S. 2358: IRS Accountability and Taxpayer Protection Act

The IRS Accountability and Taxpayer Protection Act aims to change certain procedural rules regarding penalties imposed by the Internal Revenue Service (IRS). Here’s a breakdown of the main provisions of the bill:

Changes to Penalty Assessment Procedures

The bill modifies the existing rules in the Internal Revenue Code concerning the assessment of penalties and periods during which the IRS may disallow taxpayer credits or claims. Key changes include:

- Supervisor Approval Required: The initial decision to impose a penalty or apply a disallowance period must now receive written approval from the immediate supervisor of the IRS employee making the determination. This approval must occur before any notice of the penalty or disallowance period is sent to the taxpayer.

- Definition of "Initial Determination": The first notification sent to a taxpayer regarding a specific penalty or disallowance period is defined as the "initial determination." This means the taxpayer must be informed clearly about the circumstances under which the penalty applies.

- Requests Must Specify Penalties: Any requests or inquiries made by the IRS, which could be interpreted as an initial determination, must include a clear offer of a specific penalty amount or a defined disallowance period.

Disallowance Period Adjustments

The bill introduces changes specifically related to disallowance periods for certain credits:

- A new definition of "disallowance period" is established, which applies to specific tax credits, such as those under sections 24, 25A, and 32 of the Internal Revenue Code.

- An additional requirement stipulates that if a disallowance period is automatically calculated through electronic systems, it must still receive appropriate approval before it can be applied.

Reporting Requirements

The bill mandates that the Secretary of the Treasury or a delegate must publish an annual report. This report should detail:

- All penalties assessed by the IRS in the previous calendar year.

- Information should include data categorized by different IRS organizational units that have the authority to apply or manage these penalties.

- A detailed account of how penalties progress through the assessment, determination, and review process.

Effective Date

The modifications made by the bill will apply to notices sent by the IRS after the date the act is enacted.

Relevant Companies

- None found

This is an AI-generated summary of the bill text. There may be mistakes.

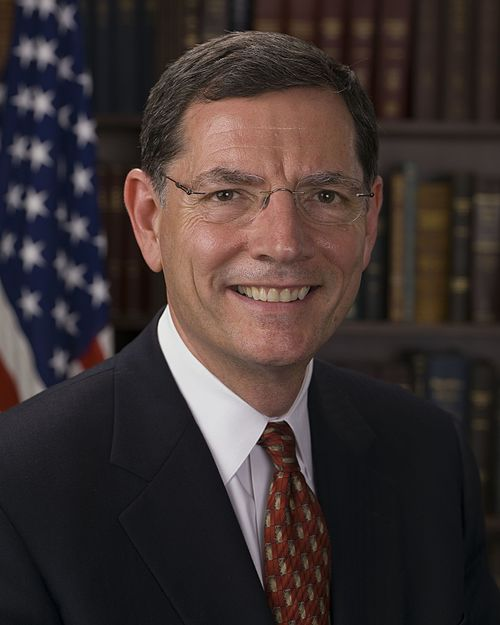

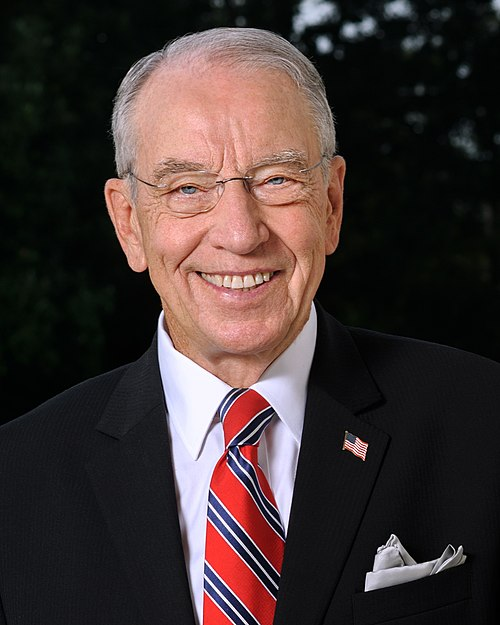

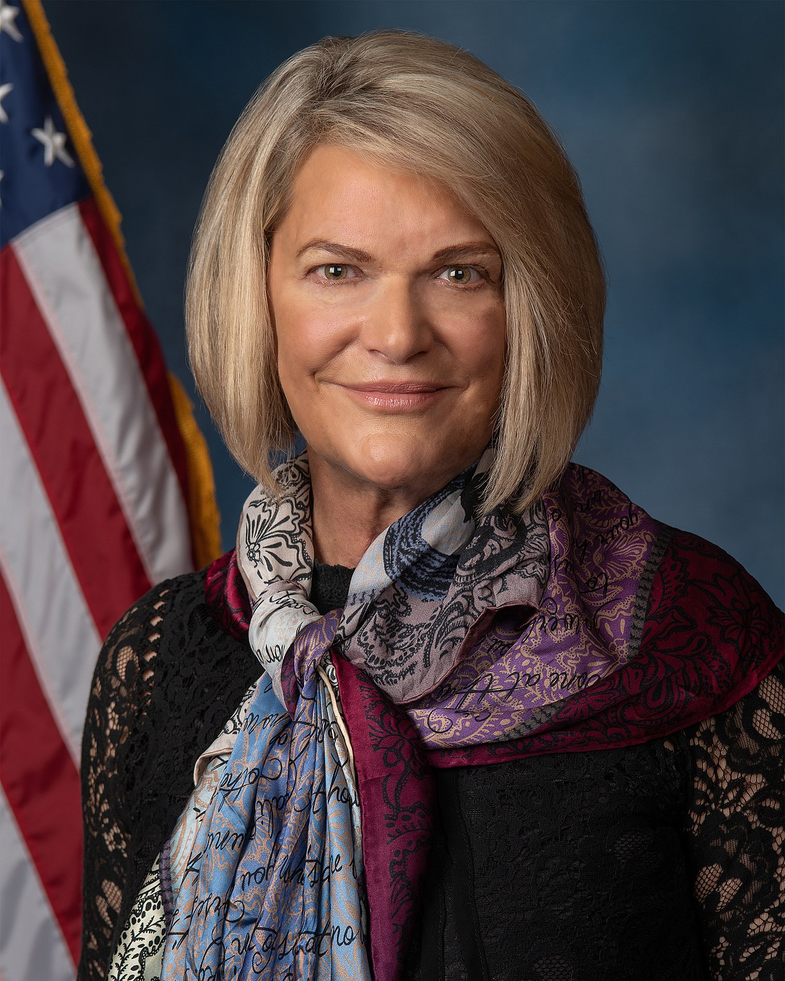

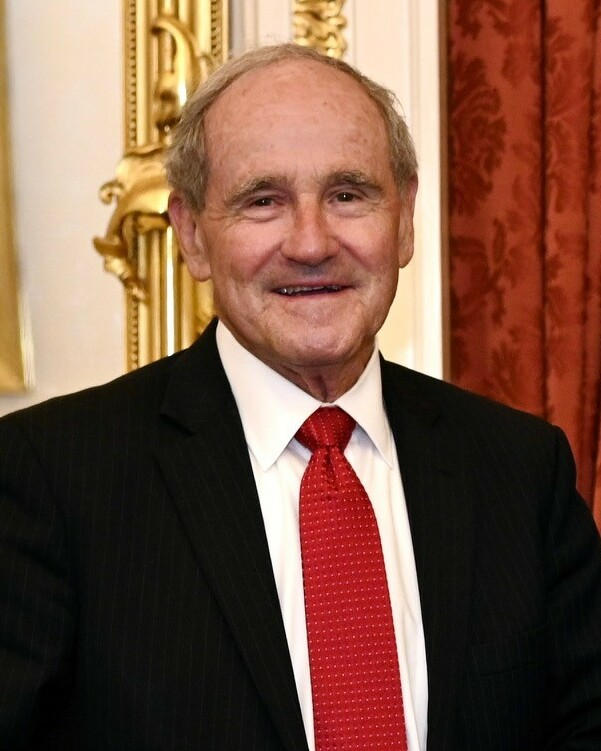

Sponsors

7 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Jul. 21, 2025 | Introduced in Senate |

| Jul. 21, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.