Senators Scott and Crapo reintroduce legislation to enhance IRS accountability by requiring supervisor approval for tax penalties.

Quiver AI Summary

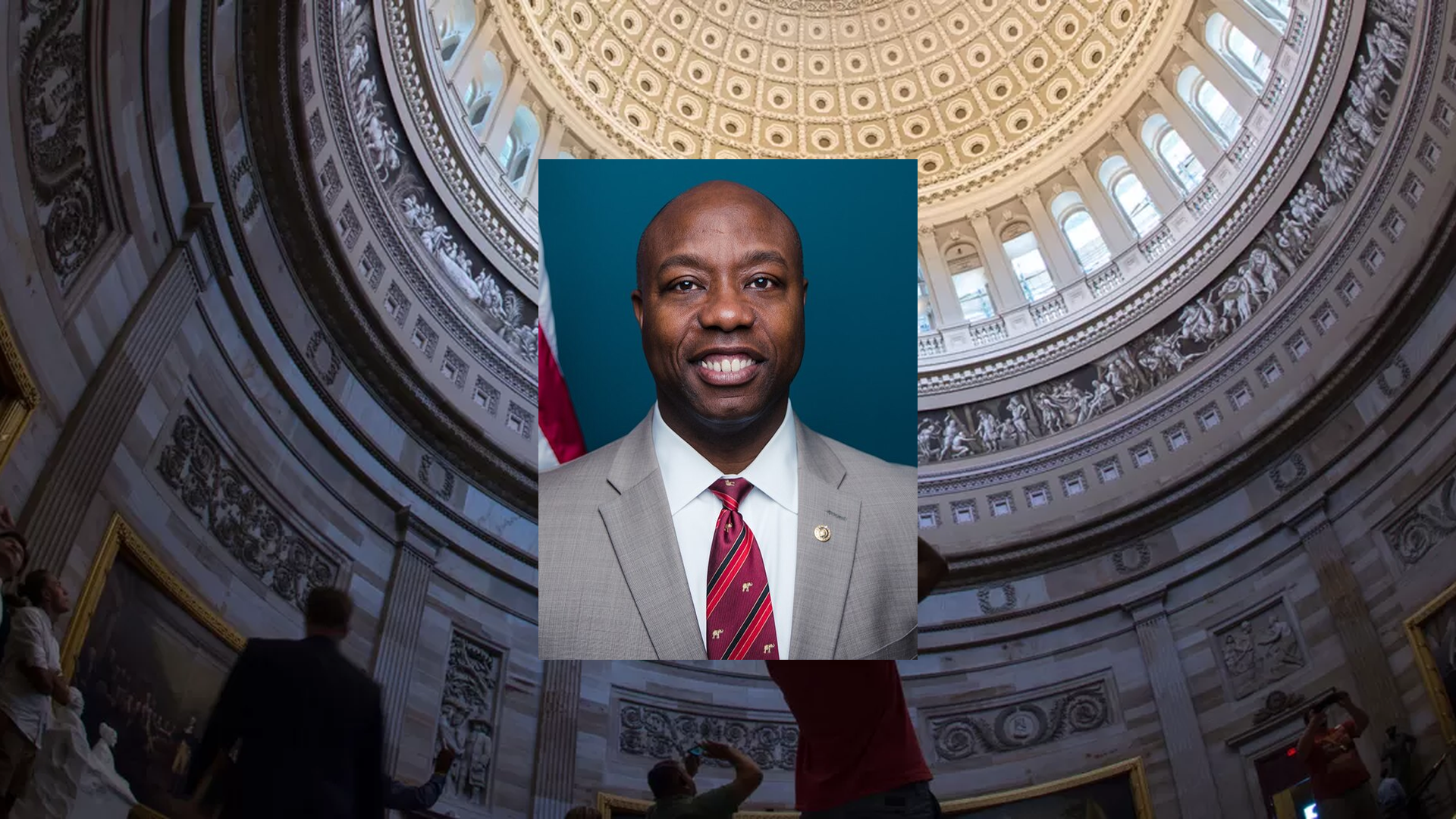

U.S. Senator Tim Scott, along with Senate Finance Committee Chairman Mike Crapo and other Republican colleagues, has reintroduced the IRS Accountability and Taxpayer Protection Act. This legislation aims to modify the imposition of tax penalties by requiring supervisor approval, enhancing IRS accountability and transparency. Scott emphasized the importance of safeguarding taxpayer rights in this reform.

Supporters of the bill, including Pete Sepp of the National Taxpayers Union, praised its intent to protect taxpayers from unauthorized penalties. They argue that it reinforces necessary safeguards established in past reforms while addressing recent challenges to those protections.

In addition to Scott and Crapo, the bill has garnered support from Senators Cynthia Lummis, Thom Tillis, Chuck Grassley, and Jim Risch. Full text of the legislation is available online for public review.

Disclaimer: This is an AI-generated summary of a press release. The model used to summarize this release may make mistakes. See the full release here.

Tim Scott Net Worth

Quiver Quantitative estimates that Tim Scott is worth $804.1K, as of July 23rd, 2025. This is the 311th highest net worth in Congress, per our live estimates.

Scott has approximately $45.6K invested in publicly traded assets which Quiver is able to track live.

You can track Tim Scott's net worth on Quiver Quantitative's politician page for Scott.

Tim Scott Bill Proposals

Here are some bills which have recently been proposed by Tim Scott:

- S.2358: A bill to amend the Internal Revenue Code of 1986 to modify the procedural rules for penalties.

- S.2301: A bill to reauthorize certain programs regarding rural health care.

- S.2237: Hospital Inpatient Services Modernization Act

- S.2228: A bill to amend the Fair Labor Standards Act of 1938 to harmonize the definition of employee with the common law.

- S.2118: Value Over Cost Act of 2025

- S.2116: A bill to require the Committee on Foreign Investment in the United States to annually review, update, and report on the facilities and property of the United States Government determined to be national security sensitive for purposes of review of real estate transactions under section 721 of the Defense Production Act of 1950.

You can track bills proposed by Tim Scott on Quiver Quantitative's politician page for Scott.

Tim Scott Fundraising

Tim Scott recently disclosed $674.9K of fundraising in a Q2 FEC disclosure filed on July 15th, 2025. This was the 94th most from all Q2 reports we have seen this year. 98.0% came from individual donors.

Scott disclosed $868.5K of spending. This was the 33rd most from all Q2 reports we have seen from politicians so far this year.

Scott disclosed $5.1M of cash on hand at the end of the filing period. This was the 47th most from all Q2 reports we have seen this year.

You can see the disclosure here, or track Tim Scott's fundraising on Quiver Quantitative.