We have received text from S. 2818: Tax Excessive CEO Pay Act of 2025. This bill was received on 2025-09-16, and currently has 4 cosponsors.

Here is a short summary of the bill:

This bill, known as the **Tax Excessive CEO Pay Act of 2025**, aims to modify the U.S. Internal Revenue Code to impose a tax increase on corporations that have a significantly large disparity between the compensation of their highest-paid employee (usually the CEO) and the median compensation of their workers.

Key Provisions

1. Tax Increase Based on Pay Ratio

The bill introduces a new tax rate for corporations whose ratio of CEO or highest-paid employee compensation to median worker compensation exceeds 50 to 1. If this pay ratio is above 50 to 1, these companies will face an increase in their corporate tax rate, calculated as follows:

- If the pay ratio is greater than 50 to 1 but not greater than 100 to 1, the tax increase will be 0.5 percentage points.

- If the pay ratio is greater than 100 to 1 but not greater than 200 to 1, the tax increase will be 1 percentage point.

- If the pay ratio is greater than 200 to 1 but not greater than 300 to 1, the tax increase will be 2 percentage points.

- If the pay ratio is greater than 300 to 1 but not greater than 400 to 1, the tax increase will be 3 percentage points.

- If the pay ratio is greater than 400 to 1 but not greater than 500 to 1, the tax increase will be 4 percentage points.

- If the pay ratio is greater than 500 to 1, the tax increase will be 5 percentage points.

2. Calculation of Pay Ratio

The pay ratio is to be determined based on the annualized average compensation over a five-year period. If the highest-paid employee is not the principal executive officer, their compensation will be used for the ratio calculation.

3. Exemptions

There are exemptions for certain corporations:

- Corporations that are not required to file with the SEC are also included in this exemption based on the same gross receipts threshold.

4. Effective Date

The changes enacted by this bill will apply to taxable years starting after December 31, 2025.

5. Regulatory Provisions

The Secretary of the Treasury will have the authority to issue necessary regulations to implement these changes and to prevent companies from circumventing the intent of the law through manipulation of workforce composition or compensation reporting.

Relevant Companies

- AMZN - Amazon.com, Inc.: As a company with a large workforce and significant executive compensation, Amazon may face a reevaluation of its tax liabilities under this bill if its CEO's compensation relative to average employee compensation exceeds the specified ratios.

- TSLA - Tesla, Inc.: Tesla's executive pay package is often noted for its size relative to average wages and could trigger a tax increase if the CEO's compensation greatly exceeds the median worker salary.

- GOOGL - Alphabet Inc.: As a major technology company, Alphabet's compensation structure includes substantial executive pay, which might lead to higher taxes if their pay ratios exceed the stipulated thresholds.

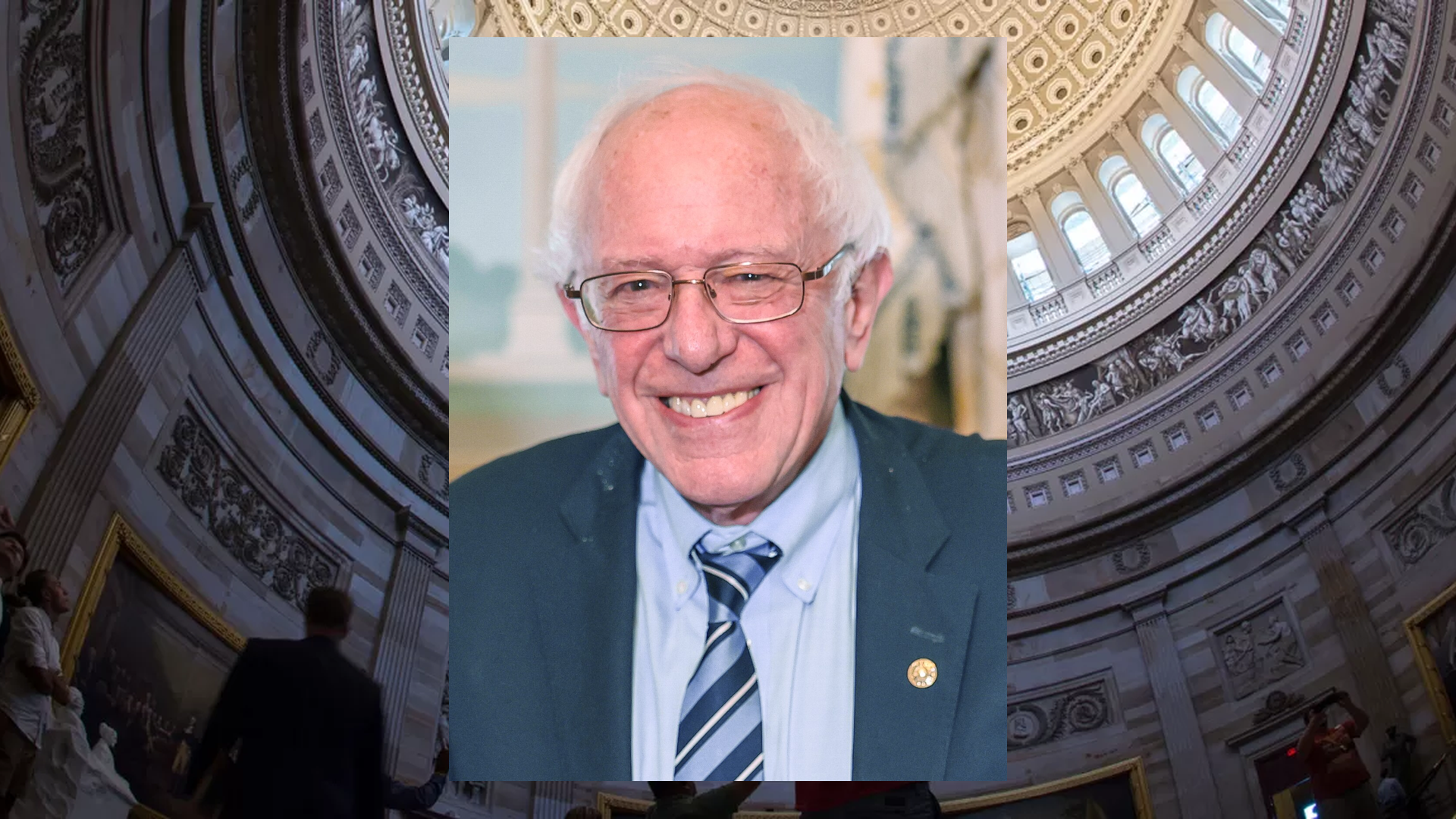

Senator Bernard Sanders Bill Proposals

Here are some bills which have recently been proposed by Senator Bernard Sanders:

- S.2819: A bill to amend the Head Start Act to improve the Act.

- S.2818: Tax Excessive CEO Pay Act of 2025

- S.2763: Keep Billionaires Out of Social Security Act

- S.2481: Pay Teachers Act

- S.2458: Employee Ownership Financing Act

- S.2444: End Polluter Welfare Act of 2025

You can track bills proposed by Senator Bernard Sanders on Quiver Quantitative's politician page for Sanders.

Senator Bernard Sanders Net Worth

Quiver Quantitative estimates that Senator Bernard Sanders is worth $1.2M, as of September 27th, 2025. This is the 315th highest net worth in Congress, per our live estimates.

Sanders has approximately $0 invested in publicly traded assets which Quiver is able to track live.

You can track Senator Bernard Sanders's net worth on Quiver Quantitative's politician page for Sanders.

This article is not financial advice. See Quiver Quantitative's disclaimers for more information.