency that is open, permissionless, private, and preserves the privacy protections similar to physical currency.

Congressional Authority

The bill expresses the sense of Congress that the Federal Reserve does not currently have the authority to issue a central bank digital currency and will not gain such authority unless it is explicitly granted by Congress.

Overall Impact

In summary, the Anti-CBDC Surveillance State Act aims to restrict the Federal Reserve's ability to interact with individuals through financial services and to prevent the introduction of a central bank digital currency, thereby emphasizing the importance of privacy and limiting government surveillance in financial matters.

Relevant Companies

None found

This article is not financial advice. Bill summaries may be unreliable. Consult Congress.gov for full bill text. See Quiver Quantitative's disclaimers for more information.

Representative Tom Emmer Bill Proposals

Here are some bills which have recently been proposed by Representative Tom Emmer:

- H.R.4398: To direct a physician or nurse practitioner employed by the Secretary of Veterans Affairs to certify the death of a veteran not later than 48 hours after such physician or nurse practitioner learns of such death, and for other purposes.

- H.R.3533: Blockchain Regulatory Certainty Act

- H.R.3234: To amend the Federal Deposit Insurance Act to modify the amount of reciprocal deposits of an insured depository institution that are not considered to be funds obtained by or through a deposit broker, and for other purposes.

- H.R.2365: Securities Clarity Act of 2025

- H.R.2184: Firearm Due Process Protection Act

- H.R.2183: CFPB Dual Mandate and Economic Analysis Act

You can track bills proposed by Representative Tom Emmer on Quiver Quantitative's politician page for Emmer.