H.R. 2365: Securities Clarity Act of 2025

This bill, known as the Securities Clarity Act of 2025, aims to clarify the definition of "security" in U.S. securities laws by excluding a new category of assets termed "investment contract assets." The bill proposes several key changes to the existing securities laws:

Key Changes Proposed by the Bill

- Definition of Investment Contract Assets: The bill defines an investment contract asset as a digital representation of value that is:

- Fungible, meaning it can be exchanged for another of the same type.

- Capable of being possessed and transferred directly between individuals without needing an intermediary.

- Recorded on a public distributed ledger using cryptography for security.

- Sold or transferred through an investment contract and not classified as a security under the existing definition.

- Amendments to Existing Laws: The bill amends several major securities laws to incorporate this new definition:

- Securities Act of 1933: Changes the definition of "security" to exclude investment contract assets.

- Investment Advisers Act of 1940: Also modifies the definition of "security" to exclude investment contract assets.

- Investment Company Act of 1940: Updates the definition similarly.

- Securities Exchange Act of 1934: Includes an exclusion for investment contract assets in the definition of "security."

- Securities Investor Protection Act of 1970: Enhances the definition by excluding investment contract assets as well.

Implications of the Bill

By defining investment contract assets and excluding them from the definition of a security, the bill could potentially ease regulatory burdens on entities dealing with such assets, promoting a clearer legal framework for digital assets. This legal change could impact how companies and individuals engage with investment contract assets in terms of compliance with federal securities laws.

Conclusion of Summary

The goal of the Securities Clarity Act of 2025 is to provide clearer regulations around certain types of digital assets, enabling innovation and investment in this space while defining how these assets fit within the existing legal and regulatory framework.

Relevant Companies

- COIN (Coinbase): As a major cryptocurrency exchange, Coinbase could be significantly impacted by this bill if it allows for a broader classification of digital assets that can be traded without stringent securities regulations.

- ETH (Ethereum foundation): If investments in Ethereum and similar platforms are redefined under this bill, their regulatory obligations may change, affecting their operations and growth strategies.

- BTC (Bitcoin network): As a leading cryptocurrency, Bitcoin's classification as an investment contract asset could also be influenced, leading to changes in how it is traded and regulated.

This is an AI-generated summary of the bill text. There may be mistakes.

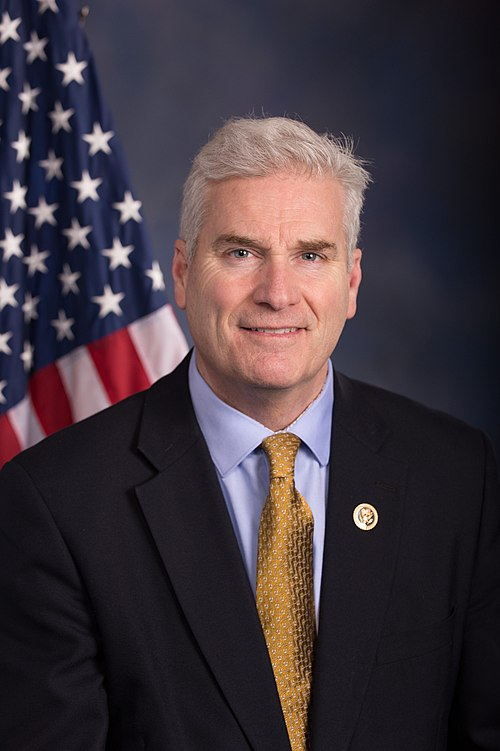

Sponsors

2 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Mar. 26, 2025 | Introduced in House |

| Mar. 26, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.