S. 3759: Securing America's Fuels Act

This bill, titled the "Securing America's Fuels Act" (SAF Act), aims to amend the Internal Revenue Code in two primary ways regarding sustainable aviation fuel (SAF). Here’s a summary of its main provisions:

1. Reinstatement of Special Rate for Sustainable Aviation Fuel

The bill reinstates a special tax credit calculation for sustainable aviation fuel produced at qualified facilities. Specifically:

- If SAF is produced at a qualified facility of a certain type, the credit amount would increase from 20 cents to 35 cents per gallon.

- If produced at a different type of qualified facility, the credit would rise from $1.00 to $1.75 per gallon.

Sustainable aviation fuel is defined as liquid fuel that is not kerosene, used in aircraft, and does not come from palm oil or petroleum, while also meeting certain technical standards.

2. Extension of Clean Fuel Production Credit

The bill extends the eligibility for the clean fuel production credit, changing the expiration date from December 31, 2029 to December 31, 2033. This allows longer-term access to the tax incentives for producers of sustainable aviation fuel.

3. Effective Date

The provisions of this bill would apply to fuel produced after December 31, 2025.

Relevant Companies

- BA - Boeing: As a major manufacturer of aircraft, Boeing could benefit from an increase in demand for sustainable aviation fuels as airlines look to reduce their carbon footprint and comply with regulations.

- GE - General Electric: GE supplies engines and technologies for aircraft that could also see increased demand aligned with the shift toward sustainable aviation fuels.

- UAL - United Airlines: As one of the major airlines, United may be directly impacted by the changes in fuel pricing and the adoption of sustainable aviation fuels aimed at reducing overall emissions.

- AAL - American Airlines: Similar to United, they may also benefit from the use of sustainable aviation fuels and any associated tax credits for fuel costs.

This is an AI-generated summary of the bill text. There may be mistakes.

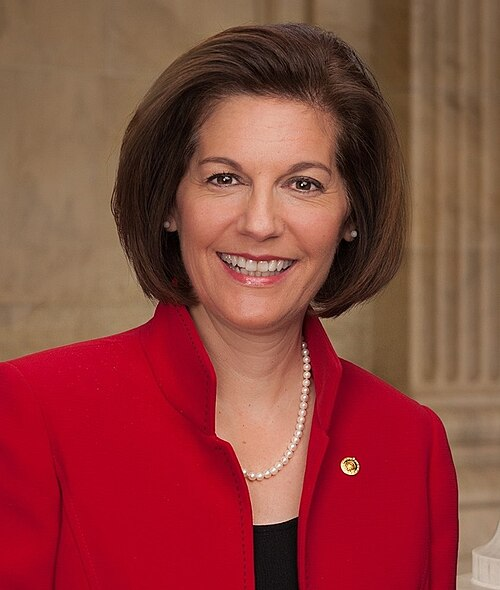

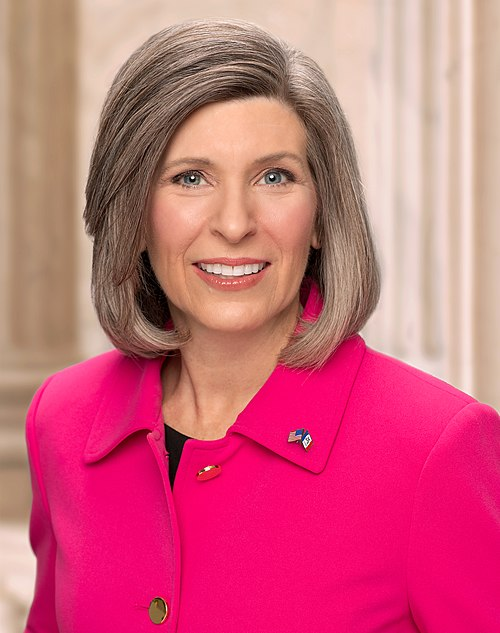

Sponsors

4 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Feb. 02, 2026 | Introduced in Senate |

| Feb. 02, 2026 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.