H.R. 3234: To amend the Federal Deposit Insurance Act to modify the amount of reciprocal deposits of an insured depository institution that are not considered to be funds obtained by or through a deposit broker, and for other purposes.

This bill proposes modifications to the Federal Deposit Insurance Act regarding how certain deposits are treated for insurance purposes. Specifically, it seeks to change the classification of "reciprocal deposits" held by banks, which are deposits made by a financial institution at another bank for the purpose of exchanging deposits with each other.

Key Provisions of the Bill

- Revised Definitions: The bill aims to redefine the amount of reciprocal deposits that are not considered to be funds obtained through a deposit broker, thus altering how these funds are accounted for by banks.

- Limits on Classification: It establishes specific tiers based on the total liabilities of the depositing institution:

- 50% of total liabilities under $1 billion.

- 40% of total liabilities between $1 billion and $10 billion.

- 30% of total liabilities between $10 billion and $250 billion.

- 20% of total liabilities between $250 billion and $1 trillion.

- 2% of total liabilities over $1 trillion.

- Agent Institution Definition: It adjusts the definition of which institutions can be classified as "agent institutions" that participate in reciprocal deposit transactions, stipulating they must have a CAMELS rating of 1, 2, or 3 during their last examination.

Impact on Financial Institutions

The amendments are intended to provide greater flexibility and potentially reduce the regulatory burdens on banks, enabling them to manage their deposit liabilities more effectively. By recalibrating how reciprocal deposits are treated, it aims to encourage liquidity and stability within the banking sector.

Implementation Timeline

Once passed, the changes would be implemented as per the relevant regulatory processes defined in the Federal Deposit Insurance Act.

Relevant Companies

None found.This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

12 bill sponsors

-

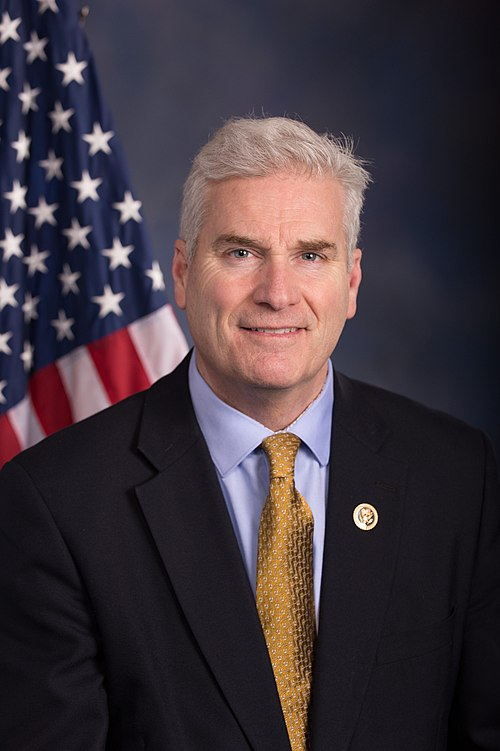

TrackTom Emmer

Sponsor

-

TrackAndy Barr

Co-Sponsor

-

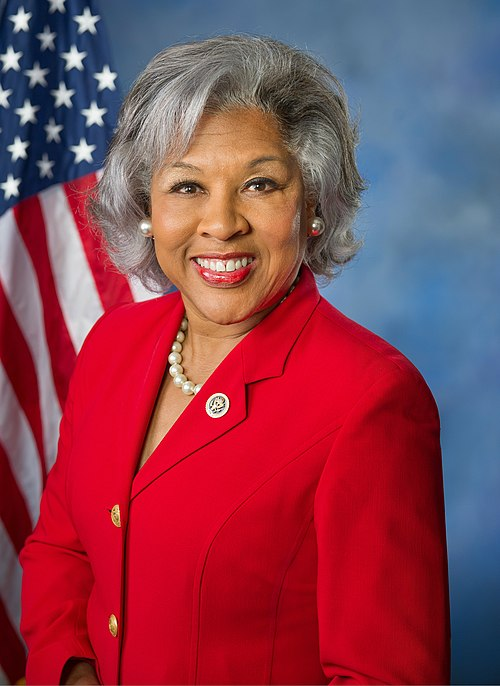

TrackJoyce Beatty

Co-Sponsor

-

TrackJack Bergman

Co-Sponsor

-

TrackMike Ezell

Co-Sponsor

-

TrackMike Flood

Co-Sponsor

-

TrackJared F. Golden

Co-Sponsor

-

TrackDaniel Meuser

Co-Sponsor

-

TrackGwen Moore

Co-Sponsor

-

TrackMike Rogers

Co-Sponsor

-

TrackPete Sessions

Co-Sponsor

-

TrackRoger Williams

Co-Sponsor

Actions

6 actions

| Date | Action |

|---|---|

| Nov. 04, 2025 | Placed on the Union Calendar, Calendar No. 314. |

| Nov. 04, 2025 | Reported (Amended) by the Committee on Financial Services. H. Rept. 119-362. |

| Sep. 16, 2025 | Committee Consideration and Mark-up Session Held |

| Sep. 16, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 51 - 0. |

| May. 07, 2025 | Introduced in House |

| May. 07, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.